Attorney-Approved Operating Agreement Form for Pennsylvania

Misconceptions

Understanding the Pennsylvania Operating Agreement form is crucial for anyone involved in a business partnership or LLC. However, several misconceptions can lead to confusion and mismanagement. Below is a list of common misconceptions about the Pennsylvania Operating Agreement form, along with clarifications for each.

-

It is not necessary to have an Operating Agreement.

Many people believe that an Operating Agreement is optional for LLCs in Pennsylvania. However, having one is highly recommended as it outlines the management structure and operational procedures, protecting all members involved.

-

All members must agree on the Operating Agreement.

While it is ideal for all members to agree, it is not a strict requirement. A majority can approve the agreement, provided the process is defined in the document itself.

-

The Operating Agreement must be filed with the state.

Some assume that the Operating Agreement needs to be submitted to the Pennsylvania Secretary of State. In reality, it is a private document that should be kept on record by the LLC.

-

Operating Agreements are only for large businesses.

This is a common belief, but Operating Agreements are essential for businesses of all sizes. Even small LLCs benefit from having clear guidelines to avoid misunderstandings.

-

Once created, the Operating Agreement cannot be changed.

Many think that an Operating Agreement is set in stone. In fact, it can be amended as needed, provided that the process for making changes is outlined in the agreement itself.

-

All Operating Agreements are the same.

People often believe that a standard template will suffice for any business. However, each Operating Agreement should be tailored to meet the specific needs and circumstances of the LLC.

-

The Operating Agreement does not address financial matters.

Some assume that financial arrangements are handled elsewhere. In reality, the Operating Agreement should clearly define how profits and losses are distributed among members.

-

Legal advice is not necessary for drafting an Operating Agreement.

While some may feel confident drafting their own agreement, consulting with a legal professional ensures that all necessary elements are included and compliant with Pennsylvania law.

-

Operating Agreements are only for multi-member LLCs.

Many believe that single-member LLCs do not need an Operating Agreement. However, it is still beneficial as it establishes the member's rights and responsibilities.

-

Once signed, the Operating Agreement is no longer relevant.

It is a misconception that the agreement loses its importance after being signed. The Operating Agreement remains a critical document for reference in the event of disputes or changes in the business.

Addressing these misconceptions can help ensure that business owners in Pennsylvania are better prepared to navigate the complexities of their Operating Agreements.

