Free IRS 2553 PDF Form

Misconceptions

The IRS Form 2553 is an important document for small business owners who wish to elect S Corporation status. However, several misconceptions surround this form, which can lead to confusion and potentially costly mistakes. Here are nine common misconceptions about the IRS Form 2553, along with clarifications for each.

- Misconception 1: Only large businesses can file Form 2553.

- Misconception 2: Filing Form 2553 is optional for all businesses.

- Misconception 3: The form can be filed at any time during the year.

- Misconception 4: All shareholders must be U.S. citizens.

- Misconception 5: There is a penalty for filing Form 2553 incorrectly.

- Misconception 6: Once filed, the S Corporation election is permanent.

- Misconception 7: Form 2553 guarantees tax savings.

- Misconception 8: You cannot change your election after filing Form 2553.

- Misconception 9: Filing Form 2553 is the only step to becoming an S Corporation.

This is not true. Form 2553 is specifically designed for small businesses that meet certain criteria. Any eligible small business can elect S Corporation status by filing this form.

While not every business must file this form, those that want to be taxed as an S Corporation must do so. Failing to file can result in default taxation as a C Corporation.

Form 2553 must be filed within a specific timeframe, typically within 75 days of the beginning of the tax year. Late filings can lead to complications.

While S Corporations have restrictions on shareholders, not all must be U.S. citizens. However, all must be individuals, certain trusts, or estates.

While there is no direct penalty, filing incorrectly can lead to your business being taxed as a C Corporation, which may result in higher taxes.

The election can be revoked or terminated under certain circumstances. If the business no longer meets the eligibility requirements, it may lose its S Corporation status.

While many businesses benefit from S Corporation status, it does not automatically result in tax savings. Each business's situation is unique, and tax implications should be analyzed carefully.

Businesses can change their election, but they must follow specific procedures and guidelines set by the IRS to do so.

Filing Form 2553 is just one part of the process. Businesses must also ensure they comply with ongoing requirements to maintain their S Corporation status.

What to Know About This Form

What is the IRS Form 2553?

The IRS Form 2553 is a document used by small businesses to elect to be treated as an S corporation for federal tax purposes. By making this election, a corporation can avoid double taxation, which occurs when both the corporation and its shareholders are taxed on the same income. Instead, the income, deductions, and credits of the S corporation pass through to the shareholders, who report this information on their personal tax returns. This can lead to potential tax savings for the business owners.

Who is eligible to file Form 2553?

To be eligible to file Form 2553, a business must meet several criteria. First, it must be a domestic corporation. Additionally, the business can have no more than 100 shareholders, all of whom must be individuals, certain trusts, or estates. Furthermore, the corporation can only have one class of stock. If a corporation meets these requirements, it can take advantage of the S corporation election by filing Form 2553 with the IRS.

When should Form 2553 be filed?

Timing is crucial when it comes to filing Form 2553. Generally, the form must be submitted within two months and 15 days after the beginning of the tax year when the S corporation status is intended to take effect. For example, if a corporation wants its S corporation status to start on January 1, it must file Form 2553 by March 15 of that year. If the deadline is missed, the corporation may have to wait until the next tax year to make the election, unless it qualifies for late election relief.

What happens after Form 2553 is submitted?

Once Form 2553 is submitted, the IRS will review the application. If everything is in order and the corporation meets the eligibility requirements, the IRS will send a confirmation of the S corporation election. This confirmation is important for the corporation's records. Following the approval, the business will need to comply with ongoing requirements, such as filing an annual tax return using Form 1120-S and providing K-1 forms to shareholders for reporting their share of the income or losses on their personal tax returns.

Different PDF Forms

Roof Certification Form - It provides a clear timeline for the moisture proof guarantee—two years.

When preparing to submit your job application, it's crucial to have a well-structured Employment Application PDF form at your disposal, as this document plays a pivotal role in the hiring process. To make the best impression, consider exploring resources like Fast PDF Templates, which offer templates that can streamline your application and ensure you present your information clearly and professionally.

Downloadable Free Printable Spanish Job Application Form - You authorize the company to verify your work history during their hiring process.

How to Use IRS 2553

Once you have gathered the necessary information, you’re ready to fill out the IRS Form 2553. This form is essential for businesses that want to elect S corporation status. Completing it accurately ensures that your business can take advantage of certain tax benefits. Follow these steps carefully to ensure everything is filled out correctly.

- Begin by downloading the IRS Form 2553 from the IRS website or obtaining a physical copy.

