Free IRS 941 PDF Form

Misconceptions

The IRS Form 941 is an important document for employers, but several misconceptions surround it. Understanding these misconceptions can help ensure compliance and accurate reporting.

- Form 941 is only for large businesses. This is not true. All employers who withhold taxes for employees must file Form 941, regardless of the size of their business.

- Form 941 must be filed monthly. Form 941 is typically filed quarterly. Employers are required to submit it four times a year.

- Only employees’ wages are reported on Form 941. In addition to employees’ wages, Form 941 also reports withheld federal income tax and Social Security and Medicare taxes.

- Filing Form 941 is optional if no taxes are owed. Employers must still file Form 941 even if they have no taxes to report for the quarter.

- Form 941 can be filed at any time during the year. There are specific deadlines for filing Form 941, which are based on the end of each quarter.

- Form 941 is the same as Form 944. These forms serve different purposes. Form 944 is designed for smaller employers with a lower tax liability, while Form 941 is for those with larger liabilities.

- Filing Form 941 guarantees that the IRS will not audit my business. Filing the form accurately does not prevent audits. The IRS can audit any business for various reasons.

- Only payroll taxes are reported on Form 941. While payroll taxes are a major focus, other related taxes, such as federal income tax withholding, are also reported.

- Form 941 can be filed electronically or by mail, but not both. Employers can choose either method, but they should not file both for the same quarter.

- Once submitted, Form 941 cannot be amended. If an error is found after filing, employers can file Form 941-X to correct any mistakes.

Understanding these misconceptions can help ensure that employers meet their obligations and avoid potential penalties. Staying informed is crucial for maintaining compliance with IRS regulations.

What to Know About This Form

What is the IRS 941 form?

