Attorney-Approved Loan Agreement Form for New York

Misconceptions

Understanding the New York Loan Agreement form can be challenging due to common misconceptions. Here are five prevalent myths and the truths behind them.

-

Misconception 1: The Loan Agreement is only for large loans.

This is false. The New York Loan Agreement can be used for both small and large loans. It is designed to outline the terms regardless of the amount borrowed.

-

Misconception 2: A Loan Agreement must be notarized to be valid.

While notarization can add an extra layer of authenticity, it is not a requirement for a Loan Agreement to be legally binding in New York.

-

Misconception 3: Only banks can issue a Loan Agreement.

This is incorrect. Individuals and private lenders can also create and execute a Loan Agreement. It is not limited to financial institutions.

-

Misconception 4: Once signed, the terms of the Loan Agreement cannot be changed.

This is misleading. Parties can amend the Loan Agreement if both agree to the changes. Written documentation of any amendments is advisable.

-

Misconception 5: A Loan Agreement is the same as a promissory note.

While related, these are different documents. A Loan Agreement outlines the terms of the loan, while a promissory note is a promise to repay the loan.

What to Know About This Form

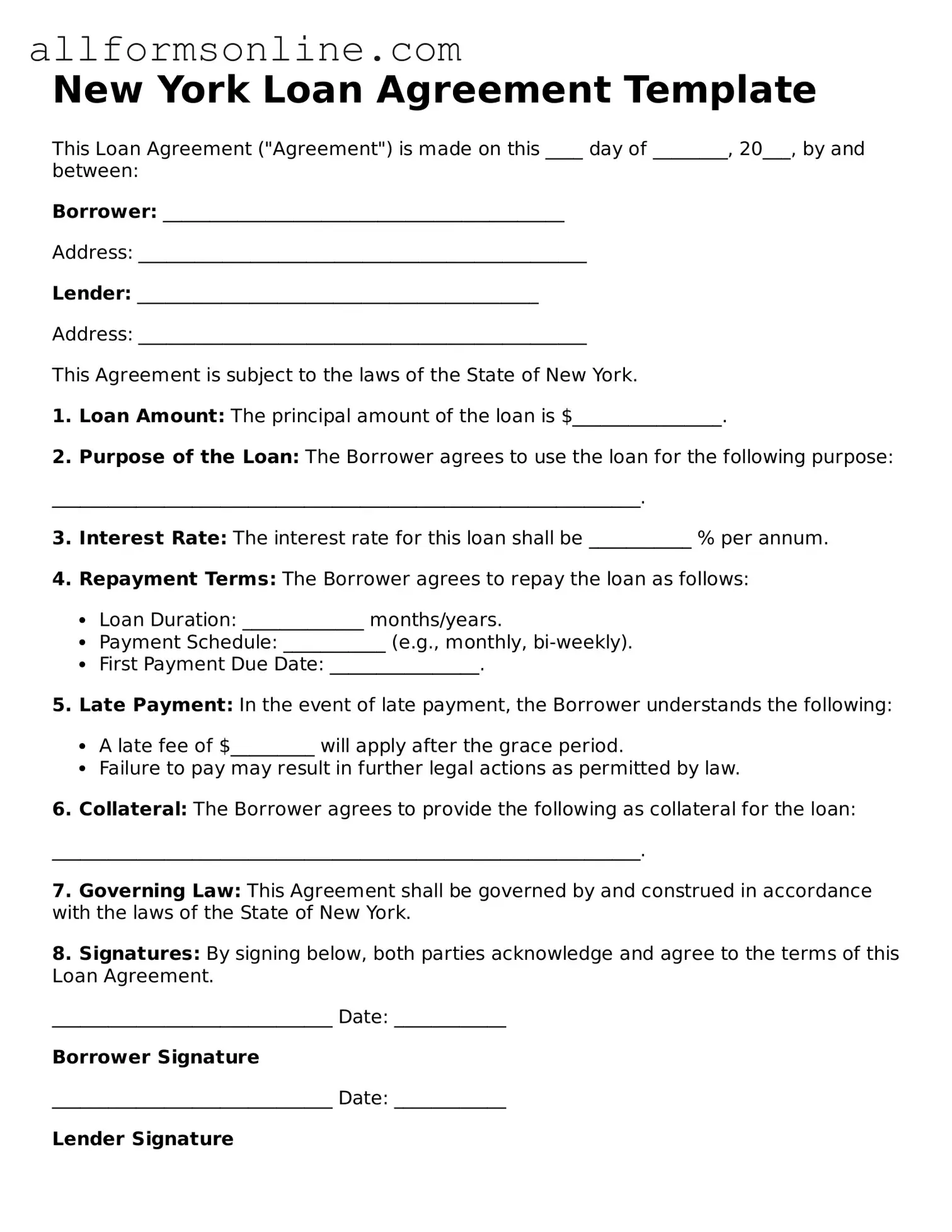

What is a New York Loan Agreement form?

The New York Loan Agreement form is a legal document that outlines the terms and conditions under which a loan is provided. It serves as a contract between the lender and the borrower, detailing important aspects such as the loan amount, interest rate, repayment schedule, and any collateral involved. This form is crucial for ensuring that both parties understand their rights and obligations, thereby minimizing the potential for disputes in the future.

Who should use a New York Loan Agreement form?

This form is suitable for individuals or entities looking to formalize a loan transaction in New York. Whether you are a private lender extending a loan to a friend or a business providing financing to another company, utilizing this agreement can help protect your interests. It is advisable for both parties to review the terms carefully and consider seeking legal advice to ensure the agreement meets their needs.

What key elements should be included in the Loan Agreement?

