Free Membership Ledger PDF Form

Misconceptions

Understanding the Membership Ledger form can be tricky, especially with all the information it contains. Here are some common misconceptions that people often have:

- It's only for large companies. Many believe that only big corporations need to maintain a Membership Ledger. In reality, any organization that issues membership interests or units should have one, regardless of size.

- It's the same as a financial ledger. Some think the Membership Ledger is just another type of financial ledger. However, it specifically tracks membership interests and their transfers, which is different from general financial transactions.

- Only transfers need to be recorded. Many assume that the ledger is only for documenting transfers of membership interests. In truth, it also includes details about the issuance of certificates and the amounts paid.

- It’s not necessary for tax purposes. Some individuals believe that the Membership Ledger isn’t relevant for tax filings. On the contrary, accurate records can be crucial for tax compliance and reporting.

- Anyone can fill it out. While it may seem simple, it’s important that someone knowledgeable about the organization’s membership structure handles the form. Incorrect entries can lead to confusion and legal issues.

- It only needs to be updated annually. Some think that updating the ledger once a year is sufficient. In reality, it should be updated whenever there are changes, such as new issuances or transfers.

- It’s not a legal requirement. A misconception exists that maintaining a Membership Ledger is optional. However, for many organizations, it is a legal requirement to keep accurate records of membership interests.

- It can be ignored if there are no changes. Some believe that if there are no transfers or new issuances, the ledger can be neglected. Yet, it’s essential to keep it up-to-date for future reference and compliance.

Being aware of these misconceptions can help ensure that your organization maintains accurate and useful records. Proper management of the Membership Ledger is essential for both legal compliance and organizational clarity.

