Attorney-Approved Bill of Sale Form for Pennsylvania

Misconceptions

Understanding the Pennsylvania Bill of Sale form can be challenging, especially with the various misconceptions surrounding it. Here are seven common misunderstandings:

- It is only for vehicle sales. Many people think the Bill of Sale is exclusively for transferring ownership of vehicles. In reality, it can be used for any personal property, including furniture, electronics, and more.

- A Bill of Sale is not legally binding. Some believe that a Bill of Sale holds no legal weight. However, when properly completed, it serves as a legal document that can protect both the buyer and seller in case of disputes.

- You don’t need a Bill of Sale for small transactions. Many assume that small transactions don’t require documentation. Even for minor purchases, having a Bill of Sale can help clarify ownership and terms of sale.

- It must be notarized to be valid. While notarization can add an extra layer of security, it is not a requirement for a Bill of Sale to be valid in Pennsylvania. The form is valid as long as both parties sign it.

- Only the seller needs to sign the Bill of Sale. Some people think that only the seller's signature is necessary. In fact, both the buyer and seller should sign the document to ensure mutual agreement on the terms.

- It’s only needed for sales between individuals. Many believe that a Bill of Sale is only for transactions between private parties. Businesses and dealers can also use this form to document sales.

- A verbal agreement is sufficient. While a verbal agreement may seem sufficient in some cases, having a written Bill of Sale is crucial for clarity and legal protection. Written agreements help avoid misunderstandings.

By clearing up these misconceptions, individuals can better understand the importance and function of the Pennsylvania Bill of Sale form in their transactions.

What to Know About This Form

What is a Pennsylvania Bill of Sale form?

