Blank Livestock Bill of Sale Form

Misconceptions

The Livestock Bill of Sale form is an important document in the agricultural sector. However, several misconceptions surround its use and implications. Below is a list of ten common misconceptions.

- The form is only necessary for large transactions. Many believe that a Bill of Sale is only needed for significant purchases. In reality, any sale of livestock, regardless of size, benefits from having a written record.

- All states have the same requirements for a Bill of Sale. Each state has its own regulations regarding livestock sales. It is essential to understand local laws to ensure compliance.

- A verbal agreement is sufficient. While verbal agreements can be legally binding, they are difficult to enforce. A written Bill of Sale provides clear evidence of the transaction.

- The form is only for the seller's protection. Both buyers and sellers benefit from a Bill of Sale. It protects the buyer by providing proof of ownership and protects the seller by documenting the sale.

- Once signed, the form cannot be changed. Amendments can be made if both parties agree. It is advisable to document any changes in writing.

- The Bill of Sale is not legally binding. A properly executed Bill of Sale is legally binding and can be enforced in court if disputes arise.

- It is only relevant for the sale of live animals. The form can also apply to the sale of livestock-related items, such as equipment or feed, depending on the context.

- Only professional sellers need a Bill of Sale. Even casual sellers or individuals selling livestock as a hobby should use the form to ensure clarity and legal protection.

- The Bill of Sale does not need to be notarized. While notarization is not always required, having a notarized document can add an extra layer of authenticity.

- Once the transaction is complete, the Bill of Sale is no longer needed. It is advisable to keep a copy for record-keeping purposes, as it may be needed for future reference or legal issues.

Understanding these misconceptions can help individuals navigate the complexities of livestock transactions more effectively.

What to Know About This Form

What is a Livestock Bill of Sale form?

