Free Payroll Check PDF Form

Misconceptions

Understanding the Payroll Check form is essential for both employers and employees. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

-

All payroll checks must be printed on special paper.

This is not true. While some businesses may choose to use specific paper for branding or security purposes, payroll checks can be printed on standard paper as long as they meet legal requirements.

-

Payroll checks can only be issued weekly.

Many believe that payroll checks are limited to weekly issuance. In reality, employers can choose to pay employees on a variety of schedules, including bi-weekly, semi-monthly, or monthly, depending on company policy and state regulations.

-

Employees cannot receive direct deposit if they prefer checks.

This is a misconception. Employees can often choose their preferred payment method. Many companies offer both options, allowing employees to receive a physical check or opt for direct deposit into their bank accounts.

-

All deductions must be itemized on the payroll check.

While it is good practice to provide itemized deductions, it is not always a legal requirement. Employers must ensure compliance with state laws, but itemization is often left to company policy.

-

Payroll checks can be backdated without consequences.

This is a serious misconception. Backdating payroll checks can lead to legal issues, including tax complications and potential penalties. It is crucial to issue checks with the correct date to avoid any legal repercussions.

-

Once a payroll check is issued, it cannot be changed.

This is not entirely accurate. While it is best to ensure accuracy before issuing a check, if an error is discovered afterward, employers can issue a corrected check or make adjustments in the next payroll cycle.

Being aware of these misconceptions can help both employers and employees navigate payroll processes more effectively.

What to Know About This Form

What is a Payroll Check form?

