Attorney-Approved Quitclaim Deed Form for New York

Misconceptions

Understanding the New York Quitclaim Deed form is essential for anyone involved in property transactions. However, several misconceptions can lead to confusion. Here are eight common misconceptions:

- Quitclaim deeds transfer ownership without warranties. Many believe that a quitclaim deed guarantees clear title. In reality, it only transfers whatever interest the grantor has, if any, without any promises about the title’s validity.

- Quitclaim deeds can only be used between family members. While often used for transferring property within families, quitclaim deeds can be utilized in various situations, including sales and transfers between unrelated parties.

- A quitclaim deed is the same as a warranty deed. This is incorrect. A warranty deed provides guarantees about the title and the grantor's right to sell, while a quitclaim deed does not offer such assurances.

- Quitclaim deeds are only for transferring real estate. Some think quitclaim deeds apply solely to real property. However, they can also transfer interests in personal property, such as vehicles or other assets.

- Once a quitclaim deed is signed, it cannot be revoked. This misconception is misleading. While a quitclaim deed is effective upon signing and delivery, the grantor may still have options to contest or revoke the deed under certain circumstances.

- All quitclaim deeds must be notarized. Although notarization is common and recommended, it is not a legal requirement in all cases. However, having a notary can help ensure the deed is accepted by the county.

- Quitclaim deeds are only valid if filed with the county. While filing with the county is necessary for public record, the deed is valid as soon as it is signed and delivered. Filing simply provides public notice.

- Using a quitclaim deed is always the best option for property transfer. This is not necessarily true. Depending on the situation, other types of deeds may be more appropriate, especially when warranties are needed.

Awareness of these misconceptions can help individuals make informed decisions regarding property transfers in New York.

What to Know About This Form

What is a Quitclaim Deed in New York?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. In New York, it allows the grantor (the person giving up their interest) to convey whatever interest they have in the property, without guaranteeing that the title is clear. This means that if there are any liens or claims against the property, the new owner may inherit those issues.

When should I use a Quitclaim Deed?

You might use a Quitclaim Deed in several situations, such as transferring property between family members, adding or removing a spouse from the title after marriage or divorce, or when dealing with property in a trust. It's a straightforward way to transfer interests without the complexities of a warranty deed.

What are the requirements for a Quitclaim Deed in New York?

To create a valid Quitclaim Deed in New York, it must include the names of the grantor and grantee, a description of the property, and the date of the transfer. The deed must also be signed by the grantor in front of a notary public. Additionally, it should be filed with the county clerk's office where the property is located.

Do I need an attorney to prepare a Quitclaim Deed?

While it is not legally required to have an attorney prepare a Quitclaim Deed, it is often a good idea. An attorney can ensure that the deed is correctly filled out and that all legal requirements are met. This can help prevent future disputes or issues with the property title.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such guarantees. The grantee receives only the interest the grantor has, if any.

What happens if there are existing liens on the property?

If there are liens on the property, the new owner who receives the property through a Quitclaim Deed may be responsible for those liens. Since the deed does not guarantee a clear title, it's important to conduct a title search before completing the transfer to understand any potential issues.

Can I revoke a Quitclaim Deed after it has been executed?

Generally, once a Quitclaim Deed is executed and recorded, it cannot be revoked unilaterally. However, if all parties involved agree, they can execute a new deed to reverse the transfer. It's advisable to consult with a legal professional in such cases to ensure the proper steps are taken.

How much does it cost to file a Quitclaim Deed in New York?

The cost to file a Quitclaim Deed in New York varies by county. Typically, there is a filing fee that ranges from $20 to $100. It's essential to check with your local county clerk's office for the exact fee and any additional requirements.

Do I need to pay taxes when using a Quitclaim Deed?

In New York, you may need to pay transfer taxes when using a Quitclaim Deed, depending on the circumstances of the transfer. Transfers between family members or certain types of trusts may be exempt. It's best to consult with a tax professional or attorney to understand any tax implications.

Where can I obtain a Quitclaim Deed form?

You can find a Quitclaim Deed form at your local county clerk's office, or you can download one from various legal websites. Make sure to use a form that complies with New York state laws to ensure it is valid.

Other Common State-specific Quitclaim Deed Forms

Quit Claim Deed Form Texas - Can simplify the process of property title transfers among friends.

When selling a vehicle, having the right documents is critical. The informational guide on the Motor Vehicle Bill of Sale form requirements provides valuable insights on how to complete this important transaction effectively and securely.

Quit Claim Deed Form Free - The Quitclaim Deed serves as a straightforward tool for property conveyance.

Pennsylvania Quit Claim Deed Form - People often use quitclaims to correct ownership issues caused by marriage, divorce, or inheritance.

