Attorney-Approved Transfer-on-Death Deed Form for New York

Misconceptions

Understanding the New York Transfer-on-Death Deed (TODD) can be challenging. Many people hold misconceptions about its purpose and function. Here are ten common misunderstandings:

- It replaces a will. A TODD does not replace a will. It is an additional tool for estate planning that specifically addresses real property transfers.

- Only wealthy individuals need a TODD. Anyone who owns real property may benefit from a TODD, regardless of their wealth. It simplifies the transfer process for all property owners.

- It avoids probate entirely. While a TODD can help avoid probate for the property it covers, other assets may still go through probate if they are not handled with similar planning.

- It requires court approval. A TODD does not require court approval to take effect. The transfer happens automatically upon the owner's death.

- It can be revoked only through a court order. A TODD can be revoked or changed at any time by the property owner without needing a court order, as long as they are still alive.

- It is only for married couples. A TODD can be used by anyone, including singles, friends, or family members, to designate beneficiaries for their property.

- Beneficiaries must pay taxes immediately. Beneficiaries typically do not pay taxes until they sell the property, not at the time of transfer.

- It is complicated to set up. The form is straightforward and can often be filled out without legal assistance, although consulting a professional can provide additional peace of mind.

- All property types can be transferred with a TODD. A TODD only applies to real property, such as homes or land, and does not cover personal property or financial accounts.

- Once signed, it cannot be changed. A TODD can be amended or revoked at any time before the owner's death, allowing for flexibility in estate planning.

Addressing these misconceptions can lead to better understanding and more effective use of the Transfer-on-Death Deed in New York.

What to Know About This Form

What is a Transfer-on-Death Deed in New York?

A Transfer-on-Death Deed (TODD) allows property owners in New York to transfer real estate to a designated beneficiary upon their death. This legal document bypasses the probate process, making the transfer of property simpler and quicker for heirs. The property owner retains full control over the property during their lifetime and can revoke or change the deed at any time before their death.

Who can be a beneficiary in a Transfer-on-Death Deed?

Beneficiaries can be individuals, such as family members or friends, or entities, such as trusts or organizations. However, it is essential to ensure that the chosen beneficiary is legally capable of receiving property. If the beneficiary is a minor, it may be advisable to establish a trust to manage the property until they reach adulthood.

How do I create a Transfer-on-Death Deed?

To create a TODD, you must complete the appropriate form, which is available through New York state resources or legal document providers. The deed must include specific details, such as the property description and the beneficiary's name. After filling out the form, you must sign it in the presence of a notary public and file it with the county clerk's office where the property is located.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked at any time before your death. To do so, you must execute a new deed that explicitly states the revocation or file a formal revocation document with the county clerk's office. It is important to ensure that the revocation is properly documented to avoid confusion among heirs.

What happens if the beneficiary predeceases me?

If the designated beneficiary passes away before you, the property will not automatically transfer to them. Instead, it will typically go to your estate and be distributed according to your will or, if there is no will, according to New York's intestacy laws. To avoid complications, consider naming an alternate beneficiary in your TODD.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications for transferring property through a TODD. The transfer occurs outside of probate, which can help avoid certain estate taxes. However, the value of the property may still be included in your estate for tax purposes. It is advisable to consult with a tax professional for personalized advice.

Is a Transfer-on-Death Deed suitable for all types of property?

A Transfer-on-Death Deed can be used for most types of real estate, including single-family homes, condominiums, and vacant land. However, it cannot be used for personal property, such as vehicles or bank accounts. For those assets, other estate planning tools, like wills or trusts, may be more appropriate.

Do I need an attorney to create a Transfer-on-Death Deed?

While it is not legally required to have an attorney to create a TODD, seeking legal advice can be beneficial. An attorney can ensure that the deed is properly executed and compliant with New York laws, helping to avoid potential issues in the future. If you have complex estate planning needs or significant assets, consulting with a legal professional is highly recommended.

Other Common State-specific Transfer-on-Death Deed Forms

Transfer on Death Deed Florida Form - Each state may have varying rules about how and when a Transfer-on-Death Deed can be used.

Transfer on Death Deed Pennsylvania - A Transfer-on-Death Deed can include multiple beneficiaries.

In order to properly document the transfer of ownership for a vehicle, it's important to utilize the appropriate paperwork, and one such resource is available at Fast PDF Templates, where you can find the California Motor Vehicle Bill of Sale form designed to facilitate this process effectively.

Transfer Deed Upon Death - A valuable tool for homeowners wanting to ensure a smooth transition for their heirs.