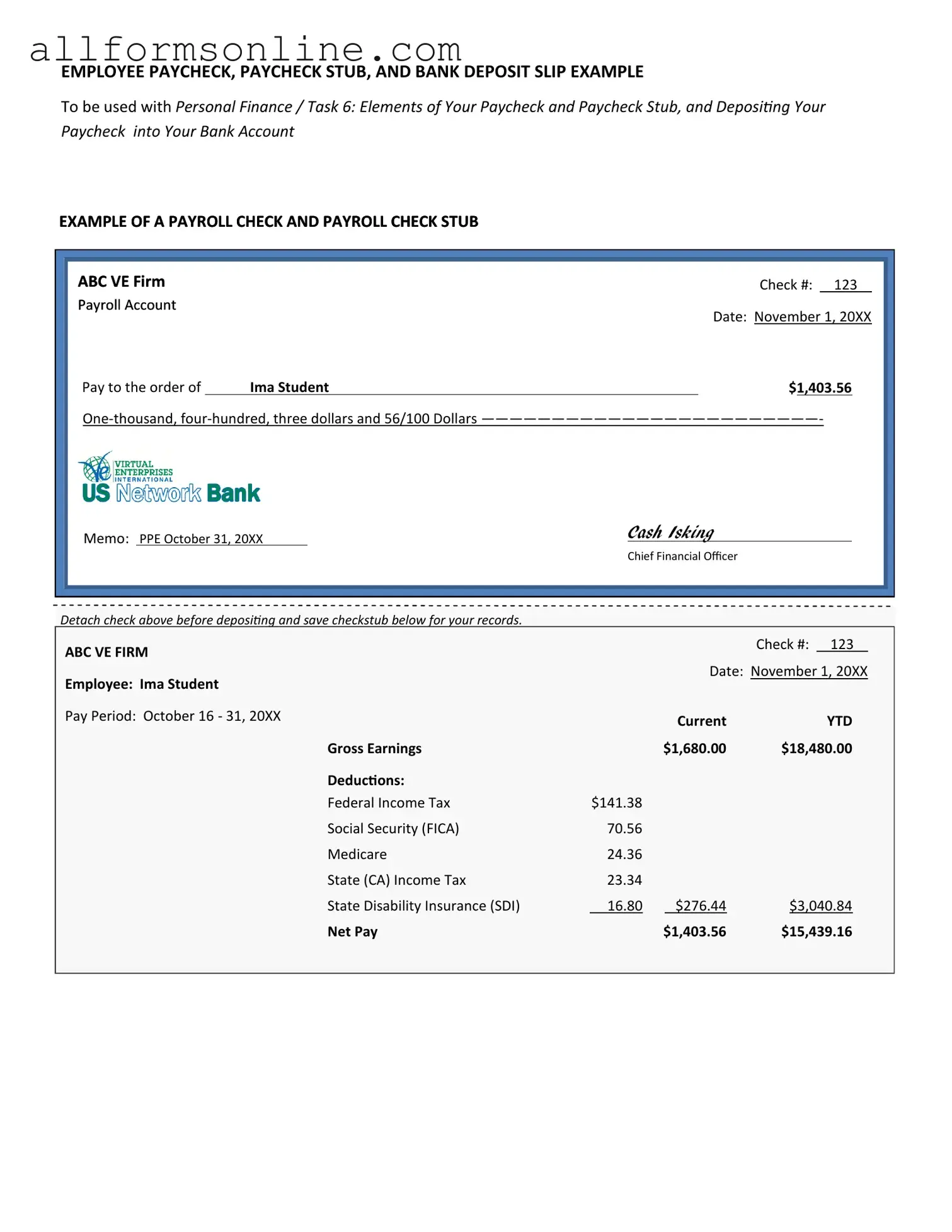

A Payroll Check form is a document used by employers to authorize the payment of wages to employees. It typically includes details such as the employee's name, the amount of pay, the pay period, and the employer's information. This form ensures that employees receive their compensation accurately and on time.

Who needs to fill out the Payroll Check form?

Employers or payroll administrators are responsible for filling out the Payroll Check form. It is essential for any business that compensates employees through checks. Employees do not fill out this form; however, they should provide accurate information for payroll processing.

What information is required on the Payroll Check form?

The Payroll Check form typically requires the employee's full name, Social Security number, pay period dates, gross pay, deductions, and net pay. Additionally, the employer's name and address, as well as the date of payment, should be included to ensure clarity and compliance with tax regulations.

How often should Payroll Check forms be submitted?

The frequency of submitting Payroll Check forms depends on the employer's payroll schedule. Many businesses operate on a weekly, biweekly, or monthly basis. Employers should establish a consistent schedule to ensure timely payments and compliance with labor laws.

What should I do if I notice an error on my Payroll Check form?

If an error is identified on the Payroll Check form, the employee should notify their employer or payroll department immediately. Corrections may involve issuing a new check or adjusting the payroll records to reflect the accurate information. Prompt action is crucial to avoid delays in payment.

Can Payroll Check forms be submitted electronically?

Yes, many companies now allow Payroll Check forms to be submitted electronically. This process often streamlines payroll operations and enhances efficiency. Employers should ensure that electronic submissions comply with applicable laws and maintain proper security measures to protect sensitive information.

What happens if a Payroll Check is lost or stolen?

If a Payroll Check is lost or stolen, the employee should report the incident to their employer immediately. The employer may then place a stop payment on the check and issue a replacement. It is important for employees to act quickly to avoid potential financial loss.

Are Payroll Check forms required for independent contractors?

Payroll Check forms are generally not required for independent contractors. Instead, businesses typically issue 1099 forms at the end of the tax year to report payments made to contractors. However, it is essential to maintain accurate records of payments made to comply with tax regulations.

How long should Payroll Check forms be kept on file?

Employers should retain Payroll Check forms for a minimum of three years, in accordance with IRS guidelines. Keeping these records helps ensure compliance with tax laws and provides documentation in case of audits or disputes regarding employee compensation.

What should I do if I have more questions about the Payroll Check form?

If additional questions arise regarding the Payroll Check form, employees should reach out to their employer's human resources or payroll department. They can provide specific guidance and clarify any concerns related to payroll processing and compensation.

Different PDF Forms

What Is an Abn in Healthcare - This notice plays a key role in managing expectations regarding medical expenses.

When dealing with medical absences, it's essential to have appropriate documentation, such as a Doctors Excuse Note, which can be accessed from resources like Fast PDF Templates. This note not only verifies the patient's condition but also supports their right to take necessary time off to recover. Properly completing and submitting this form can help maintain clear communication with employers and educational institutions during health-related absences.

Emotional Support Animal Letter From Therapist - The emotional support animal letter can enhance the quality of life for individuals in need.

What Do Immunization Records Look Like - This document highlights vaccines that protect against common childhood diseases.

How to Use Payroll Check

Completing the Payroll Check form is essential for ensuring that employees receive their due compensation accurately and on time. After filling out the form, it will need to be submitted to the payroll department for processing.

- Start by entering the employee's name in the designated field.

- Fill in the employee ID number to identify the individual correctly.

- Indicate the pay period by specifying the start and end dates.

- Enter the gross pay amount, which is the total earnings before any deductions.

- List any deductions, such as taxes or benefits, in the appropriate section.

- Calculate the net pay by subtracting the total deductions from the gross pay.

- Sign the form in the signature line to authorize the payment.

- Finally, date the form to indicate when it was completed.