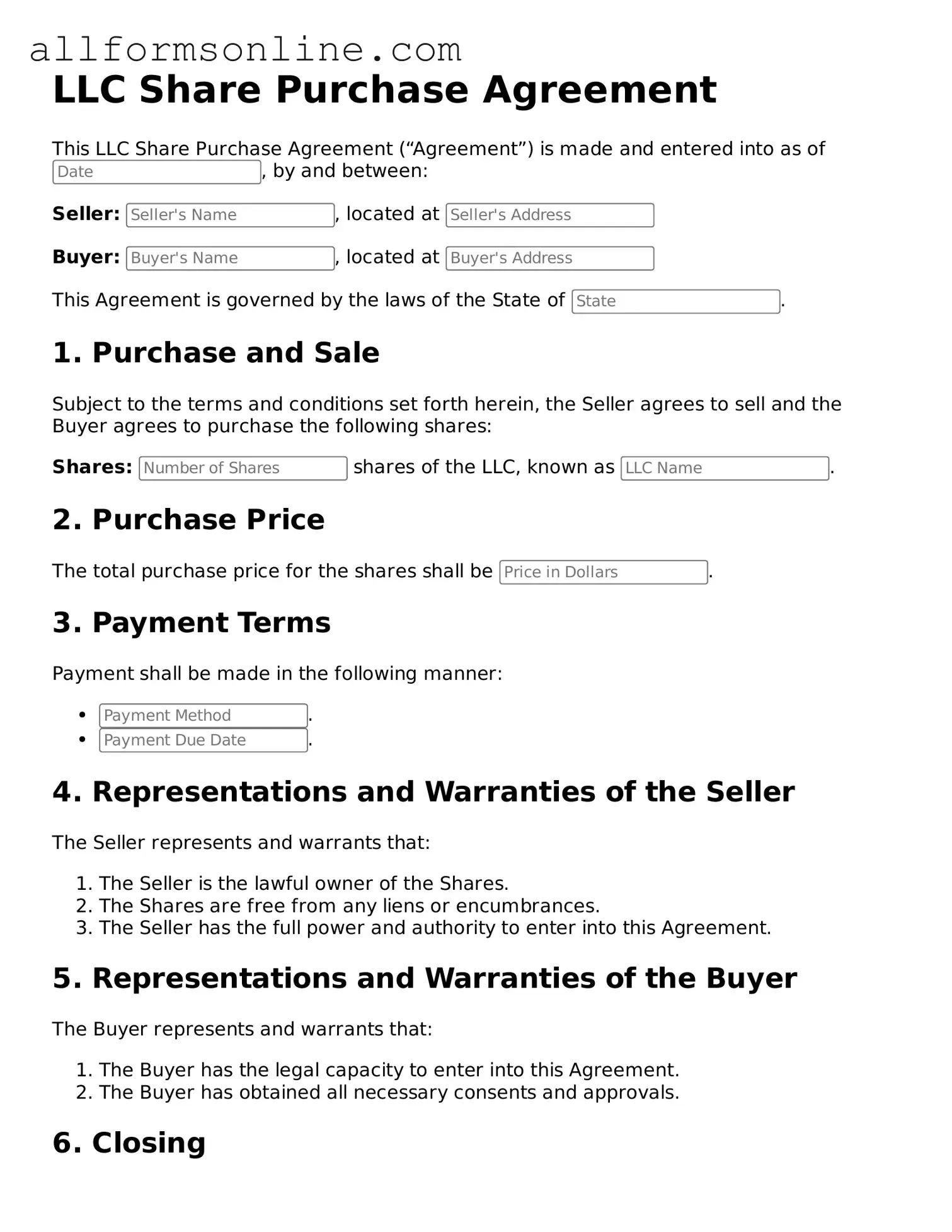

Blank LLC Share Purchase Agreement Form

Misconceptions

When it comes to the LLC Share Purchase Agreement, several misconceptions can lead to confusion for those involved in a transaction. Understanding these common misunderstandings can help clarify the process and ensure that all parties are on the same page.

- Misconception 1: An LLC Share Purchase Agreement is the same as a standard sales contract.

- Misconception 2: All members of the LLC must approve the sale of shares.

- Misconception 3: The agreement does not require legal review.

- Misconception 4: Once signed, the agreement cannot be altered.

- Misconception 5: The LLC Share Purchase Agreement is only necessary for large transactions.

