Blank Owner Financing Contract Form

Misconceptions

Owner financing can be a beneficial option for both buyers and sellers, yet several misconceptions often cloud understanding. Here are seven common misconceptions about the Owner Financing Contract form, along with clarifications to help demystify this financial arrangement.

- Owner financing is only for buyers with poor credit. Many believe that owner financing is solely a last resort for those who cannot secure traditional financing. In reality, it can appeal to a wide range of buyers, including those who prefer flexible terms or want to avoid lengthy bank processes.

- It is a complicated process. While owner financing may seem complex, it often involves straightforward terms agreed upon by both parties. With clear communication and a well-structured contract, the process can be streamlined.

- Only sellers can offer owner financing. Some think that only sellers have the ability to offer owner financing. However, buyers can also propose this arrangement, especially if they have a compelling reason or unique circumstances that make traditional financing challenging.

- Owner financing eliminates the need for a real estate agent. Although owner financing can bypass certain aspects of traditional sales, many still choose to work with real estate professionals. Agents can provide valuable insights and help ensure that the contract is fair and legally sound.

- The seller has no legal recourse if the buyer defaults. A common misconception is that sellers are left without options if a buyer fails to make payments. In reality, the contract typically outlines specific remedies for default, including the possibility of foreclosure.

- Owner financing always requires a large down payment. While some sellers may request a significant down payment, it is not a requirement. The terms of the down payment can be negotiated, allowing flexibility based on the needs of both parties.

- All owner financing contracts are the same. Many assume that these contracts follow a standard template. In truth, each contract can be tailored to fit the unique circumstances of the buyer and seller, reflecting their individual needs and agreements.

Understanding these misconceptions can help both buyers and sellers make informed decisions regarding owner financing. Clear communication and a well-drafted contract are key to a successful transaction.

What to Know About This Form

What is an Owner Financing Contract?

An Owner Financing Contract is an agreement between a seller and a buyer where the seller provides financing to the buyer for the purchase of property. Instead of securing a traditional mortgage through a bank, the buyer makes payments directly to the seller. This arrangement can benefit both parties by simplifying the buying process and potentially lowering costs.

Who can use an Owner Financing Contract?

Any property owner can offer owner financing. This includes individuals selling their homes, real estate investors, and businesses selling commercial properties. Buyers who may struggle to obtain traditional financing due to credit issues or other reasons can also benefit from this type of arrangement.

What are the advantages of using an Owner Financing Contract?

There are several advantages. For sellers, it can lead to a quicker sale and a steady stream of income from interest payments. Buyers may find it easier to qualify for financing, as sellers often have more flexible criteria than banks. Additionally, both parties can negotiate terms that suit their needs, including down payment amounts and interest rates.

What should be included in an Owner Financing Contract?

The contract should clearly outline the purchase price, down payment, interest rate, payment schedule, and length of the loan. It should also specify any penalties for late payments, responsibilities for property maintenance, and what happens if the buyer defaults on the loan. Clear terms help prevent misunderstandings in the future.

Are there risks associated with Owner Financing?

Yes, there are risks for both parties. Sellers risk not receiving full payment if the buyer defaults. Buyers might face foreclosure if they fail to make payments. It's crucial for both parties to conduct due diligence and possibly consult with a legal professional before entering into an owner financing agreement.

Can an Owner Financing Contract be modified after it is signed?

Yes, an Owner Financing Contract can be modified if both parties agree to the changes. It's important to document any modifications in writing and have both parties sign the updated agreement. This ensures that any changes are legally binding and helps avoid potential disputes down the line.

Popular Owner Financing Contract Types:

Realtor Termination Letter - Utilizing this form can help prevent misunderstandings or disputes about the status of the agreement.

In the real estate market, having a clear and detailed agreement is essential, which is why many turn to resources like Fast PDF Templates to help in drafting the Texas Real Estate Purchase Agreement form. This legal document not only outlines the terms and conditions for buying and selling property but also serves as a protective measure for both parties involved, ensuring a smoother transaction process.

Purchase Agreement Addendum - Can document agreed-upon modifications regarding financing.

