Attorney-Approved Promissory Note Form for Pennsylvania

Misconceptions

Understanding the Pennsylvania Promissory Note form can be challenging due to various misconceptions. Here are seven common misunderstandings, along with clarifications for each.

-

All Promissory Notes are the Same: Many people believe that all promissory notes are identical. In reality, the terms and conditions can vary significantly based on the agreement between the parties involved.

-

A Promissory Note Must Be Notarized: Some individuals think that notarization is a requirement for all promissory notes. While notarization can add an extra layer of validity, it is not a legal requirement in Pennsylvania for the note to be enforceable.

-

Promissory Notes Are Only for Loans: It is a common misconception that promissory notes are exclusively used for loans. In fact, they can also be used in various transactions where one party promises to pay another party a specific amount.

-

You Cannot Modify a Promissory Note: Some believe that once a promissory note is signed, it cannot be changed. However, parties can agree to modify the terms, provided both parties consent to the changes in writing.

-

Interest Rates Must Be Stated: It is often thought that a promissory note must include an interest rate. While it is common to specify an interest rate, it is not mandatory. A note can be interest-free if the parties agree.

-

Promissory Notes Are Only Legally Binding in Court: Some assume that a promissory note is only enforceable in a court of law. In reality, the note serves as a legal document that outlines the agreement, and can be enforced without court involvement if both parties adhere to its terms.

-

All Promissory Notes Are Written in Legal Language: Many people think that promissory notes must be drafted using complex legal terminology. In truth, a promissory note can be written in plain language, as long as it clearly outlines the agreement between the parties.

By addressing these misconceptions, individuals can better understand how to use the Pennsylvania Promissory Note form effectively and ensure that their agreements are clear and enforceable.

What to Know About This Form

What is a Pennsylvania Promissory Note?

A Pennsylvania Promissory Note is a legal document that outlines a promise by one party (the borrower) to pay a specified amount of money to another party (the lender) under agreed-upon terms. This document serves as a written acknowledgment of a debt and includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments.

Who can create a Promissory Note in Pennsylvania?

Any individual or business entity can create a Promissory Note in Pennsylvania. The borrower and lender do not need to be licensed professionals; however, it is advisable for both parties to understand the terms clearly. Having a well-drafted note can help prevent misunderstandings in the future.

What information should be included in a Pennsylvania Promissory Note?

Essential information includes the names and addresses of both the borrower and lender, the principal amount of the loan, the interest rate, the repayment schedule, and any terms regarding late payments or defaults. It is also beneficial to include the date the note is created and any conditions that may affect the loan.

Is a Promissory Note legally binding in Pennsylvania?

Yes, a properly executed Promissory Note is legally binding in Pennsylvania, provided it meets the necessary requirements. Both parties must agree to the terms, and the document should be signed by the borrower. To enhance its enforceability, consider having the note notarized, although this is not strictly required.

What happens if the borrower fails to repay the loan?

If the borrower fails to repay the loan according to the terms outlined in the Promissory Note, the lender has the right to pursue legal action to recover the owed amount. This may involve filing a lawsuit in a Pennsylvania court. It is important for both parties to understand their rights and responsibilities as outlined in the note.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended document to ensure clarity and enforceability. Verbal agreements may not hold up in court.

Where can I find a template for a Pennsylvania Promissory Note?

Templates for Pennsylvania Promissory Notes can be found online through legal document websites or local legal aid organizations. It is important to choose a template that complies with Pennsylvania laws. Additionally, consulting with a legal professional can provide guidance tailored to your specific situation.

Other Common State-specific Promissory Note Forms

Promissory Note Template Florida Pdf - Promissory notes may undergo negotiation, leading to changes in terms and conditions.

Obtaining a Doctors Excuse Note is essential for individuals needing to validate their absence due to health issues, and resources such as Fast PDF Templates can streamline the process of acquiring this important document.

Free Loan Agreement Template Texas - The clarity provided by a promissory note can enhance trust between borrower and lender.

