Blank Partial Release of Lien Form

Misconceptions

The Partial Release of Lien form is often misunderstood. Here are seven common misconceptions about this important document:

- It only benefits the contractor. Many believe that only contractors gain from a partial release. In reality, it protects property owners by ensuring that they can pay for completed work without being burdened by future claims.

- It releases all liens associated with a project. A partial release does not eliminate all liens. It only releases a portion of the lien, often corresponding to the completed work, while other claims may still exist.

- It is not necessary if the project is ongoing. Some assume that a partial release is irrelevant during active projects. However, it can help clarify payment obligations and protect the owner from future disputes.

- It must be filed with the court. Many think that a partial release must be filed in court to be valid. In most cases, it simply needs to be signed by the lien claimant and provided to the property owner.

- Once signed, it cannot be revoked. There is a belief that a signed partial release is final and unchangeable. While it is generally binding, there may be circumstances under which it can be contested or revoked.

- It guarantees payment for the contractor. Some contractors believe that obtaining a partial release guarantees they will be paid. However, it does not ensure payment if the owner defaults or disputes the payment.

- All states have the same rules regarding partial releases. Many assume uniformity across states. In fact, each state has its own laws and regulations governing lien releases, making it essential to understand local requirements.

What to Know About This Form

What is a Partial Release of Lien form?

