Attorney-Approved Motor Vehicle Bill of Sale Form for Pennsylvania

Misconceptions

Many people have misunderstandings about the Pennsylvania Motor Vehicle Bill of Sale form. Here are five common misconceptions clarified:

- It is only needed for used vehicles. Some believe that a Bill of Sale is unnecessary for new vehicle purchases. In reality, it serves as a record of the transaction for both the buyer and seller, regardless of the vehicle's age.

- It must be notarized. While notarization can add an extra layer of legitimacy, it is not a requirement for the Bill of Sale in Pennsylvania. A simple signature from both parties is sufficient.

- It is the same as a title transfer. A Bill of Sale is not a title transfer document. The Bill of Sale documents the sale, while the title is the legal proof of ownership that must also be transferred to the buyer.

- It is only for private sales. Many think that the Bill of Sale is only relevant for private transactions. However, dealerships also use it to record sales, and it can be beneficial for any vehicle transaction.

- It can be verbal. Some individuals assume that a verbal agreement suffices. In Pennsylvania, a written Bill of Sale is essential to provide proof of the transaction and protect both parties.

Understanding these misconceptions can help ensure a smoother vehicle transaction process in Pennsylvania.

What to Know About This Form

What is a Pennsylvania Motor Vehicle Bill of Sale?

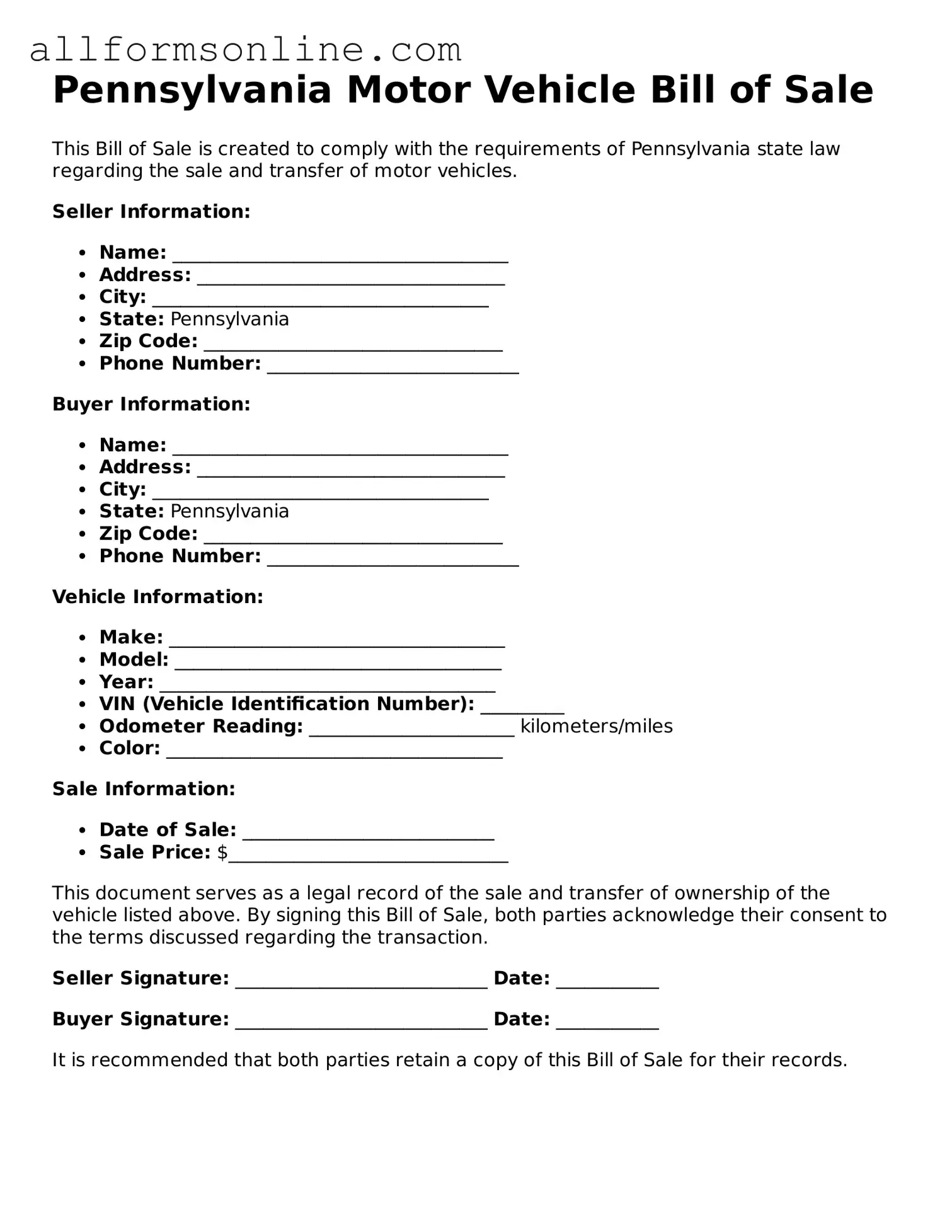

The Pennsylvania Motor Vehicle Bill of Sale is a legal document that records the transfer of ownership of a vehicle from one party to another. It serves as proof of the transaction and includes essential details about the vehicle and the parties involved. This document is particularly important for buyers and sellers to establish clear ownership and protect their rights in the sale process.

