Blank Loan Agreement Form

Loan AgreementDocuments for Particular States

Loan Agreement Form Categories

Misconceptions

Loan agreements are essential documents in the lending process, yet many misconceptions surround them. Understanding these misconceptions can help borrowers and lenders navigate their responsibilities and rights more effectively.

- Misconception 1: A loan agreement is only necessary for large loans.

- Misconception 2: Loan agreements are only for formal lenders, like banks.

- Misconception 3: Once signed, a loan agreement cannot be changed.

- Misconception 4: Loan agreements are only about repayment terms.

This is not true. Regardless of the amount, a loan agreement provides clarity and protection for both parties. Even small loans can benefit from a written agreement to avoid misunderstandings.

Many people believe that only financial institutions require loan agreements. In reality, any lending situation, including personal loans between friends or family members, can benefit from a formal agreement to outline terms and conditions.

This is misleading. While a loan agreement is a binding contract, parties can negotiate changes. Both the borrower and lender must agree to any modifications, and these should be documented in writing.

While repayment terms are a crucial aspect, loan agreements often include other important elements. These may cover interest rates, collateral, default conditions, and any fees associated with the loan.

What to Know About This Form

What is a Loan Agreement form?

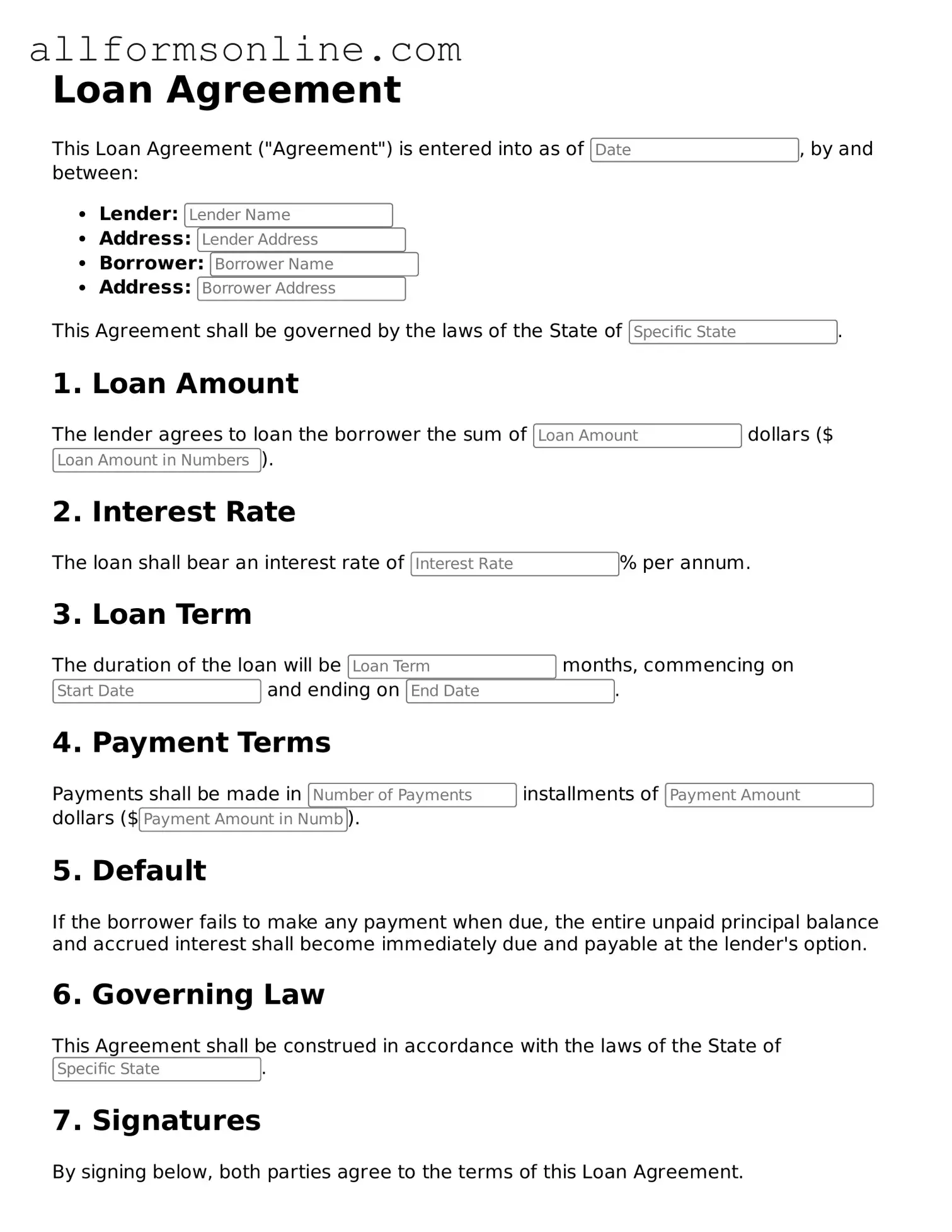

A Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It specifies the amount borrowed, interest rates, repayment schedule, and any collateral involved. This form serves as a binding contract, ensuring that both parties understand their rights and responsibilities. By having a written agreement, potential misunderstandings can be avoided, providing clarity and security for both the lender and the borrower.

What information should be included in a Loan Agreement?

When creating a Loan Agreement, it’s essential to include specific details to ensure clarity. Key elements typically include the names and addresses of both the lender and borrower, the loan amount, the interest rate, repayment terms, and the due date for payments. Additionally, any penalties for late payments or default should be outlined. If applicable, details about collateral, such as property or assets securing the loan, should also be included. This comprehensive approach helps protect both parties and provides a clear framework for the loan.

Can a Loan Agreement be modified after it is signed?

