Attorney-Approved Durable Power of Attorney Form for New York

Misconceptions

When it comes to the New York Durable Power of Attorney form, several misconceptions can lead to confusion. Understanding these common misunderstandings can help you make informed decisions about your financial and legal affairs. Here are five misconceptions:

- Misconception 1: A Durable Power of Attorney is only for the elderly.

- Misconception 2: A Durable Power of Attorney gives someone complete control over my finances.

- Misconception 3: Once I sign the Durable Power of Attorney, I cannot change it.

- Misconception 4: My agent can make medical decisions for me with a Durable Power of Attorney.

- Misconception 5: A Durable Power of Attorney is only effective when I am incapacitated.

This is not true. While many people associate this document with older adults, anyone can benefit from a Durable Power of Attorney. Unexpected events can happen at any age, making it essential to have a plan in place.

While a Durable Power of Attorney allows your agent to manage your financial matters, it does not mean they can act outside the scope you define. You can specify what powers you grant, ensuring your wishes are respected.

This is incorrect. You have the right to revoke or modify your Durable Power of Attorney at any time, as long as you are mentally competent. It’s a flexible tool that can adapt to your changing needs.

A Durable Power of Attorney specifically pertains to financial matters. For medical decisions, you would need a separate document, often called a Health Care Proxy or Advance Directive.

This is misleading. A Durable Power of Attorney becomes effective as soon as you sign it, unless you specify otherwise. It remains effective even if you become incapacitated, which is what makes it "durable."

By clarifying these misconceptions, you can better understand the importance and functionality of a Durable Power of Attorney in New York. Taking the time to create this document can provide peace of mind for you and your loved ones.

What to Know About This Form

What is a Durable Power of Attorney in New York?

A Durable Power of Attorney is a legal document that allows you to appoint someone to manage your financial affairs and make decisions on your behalf. This authority remains effective even if you become incapacitated. It ensures that your financial matters can be handled without interruption during times when you cannot make decisions for yourself.

Who can be appointed as an agent under a Durable Power of Attorney?

You can choose any competent adult to be your agent. This person can be a family member, friend, or professional, such as an attorney or accountant. It is crucial to select someone you trust, as they will have significant control over your financial matters.

What powers can I grant to my agent?

The Durable Power of Attorney form allows you to specify the powers you want to grant to your agent. These can include managing bank accounts, paying bills, filing taxes, and handling real estate transactions. You have the flexibility to limit or expand the powers based on your preferences.

Do I need to have a lawyer to create a Durable Power of Attorney?

While it is not legally required to have a lawyer, consulting one can be beneficial. A lawyer can help ensure that the document is properly completed and complies with New York laws. This can prevent potential issues in the future, especially if disputes arise regarding your agent's authority.

How do I revoke a Durable Power of Attorney?

If you wish to revoke your Durable Power of Attorney, you must create a written revocation document. This document should clearly state your intention to revoke the previous Power of Attorney. It is advisable to notify your agent and any institutions that may have a copy of the original document to prevent any confusion.

Is a Durable Power of Attorney valid if I move to another state?

A Durable Power of Attorney created in New York may not automatically be valid in another state. Each state has its own laws regarding these documents. It is important to check the laws of the state you are moving to and consider creating a new Durable Power of Attorney that complies with those laws.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, your loved ones may have to go through a lengthy and potentially costly court process to gain the authority to manage your affairs. This can lead to delays and stress for your family during an already difficult time. Establishing a Durable Power of Attorney can provide peace of mind for both you and your loved ones.

Other Common State-specific Durable Power of Attorney Forms

Power of Attorney Form Pennsylvania - You can designate specific limitations on your agent's power in this form.

When engaging in the sale or purchase of a vehicle, it is imperative to utilize a proper Motor Vehicle Bill of Sale form to ensure that both parties are protected and that the transaction is documented accurately. This form not only establishes a clear understanding of the terms but is also required for legal vehicle registration. For those interested in a seamless transaction, you can find a template for the Bill of Sale for a Car to facilitate the process.

How to Get Power of Attorney Florida - Can include limitations on the agent's authority.

