Attorney-Approved Deed in Lieu of Foreclosure Form for New York

Misconceptions

Understanding the New York Deed in Lieu of Foreclosure form is essential for homeowners facing financial difficulties. However, several misconceptions can lead to confusion about this process. Below are five common misconceptions:

-

It eliminates all debts associated with the property.

A Deed in Lieu of Foreclosure does not automatically erase all debts. Homeowners may still be responsible for any second mortgages, liens, or other obligations related to the property.

-

It is a quick and easy solution.

While it may seem like a straightforward option, the process can be lengthy. Lenders often require extensive documentation and may take time to review the request.

-

It has no impact on credit scores.

A Deed in Lieu of Foreclosure can negatively affect credit scores. This impact may be similar to that of a foreclosure, which can remain on a credit report for several years.

-

Homeowners can stay in their homes after the deed is signed.

Once the deed is executed, the homeowner typically must vacate the property. This is a significant change from other options, such as loan modifications.

-

It absolves homeowners of all future liability.

Homeowners may still face legal consequences if the lender pursues a deficiency judgment, especially if the property sells for less than the outstanding mortgage balance.

Awareness of these misconceptions can help homeowners make informed decisions regarding their financial situation and the options available to them.

What to Know About This Form

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. This option is often considered when homeowners find themselves unable to keep up with mortgage payments. By choosing this route, the homeowner can settle their debt and avoid the lengthy and stressful foreclosure process. It allows the lender to take possession of the property without going through court proceedings, which can save time and money for both parties.

What are the benefits of a Deed in Lieu of Foreclosure?

One of the primary benefits is that it can help homeowners avoid the negative impact of a foreclosure on their credit score. A Deed in Lieu typically results in less damage to credit ratings compared to a foreclosure. Additionally, it can provide a quicker resolution for both the homeowner and the lender. Homeowners may also have the opportunity to negotiate terms with the lender, such as the possibility of being released from any remaining mortgage debt. This option can lead to a more amicable exit from homeownership.

Are there any risks associated with a Deed in Lieu of Foreclosure?

While there are advantages, there are also risks to consider. Homeowners may still face tax implications, as the IRS may consider forgiven mortgage debt as taxable income. Furthermore, not all lenders accept Deeds in Lieu, so homeowners should confirm their lender’s policies. It’s also important to understand that giving up the property means relinquishing all rights to it, which can be a difficult decision for many. Consulting with a legal or financial advisor is advisable to fully understand the implications.

How does the process work?

The process generally begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will then assess the homeowner’s financial situation and the property’s value. If both parties agree to proceed, the homeowner will sign the Deed in Lieu document, transferring ownership of the property. The lender may also require the homeowner to provide a hardship letter explaining their financial difficulties. Once everything is agreed upon and signed, the lender will file the deed with the local government, officially taking ownership of the property.

Can I still live in my home during the process?

Other Common State-specific Deed in Lieu of Foreclosure Forms

Sample Deed in Lieu of Foreclosure - The property may be sold by the lender after the deed is executed.

To facilitate the transfer of ownership, utilizing the California Trailer Bill of Sale form is crucial, and you can find a helpful template at Fast PDF Templates, which provides clarity and ensures all necessary details are included for a seamless transaction.

California Pre-foreclosure Property Transfer - This option can preserve some dignity for borrowers compared to a lengthy foreclosure process.

Deed in Lieu of Foreclosure Pa - Homeowners can use this method to close one chapter while paving the way for new opportunities ahead.

