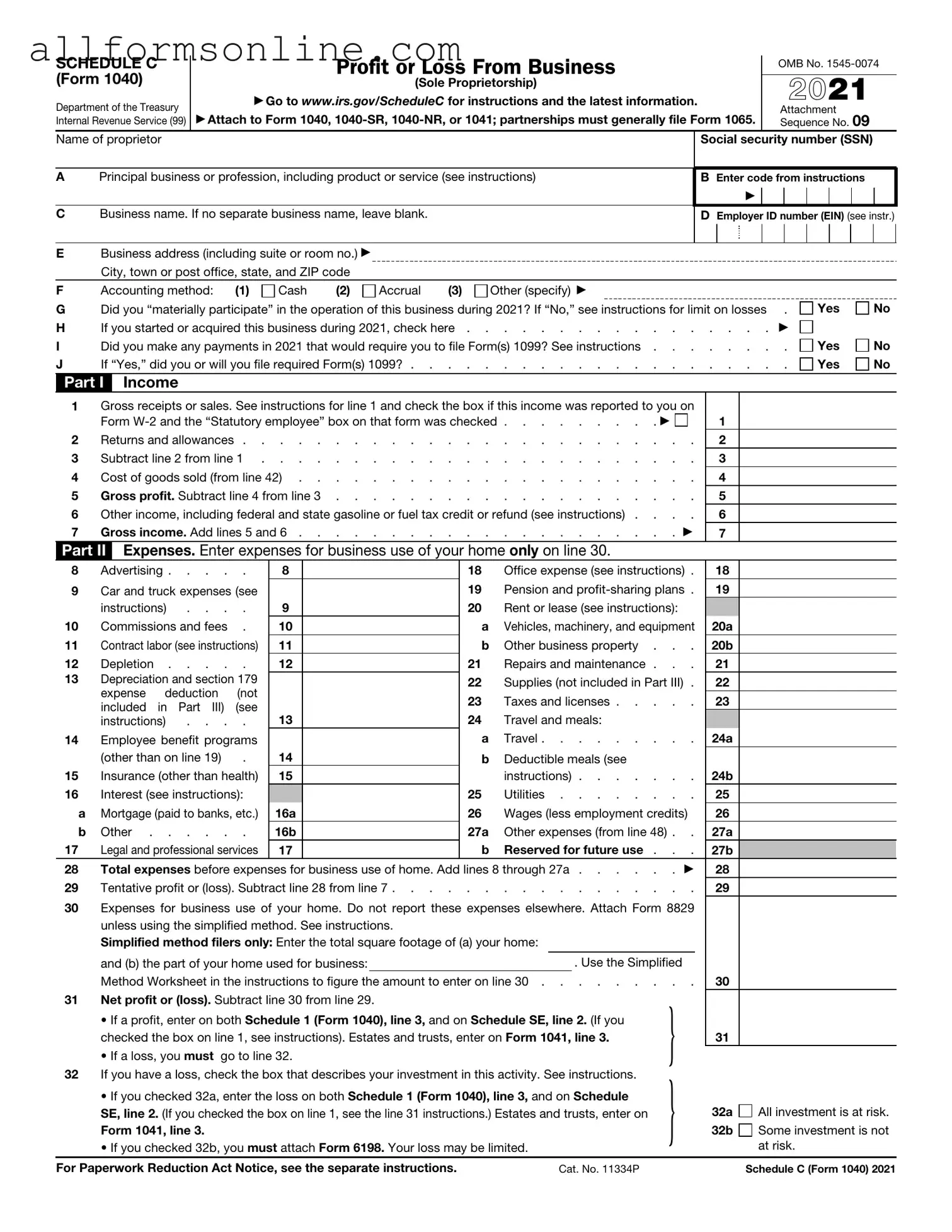

Free IRS Schedule C 1040 PDF Form

Misconceptions

When it comes to filing taxes as a self-employed individual, the IRS Schedule C (Form 1040) can be a source of confusion. Many people hold misconceptions about this form that can lead to mistakes. Here are five common misconceptions, along with clarifications to help you better understand this important tax document.

- Misconception 1: Only businesses with a formal structure need to file Schedule C.

- Misconception 2: You can’t deduct any business expenses unless you have receipts.

- Misconception 3: All income must be reported, but not all expenses can be deducted.

- Misconception 4: Filing Schedule C guarantees a tax audit.

- Misconception 5: You can only file Schedule C if you have a profit.

Many believe that only corporations or LLCs need to file this form. In reality, anyone who is self-employed, including freelancers and sole proprietors, must report their income and expenses using Schedule C.

While having receipts is ideal and can support your claims, it’s not the only way to substantiate your expenses. You can use bank statements, invoices, or other records to demonstrate your business-related expenses.