How to Use New York Durable Power of Attorney

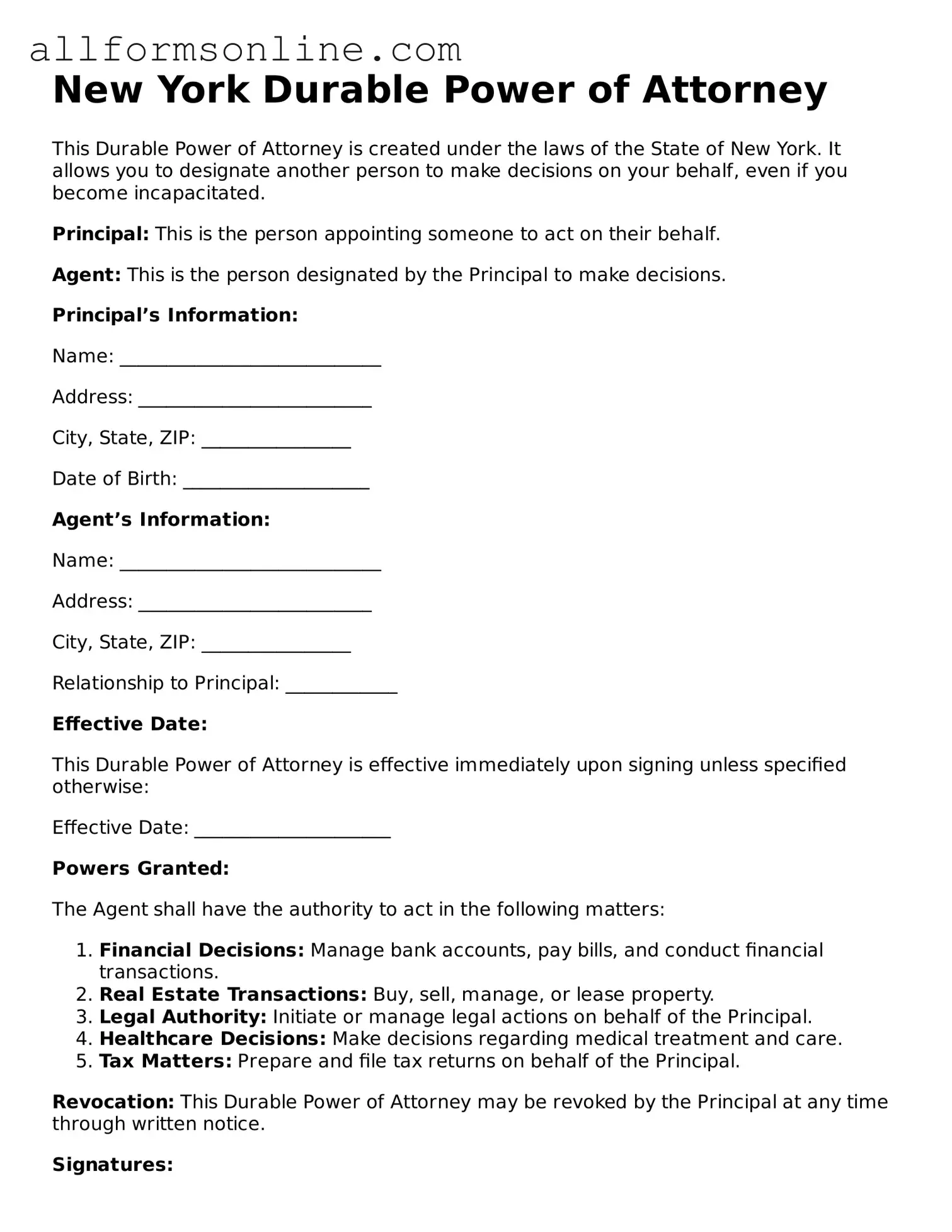

Filling out the New York Durable Power of Attorney form is a straightforward process that requires careful attention to detail. Once completed, this document allows you to designate someone to make financial decisions on your behalf if you become unable to do so. Here’s how to fill out the form step by step.

- Obtain the Form: Start by downloading the New York Durable Power of Attorney form from a reliable source or visit your local government office to get a physical copy.

- Identify Yourself: Fill in your full name, address, and date of birth at the top of the form. This ensures that your identity is clear.

- Select Your Agent: Choose a trusted individual to act as your agent. Write their name, address, and relationship to you in the designated section.

- Specify Powers: Review the list of powers granted to your agent. You can choose to grant general powers or specify certain powers. Check the appropriate boxes based on your preferences.

- Include Alternate Agent: If you wish, designate an alternate agent in case your primary agent is unable or unwilling to serve. Fill out their details in the provided space.

- Sign the Document: Sign and date the form in the presence of a notary public. This step is crucial for the document's validity.

- Witness Requirements: Depending on your situation, consider having one or two witnesses sign the document. This can add an extra layer of verification.

- Distribute Copies: After signing, make copies of the completed form. Provide copies to your agent, alternate agent, and any financial institutions or entities that may require it.

Once you have completed these steps, keep the original document in a safe place. It’s also a good idea to discuss your wishes with your agent so they are fully prepared to act on your behalf when needed.