Attorney-Approved Real Estate Purchase Agreement Form for New York

Misconceptions

Understanding the New York Real Estate Purchase Agreement is crucial for anyone involved in a real estate transaction. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings about this important document.

- It is a legally binding contract from the moment it is signed. Many believe that signing the agreement immediately makes it enforceable. In reality, it often requires additional steps, such as acceptance by the seller and completion of contingencies.

- All terms are negotiable. While many aspects of the agreement can be negotiated, some terms, such as state laws and regulations, must be adhered to and are not subject to negotiation.

- It protects the buyer more than the seller. Some think the agreement favors buyers. In truth, it aims to balance the interests of both parties, providing protections for each side.

- Once signed, it cannot be changed. Many assume that any changes to the agreement after signing are impossible. However, amendments can be made if both parties agree to the modifications.

- It includes all necessary disclosures. Some people believe the purchase agreement covers all disclosures required by law. However, separate disclosure forms may be necessary to fulfill legal obligations.

- Financing contingencies are standard. While financing contingencies are common, they are not automatically included in every agreement. Buyers must specifically request them.

- It guarantees a clear title. A common misconception is that signing the agreement ensures a clear title. In reality, buyers should obtain title insurance to protect against any title issues.

- It is only a formality. Some view the agreement as just a formality. However, it serves as a critical document that outlines the terms and conditions of the sale.

- Real estate agents can fill it out without guidance. Many believe that real estate agents can complete the agreement without legal input. While agents can assist, legal advice is often necessary to ensure compliance with all laws.

- It is the same for all types of real estate transactions. Some think the purchase agreement is uniform across all transactions. However, variations exist based on property type, location, and specific circumstances.

By addressing these misconceptions, individuals can approach the New York Real Estate Purchase Agreement with a clearer understanding, leading to more informed decisions in their real estate transactions.

What to Know About This Form

What is a New York Real Estate Purchase Agreement?

