Attorney-Approved Articles of Incorporation Form for New York

Misconceptions

When it comes to the New York Articles of Incorporation, many people hold misconceptions that can lead to confusion or missteps in the incorporation process. Here are seven common myths debunked to help clarify the truth.

-

Myth 1: The Articles of Incorporation are the same as a business license.

This is not true. The Articles of Incorporation establish your corporation's existence and structure, while a business license allows you to operate legally within your locality.

-

Myth 2: You can file the Articles of Incorporation anytime.

While you can prepare your documents at any time, they must be filed during business hours with the appropriate state office to be processed.

-

Myth 3: You don’t need to include a registered agent.

In New York, every corporation must designate a registered agent. This person or entity is responsible for receiving legal documents on behalf of the corporation.

-

Myth 4: Filing the Articles of Incorporation guarantees business success.

Filing these documents is just the first step. Success depends on effective business planning, management, and execution.

-

Myth 5: The process is too complicated for small businesses.

While it may seem daunting, many resources are available to help small business owners navigate the incorporation process. With the right guidance, it can be straightforward.

-

Myth 6: You can’t change your Articles of Incorporation once filed.

This is a misconception. Amendments can be made to your Articles of Incorporation if your business structure or details change.

-

Myth 7: All states have the same requirements for Articles of Incorporation.

Each state has its own rules and regulations regarding incorporation. It’s essential to understand New York’s specific requirements to ensure compliance.

Understanding these misconceptions can help you navigate the incorporation process more effectively. Knowledge is power, especially when it comes to establishing your business in New York!

What to Know About This Form

What is the purpose of the New York Articles of Incorporation form?

