Free IRS W-9 PDF Form

Misconceptions

Many people have misunderstandings about the IRS W-9 form. Here are eight common misconceptions, explained simply.

- Only businesses need to fill out a W-9. Many individuals, such as freelancers or contractors, also need to complete this form when working with companies.

- The W-9 is only for tax purposes. While it is primarily used for tax reporting, it also helps businesses verify the identity of their payees.

- Submitting a W-9 means I owe taxes. Not at all! Filling out a W-9 does not mean you owe taxes; it simply provides necessary information for the payer.

- The W-9 form is the same as a W-2. These forms serve different purposes. A W-2 is for employees, while a W-9 is for independent contractors and freelancers.

- Once I submit a W-9, I can’t change my information. You can submit a new W-9 anytime your information changes, like your name or address.

- The W-9 is only needed once. Depending on your work situation, you may need to fill it out for different clients or every year.

- My Social Security Number is always required on a W-9. If you have an Employer Identification Number (EIN), you can use that instead of your SSN.

- Filling out a W-9 is complicated. The form is straightforward. It asks for basic information like your name, address, and tax classification.

Understanding these misconceptions can help you navigate the W-9 process with confidence.

What to Know About This Form

What is the purpose of the IRS W-9 form?

The IRS W-9 form is used by individuals and businesses to provide their taxpayer identification information to another party. This form is typically requested by a company or individual who needs to report payments made to you to the IRS. By completing the W-9, you help ensure that the correct information is reported, which can prevent issues with your tax filings.

Who needs to fill out a W-9 form?

Generally, anyone who is a U.S. citizen or resident alien and receives income that needs to be reported to the IRS should complete a W-9. This includes freelancers, independent contractors, and vendors. If you are receiving payments for services, royalties, or other income types, the payer may request that you fill out this form to keep their records accurate.

