Attorney-Approved Durable Power of Attorney Form for Pennsylvania

Misconceptions

There are several misconceptions about the Pennsylvania Durable Power of Attorney form. Understanding these can help individuals make informed decisions. Here are four common misunderstandings:

- Misconception 1: A Durable Power of Attorney is only for financial matters.

- Misconception 2: Once I sign a Durable Power of Attorney, I lose control over my decisions.

- Misconception 3: I can only create a Durable Power of Attorney with a lawyer.

- Misconception 4: A Durable Power of Attorney is permanent and cannot be changed.

This is not true. While many people use it for financial decisions, a Durable Power of Attorney can also cover health care decisions. This means you can appoint someone to make medical choices on your behalf if you are unable to do so.

This is a common fear, but it's not accurate. You can still make decisions for yourself as long as you are capable. The Durable Power of Attorney only comes into effect if you become incapacitated.

While having a lawyer can be helpful, it is not required. Pennsylvania allows individuals to create a Durable Power of Attorney on their own, as long as they follow the state's guidelines.

This is false. You can revoke or change your Durable Power of Attorney at any time, as long as you are mentally competent. It’s important to keep your documents updated to reflect your current wishes.

What to Know About This Form

What is a Durable Power of Attorney in Pennsylvania?

A Durable Power of Attorney (DPOA) in Pennsylvania is a legal document that allows you to appoint someone to make decisions on your behalf if you become incapacitated. Unlike a regular power of attorney, a DPOA remains effective even if you are unable to make decisions for yourself due to illness or disability.

Who can be appointed as an agent under a Durable Power of Attorney?

You can appoint any competent adult as your agent. This could be a family member, friend, or trusted advisor. It's essential to choose someone who understands your wishes and can act in your best interest.

What powers can I grant to my agent?

You have the flexibility to grant a wide range of powers to your agent. These can include managing your financial affairs, handling real estate transactions, making healthcare decisions, and managing investments. You can specify which powers you want to include or exclude in the document.

Do I need to have my Durable Power of Attorney notarized?

Yes, in Pennsylvania, your Durable Power of Attorney must be signed in the presence of a notary public. This requirement helps to ensure the document's validity and protects against potential fraud.

Can I revoke my Durable Power of Attorney?

Absolutely. You have the right to revoke your Durable Power of Attorney at any time, as long as you are competent. To revoke it, you should create a written revocation and notify your agent and any relevant institutions that may rely on the DPOA.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, a court may need to appoint a guardian to make decisions on your behalf. This process can be time-consuming and may not reflect your personal wishes.

Is a Durable Power of Attorney the same as a Living Will?

No, a Durable Power of Attorney and a Living Will serve different purposes. A DPOA focuses on financial and legal decisions, while a Living Will outlines your preferences for medical treatment in case you cannot communicate your wishes. Both documents are important for comprehensive planning.

How can I ensure my Durable Power of Attorney is valid?

To ensure your DPOA is valid, follow Pennsylvania's specific requirements: it must be signed by you and notarized. Additionally, consider consulting with an attorney to ensure the document meets your needs and complies with state laws.

Can I use a Durable Power of Attorney created in another state in Pennsylvania?

Generally, a Durable Power of Attorney created in another state can be recognized in Pennsylvania, provided it complies with Pennsylvania law. However, it is advisable to consult with a local attorney to confirm its validity and effectiveness.

Other Common State-specific Durable Power of Attorney Forms

How to Get Power of Attorney Florida - Permits the agent to access medical records if included.

Obtaining an Emotional Support Animal Letter can significantly enhance the lives of those who require the comfort of an animal companion. It not only legitimizes the bond between the individual and their pet but also facilitates access to necessary adjustments in housing or travel situations. For those looking to simplify the process of acquiring such essential documentation, resources like Fast PDF Templates can provide invaluable support.

Durable Power of Attorney Pdf - Securing a Durable Power of Attorney can simplify your financial life.

