Attorney-Approved Power of Attorney Form for New York

Misconceptions

-

Misconception 1: A Power of Attorney is only needed for the elderly or those with health issues.

This is not true. While many people associate a Power of Attorney (POA) with aging or illness, anyone can benefit from having one. Life is unpredictable, and a POA can ensure that your financial and legal matters are handled according to your wishes if you become unable to do so yourself.

-

Misconception 2: A Power of Attorney gives unlimited power to the agent.

This misconception arises from a misunderstanding of the document's purpose. A POA does not grant unrestricted authority. The powers granted can be tailored to specific needs. You can limit the agent’s authority to certain transactions or decisions, ensuring that your preferences are respected.

-

Misconception 3: A Power of Attorney is only valid while the principal is alive.

Many believe that a POA ceases to be effective upon the principal's death. In fact, a POA does terminate upon death. However, it is essential to understand that it can still be a vital tool for estate planning, allowing for the management of affairs until the principal's passing.

-

Misconception 4: A Power of Attorney can be used without the principal’s consent.

This is a significant misunderstanding. A POA is only valid if the principal willingly and knowingly grants authority to the agent. If the principal is incapacitated, a court may need to appoint a guardian or conservator, as a POA cannot be established without the principal's consent.

What to Know About This Form

What is a Power of Attorney in New York?

A Power of Attorney (POA) in New York is a legal document that allows one person, known as the principal, to designate another person, called the agent or attorney-in-fact, to make decisions and act on their behalf. This can cover a range of matters, including financial transactions, legal decisions, and healthcare choices. The principal can specify the powers granted to the agent, and the document can be tailored to fit individual needs.

What types of Power of Attorney are available in New York?

New York recognizes several types of Power of Attorney forms. The most common include the General Power of Attorney, which grants broad powers to the agent, and the Limited Power of Attorney, which restricts the agent's authority to specific tasks or time periods. Additionally, there is a Durable Power of Attorney, which remains effective even if the principal becomes incapacitated. There are also Healthcare Proxy forms, which specifically allow the agent to make medical decisions for the principal.

How do I create a Power of Attorney in New York?

To create a Power of Attorney in New York, you must complete a specific form that complies with state laws. The form must be signed by the principal in the presence of a notary public. It is also advisable to have one or two witnesses present at the signing. Once completed, the document should be kept in a safe place, and copies should be provided to the agent and any relevant institutions, such as banks or healthcare providers.

Can I revoke a Power of Attorney in New York?

Yes, a Power of Attorney can be revoked in New York at any time, as long as the principal is competent to do so. To revoke the document, the principal should create a written revocation and notify the agent and any institutions that may have relied on the original Power of Attorney. It is also wise to destroy any copies of the original document to prevent confusion.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated, the durability of the Power of Attorney becomes crucial. A Durable Power of Attorney remains effective even if the principal is unable to make decisions. However, if a non-durable Power of Attorney was executed, it would become invalid upon the principal’s incapacity. It is essential for individuals to consider their options carefully when creating a Power of Attorney to ensure that their wishes are respected in the event of incapacity.

Other Common State-specific Power of Attorney Forms

Power of Attorney in Florida - It's essential to clearly outline the powers granted to the agent.

Power of Attorney Sacramento - Documentation of your wishes can aid in reducing misunderstandings among family members.

For those seeking to protect sensitive information, a well-crafted Non-disclosure Agreement is crucial to maintaining confidentiality. Understanding the importance of such agreements is essential to fostering trust in business dealings. For more details, refer to our guide on the Non-disclosure Agreement fundamentals available here.

Pa Power of Attorney Form - The form specifies the powers granted to the chosen agent or attorney-in-fact.

Where Can I Get Poa Forms - Consider the impact of your Power of Attorney on your overall health care directives.

