Attorney-Approved Promissory Note Form for New York

Misconceptions

Understanding the New York Promissory Note form can be challenging. Here are nine common misconceptions that people often have about this important document:

- All promissory notes are the same. Many believe that promissory notes are interchangeable. In reality, they can vary significantly based on state laws and specific terms agreed upon by the parties involved.

- A promissory note does not need to be in writing. Some think that verbal agreements suffice. However, a written document is essential for enforceability and clarity.

- Only banks can issue promissory notes. It is a common belief that only financial institutions can create these notes. In truth, any individual or business can draft a promissory note.

- Promissory notes do not require interest. Some people assume that all promissory notes must include interest. While many do, it is not a requirement; the terms can be set by the parties.

- Once signed, a promissory note cannot be changed. Many think that modifications are impossible after signing. In fact, parties can agree to amend the terms, but it must be documented properly.

- A promissory note guarantees repayment. Some believe that signing a note ensures that repayment will occur. While it serves as a legal commitment, it does not guarantee that the borrower will pay.

- Promissory notes are only for large loans. There is a misconception that these documents are only needed for substantial amounts. In reality, they can be used for loans of any size.

- Notarization is mandatory for all promissory notes. Some individuals think that notarizing a promissory note is always necessary. However, notarization is not required in New York for the note to be valid.

- Promissory notes are only for personal loans. Many assume these notes are only applicable in personal lending situations. However, they are also widely used in business transactions.

By addressing these misconceptions, individuals can better understand the New York Promissory Note form and its significance in financial agreements.

What to Know About This Form

What is a New York Promissory Note?