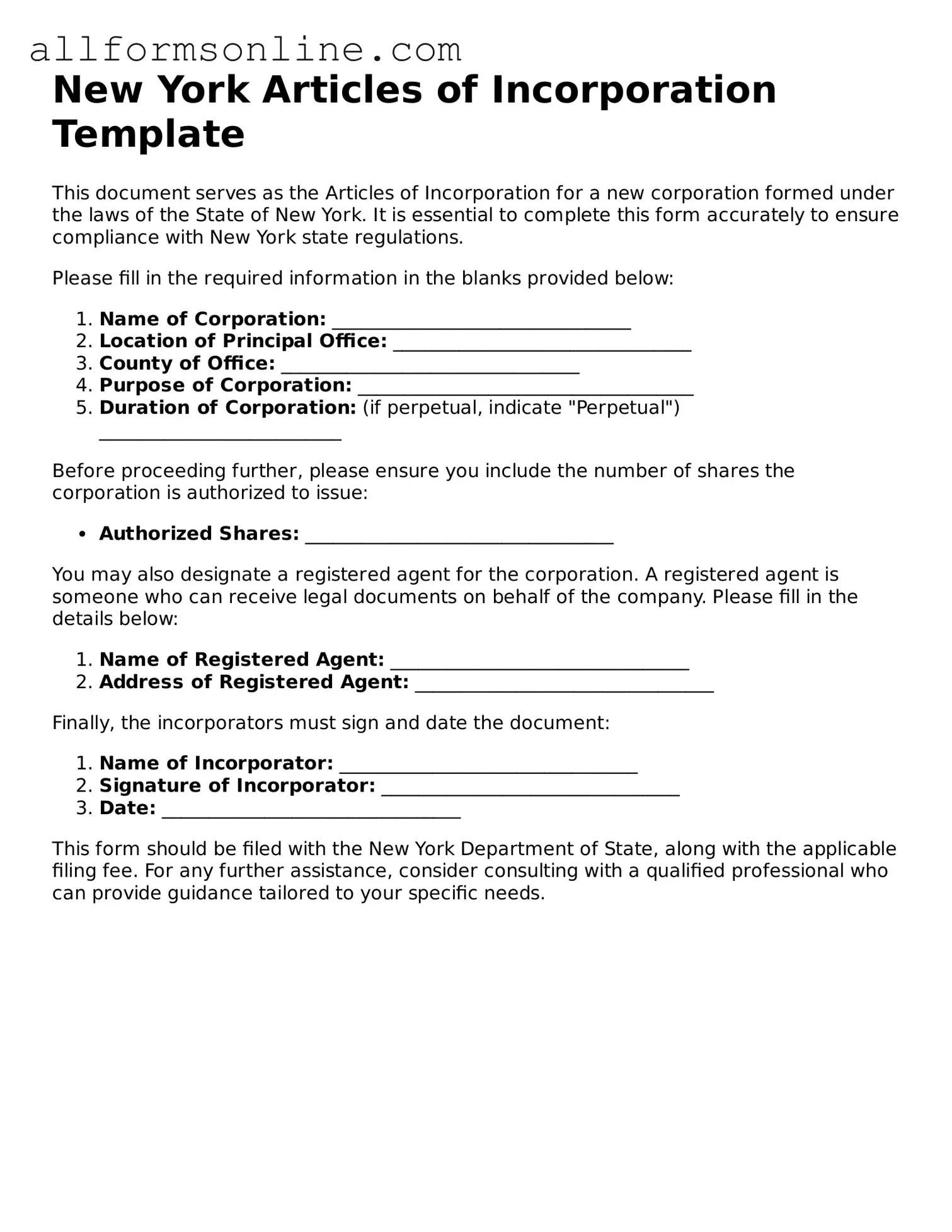

The New York Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in New York State. This form officially creates your corporation and outlines its basic structure, including the name, purpose, and duration of the business. By filing this document with the New York Department of State, you gain legal recognition for your corporation, allowing you to operate as a separate entity from its owners.

What information do I need to provide on the form?

When completing the Articles of Incorporation form, you'll need to include several key pieces of information. This includes the name of your corporation, which must be unique and not too similar to existing businesses. You'll also need to state the corporation's purpose, which can be broad but should reflect the nature of your business. Additionally, you'll provide the address of your corporation's principal office, the name and address of the registered agent, and details about the number of shares the corporation is authorized to issue. It's essential to ensure all information is accurate to avoid delays in processing.

How do I file the Articles of Incorporation in New York?

Filing the Articles of Incorporation is straightforward. You can submit the completed form either online through the New York Department of State’s website or by mailing a physical copy. If you choose to file by mail, be sure to include the required filing fee, which can vary based on the type of corporation you are establishing. Once submitted, the Department of State will review your application. If everything is in order, they will issue a Certificate of Incorporation, officially recognizing your corporation.

What happens after I file the Articles of Incorporation?

After filing, you will receive a Certificate of Incorporation if your application is approved. This certificate serves as proof that your corporation is legally established. However, your responsibilities don’t end there. You will need to comply with ongoing requirements, such as holding annual meetings, maintaining corporate records, and filing biennial statements. It’s also wise to consult with a legal professional to ensure you meet all regulatory obligations and to help navigate any complexities as your business grows.

Other Common State-specific Articles of Incorporation Forms

Start Llc - Establishes rules for managing corporate conflicts.

Texas Company Registration - Declares the duration of the corporation's existence.

The Notice to Quit form is a crucial document that landlords must utilize to initiate the eviction process effectively, ensuring that tenants are given clear communication regarding their need to vacate the property. For more information, you can refer to our guide on the importance of the Notice to Quit.

Pennsylvania Corporation Bureau - Details about registered agents are included in the document.

How to Use New York Articles of Incorporation

Once you have the New York Articles of Incorporation form ready, you can begin filling it out. This form is essential for establishing your business as a corporation in New York. After completing the form, you'll need to submit it to the New York Department of State along with the required filing fee.

- Start by entering the name of your corporation. Ensure that the name is unique and complies with New York naming regulations.

- Provide the purpose of your corporation. This can be a brief description of what your business will do.

- Fill in the county in New York where your corporation will be located. This is important for local jurisdiction.

- List the address of your corporation. Include the street address, city, state, and zip code.

- Identify the registered agent. This is the person or business entity that will receive legal documents on behalf of your corporation.

- Include the names and addresses of the initial directors. You typically need at least one director.

- Provide the number of shares your corporation is authorized to issue. Specify the classes of shares if applicable.

- Sign and date the form. The signature should be from someone authorized to file the Articles of Incorporation.

After completing these steps, double-check all the information for accuracy. Then, prepare to submit the form along with the required fee to the appropriate state office.