Free P 45 It PDF Form

Misconceptions

Understanding the P45 form can be challenging, and several misconceptions often arise. Here are six common misunderstandings about the P45 form, along with clarifications for each.

- Misconception 1: The P45 form is only necessary for employees who are leaving a job permanently.

- Misconception 2: The P45 form is only for tax purposes.

- Misconception 3: Employees do not need to keep their P45 once they have a new job.

- Misconception 4: The P45 automatically updates tax codes for new employment.

- Misconception 5: If an employee has no tax to pay, they do not need a P45.

- Misconception 6: The P45 form can be completed by anyone in the company.

This is not entirely true. While the P45 is primarily issued when an employee leaves a job, it is also relevant for those transitioning to a new job. The new employer needs the P45 to ensure correct tax deductions.

Although tax is a significant aspect, the P45 also provides crucial information for other benefits, such as Jobseeker's Allowance. It can affect your financial situation beyond just taxation.

This is misleading. It is essential to keep the P45 safe, as it may be required for future tax returns or financial applications. Copies are not available, so safeguarding the original is important.

This is incorrect. While the P45 provides the new employer with necessary tax information, it is the responsibility of the new employer to ensure the correct tax code is applied. Employees should verify this with their new employer.

This is a misunderstanding. Even if an employee has no tax liability, the P45 is still required to document the employment history and ensure that any future tax issues can be addressed properly.

This is not accurate. The P45 must be completed by the employer or an authorized payroll representative. Accuracy is crucial, as errors can lead to tax complications for the employee.

What to Know About This Form

What is the P45 form?

The P45 form is an official document that an employer provides to an employee when they leave a job. It details the employee's pay and tax deductions up to their leaving date. The P45 is essential for the employee's tax records and is used when starting a new job or applying for benefits.

What parts does the P45 form consist of?