Is a Bill of Sale required in Pennsylvania?

While a Bill of Sale is not strictly required by Pennsylvania law, it is highly recommended. Having a Bill of Sale can help resolve disputes regarding the sale, provide evidence of the transaction, and assist in the registration process with the Pennsylvania Department of Transportation (PennDOT).

What information is included in the Bill of Sale?

A typical Pennsylvania Motor Vehicle Bill of Sale includes the following information: the names and addresses of the buyer and seller, the vehicle identification number (VIN), make, model, year of the vehicle, sale price, and the date of the transaction. Both parties should sign the document to validate the sale.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale as long as it contains all the necessary information. However, using a standardized form can simplify the process and ensure that all required details are included. Many online resources provide templates specifically designed for Pennsylvania vehicle sales.

Do I need to have the Bill of Sale notarized?

Notarization is not a requirement for a Bill of Sale in Pennsylvania. However, having the document notarized can add an extra layer of authenticity and may be beneficial if disputes arise in the future.

How do I use the Bill of Sale for vehicle registration?

After completing the Bill of Sale, the buyer can use it to register the vehicle with PennDOT. The buyer must present the Bill of Sale, along with other necessary documents, such as the title and proof of insurance, when applying for a new registration. This process helps ensure that the vehicle is legally registered in the buyer's name.

What if the vehicle has a lien?

If the vehicle has a lien, it is crucial to address this before completing the sale. The seller should provide the buyer with documentation showing that the lien has been satisfied or that arrangements have been made to pay off the lien. The Bill of Sale should reflect any agreements made regarding the lien to protect both parties.

Can I use the Bill of Sale for a gift transfer?

Yes, a Bill of Sale can also be used for transferring a vehicle as a gift. In this case, the sale price may be stated as "gift" or "no consideration." It is important to document this transfer to avoid any future disputes or misunderstandings regarding ownership.

What should I do if I lose the Bill of Sale?

If the Bill of Sale is lost, it is advisable to recreate the document as accurately as possible. Both the buyer and seller should sign the new Bill of Sale. While it may not hold the same legal weight as the original, having a new document can help clarify the terms of the sale and provide a record of the transaction.

Where can I obtain a Pennsylvania Motor Vehicle Bill of Sale form?

Bill of Sale forms can be obtained from various sources. Many online legal document services provide downloadable templates. Additionally, local notary offices or auto dealerships may have standardized forms available. It is important to ensure that the form complies with Pennsylvania regulations for vehicle sales.

Other Common State-specific Motor Vehicle Bill of Sale Forms

Do You Need Bill of Sale If You Have Title - It's crucial to detail that the seller has the authority to sell the vehicle to avoid any third-party claims.

For landlords seeking to understand the legal process, it is important to familiarize themselves with the requirements related to the Notice to Quit procedure. A comprehensive understanding of the Notice to Quit form ensures proper adherence to eviction protocols and timelines.

Template Bill of Sale for Car - Can outline stipulations related to payment methods used in the transaction.

How to Use Pennsylvania Motor Vehicle Bill of Sale

Filling out the Pennsylvania Motor Vehicle Bill of Sale form is an important step in the process of transferring ownership of a vehicle. Once you have completed the form, you will need to ensure that both the buyer and seller retain a copy for their records. This documentation will help protect both parties in the event of any future disputes regarding the sale.

- Begin by entering the date of the sale at the top of the form.

- Provide the name and address of the seller. Ensure that this information is accurate and matches the seller's identification.

- Next, fill in the buyer's name and address. Again, accuracy is key here.

- Enter the vehicle's details, including the make, model, year, and Vehicle Identification Number (VIN). Double-check that the VIN matches the one on the vehicle.

- Indicate the sale price of the vehicle. Be clear and precise in this section.

- If applicable, note any additional terms of the sale, such as warranties or conditions. This can help clarify expectations for both parties.

- Both the seller and buyer should sign and date the form at the designated areas. This signifies agreement to the terms outlined.

- Finally, make copies of the completed form for both the seller and buyer to keep for their records.