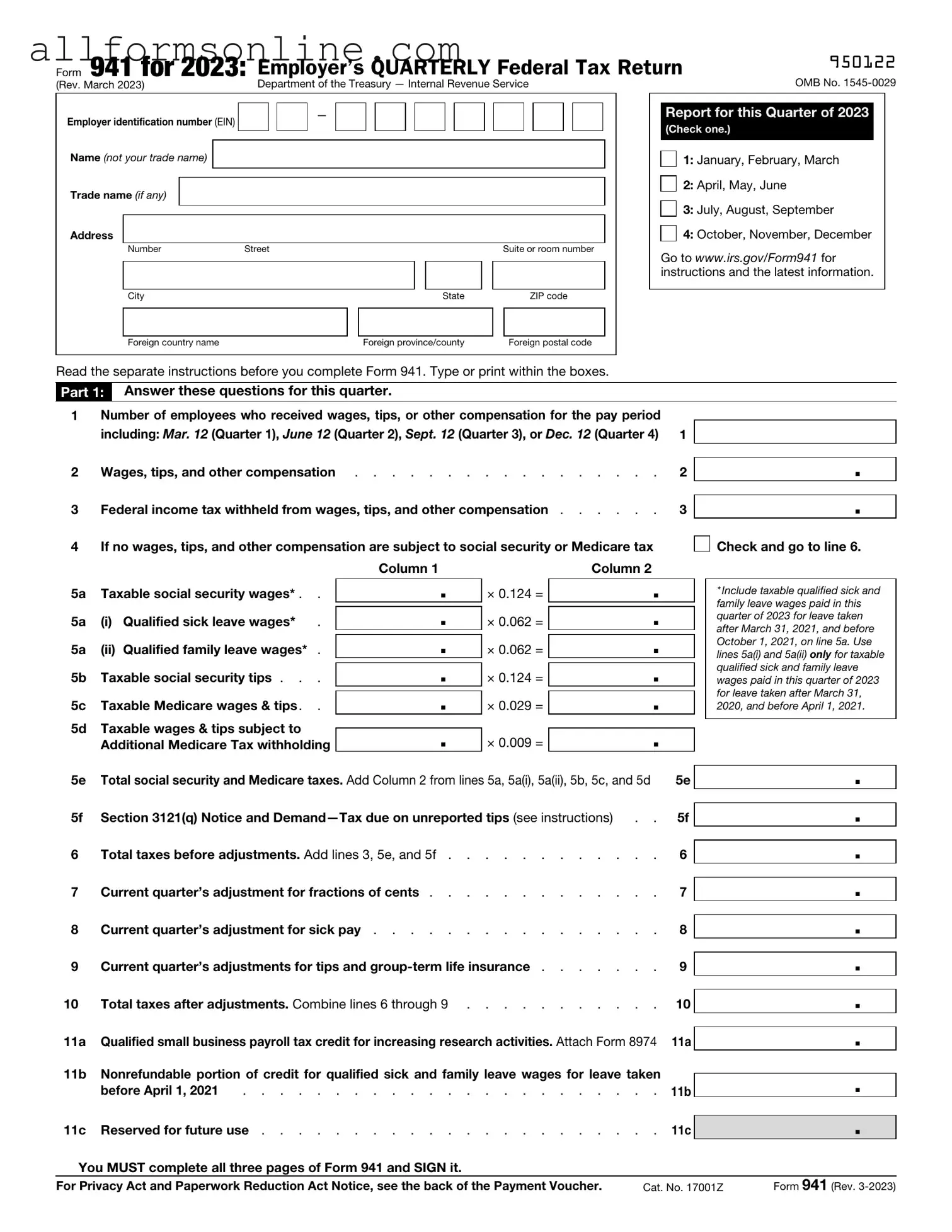

The IRS 941 form, officially known as the Employer's Quarterly Federal Tax Return, is a document that employers in the United States must file quarterly. This form reports the amount of federal income tax, Social Security tax, and Medicare tax withheld from employees' paychecks. Additionally, it accounts for the employer's portion of Social Security and Medicare taxes. Filing this form is essential for compliance with federal tax obligations and helps the IRS track payroll tax liabilities.

Who is required to file Form 941?

Any employer who pays wages to employees and is subject to federal payroll taxes must file Form 941. This includes businesses of all sizes, non-profit organizations, and government entities that have employees. If an employer has no wages to report for a quarter, they may still need to file a return indicating that no wages were paid. Special rules apply for seasonal employers or those who have ceased operations, which may affect their filing requirements.

When is the deadline for filing Form 941?

Form 941 is due four times a year, with specific deadlines for each quarter. The due dates are typically the last day of the month following the end of each quarter. For example, the deadlines are April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 for the fourth quarter. Employers who fail to file on time may incur penalties and interest on any unpaid taxes.

What happens if Form 941 is filed incorrectly?

If an employer discovers an error after filing Form 941, they should correct it as soon as possible. This can be done by filing Form 941-X, which is specifically designed for correcting mistakes on previously filed 941 forms. Common errors include miscalculating tax amounts, incorrect employee information, or failing to report all wages. Timely corrections can help avoid penalties and ensure compliance with tax obligations.

Different PDF Forms

Cg2010 Additional Insured Endorsement - Essential for contractors seeking to safeguard additional parties involved in projects.

Da Form 638 Pdf Download - Permanent order information is mandated in the latter part of the form.

In order to create a comprehensive understanding of rental agreements, it is essential to utilize resources such as the Fast PDF Templates, which can provide templates tailored to specific needs. A California Lease Agreement form is a legally binding document outlining the terms and conditions between a landlord and tenant for renting residential or commercial property in California. This form serves to protect the rights of both parties and ensure clear communication regarding rental obligations. In understanding this document, renters and landlords can engage in a more transparent and effective leasing process.

Free Direct Deposit Form Pdf - Be cautious to avoid using deposit slips for account verification.

How to Use IRS 941

Once you have gathered all necessary information, you can begin filling out the IRS 941 form. This form is essential for reporting employment taxes. Completing it accurately is crucial to ensure compliance with tax regulations.

- Start with the Employer Identification Number (EIN). Enter your EIN in the designated box at the top of the form.

- Fill in your business name and trade name if applicable. Make sure the names match what the IRS has on file.

- Provide your address. Include the street, city, state, and ZIP code.

- Indicate the quarter for which you are filing. Choose the correct quarter from the options provided.

- Enter the number of employees who received wages during the quarter.

- Report the total wages paid to employees in the quarter. This should include all taxable wages.

- Calculate the taxable Social Security wages and enter that amount. Remember to separate it from Medicare wages.

- Fill in the total taxes owed for the quarter. This includes Social Security and Medicare taxes.

- Complete the section on adjustments if applicable. This may include adjustments for sick pay or other factors.

- Sign and date the form. Ensure that the person signing has the authority to do so.

After completing the form, double-check all entries for accuracy. Once confirmed, submit it to the IRS by the due date to avoid penalties. Keep a copy for your records.