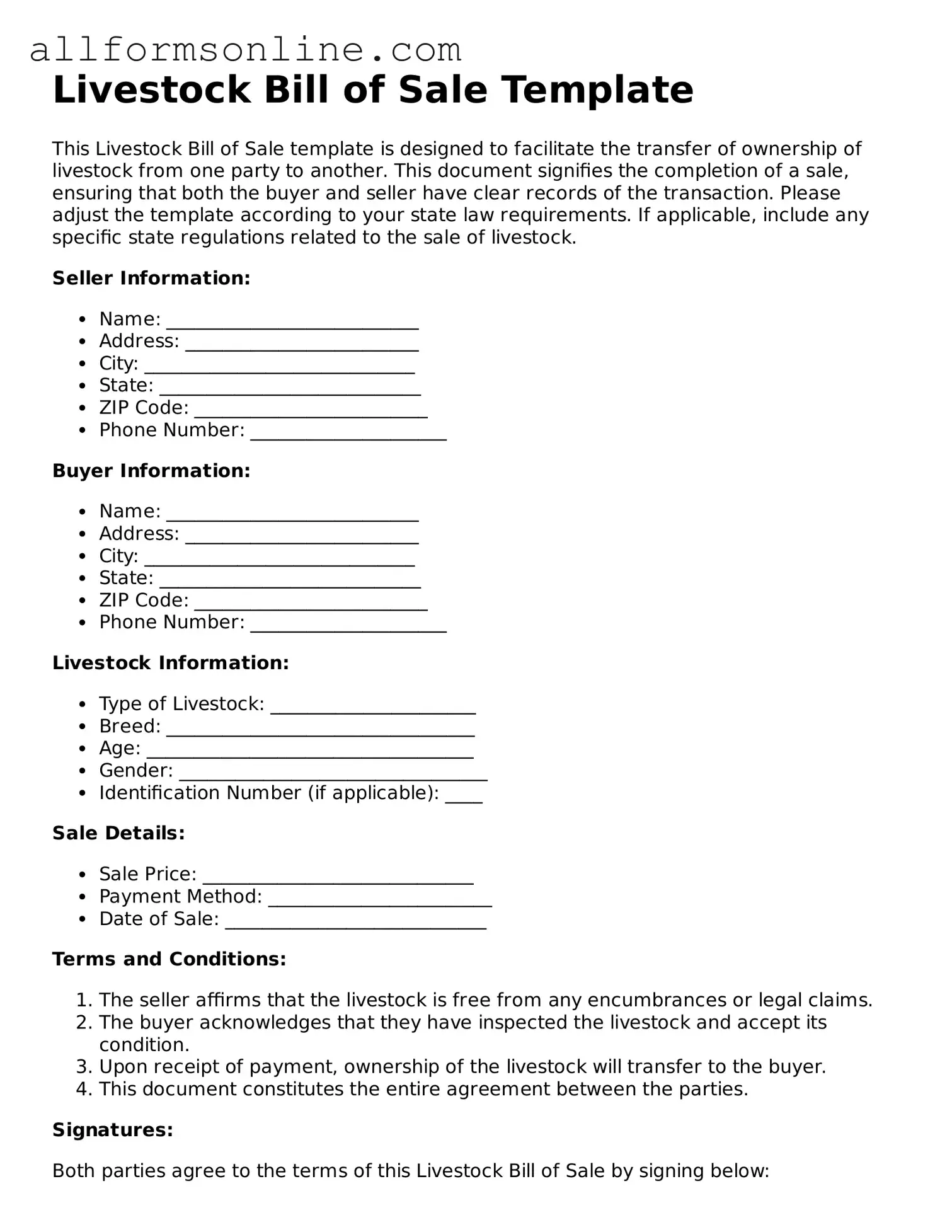

A Livestock Bill of Sale form is a legal document used to transfer ownership of livestock from one party to another. This form serves as proof of the transaction and includes important details such as the buyer's and seller's information, a description of the livestock being sold, and the sale price. It helps protect both parties by clearly outlining the terms of the sale.

Why is a Livestock Bill of Sale important?

This document is essential for several reasons. Firstly, it provides legal protection for both the buyer and the seller. In case of disputes, having a written record of the transaction can be invaluable. Secondly, it can be required for registration purposes with certain agricultural organizations or for tax purposes. Lastly, it ensures that both parties agree on the details of the sale, reducing the likelihood of misunderstandings.

What information should be included in a Livestock Bill of Sale?

To create a comprehensive Livestock Bill of Sale, several key pieces of information should be included. This includes the names and addresses of both the buyer and seller, a detailed description of the livestock (such as breed, age, and identification numbers), the sale price, and the date of the transaction. Additionally, any warranties or guarantees about the livestock's health or condition should be noted, as well as the method of payment.

Do I need to have the Livestock Bill of Sale notarized?

Notarization is not always required for a Livestock Bill of Sale, but it can add an extra layer of security and legitimacy to the document. Some states may have specific requirements regarding notarization, especially if the livestock is of significant value or if the transaction involves financing. It’s wise to check local regulations or consult with a legal expert to determine if notarization is necessary in your situation.

Can I use a Livestock Bill of Sale for different types of livestock?

Yes, a Livestock Bill of Sale can be used for various types of livestock, including cattle, sheep, goats, pigs, and horses, among others. However, it’s important to ensure that the form is tailored to the specific type of livestock being sold. Different species may require additional information, such as health records or registration details, so be sure to customize the form accordingly to meet the needs of your transaction.

Popular Livestock Bill of Sale Types:

Do Golf Carts Have a Title - Buyers may consider this document essential for their peace of mind during the purchase process.

In order to facilitate a smooth transaction, parties involved in the sale of personal property may opt to utilize a General Bill of Sale, which can be conveniently obtained at Fillable Forms. This essential document ensures that all relevant details, such as item description, sale price, and involved parties, are meticulously recorded, providing a clear framework that protects both buyers and sellers.

How to Use Livestock Bill of Sale

After obtaining the Livestock Bill of Sale form, you will need to complete it accurately to ensure a smooth transaction. Follow these steps carefully to fill out the form correctly.

- Begin by entering the date of the sale at the top of the form.

- Next, provide the name and address of the seller. This identifies the individual or business selling the livestock.

- Then, enter the name and address of the buyer. This information is essential for the new owner’s records.

- In the designated section, describe the livestock being sold. Include details such as species, breed, age, and any identification numbers, if applicable.

- Specify the sale price of the livestock. Clearly state the amount in the appropriate section of the form.

- If applicable, indicate any terms of the sale, such as payment methods or warranties. This provides clarity for both parties.

- Both the seller and buyer should sign and date the form at the bottom. This finalizes the agreement and confirms the transaction.

Once the form is completed and signed, keep a copy for your records. The buyer should also retain a copy for their documentation. This ensures both parties have proof of the transaction.