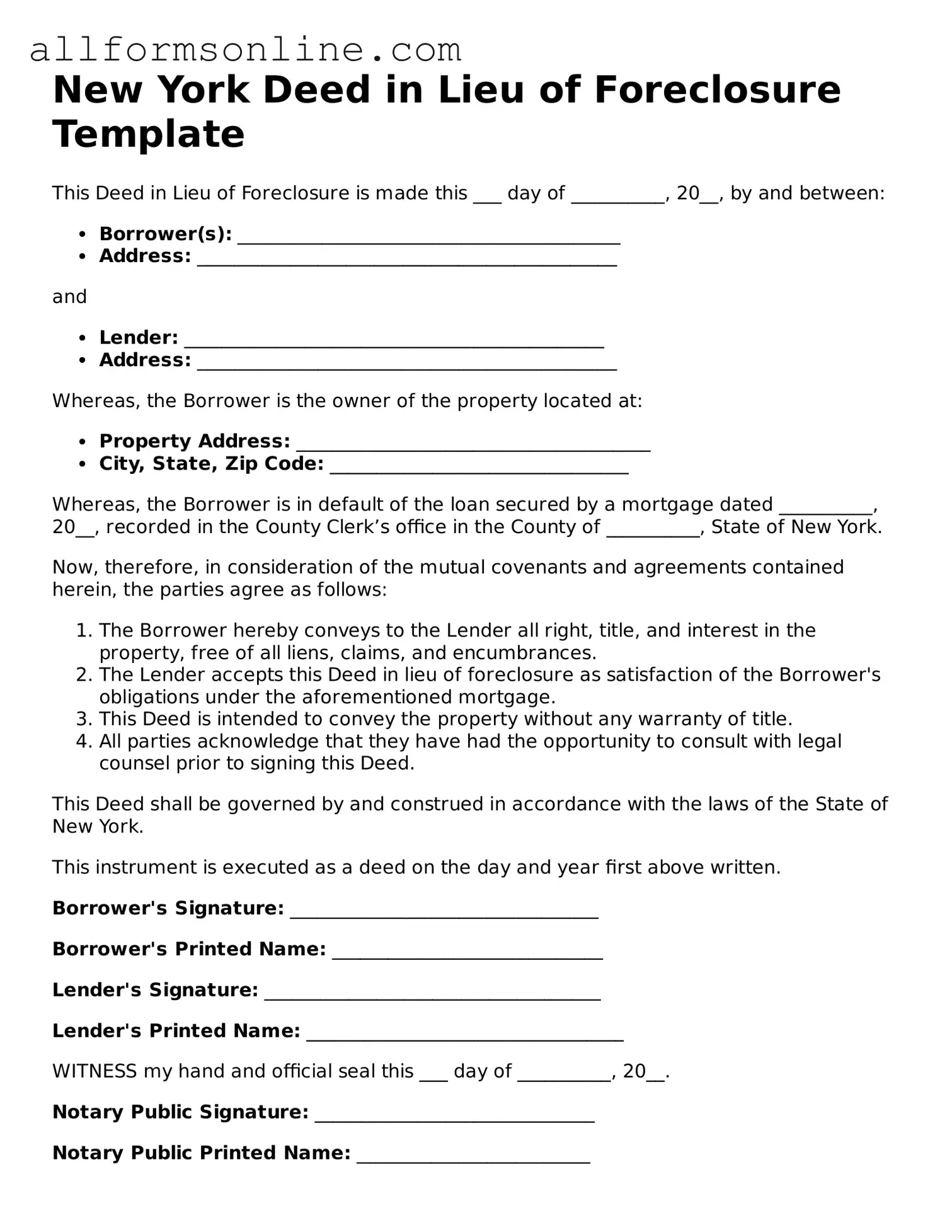

How to Use New York Deed in Lieu of Foreclosure

Once you have decided to proceed with the Deed in Lieu of Foreclosure, it is important to ensure that the form is completed accurately. This process will help facilitate the transfer of property back to the lender, allowing you to avoid further foreclosure proceedings. Follow these steps to fill out the form correctly.

- Obtain the Form: Download the New York Deed in Lieu of Foreclosure form from a reliable source or request it from your lender.

- Identify the Parties: Clearly fill in your name as the borrower and the lender’s name. Include their addresses as well.

- Property Description: Provide a complete legal description of the property. This may include the address, lot number, and any other identifying information.

- Consideration: State the consideration for the deed. This is often a nominal amount, but it should be clearly stated.

- Sign the Document: As the borrower, sign the form in the designated area. Ensure that the signature matches the name on the form.

- Notarization: Have the document notarized. This adds an extra layer of authenticity to the form.

- Submit the Form: Send the completed and notarized form to your lender. Keep a copy for your records.

After submitting the form, the lender will review it and may reach out for any additional information or clarification. Be prepared for further communication as they process your request.