Attorney-Approved Operating Agreement Form for New York

Misconceptions

Many people have misunderstandings about the New York Operating Agreement form, which can lead to confusion and mismanagement of business entities. Below is a list of common misconceptions, along with explanations to clarify the truth behind each one.

- All LLCs in New York must have an Operating Agreement. While it is highly recommended for all Limited Liability Companies (LLCs) to have one, it is not legally required. However, having an Operating Agreement can help prevent disputes among members.

- The Operating Agreement must be filed with the state. This is not true. The Operating Agreement is an internal document and does not need to be submitted to any state agency. It should be kept with other important business records.

- Only multi-member LLCs need an Operating Agreement. This misconception overlooks the fact that even single-member LLCs benefit from having an Operating Agreement. It provides clarity on management and operations.

- The Operating Agreement cannot be changed once it is created. In reality, the Operating Agreement can be amended as needed. Flexibility is one of its key advantages, allowing members to adapt to changing circumstances.

- The Operating Agreement is only for legal purposes. While it serves a legal function, it also plays a crucial role in outlining the business’s operational procedures and member responsibilities, fostering a better working relationship among members.

- Every Operating Agreement is the same. This is a significant misunderstanding. Each Operating Agreement should be tailored to the specific needs and circumstances of the LLC, reflecting the unique goals and structure of the business.

- Verbal agreements can replace a written Operating Agreement. Relying on verbal agreements can lead to misunderstandings and disputes. A written Operating Agreement provides clear documentation of the terms agreed upon by members.

- Once created, the Operating Agreement is permanent. As mentioned earlier, it can be revised. Regular reviews and updates are advisable to ensure that the document remains relevant and effective as the business evolves.

- Operating Agreements are only for large businesses. This is a common misconception. Small businesses and startups also benefit greatly from having an Operating Agreement, as it helps establish clear guidelines from the outset.

Understanding these misconceptions can help business owners make informed decisions about their LLCs. An Operating Agreement is a valuable tool that can lead to smoother operations and better relationships among members.