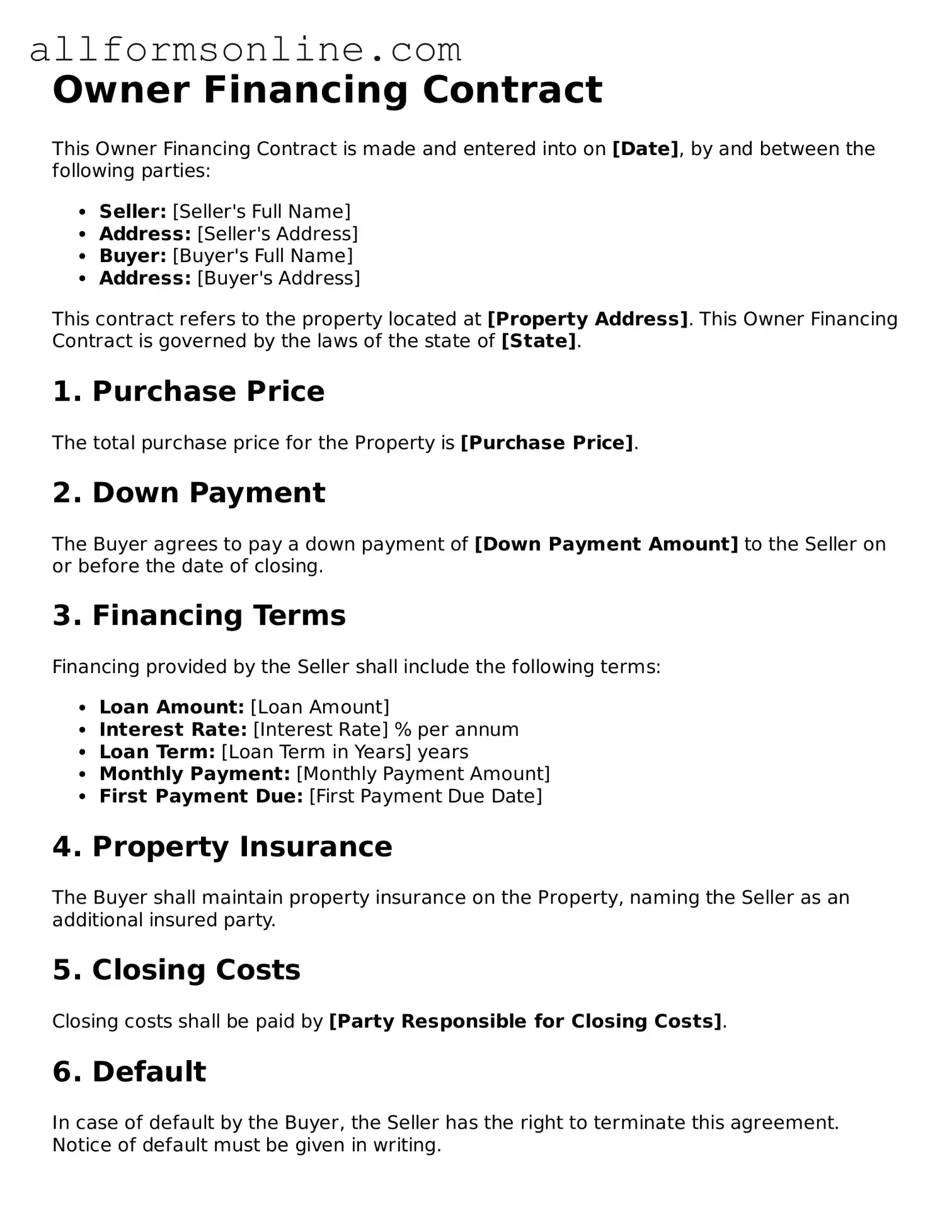

How to Use Owner Financing Contract

To successfully complete the Owner Financing Contract form, it is important to follow each step carefully. This ensures that all necessary information is accurately provided, which is crucial for the agreement between the parties involved.

- Begin by entering the date at the top of the form.

- Provide the names of the seller(s) in the designated section.

- List the buyer(s) names following the seller information.

- Fill in the property address, including the city, state, and zip code.

- Specify the purchase price of the property.

- Indicate the amount of down payment being made by the buyer.

- Detail the financing terms, including the interest rate and loan duration.

- Include any additional terms or conditions that apply to the financing agreement.

- Both parties should sign and date the form at the bottom.