- Fill in the name of your corporation at the top of the form, ensuring it matches the name registered with your state.

- Provide the corporation's address, including the city, state, and ZIP code.

- Enter the date of incorporation and the state where your corporation was formed.

- Indicate the tax year your corporation will follow. This is typically the calendar year unless you have a valid reason for a different fiscal year.

- List the names, addresses, and social security numbers (or employer identification numbers) of all shareholders. Make sure to include their percentage of ownership.

- Sign and date the form. An officer of the corporation must sign it, confirming that the information provided is accurate.

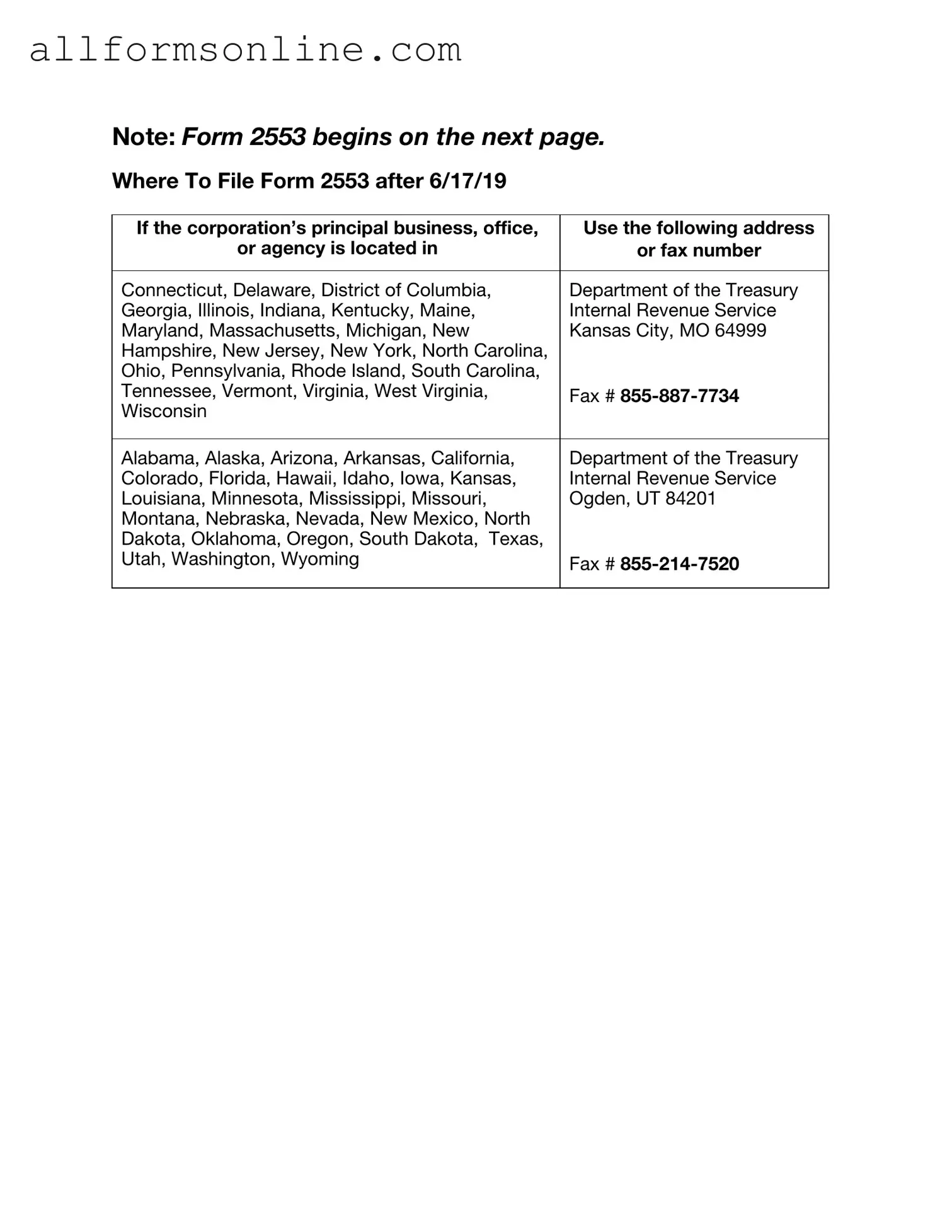

- Submit the completed form to the IRS. Ensure it is sent to the correct address based on your location and the IRS guidelines.

After submitting the form, keep a copy for your records. The IRS will process your application and notify you if your election is accepted. If there are any issues, they may contact you for clarification or additional information.