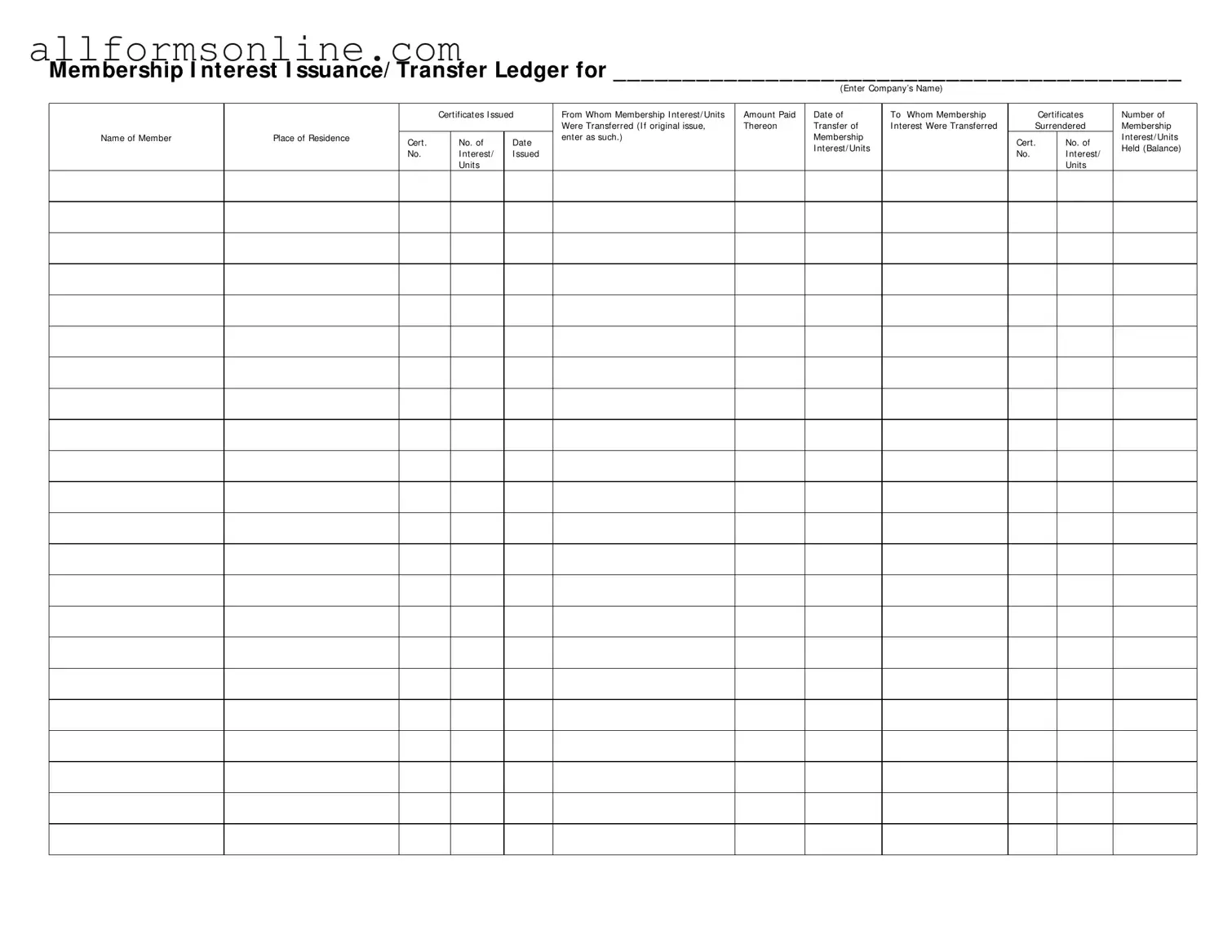

What to Know About This Form

What is the purpose of the Membership Ledger form?

The Membership Ledger form is designed to track the issuance and transfer of membership interests or units within a company. It serves as an official record that documents who holds membership interests, how many units have been issued, and any transfers that occur. This ensures transparency and accuracy in the ownership structure of the company.

What information do I need to fill out the form?

You will need to provide specific details such as the company’s name, the names of members involved in the transactions, the amounts paid for the membership interests, and the dates of issuance or transfer. Additionally, you should include the certificate numbers associated with the membership interests to maintain a clear record.

How do I record a transfer of membership interests?

To record a transfer, you will fill in the section designated for transfers on the form. Enter the name of the member transferring the interest, the name of the new member receiving it, the amount of interest being transferred, and the relevant certificate numbers. Ensure that the date of transfer is accurately noted to reflect the transaction timeline.

What should I do if I lose a membership certificate?

If a membership certificate is lost, it is essential to report the loss to the company promptly. You may need to fill out a form for a replacement certificate, which often requires providing proof of your ownership and possibly a notarized statement. The Membership Ledger should then be updated to reflect the issuance of the new certificate.

Can I use this form for different types of membership interests?

Yes, the Membership Ledger form can be used for various types of membership interests or units, as long as the structure is defined within the company’s governing documents. Ensure that the form is adapted to reflect the specific types of interests being recorded, if necessary.

How often should the Membership Ledger be updated?

The Membership Ledger should be updated promptly after any issuance or transfer of membership interests. This ensures that the record remains current and accurately reflects the ownership structure of the company. Regular reviews of the ledger can help maintain its accuracy.

Is there a specific format for entering information on the form?

Yes, it is important to follow the format outlined on the Membership Ledger form. Each section should be filled out clearly and legibly. Use the specified fields for names, amounts, and dates, and ensure that certificate numbers are entered correctly to avoid confusion.

Who is responsible for maintaining the Membership Ledger?

The responsibility for maintaining the Membership Ledger typically falls on the company’s management or designated officers. However, all members should be aware of the ledger and its contents, as it directly impacts their ownership rights and responsibilities within the company.

Different PDF Forms

Prescription Paper for Controlled Substances - Form that may require patient signatures for validation.

When engaging in a vehicle sale, it is essential to utilize a comprehensive document like the California Vehicle Purchase Agreement to safeguard both the buyer's and seller's interests. This agreement not only highlights critical details such as the purchase price and vehicle description but also clarifies any associated warranties, ensuring a transparent transaction. For those seeking a reliable template, Fast PDF Templates offers a valuable resource to facilitate this process.

Official Boyfriend Application - Desiring a companion who loves both quiet nights and fun outings.

Assurion Insurance - This form simplifies information updates.

How to Use Membership Ledger

Completing the Membership Ledger form is essential for accurately documenting membership interests and transfers. Follow these steps to ensure that all necessary information is filled out correctly.

- Begin by entering the company’s name in the designated space at the top of the form.

- In the section labeled “Certificates Issued From,” write the name of the person or entity that issued the membership interest or units.

- Next, fill in the “Membership Interest/Units” field with the number of interests or units being issued.

- Indicate the “Amount Paid” for the membership interest or units next to the corresponding entry.

- Record the “Date of Issuance” in the appropriate section.

- In the “To Whom Membership Were Transferred” section, enter the name of the individual or entity receiving the membership interest or units.

- If the entry is for an original issue, mark that clearly in the designated area.

- List the “Name of Member” and their “Place of Residence” in the specified fields.

- Fill in the “Cert. No.” for the membership interest or units being issued.

- Document the “Membership Interest/Units No.” being transferred.

- In the “Certificates Surrendered” section, note the certificate numbers of any surrendered interests or units.

- Lastly, indicate the “Number of Membership Interest/Units Held (Balance)” to reflect the current holdings accurately.