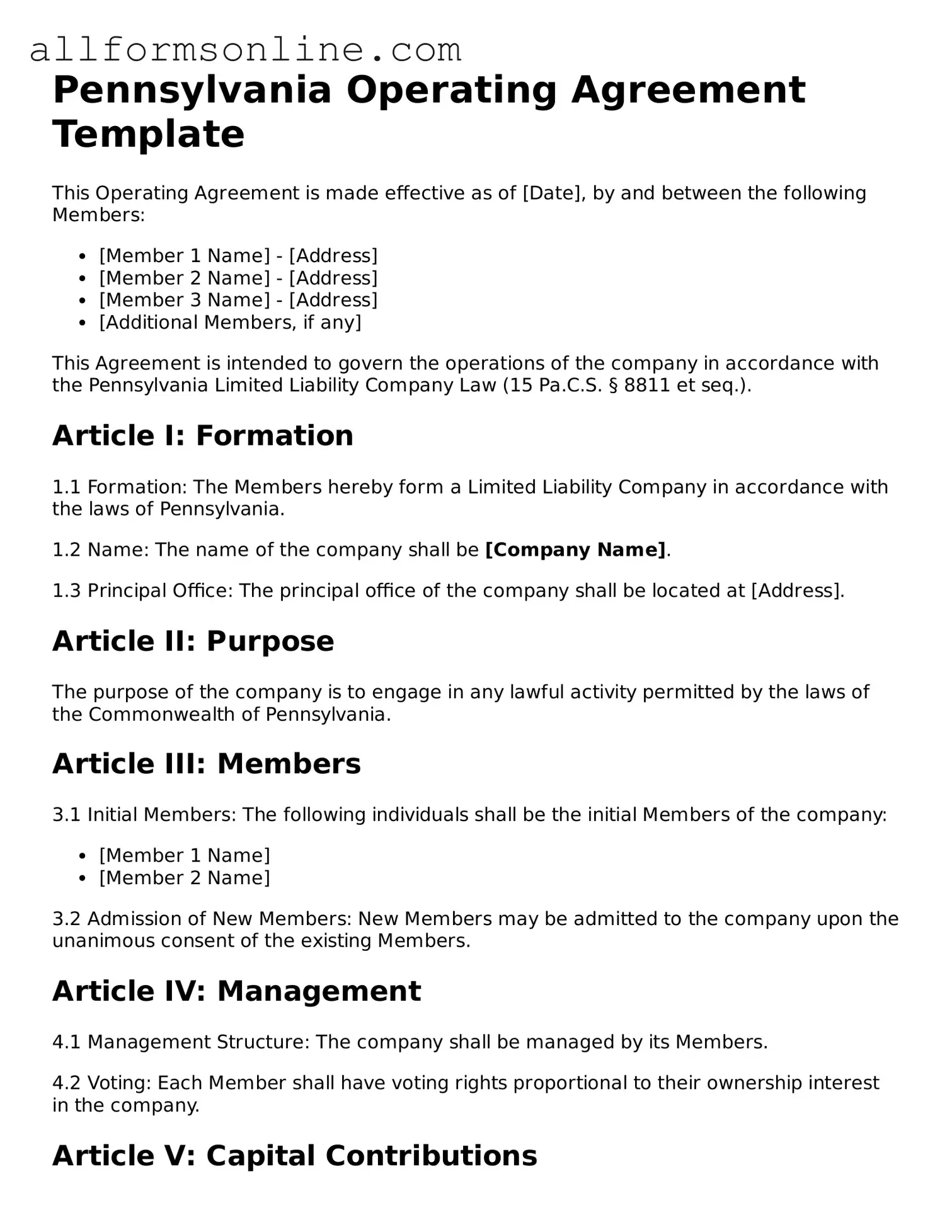

What to Know About This Form

What is a Pennsylvania Operating Agreement?

A Pennsylvania Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Pennsylvania. It serves as an internal guideline for the members of the LLC, detailing how the company will be run, the roles and responsibilities of its members, and how profits and losses will be distributed. While not required by law, having an Operating Agreement is highly recommended to prevent misunderstandings among members and to provide clarity in operations.

Is an Operating Agreement required in Pennsylvania?

No, Pennsylvania does not legally require LLCs to have an Operating Agreement. However, it is advisable to create one. An Operating Agreement can help protect the limited liability status of the LLC by demonstrating that it operates as a separate entity. Additionally, it can provide a framework for resolving disputes and managing changes within the company.

Who should draft the Operating Agreement?

The Operating Agreement can be drafted by any member of the LLC, but it is often beneficial to consult with a legal professional. A lawyer can ensure that the document complies with state laws and addresses the specific needs of the business. Members can also collaborate to create a document that reflects their mutual understanding and agreements.

What should be included in a Pennsylvania Operating Agreement?

An Operating Agreement should include several key components. These typically encompass the name and purpose of the LLC, the duration of the company, the roles and responsibilities of each member, procedures for adding or removing members, profit and loss distribution, and provisions for resolving disputes. Additionally, it may address how the company will be managed, whether by members or designated managers.

Can an Operating Agreement be changed after it is created?

Yes, an Operating Agreement can be amended. The process for making changes should be clearly outlined in the original document. Typically, amendments require the consent of a certain percentage of the members, as specified in the agreement. It is important to document any changes formally to maintain clarity and legal standing.

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, it will be governed by Pennsylvania's default LLC laws. These laws may not align with the specific intentions of the members, leading to potential disputes and misunderstandings. Without an Operating Agreement, members may find themselves subject to state-imposed rules regarding management and distribution of profits, which may not reflect their wishes.

How can I obtain a template for a Pennsylvania Operating Agreement?

Templates for Pennsylvania Operating Agreements can be found online, often provided by legal websites or business resources. However, it is important to ensure that any template used is tailored to Pennsylvania law and the specific needs of the LLC. Customizing a template or working with a legal professional is recommended to ensure that all relevant issues are adequately addressed.

Other Common State-specific Operating Agreement Forms

How to Get Llc - It may include mechanisms for regular reviews and updates of terms.

When applying for a position at Chick-fil-A, candidates can refer to resources like the Fast PDF Templates to ensure they have all necessary information and guidance for completing the job application form effectively.

Llc Operating Agreement Texas - The Operating Agreement can outline the process for dissolving the LLC.

How to Use Pennsylvania Operating Agreement

Filling out the Pennsylvania Operating Agreement form is an important step in establishing the framework for your business. This document outlines the management structure, responsibilities, and operational guidelines for your limited liability company (LLC). To ensure everything is completed accurately, follow these steps carefully.

- Gather Necessary Information: Before you begin, collect all relevant details about your LLC, including its name, address, and the names of all members.

- Title the Document: At the top of the form, clearly write “Operating Agreement” to indicate the purpose of the document.

- Fill in LLC Name: Enter the full legal name of your LLC as registered with the state of Pennsylvania.

- Provide Principal Office Address: Write the complete address of your LLC's principal office. This should be a physical address, not a P.O. Box.

- List Members: Include the names and addresses of all members who will be part of the LLC. Ensure that all information is accurate.

- Define Management Structure: Indicate whether the LLC will be managed by its members or by appointed managers. Clearly state the roles and responsibilities.

- Outline Capital Contributions: Specify the initial capital contributions made by each member. This should detail what each member is contributing to the LLC.

- Detail Profit and Loss Distribution: Describe how profits and losses will be allocated among members. This can be based on ownership percentages or another agreed-upon method.

- Include Decision-Making Procedures: Explain how decisions will be made within the LLC. Outline the voting process and any required majority for major decisions.

- Address Dissolution Procedures: Provide details on how the LLC can be dissolved if necessary. Include the process and any requirements for dissolution.

- Review and Sign: Once all sections are completed, review the document for accuracy. All members should sign and date the agreement to make it official.

After filling out the Pennsylvania Operating Agreement form, keep a copy for your records. It is advisable to share the signed document with all members involved. This agreement serves as a foundational document for your LLC, guiding its operations and helping to prevent misunderstandings in the future.