Free Mortgage Statement PDF Form

Misconceptions

Understanding mortgage statements can be challenging. Many homeowners hold misconceptions that can lead to confusion and unnecessary stress. Here are nine common myths about mortgage statements, along with clarifications to help you navigate this important document.

- Myth: The mortgage statement is just a bill.

While it does indicate how much you owe, it also provides a detailed breakdown of your account, including principal, interest, and escrow amounts.

- Myth: Late fees are charged immediately.

Late fees are typically assessed only after a specified grace period. Check your statement for the exact date when a late fee will apply.

- Myth: All payments are applied immediately to the mortgage.

Partial payments are not applied to your mortgage until the full amount is received. They are held in a suspense account until the balance is settled.

- Myth: The interest rate on my mortgage is fixed forever.

Some mortgages have adjustable rates that can change after a certain period. Always verify the terms outlined in your statement.

- Myth: Escrow is optional.

For many loans, escrow accounts for taxes and insurance are mandatory. Your statement will show if you are required to have one.

- Myth: I can ignore the delinquency notice.

Ignoring a delinquency notice can lead to serious consequences, including fees and potential foreclosure. It’s crucial to address any overdue payments promptly.

- Myth: I can pay any amount I want.

To keep your loan in good standing, you must pay the total amount due as indicated on your statement. Partial payments won't count towards your mortgage balance.

- Myth: My mortgage servicer will automatically help me if I'm in trouble.

While servicers may offer assistance options, it is your responsibility to reach out and inquire about available resources if you are experiencing financial difficulties.

- Myth: The statement is the same every month.

Each statement may vary based on your payment history, any fees incurred, and changes in escrow amounts. Review each one carefully.

By debunking these misconceptions, homeowners can better understand their mortgage statements and make informed decisions regarding their finances.

What to Know About This Form

What is a Mortgage Statement?

