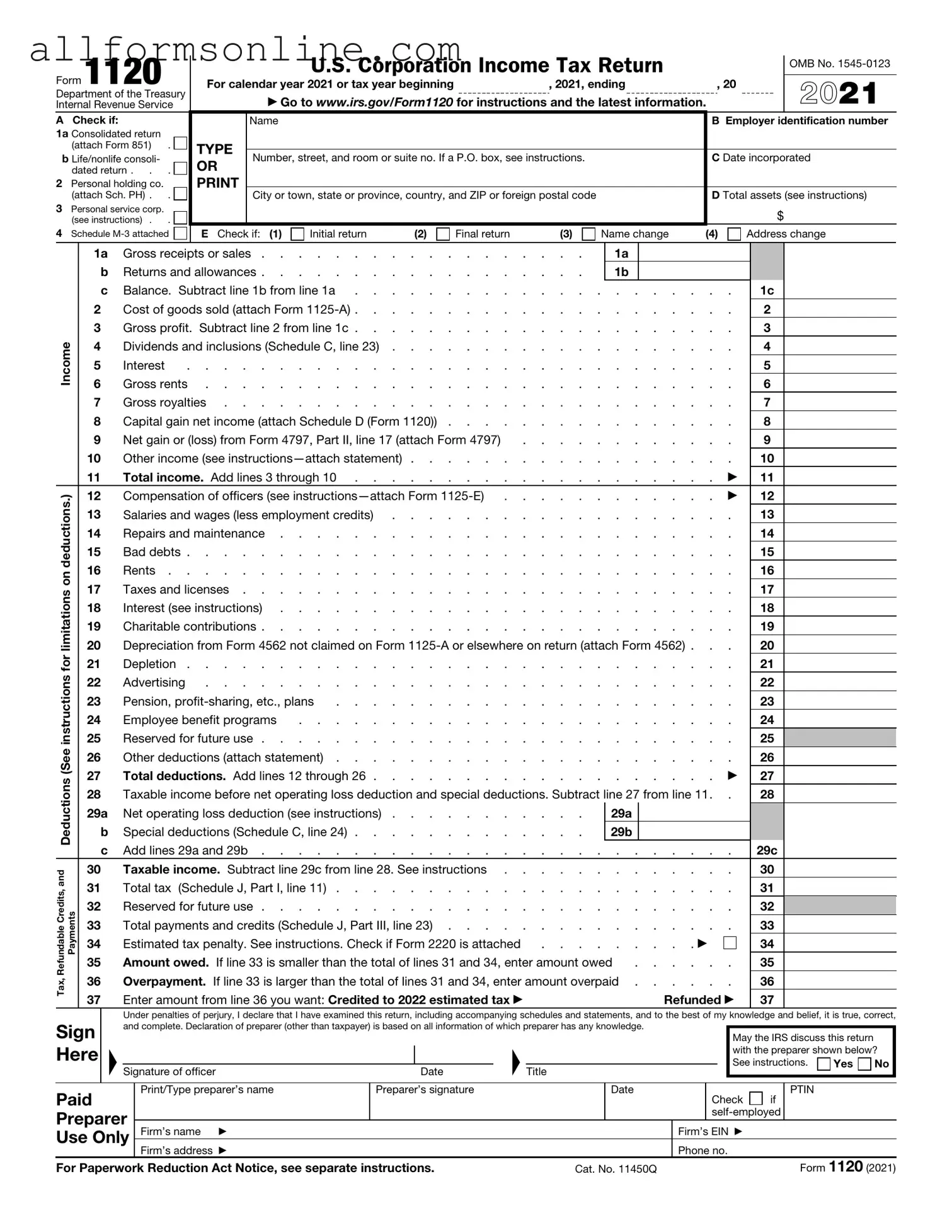

Free IRS 1120 PDF Form

Misconceptions

The IRS Form 1120 is essential for corporations to report their income, gains, losses, deductions, and credits. However, several misconceptions surround this form. Here are eight common misunderstandings:

- Only large corporations need to file Form 1120. Many people think that only big businesses must file this form. In reality, any corporation, regardless of size, must file Form 1120 if it is subject to corporate income tax.

- Filing Form 1120 is optional for corporations. Some believe that filing is optional. This is not true. Corporations are legally required to file Form 1120 annually, even if they do not owe any taxes.