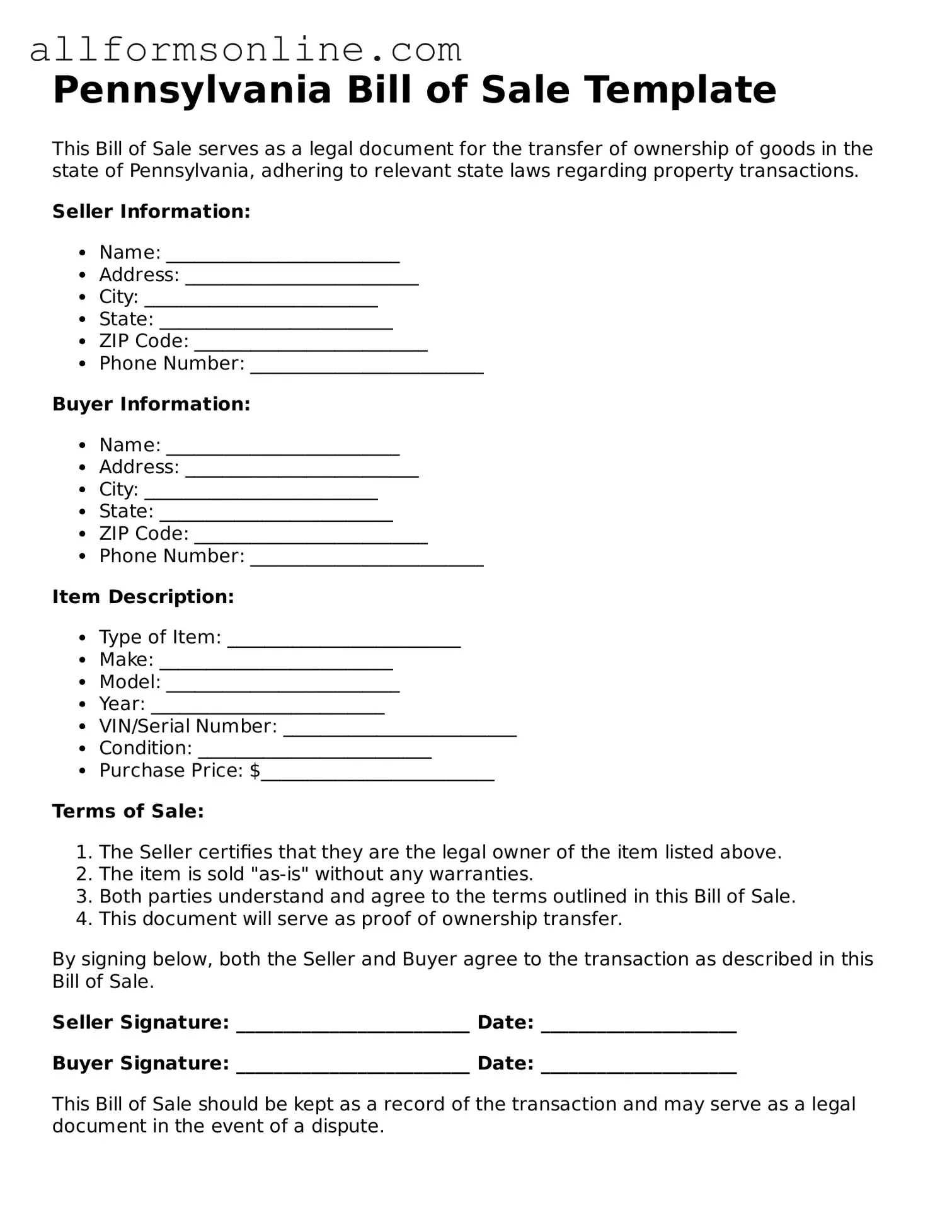

A Pennsylvania Bill of Sale form is a legal document that serves as proof of the transfer of ownership of personal property from one individual to another. This form is particularly important when selling or buying items such as vehicles, boats, or other significant assets. It outlines the details of the transaction, including the names of the buyer and seller, a description of the item being sold, the sale price, and the date of the transaction. Having this document helps protect both parties by providing a clear record of the sale.

Do I need a Bill of Sale for every transaction in Pennsylvania?

While a Bill of Sale is not always legally required for every transaction in Pennsylvania, it is highly recommended for significant purchases. For example, when dealing with vehicles, a Bill of Sale is often required for registration and title transfer. Even for smaller items, having a Bill of Sale can help clarify the terms of the sale and protect against potential disputes. It serves as a written record that can be referenced in case any issues arise after the transaction is completed.

What information should be included in a Pennsylvania Bill of Sale?

When creating a Bill of Sale in Pennsylvania, certain key details should be included to ensure its effectiveness. First, the full names and addresses of both the buyer and seller must be clearly stated. Next, a detailed description of the item being sold is essential; this includes its make, model, year, and any identifying numbers, such as a Vehicle Identification Number (VIN) for cars. Additionally, the sale price and the date of the transaction should be documented. Lastly, both parties should sign the form to validate the agreement, and it is advisable to keep a copy for personal records.

Can I create my own Bill of Sale in Pennsylvania?

Yes, you can create your own Bill of Sale in Pennsylvania. There is no specific state form that you must use, but the document should include all the necessary information to be effective. Many online resources provide templates that can help you structure your Bill of Sale properly. However, if you have any concerns about the legal implications or specific requirements, consulting with a legal professional is always a good idea. This ensures that your document meets all necessary legal standards and protects your interests in the transaction.

Other Common State-specific Bill of Sale Forms

Free Vehicle Bill of Sale Template - The document may include terms for the return of the item, if applicable.

Bill of Sales for Cars - A Bill of Sale can specify any conditions under which the sale is finalized.

How to Transfer a Title in Florida - It helps in the seamless transfer of ownership rights without legal complications.

For landlords seeking to understand the eviction process, the important Notice to Quit form is a key resource that outlines the necessary steps for ensuring compliance with legal requirements. This form is crucial for clarifying the reasons for eviction while also providing tenants with the appropriate timeframe to vacate the property. To access the form, visit the official Notice to Quit page.

Texas Auto Bill of Sale - This document can support claims made for insurance coverage of sold items.

How to Use Pennsylvania Bill of Sale

After obtaining the Pennsylvania Bill of Sale form, the next steps involve carefully filling it out with accurate information. It is important to ensure that all details are correct to avoid any issues later on.

- Begin by entering the date of the transaction at the top of the form.

- Provide the full name and address of the seller in the designated section.

- Next, enter the full name and address of the buyer.

- Describe the item being sold. Include details such as the make, model, year, and any identification numbers, if applicable.

- Indicate the sale price of the item in the appropriate field.

- Both the seller and buyer should sign the form to validate the transaction.

- Make sure to include the printed names of both parties under their signatures.

- Finally, keep a copy of the completed Bill of Sale for your records.