Attorney-Approved Deed Form for New York

Misconceptions

Understanding the New York Deed form is essential for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion. Here are eight common misconceptions explained.

-

All deeds are the same.

Many people believe that all deeds serve the same purpose. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each with its own implications and uses.

-

A deed must be notarized to be valid.

While notarization is highly recommended and often required for recording, not all deeds must be notarized to be legally valid. However, a notarized deed is generally more accepted in legal and financial transactions.

-

Once a deed is signed, it cannot be changed.

Many people think that a deed is permanent once signed. In fact, deeds can be amended or revoked, but the process may require additional legal steps.

-

Only lawyers can prepare a deed.

While it is advisable to consult a lawyer, especially for complex transactions, individuals can prepare their own deeds using templates or forms, provided they follow state guidelines.

-

Deeds do not need to be recorded.

Some believe that recording a deed is optional. However, failing to record a deed can lead to complications, such as disputes over property ownership.

-

All deeds transfer ownership equally.

Not all deeds transfer ownership in the same way. For instance, a quitclaim deed transfers whatever interest the grantor has, which may not be full ownership.

-

Deeds are only necessary for selling property.

People often think deeds are only required during sales. However, deeds are also needed for gifts, inheritance, and other transfers of property.

-

Once a deed is recorded, it cannot be disputed.

Recording a deed does not eliminate the possibility of disputes. Challenges can arise due to issues like fraud, errors, or conflicting claims to the property.

By understanding these misconceptions, individuals can navigate the complexities of real estate transactions in New York more effectively.

What to Know About This Form

What is a New York Deed form?

A New York Deed form is a legal document used to transfer ownership of real property in New York State. It serves as proof of the transfer and outlines the details of the transaction, including the names of the parties involved, a description of the property, and any conditions or restrictions related to the transfer.

What types of deeds are available in New York?

New York offers several types of deeds, including the Warranty Deed, Quitclaim Deed, and Bargain and Sale Deed. A Warranty Deed provides the highest level of protection for the buyer, ensuring that the seller holds clear title to the property. A Quitclaim Deed transfers whatever interest the seller has in the property without guaranteeing that the title is clear. A Bargain and Sale Deed implies that the seller has the right to sell the property but does not guarantee a clear title.