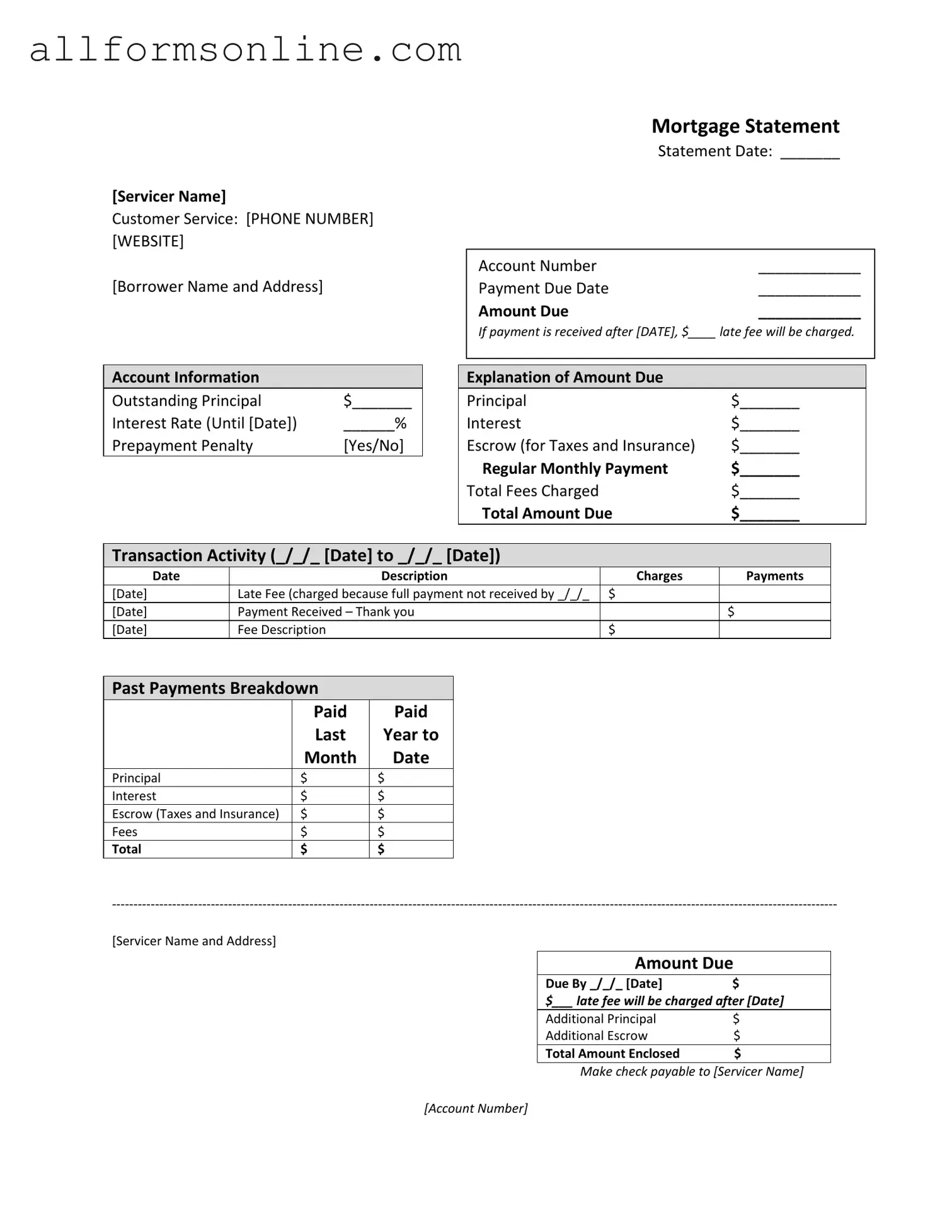

A Mortgage Statement is a document that provides a detailed summary of your mortgage account. It includes information such as your outstanding principal balance, interest rate, payment due date, and the total amount due. This statement also outlines any fees charged and provides a breakdown of your recent payment history. It's essential for keeping track of your mortgage payments and understanding your financial obligations.

What should I do if I see an error on my Mortgage Statement?

If you notice an error on your Mortgage Statement, contact your loan servicer immediately. Use the customer service phone number or website listed on the statement. Be prepared to provide details about the error, such as the specific amount or transaction in question. The servicer will investigate the issue and provide you with a resolution. It's important to address errors promptly to avoid complications with your account.

What happens if I miss a payment?

Missing a payment can lead to serious consequences. If your payment is not received by the due date, you may incur a late fee, as indicated on your Mortgage Statement. Continued missed payments can result in your account becoming delinquent, which may lead to foreclosure. It's crucial to communicate with your servicer if you are experiencing financial difficulties, as they may offer options for assistance or mortgage counseling.

How can I make a payment on my mortgage?

You can typically make a payment on your mortgage through several methods. Most servicers allow online payments via their website. You can also make payments by mail, using the address provided on your Mortgage Statement. If you prefer, you may be able to set up automatic payments to ensure your mortgage is paid on time each month. Always confirm the payment method and details with your servicer to avoid any issues.

Different PDF Forms

Da - Familiarize yourself with the handbook DA PAM 710-2-1 for guidelines.

Bpo Template - This form evaluates the value of a property based on current market conditions.

This Georgia Motorcycle Bill of Sale form is a crucial document for anyone looking to complete a motorcycle transaction. For further guidance, refer to our useful resource on the detailed Motorcycle Bill of Sale requirements.

Baseball Evaluation Sheet - Equip teams with a fair evaluation process for selecting talented players.

How to Use Mortgage Statement

Filling out your Mortgage Statement form accurately is crucial for managing your mortgage effectively. Follow these steps to ensure you complete the form correctly.

- Contact Information: Write the name of your mortgage servicer at the top of the form. Include their customer service phone number and website for easy reference.

- Borrower Information: Fill in your name and address in the designated section.

- Statement Date: Enter the date of the statement in the provided space.

- Account Number: Write your mortgage account number clearly.

- Payment Due Date: Indicate the date your next payment is due.

- Amount Due: Fill in the total amount you owe for this payment period.

- Late Fee Information: Note the date after which a late fee will apply and the amount of that fee.

- Account Information: Fill out the outstanding principal, interest rate, and whether there is a prepayment penalty.

- Explanation of Amount Due: Break down the total amount due into principal, interest, escrow for taxes and insurance, regular monthly payment, total fees charged, and total amount due.

- Transaction Activity: Document the dates and descriptions of any charges or payments made during the specified period.

- Past Payments Breakdown: Provide a summary of payments made last year, including principal, interest, escrow, fees, and total.

- Additional Information: Fill in any additional principal or escrow amounts and the total amount you are enclosing with your payment.

- Important Messages: Review the important messages section for any notes on partial payments or delinquency notices.

Once you have filled out the form, double-check all entries for accuracy. This will help you avoid any potential issues with your mortgage. After confirming everything is correct, send the form along with your payment to the address provided by your servicer.