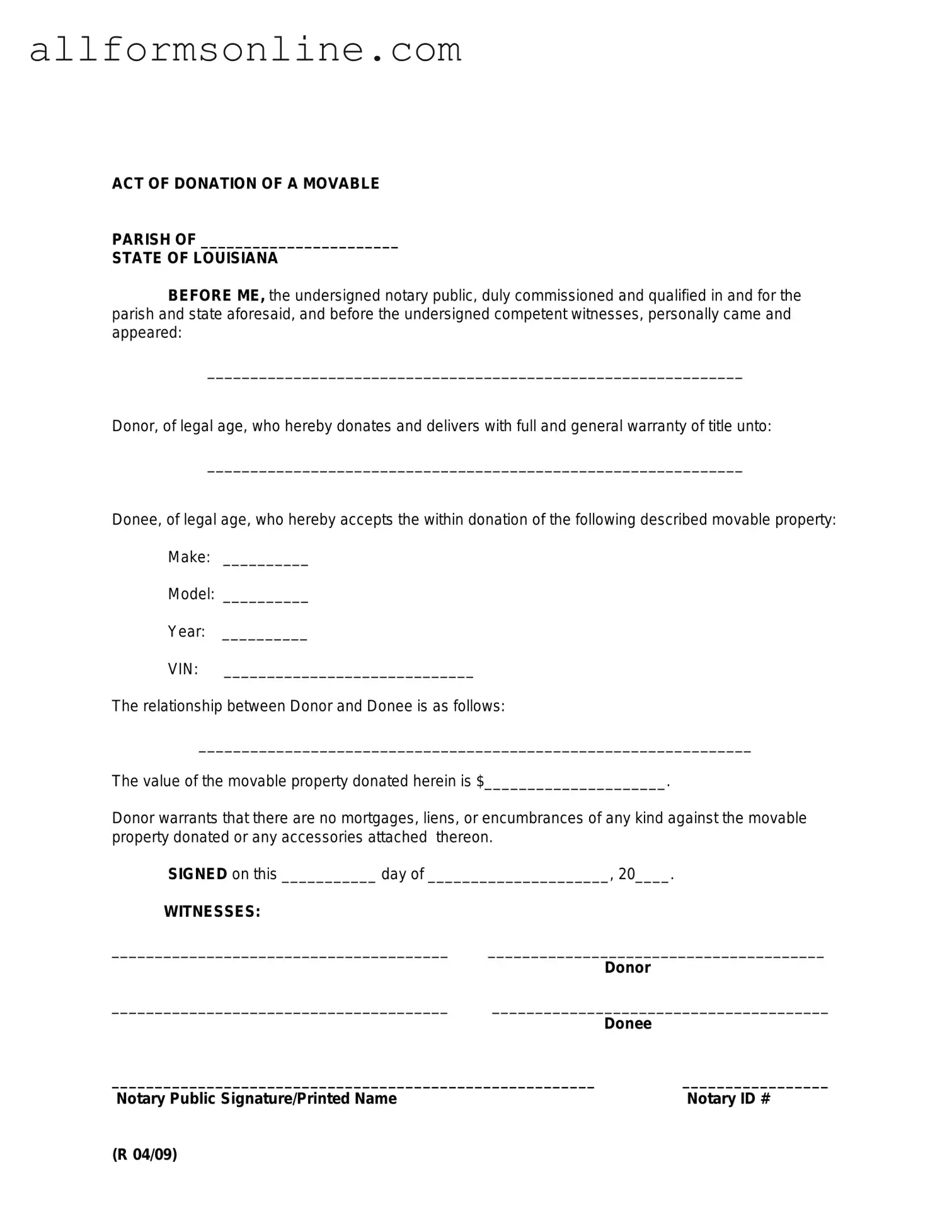

Free Louisiana act of donation PDF Form

Misconceptions

The Louisiana act of donation form serves a specific purpose in the context of property transfer. However, several misconceptions surround this legal document. Below are four common misunderstandings, along with clarifications to help demystify the act of donation.

- Misconception 1: The act of donation is only for transferring real estate.

- Misconception 2: An act of donation must be notarized to be valid.

- Misconception 3: Donors can revoke an act of donation at any time.

- Misconception 4: The act of donation is the same as a will.

This is not entirely accurate. While many people associate the act of donation with real property, it can also apply to personal property, such as vehicles, jewelry, or other valuable items. The key factor is the intent to donate, regardless of the type of property involved.

While notarization adds a layer of authenticity and can help prevent disputes, it is not strictly required for all acts of donation. Some donations may be valid without notarization, depending on the circumstances and the type of property being transferred. However, having a notarized document can provide greater legal protection.

