Attorney-Approved Deed in Lieu of Foreclosure Form for Pennsylvania

Misconceptions

Understanding the Pennsylvania Deed in Lieu of Foreclosure can be challenging. Here are four common misconceptions about this legal document:

- It eliminates all debt obligations immediately. Many people believe that signing a Deed in Lieu of Foreclosure automatically cancels all debts associated with the mortgage. However, this is not always the case. While it may release the borrower from the property debt, it does not necessarily absolve them of other financial responsibilities, such as second mortgages or home equity lines of credit.

- It is a quick and easy process. Some assume that the Deed in Lieu of Foreclosure is a straightforward solution to avoid foreclosure. In reality, the process can be lengthy and requires approval from the lender. The lender will often conduct a thorough review of the borrower's financial situation before agreeing to this option.

- It has no impact on credit scores. Another misconception is that a Deed in Lieu of Foreclosure does not affect credit ratings. In truth, this action can still have a negative impact on a person's credit score, similar to a foreclosure. It is important to understand that any significant change in property ownership can influence creditworthiness.

- It is available to everyone facing foreclosure. Many believe that anyone can opt for a Deed in Lieu of Foreclosure regardless of their situation. However, lenders typically have specific criteria that must be met. For instance, the borrower must be unable to continue making mortgage payments, and the property must be free of other liens to qualify.

By addressing these misconceptions, individuals can make more informed decisions regarding their options when facing potential foreclosure in Pennsylvania.

What to Know About This Form

What is a Deed in Lieu of Foreclosure in Pennsylvania?

A Deed in Lieu of Foreclosure is a legal process that allows a homeowner to voluntarily transfer the ownership of their property to the lender in order to avoid foreclosure. This option can be beneficial for homeowners who are struggling to make mortgage payments and wish to avoid the lengthy and often stressful foreclosure process. By signing over the deed, the homeowner can typically settle their mortgage obligations and may even be able to negotiate terms that prevent further financial repercussions, such as a deficiency judgment.

Who is eligible to use a Deed in Lieu of Foreclosure?

Eligibility for a Deed in Lieu of Foreclosure generally depends on the lender's policies and the specific circumstances of the homeowner. Typically, homeowners who are facing financial hardship and have exhausted other options, such as loan modifications or short sales, may qualify. It’s essential for homeowners to communicate openly with their lender about their financial situation. Lenders usually require that the property be free of any other liens or encumbrances, so this is another factor to consider before pursuing this option.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

There are several benefits to consider when opting for a Deed in Lieu of Foreclosure. First, it can provide a quicker resolution compared to the traditional foreclosure process. Homeowners may also avoid the negative impact on their credit score that comes with foreclosure. Additionally, lenders may be more willing to work with homeowners to negotiate terms that can lead to a smoother transition, such as potential relocation assistance or forgiveness of remaining debt. This option can also allow homeowners to leave the property without the stress of a foreclosure sale.

What steps should a homeowner take to initiate a Deed in Lieu of Foreclosure?

To initiate a Deed in Lieu of Foreclosure, homeowners should first contact their lender to express their interest in this option. It’s important to gather all relevant financial documents, including income statements, tax returns, and mortgage information, as the lender will likely require this information to assess eligibility. Once the lender agrees to consider the deed in lieu, they will typically provide specific instructions and necessary forms. Homeowners should also consult with a real estate attorney or a housing counselor to ensure they understand the implications and to navigate the process effectively.

Other Common State-specific Deed in Lieu of Foreclosure Forms

Deed in Lieu - Borrowers may also need to provide financial documentation to support their request for this option.

The California Residential Lease Agreement is a vital legal document that governs the rental relationship, ensuring that both landlords and tenants understand their rights and responsibilities. To facilitate this process and avoid miscommunication, resources like Fast PDF Templates can provide valuable templates that simplify the creation of lease agreements.

California Pre-foreclosure Property Transfer - This form can be beneficial for lenders seeking to quickly recover their investment in a property.

Deed in Lieu of Mortgage - Creditors may still pursue other obligations if the Deed in Lieu doesn't encompass all debts associated with the property.