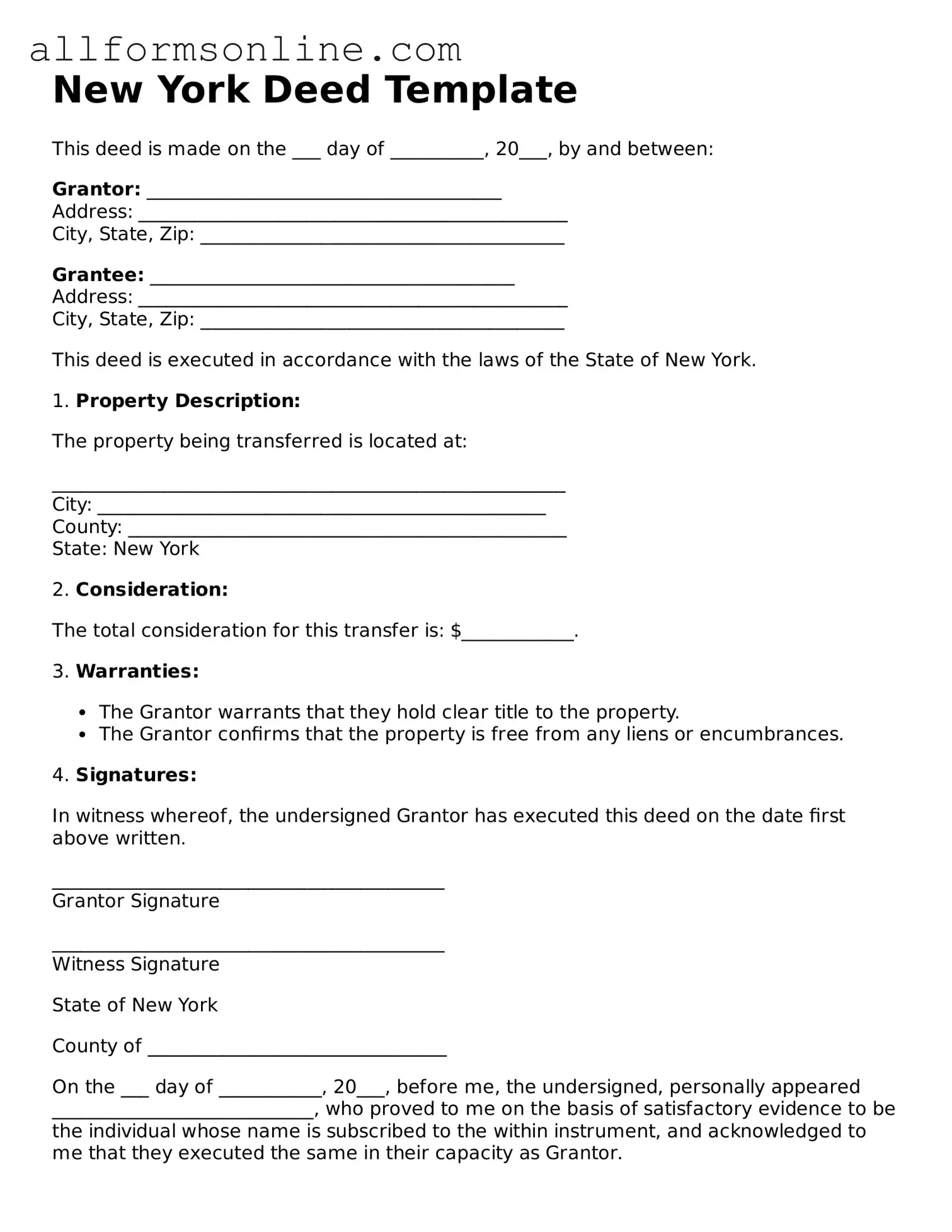

How do I fill out a New York Deed form?

To fill out a New York Deed form, start by clearly identifying the parties involved. Include the full names and addresses of the grantor (seller) and grantee (buyer). Next, provide a detailed description of the property, including its address and any relevant tax identification numbers. Finally, sign the form in front of a notary public to ensure its validity. Make sure to check for any additional requirements specific to your county.

Do I need to record the Deed after it is signed?

Yes, it is essential to record the Deed with the county clerk's office where the property is located. Recording the Deed protects your ownership rights and provides public notice of the transfer. This step is crucial for establishing legal ownership and can prevent future disputes over the property.

What fees are associated with filing a New York Deed?

When filing a New York Deed, you may incur several fees, including recording fees charged by the county clerk's office. These fees vary by county and are typically based on the number of pages in the Deed. Additionally, if applicable, you may need to pay transfer taxes, which are calculated based on the sale price of the property. Always check with your local office for the most accurate fee schedule.

Can I use a New York Deed form for any type of property?

Generally, a New York Deed form can be used for most types of real property, including residential, commercial, and vacant land. However, certain properties, such as those held in a trust or subject to specific regulations, may require special forms or additional documentation. It’s advisable to consult with a legal professional if you have questions about your specific situation.

Other Common State-specific Deed Forms

Pennsylvania Deed Form - The Deed should be accurately filled out to prevent future disputes.

Property Owners Search - The process of transferring a Deed varies by state, so local laws need to be considered.

In addition to the importance of clearly outlining the terms of the rental agreement, utilizing resources such as Fast PDF Templates can greatly assist landlords and tenants in creating a comprehensive document that meets legal requirements and protects their interests.

Grant Deed California - The recording of the Deed often protects the grantee from claims by third parties over the property.

How to Use New York Deed

After obtaining the New York Deed form, the next step is to complete it accurately to ensure a smooth property transfer. This process involves providing specific information about the property and the parties involved. Follow the steps outlined below to fill out the form correctly.

- Gather Required Information: Collect details such as the names of the grantor (seller) and grantee (buyer), the property address, and the legal description of the property.

- Fill in Grantor Information: Write the full name of the grantor, including any middle names or initials, and their address.

- Fill in Grantee Information: Enter the full name of the grantee, ensuring accuracy in spelling, along with their address.

- Describe the Property: Provide a detailed description of the property, including its street address and any relevant legal descriptions, such as lot numbers or parcel numbers.

- Indicate Consideration: State the amount of money or other consideration being exchanged for the property. This is often referred to as the purchase price.

- Sign the Deed: The grantor must sign the deed in the presence of a notary public. Ensure that the signature matches the name listed on the form.

- Notarization: Have the notary public sign and seal the deed to confirm the authenticity of the signature.

- File the Deed: Submit the completed deed to the appropriate county clerk's office for recording. Check if there are any filing fees required.