A comprehensive Loan Agreement should include several key elements. First, it should clearly state the names and addresses of both the lender and the borrower. Next, it should specify the loan amount and the interest rate, whether fixed or variable. Additionally, the repayment terms, including the schedule and any penalties for late payments, should be clearly outlined. Finally, any collateral securing the loan must be described, along with provisions for default and dispute resolution.

Is it necessary to notarize the Loan Agreement?

While notarization is not always required for a Loan Agreement to be legally binding in New York, it is highly recommended. Having the document notarized can provide an extra layer of protection by verifying the identities of the parties involved and ensuring that they signed the agreement willingly. This can be particularly useful in the event of a dispute, as it adds credibility to the document.

Can the Loan Agreement be modified after it is signed?

Yes, a Loan Agreement can be modified after it is signed, but any changes must be documented in writing and agreed upon by both parties. It is essential to specify the modifications clearly to avoid confusion later. Both parties should sign the amended agreement to ensure that the changes are enforceable. Keeping open communication throughout the loan period can help facilitate any necessary adjustments.

Other Common State-specific Loan Agreement Forms

Promissory Note Texas - It includes provisions for what happens in case of default.

For those seeking a thorough understanding of the risks involved, the Georgia Hold Harmless Agreement is an essential tool for safeguarding parties during various events. This legal document clarifies responsibilities and helps manage potential liabilities associated with activities, ensuring informed participation. For more information, you can access the complete Hold Harmless Agreement process.

Promissory Note California - Sets the duration of the loan repayment period.

How to Use New York Loan Agreement

After obtaining the New York Loan Agreement form, you will need to carefully complete it to ensure that all necessary information is provided. This will help in establishing the terms of the loan clearly and accurately.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of both the borrower and the lender in the designated sections.

- Specify the loan amount in the appropriate field.

- Indicate the interest rate applicable to the loan.

- State the repayment terms, including the duration of the loan and the payment schedule.

- Include any fees or additional costs associated with the loan.

- Detail any collateral that may be required for the loan.

- Sign and date the form at the bottom. Ensure both parties have signed where indicated.

- Make copies of the completed form for your records.