This is not true. While both documents facilitate a transaction, an LLC Share Purchase Agreement specifically addresses the sale of membership interests in a limited liability company, which includes unique considerations related to ownership and liability.

This misconception arises from a misunderstanding of how LLCs operate. Depending on the operating agreement, it may only require the approval of a certain percentage of members to proceed with a share sale, not necessarily unanimous consent.

Many people believe that since the form is standardized, it doesn’t need a legal review. However, having a qualified attorney review the agreement is crucial to ensure that all terms are fair and compliant with state laws.

This is misleading. While the agreement is binding once executed, parties can negotiate amendments if both agree to the changes. It’s essential to document any alterations formally.

Many believe that only significant transactions require this agreement. In reality, any transfer of membership interests, regardless of size, should be documented to protect all parties involved and maintain clear records.

What to Know About This Form

What is an LLC Share Purchase Agreement?

An LLC Share Purchase Agreement is a legal document that outlines the terms and conditions under which an individual or entity agrees to buy shares in a Limited Liability Company (LLC). This agreement serves to protect both the buyer and the seller by clearly defining the rights and obligations of each party involved in the transaction. It typically includes details such as the purchase price, payment terms, representations and warranties, and any conditions that must be met before the sale can be completed.

Why is it important to have an LLC Share Purchase Agreement?

Having an LLC Share Purchase Agreement is crucial for several reasons. First, it provides a clear framework for the transaction, minimizing the risk of misunderstandings or disputes between the buyer and seller. Second, it helps to ensure that both parties are aware of their rights and responsibilities, which can protect them legally in case issues arise after the sale. Finally, this agreement can also facilitate a smoother transition of ownership, ensuring that all necessary steps are taken for a successful transfer of shares.

What key elements should be included in an LLC Share Purchase Agreement?

When drafting an LLC Share Purchase Agreement, several key elements should be included to ensure its effectiveness. These elements typically consist of the names and addresses of the buyer and seller, a description of the shares being sold, the purchase price, and payment terms. Additionally, it is important to include any representations and warranties made by both parties, conditions that must be satisfied before closing, and any applicable governing laws. Including these elements helps to create a comprehensive and enforceable agreement.

Can an LLC Share Purchase Agreement be modified after it is signed?

Yes, an LLC Share Purchase Agreement can be modified after it is signed, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and the seller to ensure that the changes are legally binding. It is essential to approach any modifications carefully, as changes may affect the rights and obligations outlined in the original agreement. Always consider consulting with a legal professional when making amendments to ensure compliance with applicable laws and regulations.

Popular Templates:

Trader Joes Careers - Believes in continuous improvement and professional growth.

When engaging in the sale or purchase of personal property, it is essential to have a solid understanding of the required documentation; thus, using a General Bill of Sale can be beneficial. This document not only captures the specifics of the transaction, such as item description and sale price, but it also promotes security for both parties involved. For those looking to simplify the process, templates are available through Fillable Forms, making it easier to create a comprehensive bill of sale that meets legal standards.

Roof Estimate Sample - Plan your roofing project effectively by starting with our estimate.

How to Use LLC Share Purchase Agreement

Filling out the LLC Share Purchase Agreement form is a crucial step in formalizing the transfer of ownership in a limited liability company. To ensure that all necessary information is accurately captured, follow these detailed steps. Each section of the form is designed to collect specific information, so take your time to review and fill it out carefully.

- Begin by entering the date at the top of the form. This date marks when the agreement is being executed.

- Provide the full legal name of the LLC. This should match the name registered with the state.

- Next, list the names of the seller(s). Include their full names and any relevant titles or roles within the LLC.

- In the following section, enter the names of the buyer(s). Again, include full names and titles as necessary.

- Specify the number of shares being sold. Be precise with the quantity to avoid confusion later.

- Indicate the purchase price per share. This should be a clear figure that both parties agree upon.

- Fill in the total purchase price by multiplying the number of shares by the price per share.

- Include any conditions or contingencies that need to be met before the sale is finalized. This may involve approvals or other requirements.

- Both parties should sign and date the agreement at the bottom. Ensure that all signatures are legible.

After completing the form, review it for accuracy. Make copies for all parties involved, and consider having it notarized to add an extra layer of authenticity. This agreement is now ready to be executed, marking a significant step in the ownership transition of the LLC.