Attorney-Approved Articles of Incorporation Form for Pennsylvania

Misconceptions

When it comes to the Pennsylvania Articles of Incorporation form, several misconceptions can lead to confusion for those looking to establish a business. Here are ten common misunderstandings:

- It's only for large businesses. Many believe that only corporations with significant revenue need to file Articles of Incorporation. In reality, any business entity that wants to operate as a corporation in Pennsylvania must file this form, regardless of size.

- Filing is optional. Some think that filing Articles of Incorporation is merely a suggestion. However, it is a legal requirement for corporations in Pennsylvania. Not filing can lead to personal liability for business debts.

- All forms are the same across states. People often assume that Articles of Incorporation forms are standardized nationwide. Each state has its own requirements and forms, and Pennsylvania's are unique.

- Only lawyers can file. While having legal assistance can be beneficial, anyone can file the Articles of Incorporation. Many resources are available to help individuals complete the process on their own.

- Once filed, it's permanent. Some believe that filing the Articles of Incorporation means the corporation will exist indefinitely. In reality, corporations must comply with ongoing requirements, including annual reports and fees.

- Articles of Incorporation are the same as a business license. Many confuse these two documents. The Articles of Incorporation establish the corporation's existence, while a business license allows the business to operate legally.

- There are no fees associated with filing. Some people think filing is free. However, there are filing fees that must be paid to the Pennsylvania Department of State when submitting the form.

- It's a quick process. While some may believe that filing the Articles of Incorporation is a fast task, it can take time for processing. Planning ahead is essential to avoid delays in starting the business.

- All information is confidential. Many assume that the details provided in the Articles of Incorporation are private. However, these documents are public records and can be accessed by anyone.

- You can't change the Articles after filing. Some think that once the Articles of Incorporation are filed, they cannot be amended. In fact, corporations can file amendments to change certain provisions as needed.

What to Know About This Form

What is the Pennsylvania Articles of Incorporation form?

The Pennsylvania Articles of Incorporation form is a legal document required to establish a corporation in the state of Pennsylvania. This form outlines essential details about the corporation, such as its name, purpose, registered office address, and the names of its initial directors. Filing this document with the Pennsylvania Department of State is a crucial step in the incorporation process.

Who needs to file the Articles of Incorporation?

Any individual or group looking to create a corporation in Pennsylvania must file the Articles of Incorporation. This includes for-profit corporations, non-profit organizations, and professional corporations. It is important to ensure that the chosen name for the corporation is unique and complies with state regulations before filing.

