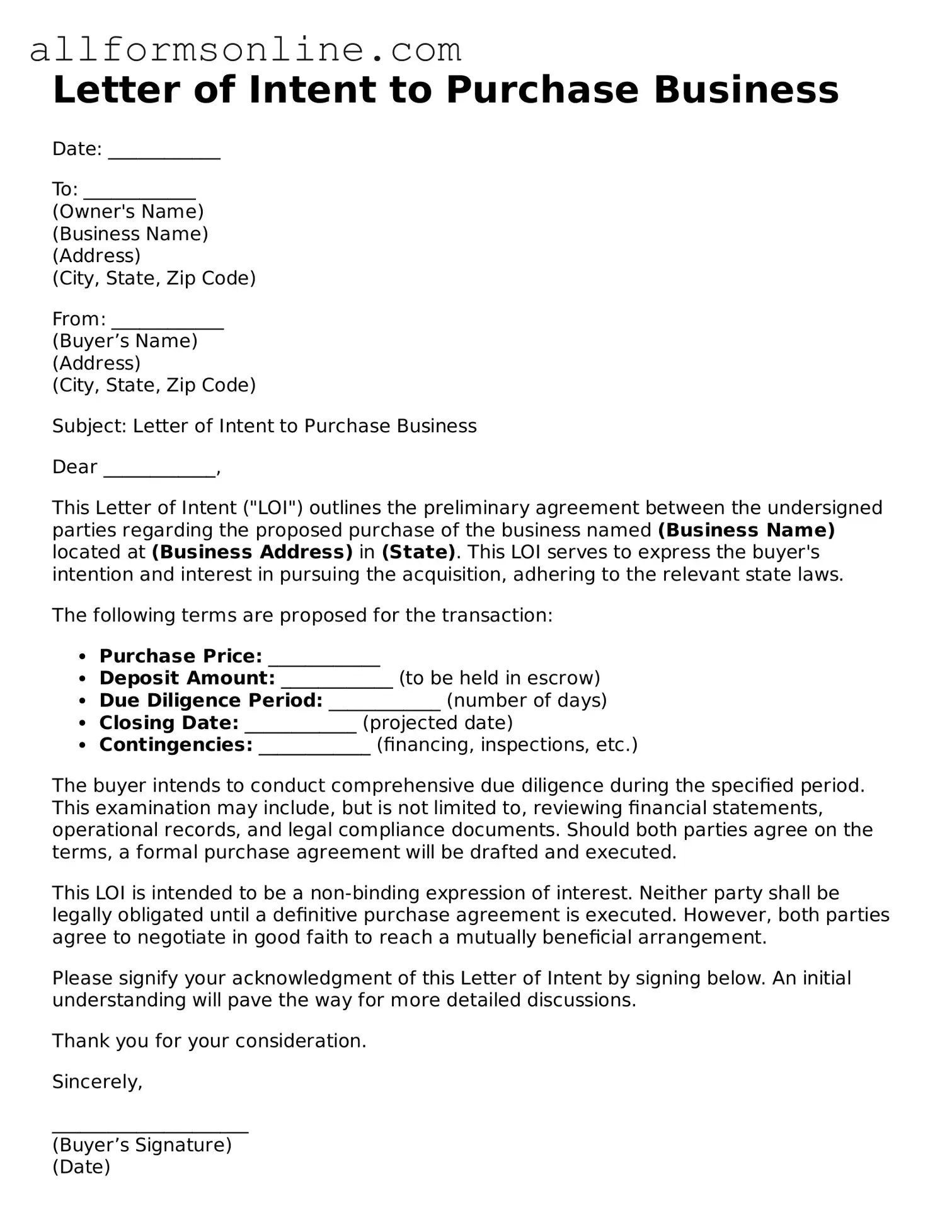

Blank Letter of Intent to Purchase Business Form

Misconceptions

Understanding the Letter of Intent to Purchase Business form is crucial for anyone involved in a business transaction. Here are ten common misconceptions about this important document:

-

It is a legally binding contract.

Many believe that a Letter of Intent (LOI) is a final contract. In reality, it typically outlines the intent to negotiate further and is not legally binding unless specified.

-

It is only necessary for large transactions.

Some think LOIs are only for significant deals. However, they can be beneficial for transactions of any size, providing clarity and direction.

-

It guarantees the sale will happen.

Just because an LOI is signed does not mean the sale will proceed. It serves as a starting point for negotiations, not a guarantee.

-

It must be complex and lengthy.

Many assume that LOIs need to be complicated. In fact, a straightforward and clear LOI can be just as effective.

-

Only buyers need to sign it.