What to Know About This Form

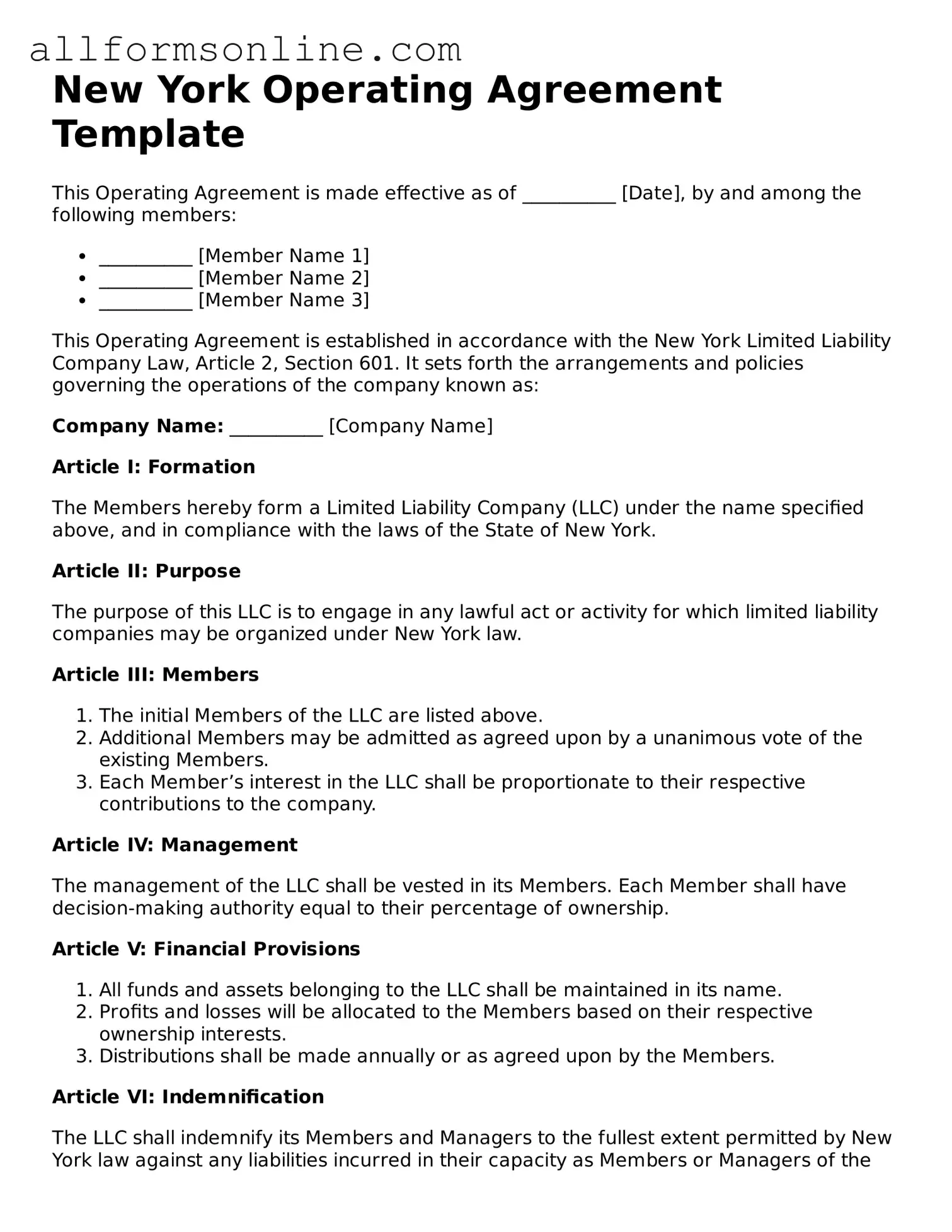

What is a New York Operating Agreement?

A New York Operating Agreement is a legal document that outlines the ownership and operating procedures of a Limited Liability Company (LLC) in New York. This agreement serves as a blueprint for how the business will be managed, detailing the rights and responsibilities of its members.

Is an Operating Agreement required in New York?

While New York law does not mandate that LLCs have an Operating Agreement, it is highly recommended. Having this document helps prevent misunderstandings among members and provides clarity on how the business should operate. It can also protect members' personal assets in case of legal disputes.

Who should draft the Operating Agreement?

The Operating Agreement can be drafted by any member of the LLC, but it is often beneficial to consult with a legal professional. This ensures that the agreement complies with state laws and adequately addresses the specific needs of the business and its members.

What should be included in the Operating Agreement?

The Operating Agreement should include details such as the name and purpose of the LLC, the members' contributions, profit distribution, management structure, and procedures for adding or removing members. It may also cover dispute resolution methods and the process for dissolving the LLC.

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. Members can agree to changes as needed. It is important to document any amendments in writing and ensure that all members consent to the changes. This keeps the agreement current and reflective of the business’s needs.

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, it will be governed by New York's default LLC laws. This may not align with the members' intentions and can lead to conflicts or confusion regarding management and profit distribution. It is advisable to create an Operating Agreement to avoid these issues.

How do I file the Operating Agreement?

The Operating Agreement does not need to be filed with the state. However, it should be kept on record with the LLC’s other important documents. Each member should have a copy for their reference, ensuring that everyone is aware of the terms outlined in the agreement.

Other Common State-specific Operating Agreement Forms

Does Llc Need Operating Agreement - This agreement may include a buy-sell agreement for member ownership interests.

Pennsylvania Llc Operating Agreement - It can specify how disputes will be resolved among members.

To ensure your final wishes are respected, consider working with a structured guide to create your Last Will and Testament document. This form is vital in clearly outlining your desires regarding asset distribution and the care of loved ones.

Llc Operating Agreement Texas - It serves as a central reference point for the LLC's internal operations.

Florida Operating Agreement - It may require members to contribute additional capital if necessary.

How to Use New York Operating Agreement

Completing the New York Operating Agreement form is an important step for your business. This document outlines the management structure and operating procedures of your limited liability company (LLC). By following these steps, you can ensure that all necessary information is accurately provided.

- Gather Information: Collect all relevant details about your LLC, including its name, address, and the names of the members (owners).

- Start with the Basics: Fill in the name of your LLC at the top of the form. Ensure that it matches the name registered with the state.

- Provide Member Details: List the names and addresses of all members. Be clear and accurate, as this information is crucial for legal purposes.

- Define Management Structure: Indicate whether your LLC will be member-managed or manager-managed. This decision affects how decisions are made within the company.

- Outline Voting Rights: Specify how voting will occur among members. Include details on how votes are counted and what constitutes a quorum.

- Address Profit and Loss Distribution: Clearly state how profits and losses will be allocated among members. This can be based on ownership percentages or another agreed-upon method.

- Include Additional Provisions: If there are any special agreements or provisions, such as buyout agreements or restrictions on transferring ownership, include them in this section.

- Review and Sign: Once all sections are filled out, review the document for accuracy. All members should sign the agreement to make it official.

After completing the form, keep a copy for your records. You may also need to file this agreement with your state or provide it to financial institutions or potential investors. Having a well-prepared Operating Agreement can help prevent misunderstandings and disputes in the future.