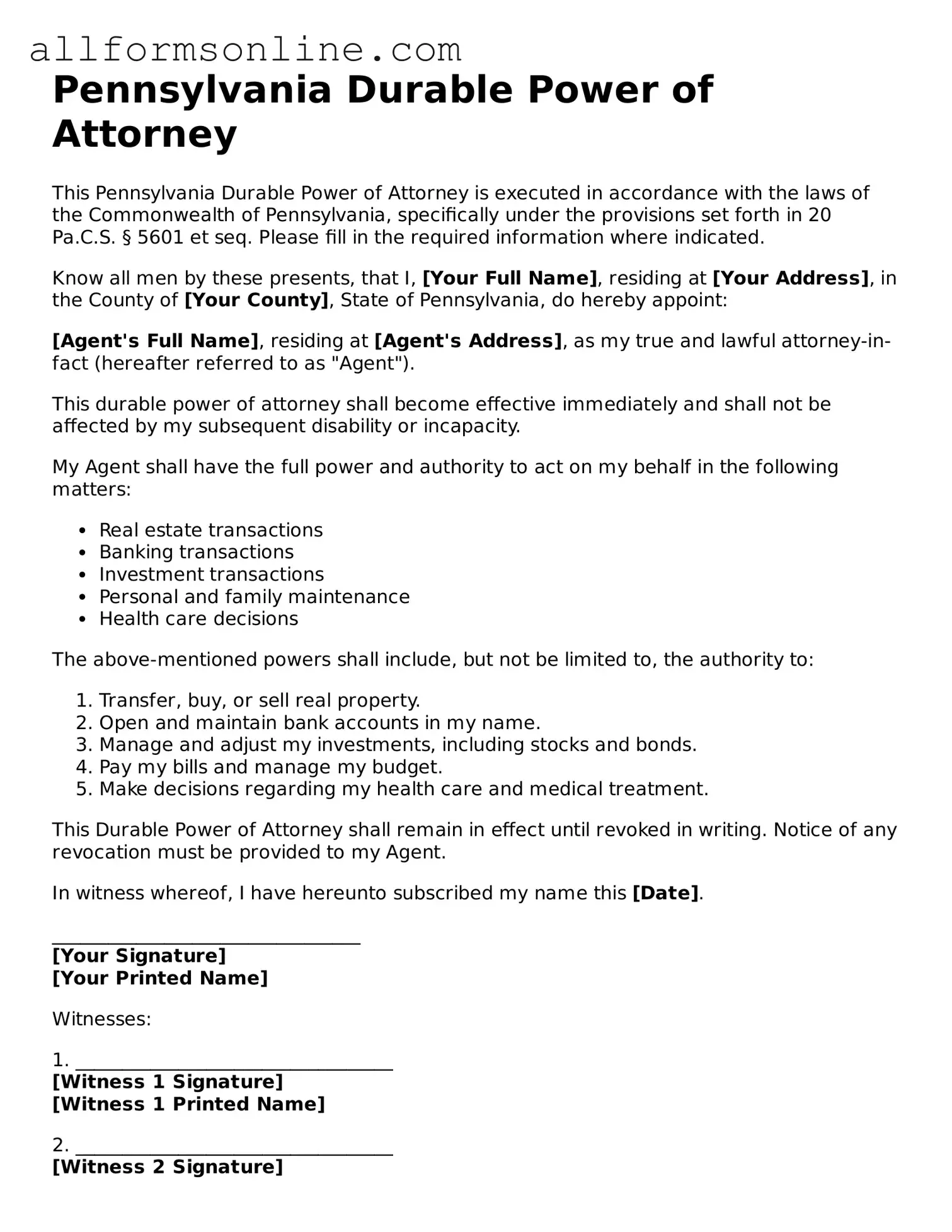

How to Use Pennsylvania Durable Power of Attorney

Filling out the Pennsylvania Durable Power of Attorney form is an important step in ensuring your financial and legal matters are handled according to your wishes. Follow these steps carefully to complete the form accurately.

- Obtain the Form: Get a copy of the Pennsylvania Durable Power of Attorney form. You can find it online or at legal supply stores.

- Read the Instructions: Review any instructions provided with the form to understand the requirements and options available.

- Fill in Your Information: Enter your name, address, and other personal details at the top of the form. This identifies you as the principal.

- Choose Your Agent: Clearly write the name and contact information of the person you are appointing as your agent. This individual will act on your behalf.

- Specify Powers: Indicate the powers you wish to grant your agent. You can select general powers or specific ones, depending on your needs.

- Set Effective Date: Decide when the powers will begin. You may choose to have them effective immediately or upon a certain event.

- Sign the Form: Sign and date the form in the designated area. Your signature is crucial for the document to be valid.

- Notarization: Have the form notarized. This adds an extra layer of authenticity to your document.

- Distribute Copies: Provide copies of the signed and notarized form to your agent and any institutions that may need it.