Yes, a Loan Agreement can be modified after it has been signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the lender and borrower to maintain clarity and enforceability. This might include changes to the repayment schedule, interest rates, or other terms. Keeping a record of any amendments ensures that all parties are on the same page and helps prevent disputes in the future.

What happens if the borrower defaults on the Loan Agreement?

If a borrower defaults on a Loan Agreement, it means they have failed to meet the terms of the agreement, such as missing a payment or not repaying the loan as agreed. The lender has several options in this situation. They may choose to contact the borrower to discuss the issue and explore possible solutions. If necessary, the lender might initiate legal action to recover the owed amount, which could include seizing collateral if it was part of the agreement. Defaulting can also negatively impact the borrower’s credit score, making it more challenging to secure loans in the future.

Popular Templates:

Employee Handbook Template Free - This document explains the protocols for leave requests, including vacation and sick leave.

In today's competitive job market, having a well-prepared Employment Application PDF form is essential for job seekers. This form not only consolidates personal information, work history, and relevant skills but also presents candidates in a professional manner. For those looking for a reliable template to guide them in this process, the Fast PDF Templates can be an invaluable resource, ensuring that applicants can present themselves effectively and increase their chances of landing an interview.

Spousal Sponsorship Support Letters From Friends and Family - This document reflects our daily routines that reinforce our connection.

How to Use Loan Agreement

After obtaining the Loan Agreement form, you are ready to fill it out. Ensure you have all necessary information at hand, such as the details of the borrower and lender, loan amount, and repayment terms. Follow these steps carefully to complete the form accurately.

- Begin by entering the date at the top of the form.

- Fill in the full legal name of the lender in the designated space.

- Provide the full legal name of the borrower.

- State the principal amount of the loan clearly.

- Specify the interest rate for the loan.

- Indicate the repayment schedule, including start date and frequency of payments.

- Include any fees or additional costs associated with the loan.

- Write down any collateral offered for the loan, if applicable.

- Both parties should sign and date the form at the bottom.

Once you have completed the form, review it for accuracy. Ensure all information is correct and legible. After verification, both parties should keep a signed copy for their records.