It’s true that all income must be reported. However, many people are unaware that most ordinary and necessary business expenses can be deducted, including things like office supplies, travel costs, and even a portion of your home if you use it for business.

Some individuals fear that simply filing a Schedule C will trigger an audit. While self-employed individuals may be scrutinized more closely, filing accurately and honestly is the best way to avoid issues with the IRS.

This is not true. You can file Schedule C even if your business operated at a loss. Reporting losses can sometimes provide tax benefits, such as offsetting other income.

Understanding these misconceptions can help you navigate the process of filing your taxes more confidently. Always consider consulting a tax professional if you have specific questions about your situation.

What to Know About This Form

What is IRS Schedule C?

IRS Schedule C is a form used by sole proprietors to report income or loss from their business. It is part of the individual income tax return, Form 1040. This form allows business owners to detail their earnings, expenses, and ultimately determine their taxable income from self-employment activities.

Who needs to file Schedule C?

If you are a sole proprietor or a single-member LLC, you must file Schedule C if you have income from your business. This includes any money earned from freelance work, side gigs, or any other self-employment activities. If your business expenses exceed your income, you can still file Schedule C to report the loss.

What information do I need to complete Schedule C?

To fill out Schedule C, gather information about your business income and expenses. This includes sales receipts, invoices, bank statements, and records of any expenses such as supplies, advertising, and travel costs. You will also need your business name, address, and the type of business you operate.

How do I report income on Schedule C?

Report your total income on Line 1 of Schedule C. This includes all money received from sales or services before any expenses are deducted. If you received any 1099 forms from clients, use those amounts to help calculate your total income.

What types of expenses can I deduct on Schedule C?

You can deduct a variety of business expenses on Schedule C, including costs for supplies, rent, utilities, and travel. Other deductible expenses may include advertising, professional fees, and vehicle expenses if you use your car for business purposes. Keep in mind that personal expenses are not deductible.

What is the difference between a sole proprietorship and an LLC?

A sole proprietorship is the simplest form of business structure, where one individual owns and operates the business. An LLC, or Limited Liability Company, offers personal liability protection to its owners while still allowing them to report income on Schedule C. Both structures may use Schedule C, but LLCs often have more formal requirements.

Can I file Schedule C electronically?

Yes, you can file Schedule C electronically using tax software or through a tax professional. Many tax preparation programs automatically include Schedule C when you indicate that you have self-employment income. Electronic filing can speed up the process and help ensure accuracy.

What happens if I don’t file Schedule C when required?

If you fail to file Schedule C when required, you may face penalties from the IRS. This could include fines and interest on any unpaid taxes. It's essential to file even if you have a loss, as it can help establish your business for future tax years.

Where can I find Schedule C and instructions for filing?

You can find Schedule C and its instructions on the IRS website. They provide the most up-to-date forms and guidelines. Additionally, many tax preparation software programs include Schedule C, making it easier to complete your tax return accurately.

Different PDF Forms

How Long Do Credits Last for College - Include your telephone number for any follow-up questions.

A California Lease Agreement form is a legally binding document outlining the terms and conditions between a landlord and tenant for renting residential or commercial property in California. This form serves to protect the rights of both parties and ensure clear communication regarding rental obligations. For those seeking a comprehensive template, Fast PDF Templates can be a valuable resource. In understanding this document, renters and landlords can engage in a more transparent and effective leasing process.

W9 Form 2022 - Typically, the W-9 form does not need to be submitted directly to the IRS.

Which of These Items Is Checked in a Pre-trip Inspection? - Ensure that all personal belongings are secured during travel.

How to Use IRS Schedule C 1040

Filling out the IRS Schedule C (Form 1040) is an important step for self-employed individuals or those running a business as a sole proprietor. This form helps report income and expenses from your business activities. Below are the steps to guide you through the process of completing the form accurately.

- Obtain a copy of IRS Schedule C (Form 1040). You can download it from the IRS website or request a physical copy.

- Enter your name and Social Security number at the top of the form. If you have a business name, include that as well.

- In Part I, report your business income. List all income earned from your business activities. Be sure to include any cash, checks, or credit card payments received.

- In Part II, detail your business expenses. Categorize your expenses such as advertising, car and truck expenses, and supplies. Be thorough and accurate.

- Calculate your net profit or loss by subtracting total expenses from total income. This number will be crucial for your overall tax return.

- Complete Part III if you have cost of goods sold. This section requires information on inventory and purchases related to your business.

- Fill out Part IV if you qualify for any specific deductions or credits related to your business.

- Review the entire form for accuracy. Make sure all calculations are correct and that you have included all necessary information.

- Sign and date the form. If you are filing jointly, your spouse must also sign.

- Submit the completed Schedule C along with your Form 1040 by the tax filing deadline.

Following these steps will help ensure that your Schedule C is filled out correctly. This process is essential for complying with tax regulations and accurately reporting your business activities.