How to Use New York Power of Attorney

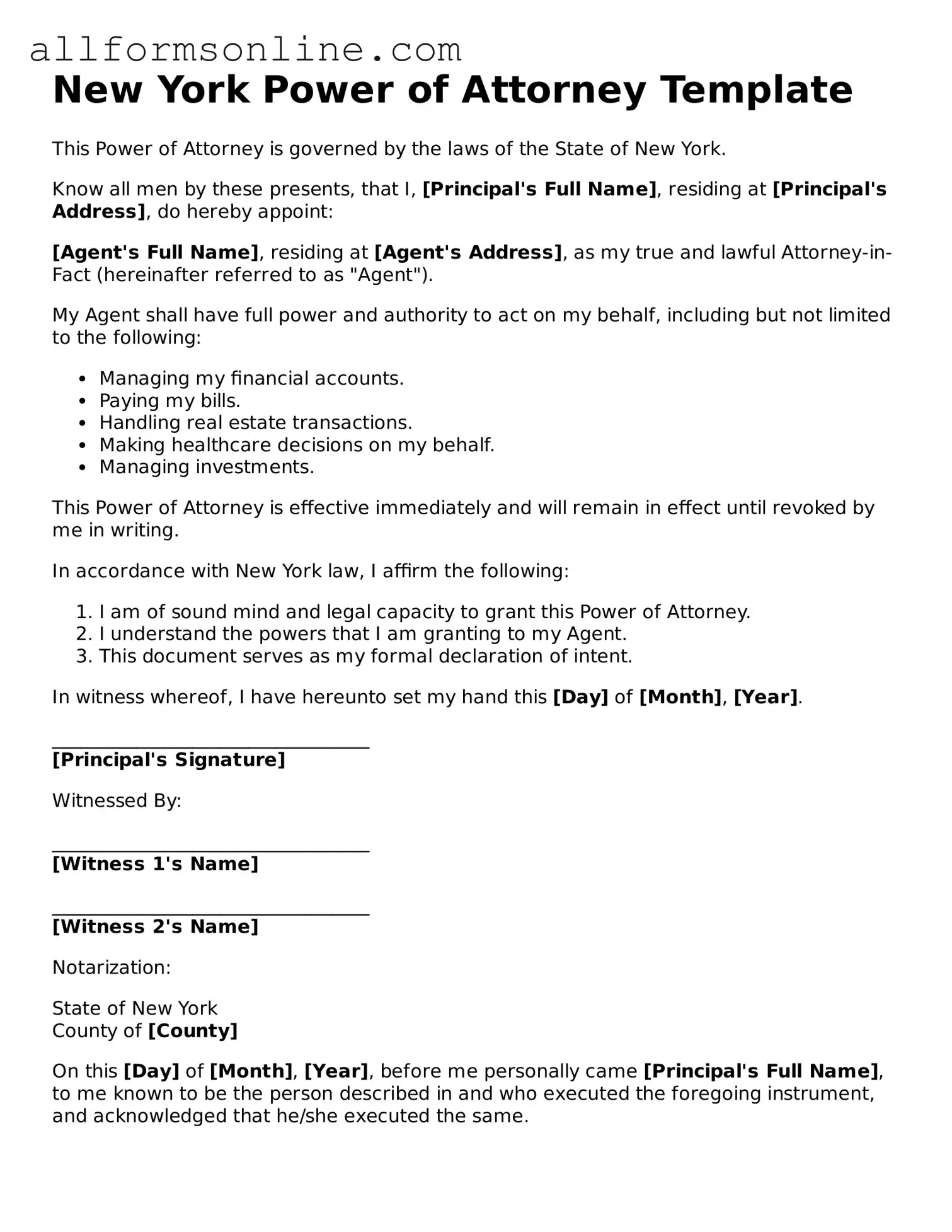

Filling out the New York Power of Attorney form requires careful attention to detail. This document allows you to designate someone to act on your behalf in financial matters. Once completed, the form must be signed and notarized to be legally binding.

- Obtain the New York Power of Attorney form. You can find it online or at a local legal office.

- Begin with the top section, where you will enter your name and address. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your agent. This person will have the authority to act on your behalf.

- Decide whether you want to grant your agent general powers or specific powers. If you choose specific powers, list them in the designated section.

- Indicate whether the power of attorney will be effective immediately or if it will become effective at a later date.

- Include any additional instructions or limitations regarding your agent’s authority, if necessary.

- Sign and date the form in the presence of a notary public. This step is crucial for the form to be valid.

- Have the notary public sign and stamp the document to complete the notarization process.

- Distribute copies of the completed and notarized form to your agent and any relevant financial institutions.