Blank Operating Agreement Form

Operating AgreementDocuments for Particular States

Operating Agreement Form Categories

Misconceptions

Operating agreements are crucial for limited liability companies (LLCs), yet many misunderstand their purpose and importance. Here are nine common misconceptions about operating agreements, clarified for better understanding.

-

Operating agreements are only necessary for large businesses.

This is not true. Every LLC, regardless of size, should have an operating agreement. It provides structure and clarity on how the business will operate.

-

Operating agreements are legally required in all states.

While many states do not mandate an operating agreement, having one is highly recommended. It helps prevent disputes and outlines the management structure.

-

Verbal agreements are sufficient.

Relying on verbal agreements can lead to misunderstandings. Written agreements provide a clear record of the terms agreed upon by all members.

-

Operating agreements are set in stone.

In reality, these agreements can be amended as needed. Members can update the agreement to reflect changes in business operations or ownership.

-

All operating agreements must be the same.

Each operating agreement can be tailored to fit the specific needs of the LLC. There is no one-size-fits-all approach.

-

Operating agreements only cover financial aspects.

While finances are important, operating agreements also address management roles, decision-making processes, and member responsibilities.

-

Once an operating agreement is signed, it cannot be changed.

Members can revise the agreement as their business evolves. Flexibility is a key feature of a well-crafted operating agreement.

-

Operating agreements are only for multi-member LLCs.

Even single-member LLCs benefit from having an operating agreement. It helps establish the owner’s intentions and can assist in legal matters.

-

Having an operating agreement guarantees protection from personal liability.

While an operating agreement is important, it does not automatically protect members from personal liability. Proper business practices and compliance with laws are also necessary.

Understanding these misconceptions can help ensure that LLC members create effective operating agreements that serve their best interests and promote smooth business operations.

What to Know About This Form

What is an Operating Agreement?