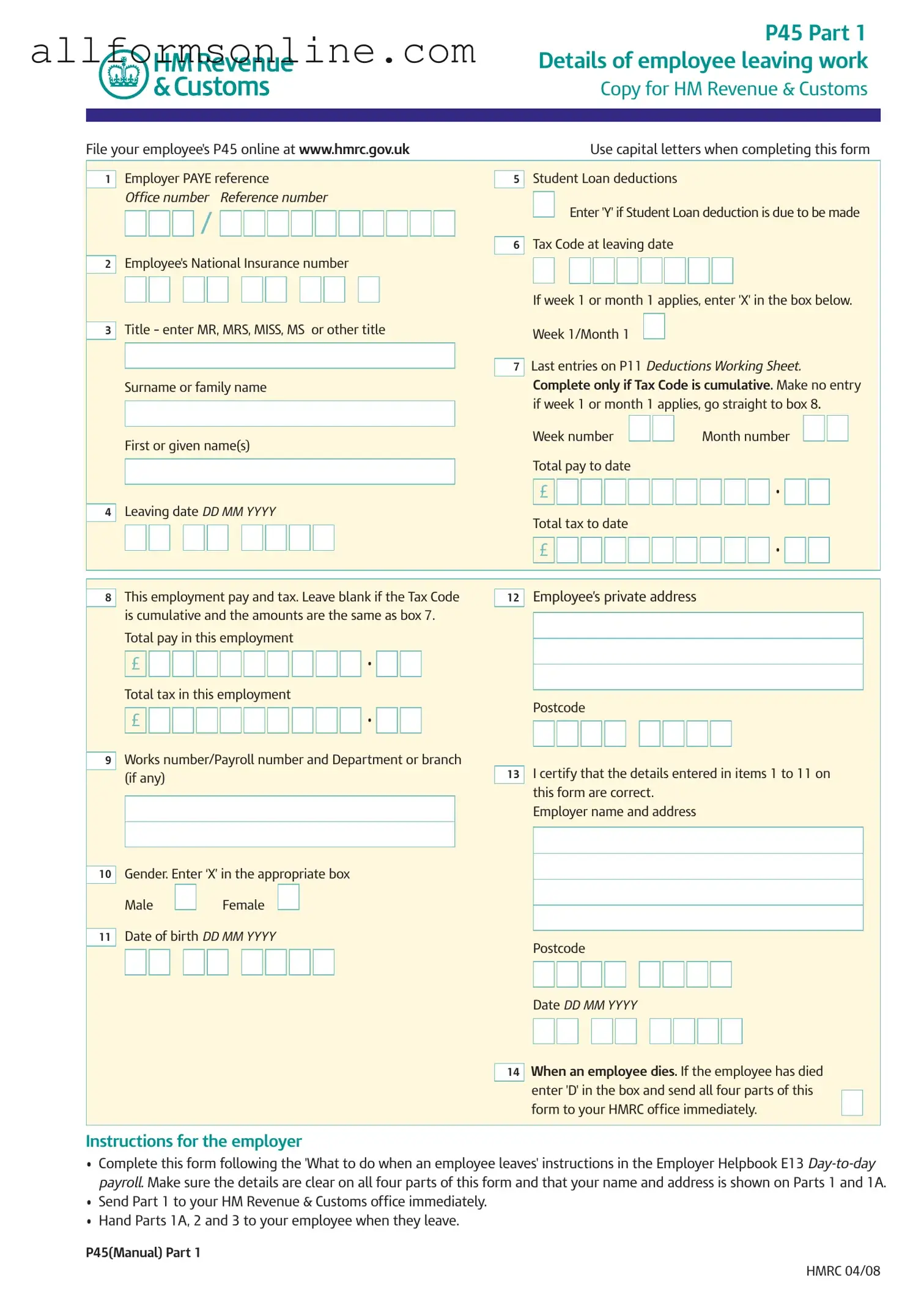

The P45 form consists of three parts: Part 1, Part 1A, and Part 2. Part 1 is sent to HM Revenue & Customs (HMRC) by the employer. Part 1A is given to the employee, and Part 2 is provided to the new employer. Each part contains important information regarding the employee's tax and pay details.

How should I complete the P45 form?

When completing the P45 form, use capital letters for clarity. Ensure that all required fields are filled out accurately, including the employee's National Insurance number, tax code, and total pay and tax amounts. If the employee is on a week 1 or month 1 tax code, mark the appropriate box. Double-check all entries for correctness before submitting or distributing the form.

What should an employee do with their P45?

An employee should keep Part 1A of the P45 safe, as it may be needed for tax returns or when starting a new job. Parts 2 and 3 should be given to the new employer to ensure correct tax deductions. If the employee does not want their new employer to see the details, they can send the form directly to HMRC with a request for confidentiality.

What if an employee dies?

If an employee passes away, the employer must enter 'D' in the designated box on the P45 form and send all four parts to HMRC immediately. This ensures that the employee's tax affairs are handled appropriately and in a timely manner.

What happens if I do not receive my P45?

If you do not receive your P45 after leaving a job, you should contact your former employer to request it. It is important to obtain this document for your tax records. If you encounter difficulties, you can reach out to HMRC for assistance in obtaining the necessary information.

Can I use the P45 form for tax refunds?

Yes, the P45 form can be used to claim tax refunds. If you have overpaid tax, you can present your P45 to HMRC when applying for a refund. Additionally, if you are not working and wish to claim a refund, you may need to complete a separate form, such as the P50, to initiate the process.

Different PDF Forms

Trader Joes Careers - Adept at multitasking and handling various duties.

A California Lease Agreement form is a legally binding document outlining the terms and conditions between a landlord and tenant for renting residential or commercial property in California. This form serves to protect the rights of both parties and ensure clear communication regarding rental obligations. For those seeking an effective template, Fast PDF Templates can provide valuable resources. In understanding this document, renters and landlords can engage in a more transparent and effective leasing process.

Printable Home Daycare Child Care Receipt Template - Serves as a safeguard against discrepancies in payments between parents and providers.

Cat Health Certificate - Individual forms are needed for each animal traveling.

How to Use P 45 It

Completing the P45 It form is an important step when an employee leaves a job. This form consists of several parts that need to be filled out accurately to ensure proper record-keeping and tax processing. Follow these steps carefully to complete the form correctly.

- Begin by entering the Employer PAYE reference in the designated field.

- Fill in the Office number and Reference number as applicable.

- Provide the Employee's National Insurance number.

- Indicate the employee's title (MR, MRS, MISS, MS, or other) in the title section.

- Enter the Surname or family name and First or given name(s).

- Input the Leaving date in the format DD MM YYYY.

- Specify if Student Loan deductions apply by marking the appropriate box.

- For the Tax Code at leaving date, enter the relevant code.

- If applicable, indicate Week 1/Month 1 status by entering 'X' in the box.

- Fill in the Total pay to date and Total tax to date amounts.

- Complete the employee's private address and Postcode.

- Mark the Gender by entering 'X' in the appropriate box.

- Provide the Date of birth in the format DD MM YYYY.

- Sign and date the form to certify that all details are correct.

After filling out the P45 It form, ensure that all parts are distributed correctly. Send Part 1 to HM Revenue & Customs and provide Parts 1A, 2, and 3 to the employee. They will need these for future employment or tax purposes. Keeping accurate records is essential for compliance and to avoid any issues with tax deductions.