This is misleading. Once an act of donation is executed and accepted by the donee, it generally cannot be revoked without the consent of both parties. Exceptions may exist in certain situations, but they are limited and often complex. Understanding the implications of the donation is essential before proceeding.

This is a common confusion. An act of donation is a present transfer of property, while a will only takes effect upon the death of the individual. In contrast, a donation is an immediate gift. Individuals should consider their intentions carefully when deciding between these two options.

What to Know About This Form

What is the Louisiana Act of Donation Form?

The Louisiana Act of Donation Form is a legal document used to transfer ownership of property from one individual to another without the exchange of money. This form is commonly utilized in situations where a person wishes to donate real estate or personal property to another party, often a family member or charitable organization. The act formalizes the donation and ensures that it is legally recognized in the state of Louisiana.

Who can use the Louisiana Act of Donation Form?

Any individual who owns property in Louisiana can use the Act of Donation Form to transfer ownership. This includes homeowners, landowners, and individuals possessing personal property. The donor must be of sound mind and legal age, while the recipient must also be capable of accepting the donation. In some cases, a guardian may act on behalf of a minor or incapacitated person.

What types of property can be donated using this form?

The form can be used to donate various types of property, including real estate, vehicles, personal belongings, and other tangible assets. It is important to specify the type of property being donated clearly in the document to avoid any confusion or disputes in the future.

Is there a requirement for witnesses or notarization?

Yes, the Louisiana Act of Donation Form typically requires the signatures of witnesses and may also need to be notarized. This adds a layer of authenticity to the document and helps ensure that the donation is valid and enforceable. The number of required witnesses may vary, so it is advisable to consult the specific guidelines for the form.

What are the tax implications of making a donation?

Donations can have tax implications for both the donor and the recipient. The donor may be eligible for a charitable deduction if the donation is made to a qualified organization. However, it is essential to consult a tax professional to understand any potential gift tax liabilities or exemptions that may apply to the donation.

Can the donation be revoked after the form is signed?

Once the Louisiana Act of Donation Form is signed and executed, the donation is generally considered final and cannot be revoked. However, there may be specific circumstances under which a donation can be contested, such as evidence of fraud or undue influence. It is crucial to ensure that the decision to donate is made thoughtfully and voluntarily.

How do I properly complete the Louisiana Act of Donation Form?

To complete the form, the donor must provide detailed information about themselves, the recipient, and the property being donated. All parties involved should read the document carefully to ensure accuracy. It is advisable to seek legal assistance to ensure that the form complies with Louisiana laws and adequately protects the interests of both the donor and the recipient.

Where should I file the Louisiana Act of Donation Form?

The completed Louisiana Act of Donation Form should be filed with the appropriate parish clerk of court where the property is located. This filing helps to publicly document the transfer of ownership and ensures that the donation is recognized legally. It is important to keep a copy of the filed document for personal records.

Different PDF Forms

Proof Paperwork Positive Planned Parenthood Pregnancy Test Results - Check boxes allow you to quickly respond to questions about your health.

Melaleuca Membership Requirements - People often suspend benefits for various personal reasons.

The Georgia Hold Harmless Agreement is crucial for individuals and organizations seeking to safeguard themselves from liability risks. For those interested in learning more about the details, a helpful resource is available through a comprehensive overview of the Hold Harmless Agreement, which outlines its significance and practical applications.

Temporary Custody Order Mn - This form allows for a structured approach to temporary child custody situations.

How to Use Louisiana act of donation

Filling out the Louisiana Act of Donation form is an important step in legally transferring ownership of property. This process requires careful attention to detail to ensure that all necessary information is accurately provided. Below are the steps to guide you through completing the form.

- Begin by obtaining the Louisiana Act of Donation form. This can typically be found online or at your local courthouse.

- Read through the entire form to familiarize yourself with the sections that need to be completed.

- In the first section, provide the names and addresses of both the donor (the person giving the property) and the donee (the person receiving the property).

- Clearly describe the property being donated. This includes specifying the type of property, its location, and any identifying details, such as a legal description or parcel number.

- Indicate whether the donation is made with any conditions or restrictions. If so, clearly outline these conditions in the designated area.

- Include the date of the donation. This should be the date on which the transfer is intended to take effect.

- Both the donor and the donee must sign the form. Ensure that signatures are dated appropriately.

- If necessary, have the form notarized. This step may be required to validate the document legally.

- Make copies of the completed form for your records and for the donee.

- Submit the form to the appropriate local government office, if required, to finalize the donation process.