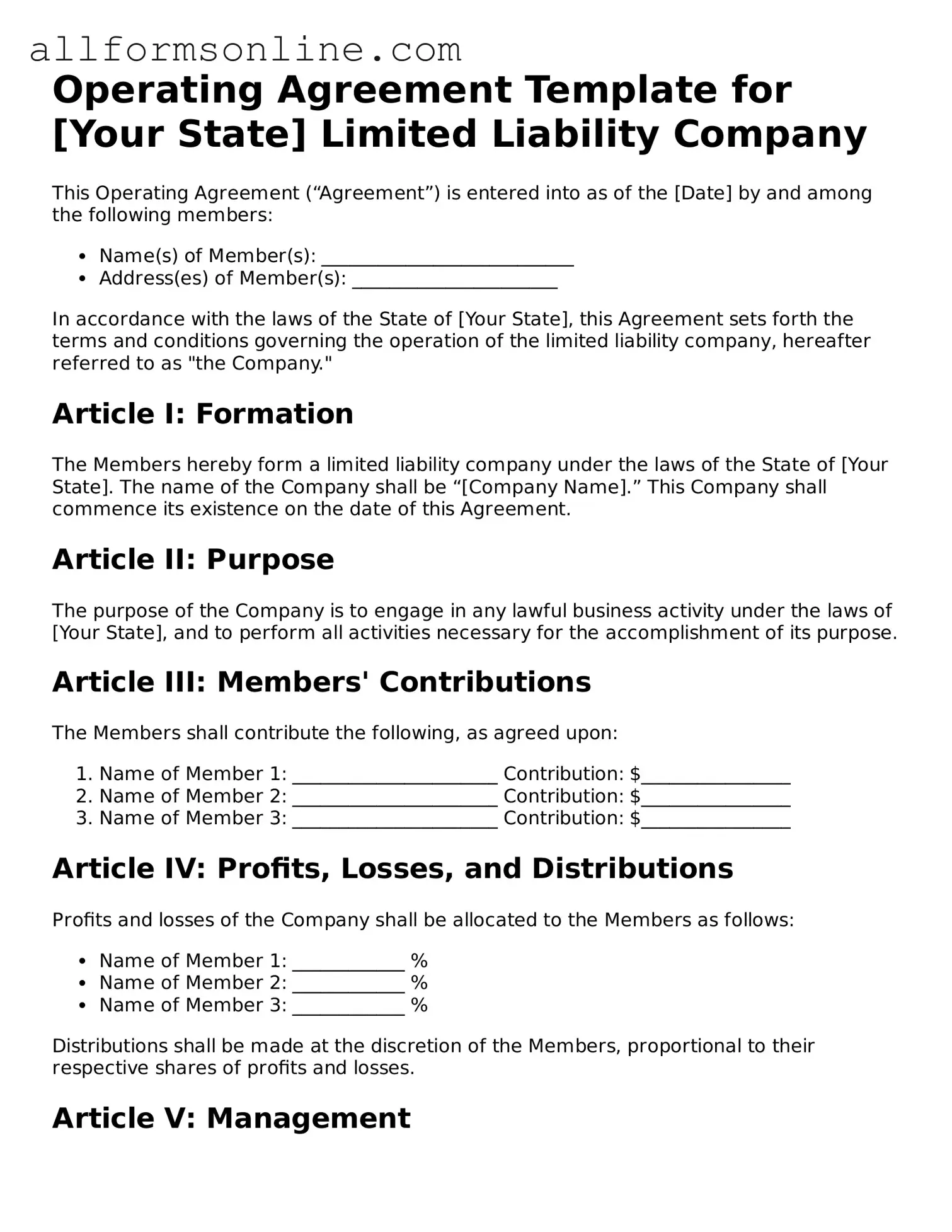

An Operating Agreement is a vital document for limited liability companies (LLCs). It outlines the ownership structure, management responsibilities, and operational procedures of the LLC. This agreement serves as a blueprint for how the business will run, ensuring that all members are on the same page regarding their roles and expectations.

Why do I need an Operating Agreement?

Having an Operating Agreement is essential for several reasons. First, it helps protect your limited liability status by demonstrating that your LLC is a separate entity from its owners. Second, it can prevent misunderstandings among members by clearly defining roles and responsibilities. Lastly, if any disputes arise, having a written agreement can help resolve issues more smoothly.

Who should create the Operating Agreement?

All members of the LLC should participate in creating the Operating Agreement. This collaborative approach ensures that everyone's voice is heard and that the document reflects the collective vision for the business. While it’s possible to draft the agreement independently, consulting with a legal professional can provide additional insights and help tailor the document to your specific needs.

What should be included in an Operating Agreement?

Your Operating Agreement should cover several key areas. These include the LLC's name and address, the purpose of the business, details about ownership percentages, management structure, voting rights, and procedures for adding or removing members. It’s also wise to include guidelines for handling profits and losses, as well as procedures for dissolving the LLC if necessary.

Is an Operating Agreement required by law?

While most states do not legally require LLCs to have an Operating Agreement, it is highly recommended. Some states may require it for certain types of LLCs or for specific business activities. Even if it’s not mandated, having an Operating Agreement can significantly benefit your business and its members.

Can the Operating Agreement be changed later?

Yes, the Operating Agreement can be amended as needed. It’s important to establish a process for making changes within the document itself. This might include requiring a certain percentage of member approval or specifying how amendments should be documented. Flexibility is key, as your business may evolve over time.

How does an Operating Agreement affect taxes?

The Operating Agreement can influence how your LLC is taxed. By default, single-member LLCs are treated as sole proprietorships, while multi-member LLCs are treated as partnerships. However, the Operating Agreement can specify how profits and losses are distributed among members, which may impact tax responsibilities. Consulting a tax professional can help clarify these implications.

What happens if we don’t have an Operating Agreement?

If your LLC lacks an Operating Agreement, state default rules will govern your business operations. These rules may not align with your specific needs or intentions, leading to potential conflicts among members. Without a clear agreement, resolving disputes can become more challenging, and your business may not operate as smoothly as it could.

Where can I find a template for an Operating Agreement?

Templates for Operating Agreements can be found online, often provided by legal websites or business formation services. While using a template can be a helpful starting point, it’s essential to customize it to fit your LLC’s unique circumstances. Consider consulting with a legal professional to ensure that your agreement meets all necessary requirements and reflects your business goals.

Popular Templates:

How to Balance a Cash Register - Can serve as a reference for resolving cash disputes.

To ensure peace of mind about your estate planning, consider utilizing a user-friendly tool for your Last Will and Testament guidelines. This document plays a critical role in addressing how your assets should be distributed, making it vital for personal and family security.

Furniture Purchase Agreement Template - Improves the professionalism of furniture sales transactions.

Ncoer Order of Signatures - The DA 2166-9-1 encompasses the Army's commitment to excellence and professionalism among its NCOs.

How to Use Operating Agreement

Completing the Operating Agreement form is an important step in establishing the structure and rules for your business. This document will help clarify the roles and responsibilities of the members involved. Follow these steps carefully to ensure accuracy.

- Begin by entering the name of your business at the top of the form. Make sure it matches the name registered with your state.

- Next, provide the principal address of your business. This should be the location where the business operates.

- List the names and addresses of all members involved in the business. Each member should be clearly identified.

- Specify the ownership percentage for each member. This reflects their stake in the business.

- Outline the management structure. Indicate whether the business will be member-managed or manager-managed.

- Detail the voting rights of each member. This will determine how decisions are made within the business.

- Include provisions for profit and loss distribution. Clearly state how profits and losses will be shared among members.

- Address how new members can be added to the business. Include any necessary approval processes.

- Provide information on how disputes among members will be resolved. This can help prevent conflicts down the line.

- Finally, ensure that all members sign and date the document. This confirms their agreement to the terms outlined.