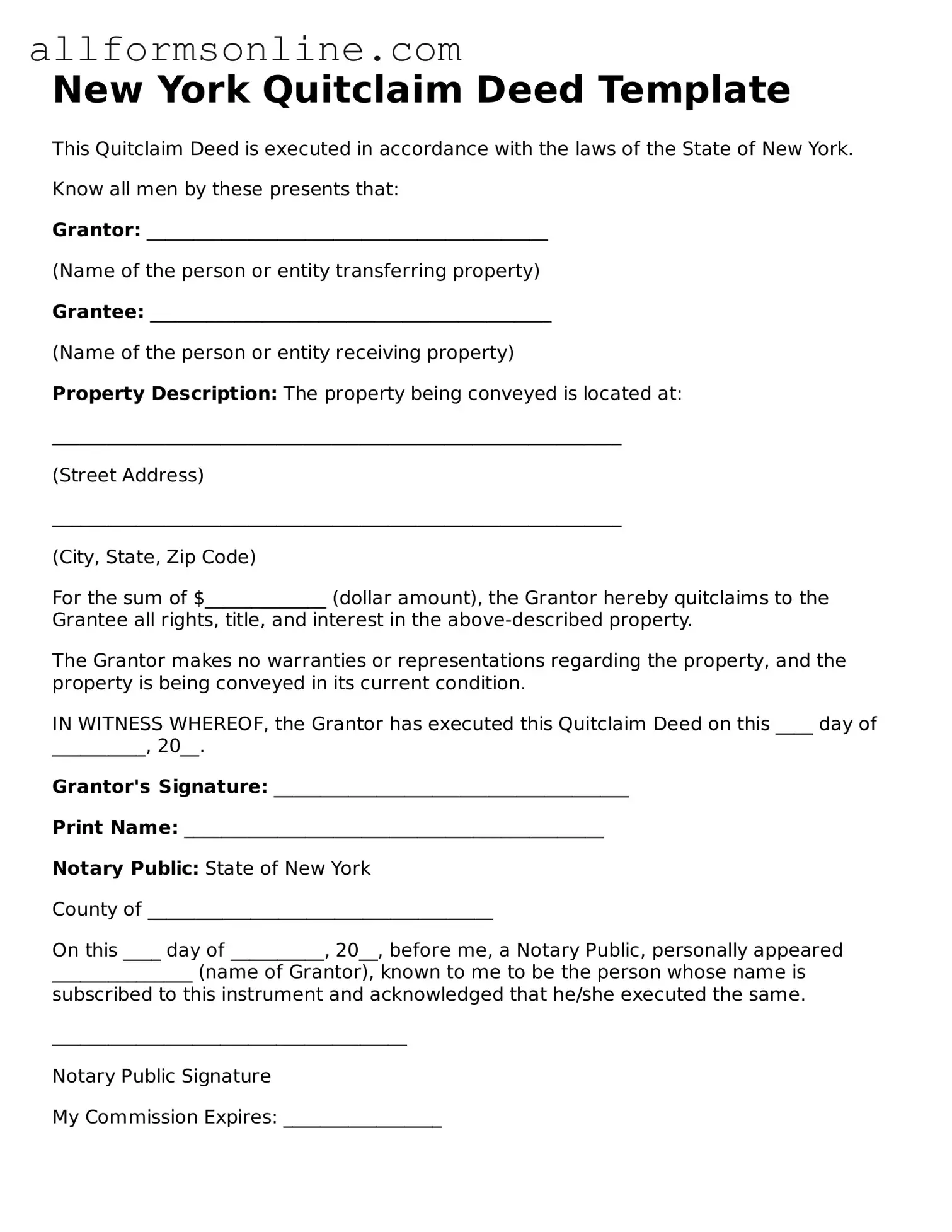

How to Use New York Quitclaim Deed

After obtaining the New York Quitclaim Deed form, you will need to complete it accurately. Follow these steps to ensure that all necessary information is provided correctly.

- Identify the Grantor: Enter the full name of the person transferring the property. Include their address.

- Identify the Grantee: Enter the full name of the person receiving the property. Include their address as well.

- Property Description: Provide a complete legal description of the property. This may include the lot number, block number, and any other relevant details. You can find this information on the current deed or property tax records.

- Consideration: State the amount of consideration for the transfer, if applicable. If no money is exchanged, you can write “for love and affection” or similar wording.

- Signatures: The Grantor must sign the form in front of a notary public. Ensure that the notary public completes their section as well.

- Filing: Submit the completed Quitclaim Deed to the appropriate county clerk’s office for recording. Check if there is a filing fee.