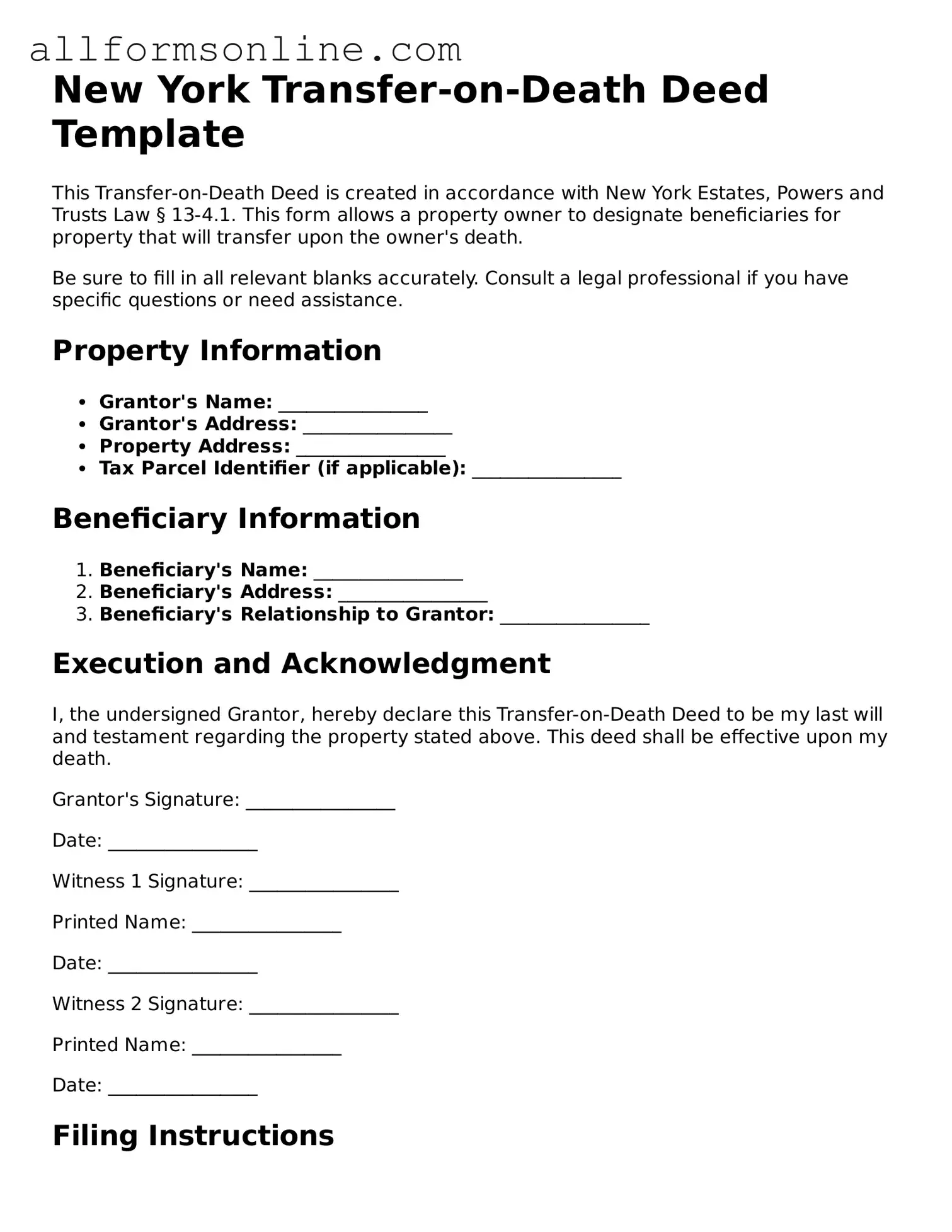

How to Use New York Transfer-on-Death Deed

Filling out the New York Transfer-on-Death Deed form is an important step in planning for the future of your property. Once completed, this form allows you to designate a beneficiary who will receive your property upon your passing. It is essential to ensure that all information is accurate and complete to avoid any complications later on.

- Begin by downloading the New York Transfer-on-Death Deed form from a reliable source.

- Carefully read the instructions that accompany the form to understand what information is required.

- In the first section, provide your name as the current owner of the property.

- Next, enter your address, including the city, state, and ZIP code.

- Identify the property you wish to transfer by including its legal description. This may involve the street address and any additional identifying information.

- Designate the beneficiary by writing their full name. Ensure that this person is someone you trust.

- Include the beneficiary’s address, again providing the city, state, and ZIP code.

- Sign and date the form in the designated area. Your signature must be done in the presence of a notary public.

- Have the form notarized. This step is crucial for the deed to be legally valid.

- Once notarized, file the completed deed with the county clerk’s office where the property is located. Keep a copy for your records.