Attorney-Approved Quitclaim Deed Form for Pennsylvania

Misconceptions

Understanding the Pennsylvania Quitclaim Deed form is essential for anyone involved in property transactions. However, several misconceptions can lead to confusion. Here are four common misconceptions:

- A quitclaim deed transfers ownership without any warranties. Many people believe that a quitclaim deed guarantees clear title. In reality, it simply transfers whatever interest the grantor has in the property, if any. There are no assurances regarding the validity of that interest.

- Quitclaim deeds are only used between family members. While it is true that quitclaim deeds are often used in familial transactions, they are not limited to such situations. They can be used in various scenarios, including sales, transfers, or clearing up title issues.

- Using a quitclaim deed means the transaction is quick and easy. Although quitclaim deeds can simplify the transfer process, they do not eliminate the need for due diligence. Buyers should still research the property and ensure there are no liens or other issues that could affect ownership.

- A quitclaim deed is the same as a warranty deed. This misconception can lead to significant misunderstandings. A warranty deed provides guarantees about the title, including protection against claims. In contrast, a quitclaim deed offers no such protections.

Clarifying these misconceptions can help individuals make informed decisions when dealing with property transfers in Pennsylvania.

What to Know About This Form

What is a Quitclaim Deed in Pennsylvania?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any guarantees about the property's title. In Pennsylvania, this type of deed conveys whatever interest the grantor has in the property, if any, to the grantee. It is often used in situations where the parties know each other, such as family transfers or divorces.

How do I complete a Quitclaim Deed in Pennsylvania?

To complete a Quitclaim Deed in Pennsylvania, you need to fill out the form with the names of the grantor (the person transferring the property) and the grantee (the person receiving the property). Include a legal description of the property, which can usually be found on the property tax bill or deed. After filling out the form, both parties must sign it in the presence of a notary public.

Do I need a lawyer to prepare a Quitclaim Deed?

While it is not legally required to have a lawyer prepare a Quitclaim Deed, consulting with a legal professional can be beneficial. A lawyer can ensure that the deed is completed correctly and that all legal requirements are met, reducing the risk of future disputes.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is different from a Warranty Deed. A Warranty Deed provides guarantees about the title, ensuring that the grantor has the right to transfer the property and that the title is free from any claims. In contrast, a Quitclaim Deed offers no such assurances, making it a riskier option for the grantee.

What are the advantages of using a Quitclaim Deed?

One of the main advantages of a Quitclaim Deed is its simplicity. It is straightforward to prepare and execute, making it a quick option for transferring property. Additionally, it is often used in family situations, where trust exists between the parties involved. It can also help avoid probate in some cases.

Are there any disadvantages to using a Quitclaim Deed?

Yes, there are disadvantages. The primary concern is the lack of guarantees about the title. If there are any liens, claims, or issues with the property, the grantee may inherit those problems. Additionally, using a Quitclaim Deed may not be suitable for transactions involving buyers who are unfamiliar with the property.

How do I record a Quitclaim Deed in Pennsylvania?

To record a Quitclaim Deed in Pennsylvania, you must take the signed and notarized deed to the county recorder of deeds office where the property is located. There may be a recording fee, and it is advisable to check with the office for any specific requirements or forms needed for recording.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it cannot be revoked unilaterally. However, the grantor and grantee can agree to a new deed that reverses the transfer. This new deed would need to be executed and recorded in the same manner as the original Quitclaim Deed.

Is a Quitclaim Deed taxable in Pennsylvania?

In Pennsylvania, the transfer of property via a Quitclaim Deed may be subject to real estate transfer tax. The tax is typically based on the property's value. It is essential to check with local authorities or a tax professional to understand any potential tax implications associated with the transfer.

Can I use a Quitclaim Deed for property purchased with a mortgage?

Yes, you can use a Quitclaim Deed to transfer property that has a mortgage. However, it is important to note that the mortgage remains in the original borrower's name, and the lender may have specific requirements or restrictions regarding the transfer. Always consult with the mortgage lender before proceeding.

Other Common State-specific Quitclaim Deed Forms

Quick Deed Florida - A Quitclaim Deed does not ensure that the property is free from liens or other claims.

Quit Claim Deed Form Ny - The document must be signed by the person transferring their interest.

Quit Claim Deed Form Free - A Quitclaim Deed is versatile and widely applicable in various transactions.

In California, the importance of the EDD DE 2501 form cannot be overstated, as it serves as a vital step in securing Disability Insurance benefits. For those looking for reliable resources to assist with completing this form, Fast PDF Templates offers valuable tools to ensure accuracy and compliance, ultimately enhancing the chances of receiving timely support during periods of temporary disability.