Some people think only the buyer's signature is necessary. Both parties typically sign the LOI to show mutual agreement on the terms outlined.

-

It covers all terms of the sale.

There is a misconception that an LOI includes every detail of the transaction. Instead, it usually highlights key points, leaving room for further negotiation.

-

It can be ignored once signed.

Some believe that once the LOI is signed, it can be disregarded. However, it sets the tone for future discussions and commitments.

-

It is not necessary if a formal contract will follow.

Many think that an LOI is redundant if a formal contract is coming. However, it can help clarify intentions and streamline the process.

-

It is only for buyers.

Some people believe that only buyers use LOIs. In fact, sellers can also benefit from outlining their expectations and terms.

-

It cannot be modified once signed.

Lastly, some think an LOI is set in stone after signing. However, parties can negotiate and amend the terms as needed.

Addressing these misconceptions can lead to a more efficient and effective business transaction process.

What to Know About This Form

What is a Letter of Intent to Purchase Business?

A Letter of Intent (LOI) to Purchase Business is a document that outlines the preliminary agreement between a buyer and a seller regarding the sale of a business. It expresses the buyer's interest in purchasing the business and sets the stage for further negotiations. While it is not a legally binding contract, it signals serious intent and lays out key terms that both parties are willing to discuss.

Why is an LOI important in a business transaction?

An LOI serves several important purposes. First, it clarifies the intentions of both the buyer and seller, helping to avoid misunderstandings. Second, it provides a framework for the negotiation process, outlining essential terms such as price, payment structure, and timelines. Lastly, it can also help secure financing, as lenders often want to see a formal agreement before providing funds.

What key elements should be included in the LOI?

While the specifics can vary, a well-crafted LOI typically includes the purchase price, payment terms, a description of the business being sold, any contingencies (like financing or inspections), and a timeline for the transaction. Additionally, it may address confidentiality and exclusivity agreements, ensuring that both parties are protected during negotiations.

Is an LOI legally binding?

Generally, an LOI is not legally binding in its entirety. However, certain sections, such as confidentiality or exclusivity clauses, may be enforceable. It's essential to clearly indicate which parts of the LOI are binding and which are not. This clarity helps both parties understand their rights and obligations as they move forward.

How does an LOI differ from a purchase agreement?

An LOI is a preliminary document that outlines the basic terms of a potential sale, while a purchase agreement is a comprehensive contract that finalizes the sale. The purchase agreement includes detailed provisions, representations, warranties, and obligations of both parties. Essentially, the LOI is a starting point that leads to the more formal purchase agreement.

Can I change the terms of the LOI after it has been signed?

Yes, the terms of an LOI can be modified after it has been signed, but both parties must agree to any changes. Open communication is key. If you find that certain terms need adjustment, it’s best to discuss these changes as soon as possible to avoid complications later in the process.

Should I hire a lawyer to help with the LOI?

While it’s not mandatory to hire a lawyer for drafting an LOI, it is highly advisable. An experienced attorney can help ensure that the document accurately reflects your intentions and protects your interests. They can also guide you through the negotiation process and assist with any legal implications that may arise.

What happens after the LOI is signed?

Once the LOI is signed, both parties typically move forward with due diligence, where the buyer investigates the business's financials, operations, and legal standing. This process can take time and may lead to further negotiations. If everything checks out, the parties will then work towards drafting a formal purchase agreement to finalize the sale.

Popular Letter of Intent to Purchase Business Types:

Letter of Intent to Purchase Property - A tool to outline initial terms related to price, timeframe, and contingencies.

For families considering home education, the Mississippi Homeschool Letter of Intent provides a vital means of communication with educational authorities. Ensuring adherence to legal requirements, this document is essential for families to formally inform the local school district of their intent. For more guidance, check out this comprehensive overview of the Mississippi Homeschool Letter of Intent.

Letter of Intrest - The initial investment structure may be proposed within this document.

How to Use Letter of Intent to Purchase Business

Once you have the Letter of Intent to Purchase Business form in hand, it’s time to complete it accurately. This form is crucial for outlining the terms of your proposed purchase. Filling it out correctly will help set the stage for negotiations and ensure that both parties are on the same page.

- Begin by entering your name and contact information at the top of the form.

- Provide the name of the business you intend to purchase.

- Include the business address and any relevant identification numbers, such as the Employer Identification Number (EIN).

- State the proposed purchase price clearly.

- Outline any terms and conditions you wish to include, such as payment structure or contingencies.

- Specify the timeline for the transaction, including any deadlines for due diligence or closing dates.

- Sign and date the form at the bottom to indicate your agreement to the terms outlined.

After completing the form, review it carefully to ensure all information is accurate. Once satisfied, you can present it to the seller for consideration.