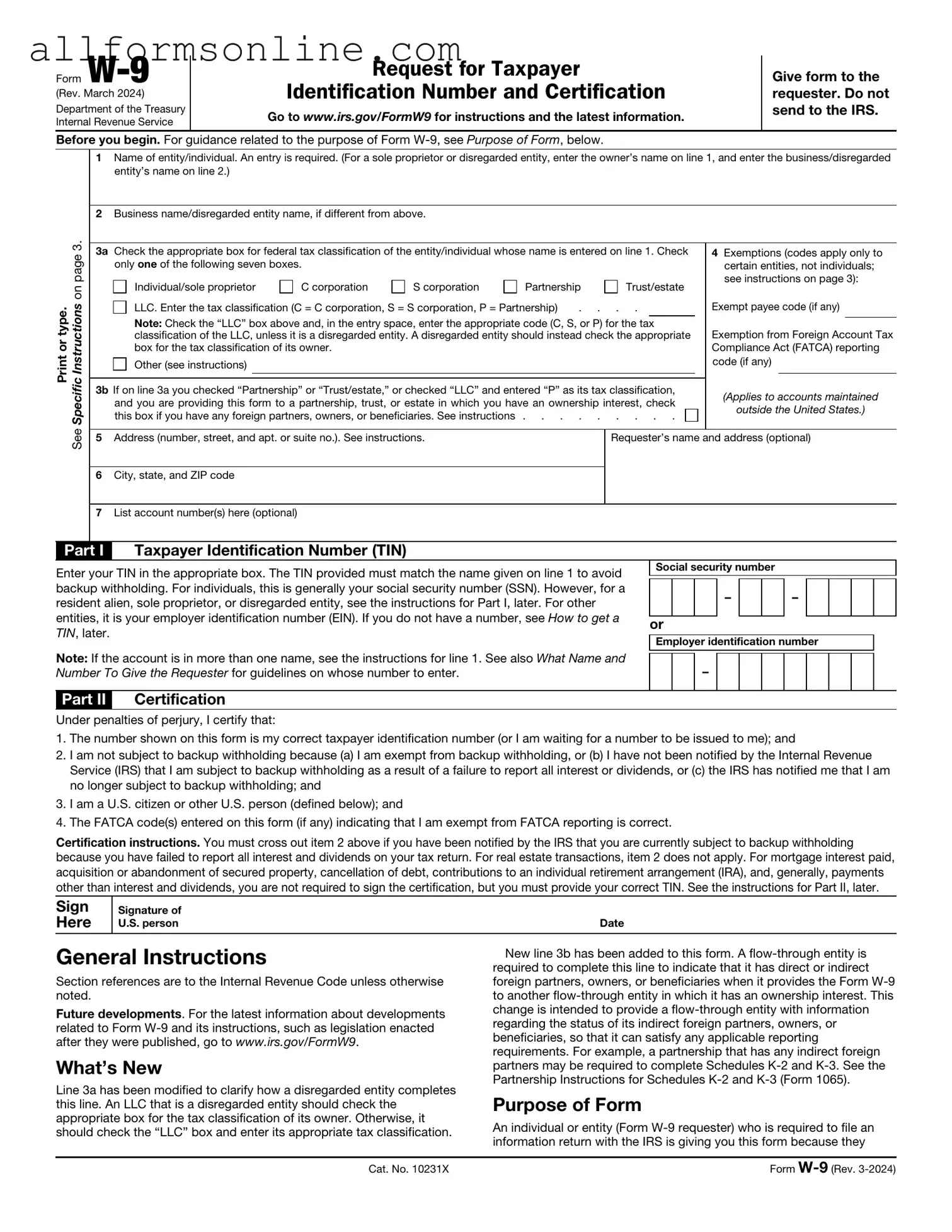

What information is required on the W-9 form?

The W-9 form asks for basic information such as your name, business name (if applicable), address, and taxpayer identification number (TIN). For individuals, this is typically your Social Security number (SSN). For businesses, it may be your Employer Identification Number (EIN). You will also need to certify that the information provided is accurate and that you are not subject to backup withholding.

How is the W-9 form submitted?

After completing the W-9 form, you do not submit it directly to the IRS. Instead, you provide it to the person or business that requested it. They will use the information to prepare their own tax documents, such as Form 1099, which they will file with the IRS. Make sure to keep a copy for your own records as well.

What happens if I don’t fill out a W-9 form when requested?

If you do not complete and return a W-9 form when requested, the payer may be required to withhold a portion of your payments for tax purposes. This is known as backup withholding. The current backup withholding rate is 24%. To avoid this, it’s best to provide the requested information as soon as possible.

Can I refuse to provide my information on a W-9 form?

While you can technically refuse to provide your information, doing so may lead to negative consequences. If you do not complete the W-9, the payer may withhold taxes from your payments, as mentioned earlier. Additionally, they may choose not to work with you or may terminate any existing contracts. It’s generally in your best interest to comply with the request if you want to receive payment for your services.

Different PDF Forms

CBP Declaration Form 6059B - The information collected aids in the enforcement of U.S. laws concerning prohibited items.

When completing an Employment Application PDF form, it's essential for candidates to present their qualifications clearly and concisely, as this document serves as a critical first impression for potential employers. Utilizing resources like Fast PDF Templates can provide valuable guidance in ensuring that all necessary information is included and formatted correctly, thereby improving a candidate's chances of landing an interview.

Reg 256 Ca Dmv - The form will guide the applicant through the specific steps needed for a successful application.

Bill of Lading Form Pdf - The Straight Bill is key in maintaining the supply chain flow.

How to Use IRS W-9

After obtaining the IRS W-9 form, you will need to complete it accurately to provide your taxpayer information to the requester. This is often required for tax purposes, such as when you are working as an independent contractor or receiving certain types of income. Follow these steps to fill out the form properly.

- Begin by downloading the IRS W-9 form from the official IRS website or obtain a physical copy.

- In the first section, enter your name as it appears on your tax return. If you are a business, provide the name of the business.

- Next, check the appropriate box to indicate your tax classification. Options include individual, corporation, partnership, or other.

- If applicable, fill in your business name, trade name, or DBA (doing business as) name in the designated area.

- Provide your address, including street address, city, state, and ZIP code. Ensure this information is current and accurate.

- In the next section, enter your taxpayer identification number (TIN). This could be your Social Security Number (SSN) or Employer Identification Number (EIN).

- Leave the next section blank unless you are exempt from backup withholding. If you are exempt, provide the appropriate code.

- Sign and date the form at the bottom. Your signature confirms that the information provided is accurate.

- Finally, submit the completed form to the requester. Do not send it to the IRS.