Quit Claim Deed Form Texas - Commonly utilized to correct property ownership records.

How to Use Pennsylvania Quitclaim Deed

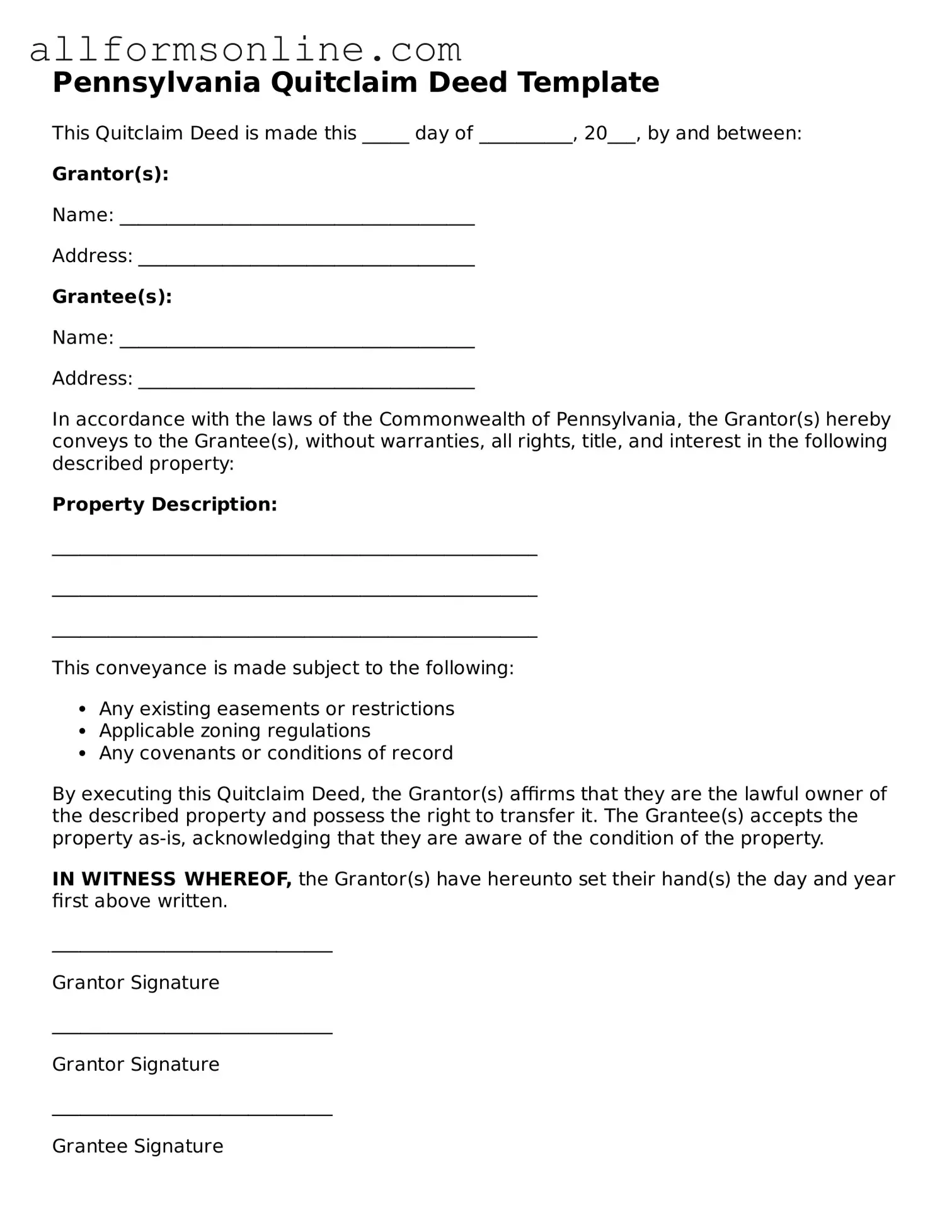

After obtaining the Pennsylvania Quitclaim Deed form, you will need to fill it out accurately to ensure a smooth transfer of property ownership. Once completed, the form must be signed, notarized, and then filed with the appropriate county office.

- Begin by entering the name of the grantor (the person transferring the property) in the designated space.

- Next, fill in the name of the grantee (the person receiving the property).

- Provide the address of the property being transferred, including the county and municipality.

- Include a legal description of the property. This may require a survey or previous deed for accuracy.

- Indicate the consideration (the amount of money or value exchanged) for the property transfer.

- Sign the form in front of a notary public. The notary will verify your identity and witness your signature.

- Once notarized, make copies of the completed form for your records.

- File the original Quitclaim Deed with the county recorder of deeds office in the county where the property is located. Pay any applicable filing fees.