- Form 1120 is the same as personal tax forms. Many confuse Form 1120 with personal tax forms like the 1040. These forms serve different purposes. Form 1120 is specifically for corporations, while 1040 is for individual taxpayers.

- All income is taxable on Form 1120. There is a belief that all income reported is taxable. However, certain deductions and credits can reduce taxable income significantly.

- Filing late will always result in severe penalties. While late filing can incur penalties, there are situations where penalties can be reduced or waived. It’s essential to communicate with the IRS if you face challenges.

- Corporations can only file Form 1120 once a year. Some think corporations can only file once annually. However, they can file amended returns if they discover errors or need to make changes.

- Form 1120 is difficult to complete. Many believe that filling out Form 1120 is overly complicated. With proper guidance and resources, it can be manageable. There are many tools and professionals available to assist.

- Filing Form 1120 guarantees a refund. Some assume that filing will always result in a tax refund. This is not guaranteed. Refunds depend on various factors, including income, deductions, and credits.

Understanding these misconceptions can help corporations better navigate their tax obligations and ensure compliance with IRS regulations.

What to Know About This Form

What is the IRS Form 1120?

The IRS Form 1120 is the U.S. Corporation Income Tax Return. Corporations use this form to report their income, gains, losses, deductions, and credits. It is essential for corporations to file this form annually to determine their tax liability to the federal government.

Who needs to file Form 1120?

Any corporation operating in the United States must file Form 1120, regardless of whether it has taxable income. This includes C corporations, which are taxed separately from their owners. S corporations, however, use a different form (1120S) and are not required to file Form 1120.

What information is required on Form 1120?

Form 1120 requires various pieces of information, including the corporation's name, address, Employer Identification Number (EIN), and the total income and deductions. Corporations must also report any tax credits and calculate their tax liability based on the net income reported.

When is Form 1120 due?

Form 1120 is typically due on the 15th day of the fourth month following the end of the corporation's tax year. For most corporations that operate on a calendar year, this means the form is due on April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

What happens if a corporation fails to file Form 1120?

If a corporation fails to file Form 1120 by the deadline, it may face penalties. The IRS can impose a failure-to-file penalty, which can accumulate over time. Additionally, failure to file can result in interest on any unpaid taxes, further increasing the corporation's financial burden.

Can Form 1120 be filed electronically?

Yes, Form 1120 can be filed electronically. The IRS encourages electronic filing as it is faster and often more secure than paper filing. Corporations can use IRS-approved e-file providers to submit their returns online, which can also help in ensuring accuracy and timely submission.

Different PDF Forms

Formulario I-134 - Once submitted, the I-134 can be reviewed by immigration officials to assess financial capability.

Netspend Dispute Online - Provide detailed information about each unauthorized charge for review.

For those in need of completing the Statement of Fact Texas form, it's essential to provide all required details accurately, which can be conveniently done by visiting texasformspdf.com/fillable-statement-of-fact-texas-online/ to ensure adherence to legal requirements and avoid penalties associated with misinformation.

Physical Exam Form for Healthcare Workers - List any allergies or sensitivities to medications clearly.

How to Use IRS 1120

Completing the IRS 1120 form is a crucial task for corporations to report their income, gains, losses, deductions, and credits. Following these steps carefully will help ensure accurate submission and compliance with tax regulations.

- Gather necessary financial documents, including income statements, balance sheets, and records of deductions.

- Download the IRS 1120 form from the IRS website or obtain a physical copy from a tax professional.

- Begin with the basic information section. Fill in the corporation's name, address, and Employer Identification Number (EIN).

- Provide the date of incorporation and the total assets at the end of the year.

- Complete the income section. Report all sources of income, including sales, dividends, and interest.

- Move on to the deductions section. List all allowable deductions, such as salaries, rent, and utilities.

- Calculate the taxable income by subtracting total deductions from total income.

- Fill out the tax computation section to determine the tax owed based on the taxable income.

- Complete any additional schedules required, such as Schedule C for dividends or Schedule J for tax computation.

- Review all entries for accuracy. Ensure that all calculations are correct and that there are no missing sections.

- Sign and date the form. If someone else is preparing the form, they must also sign it.

- Submit the completed form by mail or electronically, depending on the filing method chosen.

After completing these steps, keep a copy of the form and all supporting documents for your records. This will be important for future reference or in case of an audit.