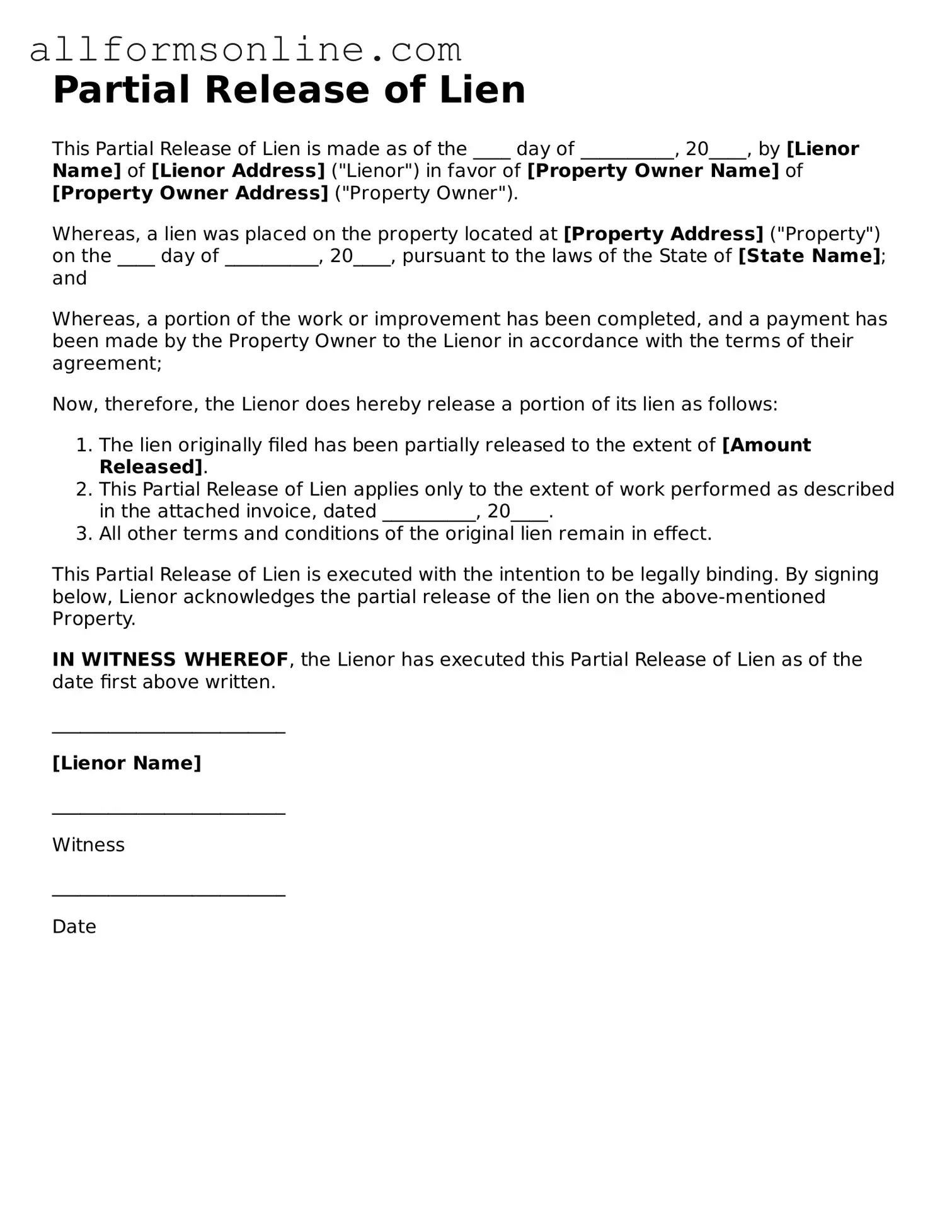

A Partial Release of Lien form is a legal document used to remove a lien on a specific portion of a property or project. This form is typically used when a contractor or supplier has been paid for part of their work but still holds a lien on the entire property. By filing this form, they acknowledge that they are releasing their claim on the portion that has been paid, while still retaining the right to claim on the unpaid portion.

When should I use a Partial Release of Lien?

You should use a Partial Release of Lien when you have received payment for a specific part of your work or services but still have outstanding payments for other parts. This form helps clarify which parts of the project are paid for and which are not. It protects both the property owner and the contractor by ensuring that there is a clear record of payments made and claims still in effect.

How do I fill out a Partial Release of Lien form?

To fill out a Partial Release of Lien form, start by providing your name and the name of the property owner. Include details about the property, such as the address and legal description. Next, specify the amount that has been paid and the specific work or services related to that payment. Finally, sign and date the form. It may also be necessary to have the form notarized, depending on your state’s requirements.

What happens after I file a Partial Release of Lien?

After filing a Partial Release of Lien, the lien on the specified portion of the property is officially removed. The property owner should receive a copy of the filed document for their records. It is important to keep a copy for your own records as well. If there are still outstanding payments, the lien remains in effect for those amounts. Always ensure that the release is properly recorded with the appropriate local government office to avoid any future disputes.

Popular Partial Release of Lien Types:

Tattoo Release Form - It's a practical step for both parties to ensure clarity and safety.

To ensure proper protection, it's vital for participants to familiarize themselves with the California Release of Liability form, which is a legal document designed to protect individuals and organizations from claims resulting from injuries or damages that may occur during an activity. By signing this form, participants acknowledge the risks involved and agree to waive their right to hold the organizers accountable. For those looking to engage in activities that carry inherent risks, consider filling out the form available at https://califroniatemplates.com/fillable-release-of-liability, as understanding this form is essential for responsible participation.

Free Waiver of Liability Form - Use this to simplify the aftermath of a vehicle collision.

How to Use Partial Release of Lien

After completing the Partial Release of Lien form, it's essential to ensure that all parties involved receive a copy. This step is crucial for maintaining transparency and avoiding any potential disputes. Once you have filled out the form accurately, you can move on to the next steps, which may involve filing the document with the appropriate authority or sharing it with relevant stakeholders.

- Begin by entering the date at the top of the form. This date should reflect when you are completing the document.

- Fill in the name and address of the property owner. Ensure that this information is accurate to avoid any issues.

- Provide the name and address of the lien claimant. This is the individual or entity that has placed the lien on the property.

- Clearly describe the property involved. Include details such as the address and any other identifying information.

- Indicate the amount being released. Specify the dollar amount that corresponds to the partial release of the lien.

- Sign the form. The lien claimant must sign to validate the release. Make sure the signature is dated.

- Have the signature notarized if required. Check local laws to see if notarization is necessary for your situation.

- Make copies of the completed form for your records and for the property owner.

- Submit the form to the appropriate local office or authority, if needed. This may involve filing it with the county recorder or another relevant agency.