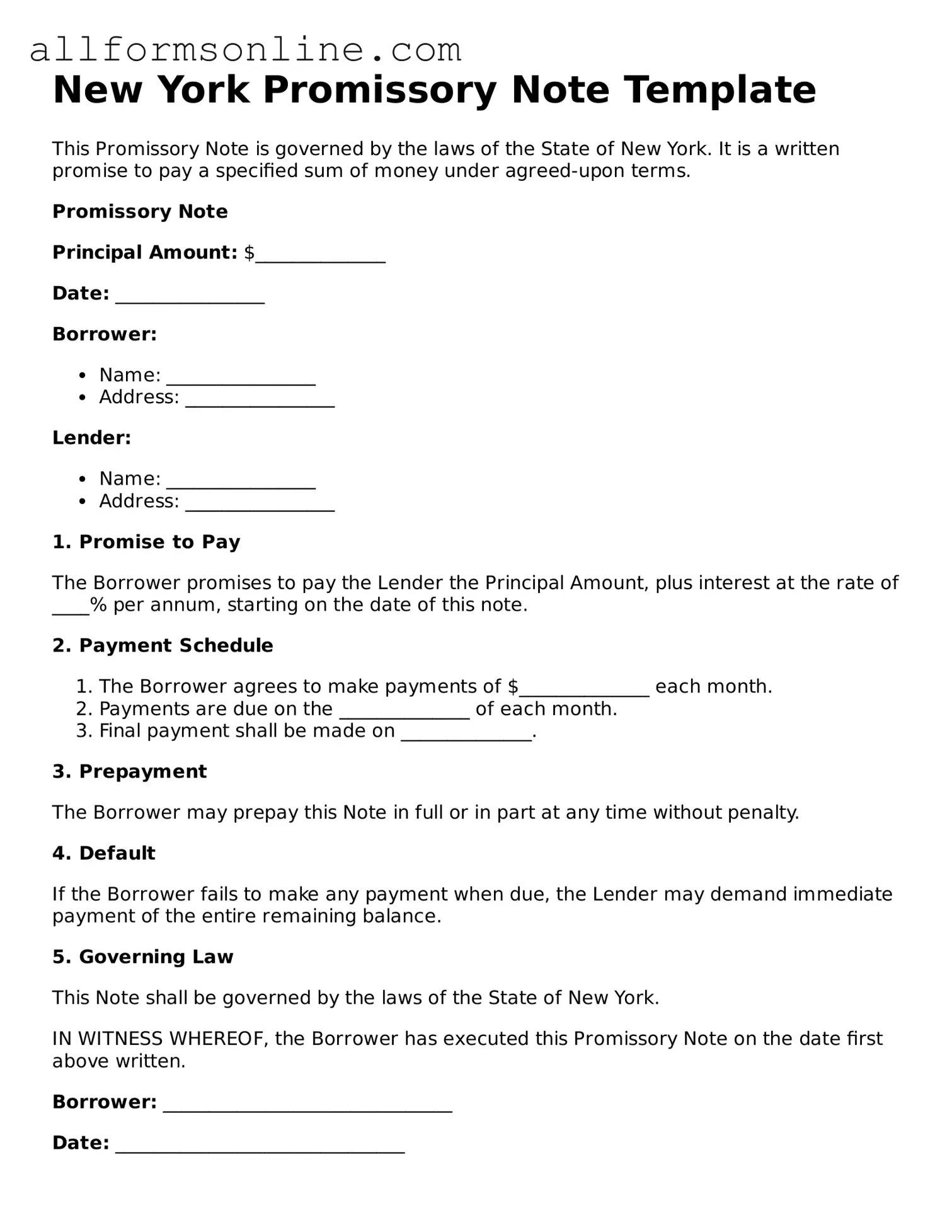

A New York Promissory Note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. This document typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral that may be involved. It serves as a formal agreement that can be enforced in court if necessary, providing both parties with clarity and security in the lending process.

What are the key components of a New York Promissory Note?

The key components of a New York Promissory Note include the names and addresses of both the borrower and the lender, the principal amount being borrowed, the interest rate (if applicable), the repayment schedule, and any late fees or penalties for missed payments. Additionally, the document may specify whether the note is secured or unsecured, meaning whether it is backed by collateral. Signature lines for both parties are also essential, as they indicate acceptance of the terms laid out in the note.

How does a New York Promissory Note differ from other loan agreements?

Is a New York Promissory Note legally binding?

Yes, a New York Promissory Note is legally binding once it has been signed by both parties. This means that if the borrower fails to repay the loan according to the terms specified in the note, the lender has the right to take legal action to recover the owed amount. However, it is important to ensure that the note complies with New York laws and includes all necessary components to be enforceable. Proper documentation and clarity in the terms can help prevent disputes and misunderstandings in the future.

Other Common State-specific Promissory Note Forms

Promissory Note Template Florida Pdf - The note may include provisions for late fees if payments are missed.

In today’s fast-paced world, ensuring that you have the proper documentation when health issues arise is critical; for instance, using the Doctors Excuse Note form can simplify the process. This form verifies a patient's medical condition and their ability to attend work or school, acting as an essential communication tool with employers or educational institutions. To streamline your documentation process, visit Fast PDF Templates for convenient templates that meet your needs and ensure that your rights are upheld during illness.

Promissory Note Form California - The promissory note can be an asset for the lender if the need arises to liquidate it.

How to Use New York Promissory Note

After you have obtained the New York Promissory Note form, you will need to fill it out accurately. This form is essential for documenting a loan agreement between a borrower and a lender. Follow these steps to complete the form correctly.

- Start with the date. Write the date on which the promissory note is being executed at the top of the form.

- Identify the borrower. Clearly state the full name and address of the person or entity borrowing the money.

- Identify the lender. Provide the full name and address of the person or entity lending the money.

- Specify the principal amount. Write the exact amount of money being borrowed in both numbers and words to avoid any confusion.

- Outline the interest rate. Indicate the annual interest rate that will apply to the loan, if any.

- Define the repayment terms. Clearly describe how and when the borrower will repay the loan. Include the payment schedule, such as monthly or quarterly payments.

- Include any late fees. If applicable, specify any fees that will be charged for late payments.

- Sign the document. Both the borrower and the lender must sign the promissory note to make it legally binding.

- Include witnesses or notarization. If required, have a witness sign or have the document notarized to enhance its validity.