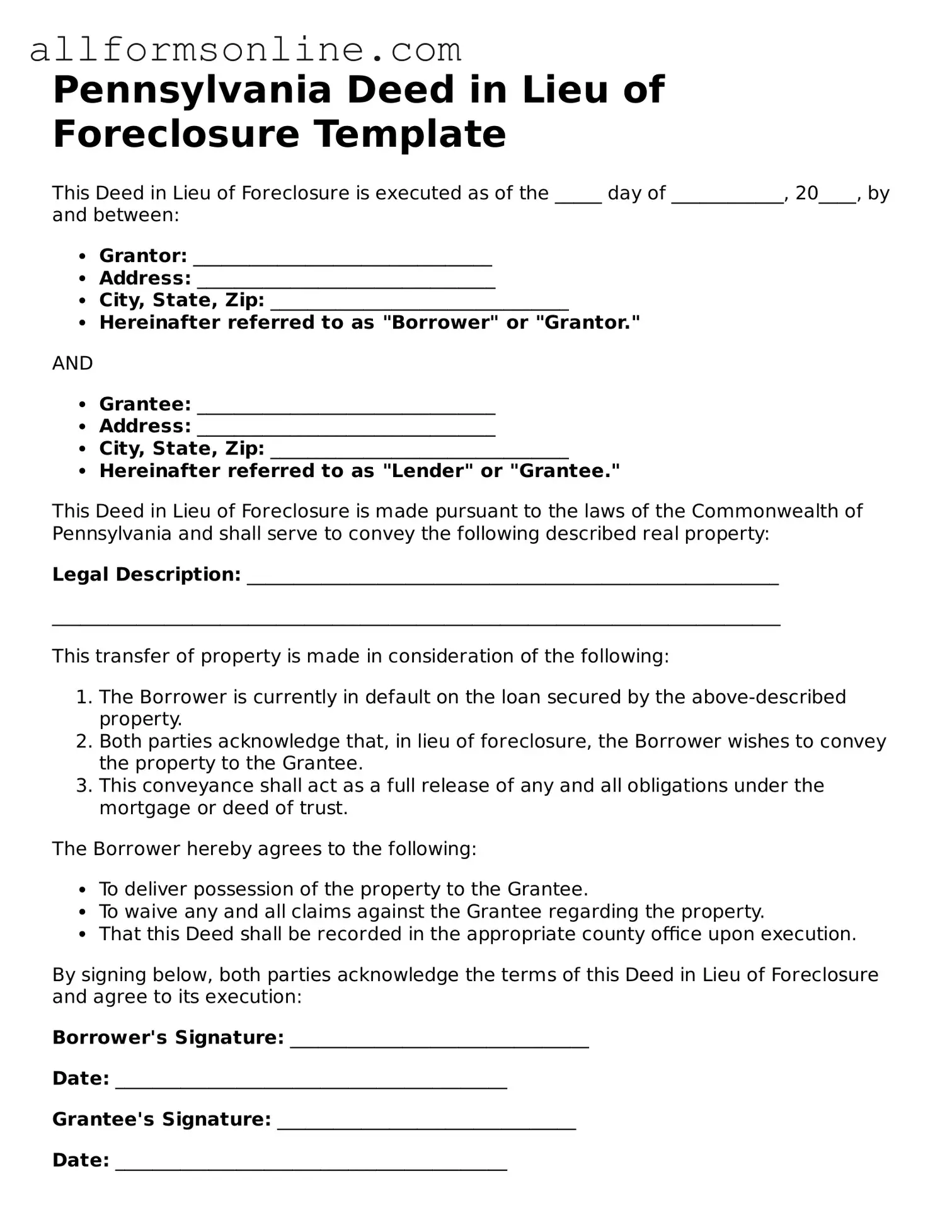

How to Use Pennsylvania Deed in Lieu of Foreclosure

After completing the Pennsylvania Deed in Lieu of Foreclosure form, the next steps typically involve submitting the form to the appropriate parties, which may include your lender and local government offices. Ensure that all required documents are prepared for submission, as this will facilitate a smoother process.

- Obtain the Pennsylvania Deed in Lieu of Foreclosure form from a reliable source, such as a legal aid office or online legal resource.

- Read the form carefully to understand the information required.

- Enter the name of the property owner(s) in the designated section.

- Provide the address of the property that is subject to the deed.

- Include the legal description of the property, which can usually be found on the property deed or tax records.

- Fill in the lender's name and address in the appropriate fields.

- Indicate the date on which the deed is being executed.

- Sign the form in the presence of a notary public to ensure it is legally binding.

- Make copies of the completed form for your records.

- Submit the original signed form to your lender and any required local government offices.