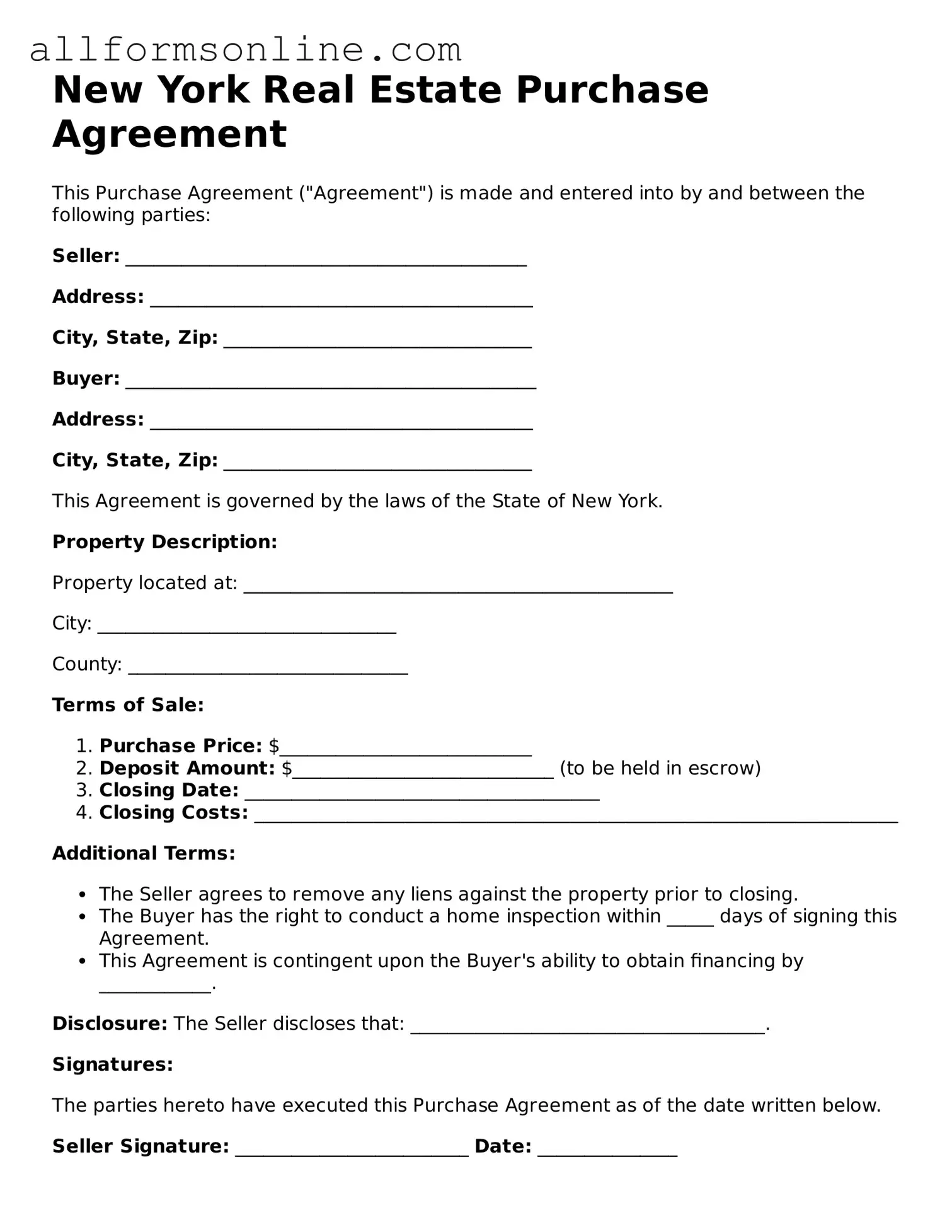

A New York Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions of a property sale. It includes details about the buyer, seller, property description, purchase price, and any contingencies that may apply. This agreement serves as a formal contract between the parties involved in the transaction.

What information is typically included in the agreement?

The agreement generally includes the names of the buyer and seller, the property's address, the purchase price, and the closing date. Additionally, it may outline any contingencies, such as financing or inspections, and specify who is responsible for closing costs and other fees associated with the transaction.

Is the Real Estate Purchase Agreement required in New York?

While it is not legally required to have a written agreement for a real estate transaction, it is highly recommended. A written purchase agreement protects both parties by clearly stating the terms of the sale and minimizing misunderstandings. Without it, verbal agreements may lead to disputes.

Can the terms of the agreement be negotiated?

Yes, the terms of the agreement can and often are negotiated. Buyers and sellers may discuss various aspects, such as the purchase price, closing date, and any contingencies. It’s important that both parties come to a mutual understanding before signing the agreement.

What happens if one party does not fulfill their obligations?

If one party fails to meet their obligations as outlined in the agreement, it could be considered a breach of contract. The non-breaching party may have the right to seek remedies, which could include financial compensation or, in some cases, specific performance, meaning they can compel the other party to fulfill their obligations under the agreement.

How can I ensure my interests are protected in the agreement?

To protect your interests, it is advisable to work with a real estate attorney or a qualified real estate agent. They can help you understand the terms of the agreement and negotiate on your behalf. Additionally, ensure that all verbal agreements are documented in writing within the purchase agreement.

What is the typical timeline for completing a Real Estate Purchase Agreement?

The timeline can vary depending on the specifics of the transaction. Typically, once an agreement is signed, the buyer will conduct inspections and secure financing. This process can take anywhere from a few weeks to a couple of months. The closing usually occurs after all contingencies have been satisfied.

Where can I obtain a New York Real Estate Purchase Agreement form?

You can obtain a New York Real Estate Purchase Agreement form from various sources, including real estate agents, legal websites, or local real estate boards. It is crucial to ensure that the form you use complies with New York state laws and regulations.

Other Common State-specific Real Estate Purchase Agreement Forms

Real Estate Purchase Agreement Pdf - It requires signatures from both the buyer and seller to validate the transaction.

The California Residential Lease Agreement is a legal document that outlines the terms and conditions under which a property is rented from a landlord to a tenant. This form is essential for clearly defining the rights and responsibilities of both parties in the rental relationship. For those looking to simplify the process, templates like those offered by Fast PDF Templates can provide valuable guidance, helping to ensure a smoother leasing process and avoid potential disputes.

Texas Real Estate Contract - It specifies the purchase price and any contingencies that may apply.

Real Estate Purchase and Sale Agreement - It is essential for buyers to carefully review the terms, as they govern the expectations and commitments involved.

Pennsylvania Real Estate Contract - This crucial document underpins the entire property transaction process, making it essential.

How to Use New York Real Estate Purchase Agreement

Filling out the New York Real Estate Purchase Agreement form is an important step in the home buying process. This document outlines the terms and conditions of the sale, ensuring that both the buyer and seller understand their obligations. Follow these steps to complete the form accurately.

- Start with the date at the top of the form. Write the date when you are filling out the agreement.

- Enter the names of the buyer(s). Make sure to include all legal names as they appear on identification.

- Next, list the seller(s) names in the designated section. Again, use full legal names.

- Provide the property address. Include the street number, street name, city, state, and zip code.

- Fill in the purchase price. This is the agreed amount that the buyer will pay for the property.

- Specify the amount of the deposit. This is usually a percentage of the purchase price and shows the buyer's commitment.

- Detail the closing date. This is when the sale will be finalized, and ownership will transfer.

- Include any contingencies. Common contingencies might relate to financing, inspections, or the sale of another property.

- Sign and date the agreement. Both the buyer(s) and seller(s) must sign to make the agreement valid.

Once you have filled out the form, review it carefully for any errors or omissions. After confirming everything is correct, both parties should keep a copy for their records.