How to Use Pennsylvania Promissory Note

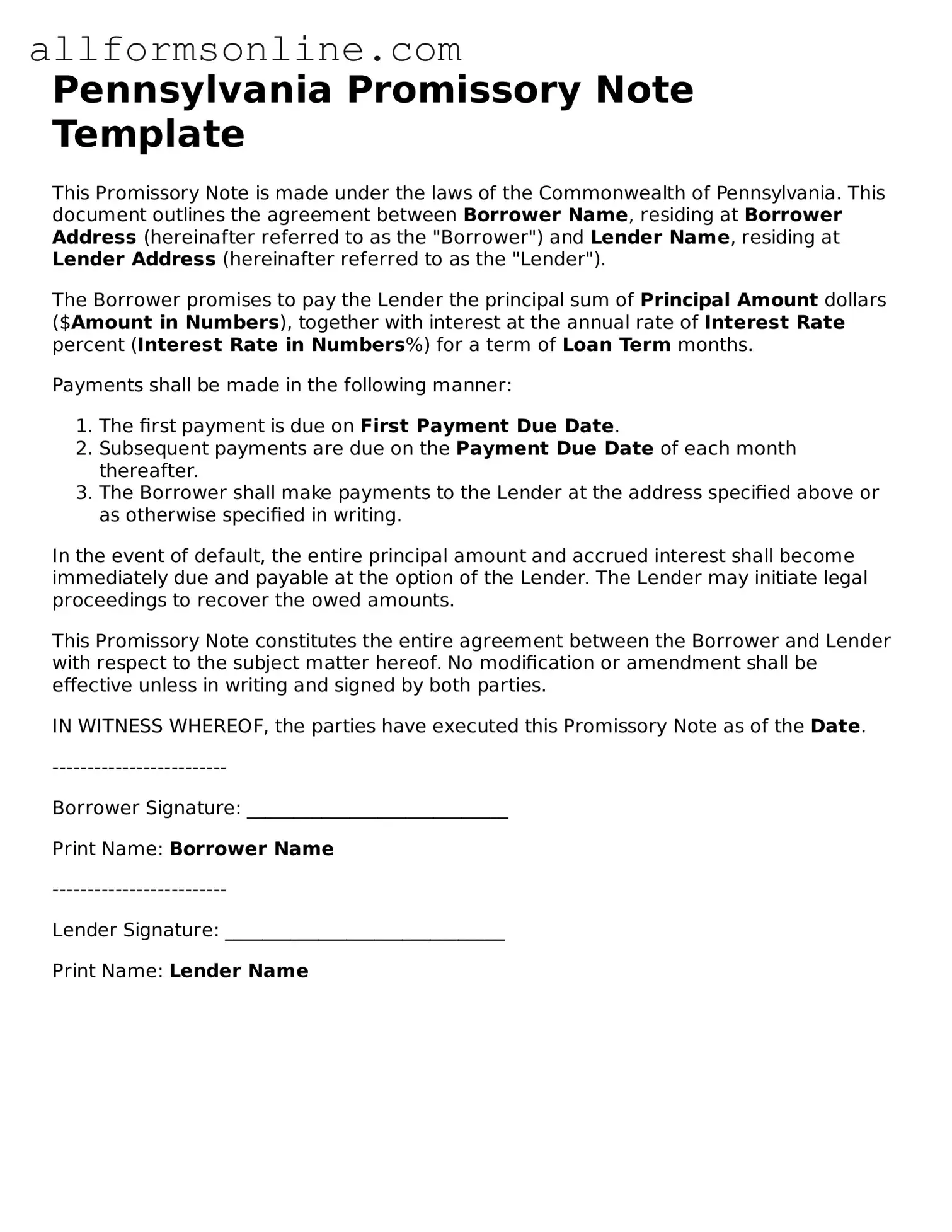

After obtaining the Pennsylvania Promissory Note form, you will need to complete it accurately to ensure that all necessary information is provided. This will facilitate the agreement between the parties involved and help avoid any misunderstandings.

- Begin by entering the date at the top of the form. This should be the date when the note is being executed.

- Clearly state the name of the borrower. This is the individual or entity that will be responsible for repaying the loan.

- Next, provide the address of the borrower. Include the street address, city, state, and ZIP code.

- Identify the lender by writing their name in the designated space. This is the individual or entity providing the loan.

- Include the lender's address, ensuring to add the street address, city, state, and ZIP code.

- Specify the principal amount being borrowed. This is the total sum that the borrower agrees to repay.

- Indicate the interest rate, if applicable. Clearly state whether it is fixed or variable.

- Detail the repayment schedule. Specify the frequency of payments, such as weekly, monthly, or annually, along with the duration of the loan.

- Include any late fees or penalties for missed payments, if applicable. This ensures both parties are aware of the consequences of late payments.

- Have both parties sign and date the document at the bottom. This signifies agreement to the terms laid out in the promissory note.

Once completed, review the form for any errors or missing information. It is important to keep a copy for your records and provide a copy to the other party involved in the agreement.