Attorney-Approved Deed Form for Pennsylvania

Misconceptions

Understanding the Pennsylvania Deed form is essential for anyone involved in real estate transactions in the state. However, several misconceptions can cloud this understanding. Here are five common myths about the Pennsylvania Deed form, along with clarifications to help you navigate the process.

-

All deeds are the same. Many people believe that all deed forms are interchangeable. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each serving distinct purposes and offering varying levels of protection for the buyer.

-

A deed does not need to be recorded. Some individuals think that as long as a deed is signed, it doesn’t need to be filed with the county. However, recording the deed is crucial. It provides public notice of ownership and protects the buyer’s rights against future claims.

-

Only a lawyer can prepare a deed. While having a lawyer review your deed can be beneficial, it is not a legal requirement. Many people successfully complete their transactions using online resources and templates designed for Pennsylvania deeds.

-

Once a deed is signed, it cannot be changed. This misconception suggests that a deed is set in stone once executed. In fact, if errors are discovered or circumstances change, a new deed can be created to correct or update the information.

-

All property transfers require a new deed. Some believe that every transfer of property necessitates a new deed. However, certain situations, like transfers between spouses or in family trusts, may not require a new deed to be filed.

By dispelling these myths, you can approach the Pennsylvania Deed form with greater confidence and clarity. Understanding the nuances of real estate documentation is key to a smooth transaction.

What to Know About This Form

What is a Pennsylvania Deed form?

A Pennsylvania Deed form is a legal document used to transfer ownership of real estate in Pennsylvania. It serves as proof of the transfer and outlines the details of the property being conveyed, including the names of the parties involved and a description of the property. This document must be properly executed and recorded to ensure the transfer is legally recognized.

What types of deeds are available in Pennsylvania?

In Pennsylvania, several types of deeds can be used, including Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds. A Warranty Deed provides the highest level of protection to the buyer, guaranteeing that the seller holds clear title to the property. A Quitclaim Deed transfers whatever interest the seller has in the property without any guarantees. A Special Warranty Deed offers limited warranties, protecting against issues that arose only during the seller's ownership.

How do I fill out a Pennsylvania Deed form?