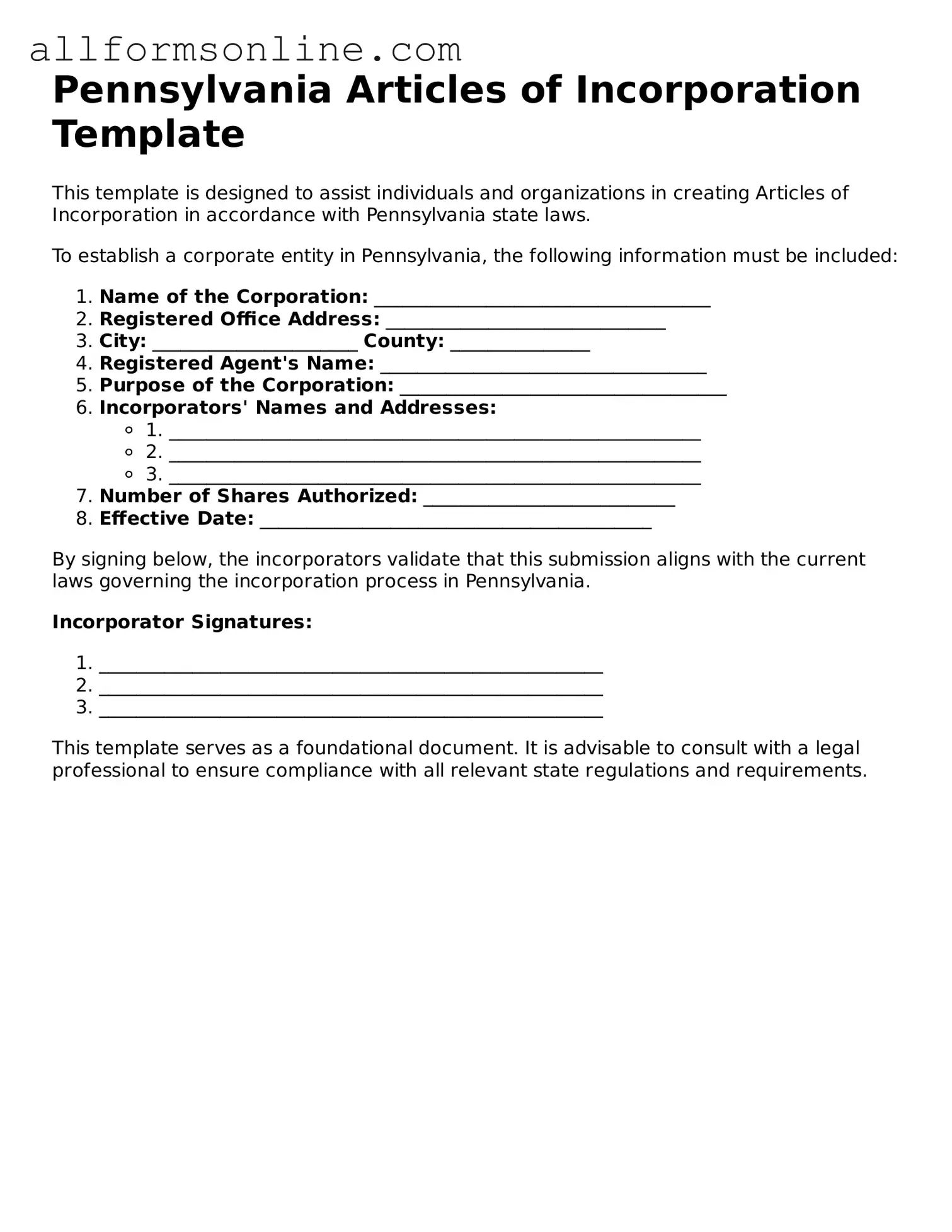

What information is required on the form?

The Articles of Incorporation form requires several key pieces of information. This includes the name of the corporation, the purpose of the corporation, the address of the registered office, and the names and addresses of the initial directors. Additionally, the form may require information about the corporation's stock structure, if applicable.

How do I file the Articles of Incorporation?

To file the Articles of Incorporation, you can submit the form online through the Pennsylvania Department of State’s website or by mailing a paper form. When filing, ensure that all required information is complete and accurate. There is a filing fee associated with this process, which varies depending on the type of corporation being formed.

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Typically, online submissions are processed more quickly than paper filings. You may expect a turnaround of a few business days for online filings, while paper submissions can take several weeks. To expedite the process, consider using expedited services if available.

What happens after I file the Articles of Incorporation?

Once the Articles of Incorporation are filed and approved, the corporation officially comes into existence. You will receive a certificate of incorporation from the Pennsylvania Department of State. This document serves as proof of the corporation’s legal status. After incorporation, the corporation must comply with ongoing requirements, such as obtaining necessary licenses and filing annual reports.

Can I amend the Articles of Incorporation after filing?

Yes, amendments to the Articles of Incorporation can be made after the initial filing. If there are changes to the corporation’s name, purpose, or structure, an amendment form must be filed with the Pennsylvania Department of State. This ensures that the corporation’s records remain accurate and up to date. There may be additional fees associated with filing amendments.

Other Common State-specific Articles of Incorporation Forms

Texas Company Registration - Outlines procedures for shareholder meetings.

For anyone renting in Georgia, understanding the process is vital, and utilizing our comprehensive Lease Agreement form can help streamline your rental experience. This document is designed to protect both landlords and tenants by clearly outlining responsibilities and expectations during the rental period. For more information, please visit our helpful Lease Agreement resources.

Start Llc - Allows for the issuance of different classes of stock.

How to Use Pennsylvania Articles of Incorporation

After gathering the necessary information, you can proceed to fill out the Pennsylvania Articles of Incorporation form. This document is essential for establishing your corporation in the state. It requires specific details about your business, such as its name, purpose, and registered agent. Follow these steps to complete the form accurately.

- Begin by entering the name of your corporation. Ensure that the name is unique and complies with Pennsylvania naming requirements.

- Provide the purpose of your corporation. A brief description of your business activities will suffice.

- List the registered office address. This is where official documents will be sent.

- Include the name and address of your registered agent. This person or business will receive legal documents on behalf of your corporation.

- Indicate the number of shares your corporation is authorized to issue. Specify the par value if applicable.

- Fill in the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation.

- Sign and date the form. Ensure that all incorporators provide their signatures.

- Review the completed form for accuracy. Make any necessary corrections before submission.

- Submit the form along with the required filing fee to the appropriate state office.