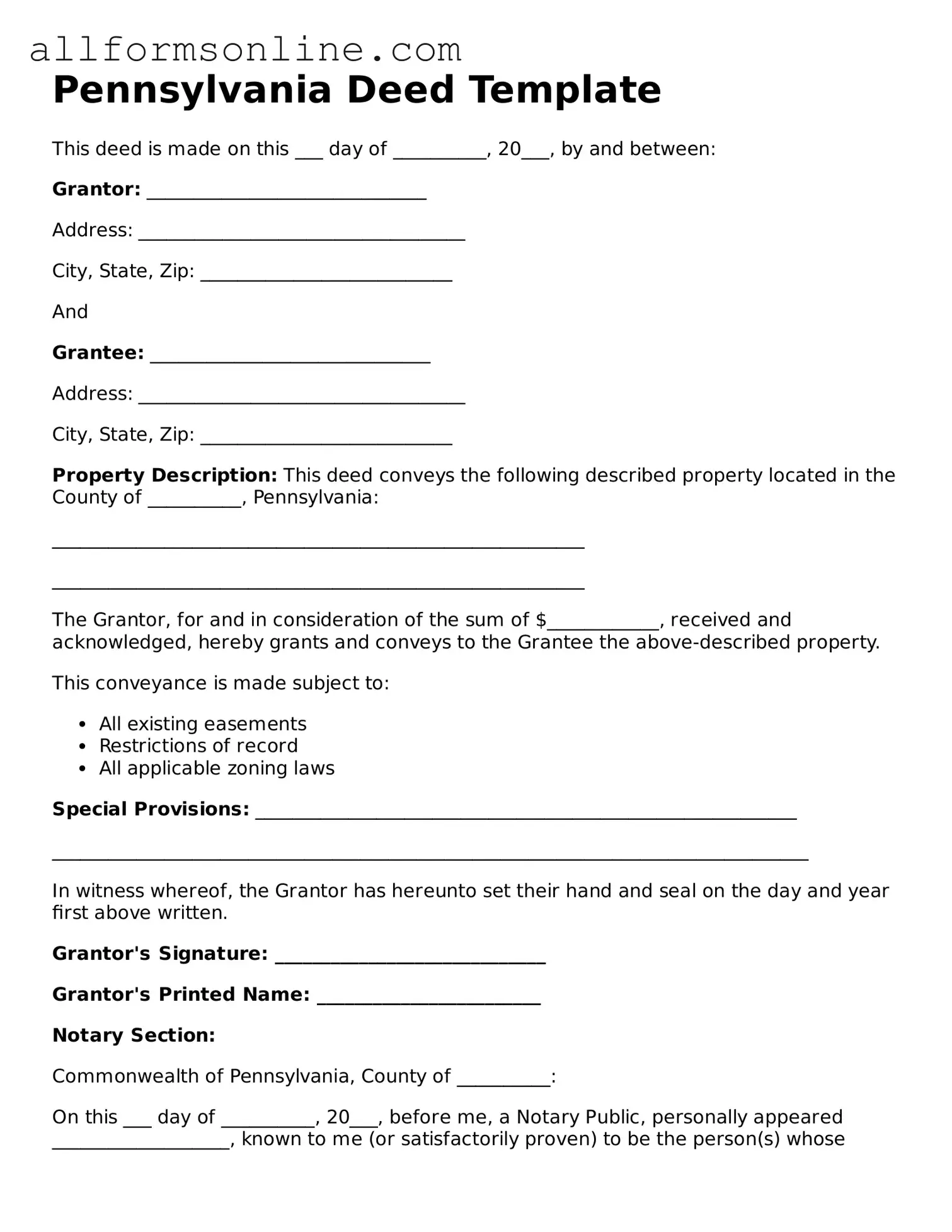

To fill out a Pennsylvania Deed form, start by entering the names and addresses of the grantor (seller) and grantee (buyer). Next, provide a legal description of the property, which can typically be found on the previous deed or property tax records. Be sure to include the date of the transaction and any consideration (payment) involved. Finally, both parties must sign the document in the presence of a notary public.

Is notarization required for a Pennsylvania Deed?

Yes, notarization is required for a Pennsylvania Deed. The signatures of both the grantor and grantee must be acknowledged before a notary public. This step is crucial as it helps to verify the identities of the parties involved and confirms that they are signing the document willingly.

How do I record a Pennsylvania Deed?

To record a Pennsylvania Deed, take the completed and notarized document to the county recorder of deeds office in the county where the property is located. There, you will submit the deed along with any required fees. Once recorded, the deed becomes part of the public record, providing legal notice of the property transfer.

Are there any fees associated with recording a Pennsylvania Deed?

Yes, there are fees associated with recording a Pennsylvania Deed. These fees vary by county and are typically based on the number of pages in the document. It’s advisable to check with the local recorder of deeds office for the specific fee schedule and any additional requirements that may apply.

What happens if a Pennsylvania Deed is not recorded?

If a Pennsylvania Deed is not recorded, the transfer of ownership may not be legally recognized. This can lead to complications, especially if disputes arise regarding property ownership. Not recording the deed also means that the public will not have notice of the transfer, which can impact future transactions involving the property.

Can I create my own Pennsylvania Deed form?

While it is possible to create your own Pennsylvania Deed form, it is recommended to use a standardized form or consult with a legal professional to ensure that all necessary elements are included. Properly drafted deeds help prevent legal issues in the future and ensure compliance with state laws.

Other Common State-specific Deed Forms

House Ownership Document - The Deed form is often recorded in the local county clerk's office.

The California Release of Liability form is a legal document that helps protect individuals and organizations from being held responsible for injuries or damages that may occur during certain activities. Typically used in recreational settings or events, this form outlines the risks involved and requires participants to acknowledge and accept those risks. For those looking for a reliable template to facilitate this process, they can refer to Fast PDF Templates, which provides valuable resources for ensuring that liability concerns are adequately addressed.

Property Owners Search - In joint ownership scenarios, all owners usually need to sign the Deed.

How to Use Pennsylvania Deed

Once you have your Pennsylvania Deed form in hand, it's time to fill it out carefully. Accurate completion is essential to ensure that the transfer of property goes smoothly. Follow these steps to make the process easier.

- Gather Necessary Information: Collect all relevant details about the property, including the address, parcel number, and legal description.

- Identify the Grantor and Grantee: Clearly write the names and addresses of both the person transferring the property (grantor) and the person receiving it (grantee).

- Fill in the Date: Indicate the date on which the deed is being executed.

- Describe the Property: Provide a complete and accurate description of the property, including any specific boundaries or features.

- Sign the Document: The grantor must sign the deed in the presence of a notary public. Ensure that the signature is clear and matches the name provided.

- Notarization: Have the deed notarized to verify the authenticity of the signatures. This step is crucial for the document to be legally binding.

- Record the Deed: After notarization, take the completed deed to the local county recorder’s office to officially record the transfer.

By following these steps, you can ensure that your Pennsylvania Deed form is filled out correctly and ready for the next phase of the property transfer process. Proper documentation is vital for protecting your rights and interests in real estate transactions.