Attorney-Approved Real Estate Purchase Agreement Form for Pennsylvania

Misconceptions

Understanding the Pennsylvania Real Estate Purchase Agreement form is crucial for both buyers and sellers. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

- The form is only for residential properties. Many believe that the Pennsylvania Real Estate Purchase Agreement is exclusively for residential transactions. In reality, it can also be used for commercial properties, as long as the specific terms are adjusted accordingly.

- It is a legally binding document only when signed. While a signature is essential for the agreement to be enforceable, the terms discussed and agreed upon during negotiations can create an implied contract. This means that parties may have obligations even before signing.

- All agreements must be in writing. Although it is advisable to have a written agreement for clarity and legal protection, verbal agreements can sometimes be enforceable under certain circumstances. However, proving the terms of a verbal agreement can be challenging.

- Only real estate agents can complete the form. Some individuals think that only licensed agents can fill out the Pennsylvania Real Estate Purchase Agreement. In fact, buyers and sellers can complete the form themselves, though it is often wise to seek professional assistance to ensure accuracy.

- Once signed, the terms cannot be changed. Many assume that after signing the agreement, the terms are set in stone. However, parties can negotiate changes to the agreement even after it has been signed, provided all parties agree and document the changes properly.

- The form covers all possible contingencies. There is a belief that the Pennsylvania Real Estate Purchase Agreement addresses every possible scenario. In truth, while it includes many common contingencies, parties should consider additional clauses to address specific concerns or conditions unique to their transaction.

Awareness of these misconceptions can help individuals navigate the real estate process more effectively, ensuring a smoother transaction experience.

What to Know About This Form

What is a Pennsylvania Real Estate Purchase Agreement?

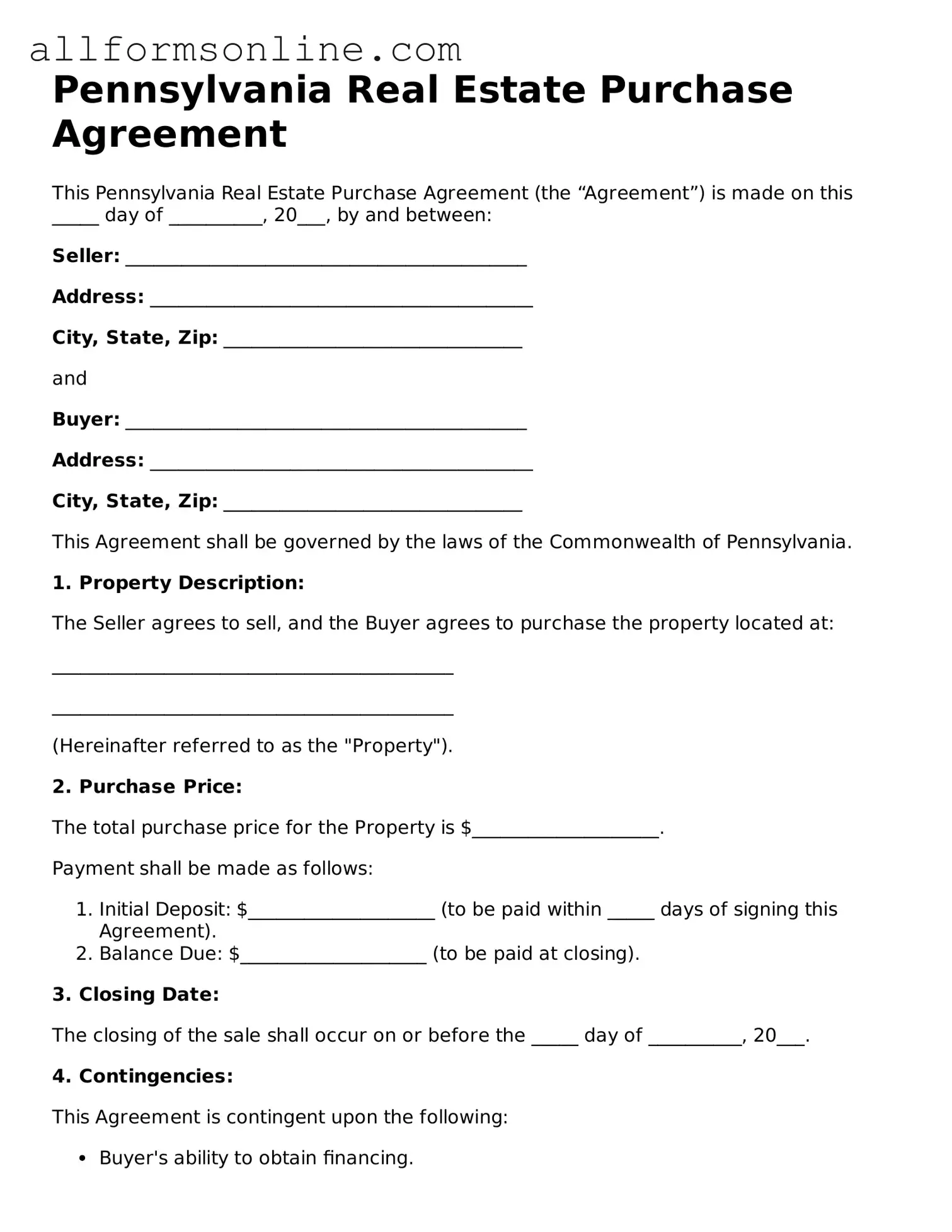

The Pennsylvania Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a property is bought and sold in Pennsylvania. This agreement serves as a binding contract between the buyer and seller, detailing important aspects such as the purchase price, closing date, and any contingencies that may apply. It ensures that both parties have a clear understanding of their rights and obligations throughout the transaction process.

What are the key components of the agreement?

Several essential elements make up the Pennsylvania Real Estate Purchase Agreement. These include the identification of the parties involved, a description of the property being sold, the agreed-upon purchase price, and the payment terms. Additionally, the agreement may include contingencies, such as financing or inspection requirements, as well as details about closing costs and the timeline for the transaction.

Is the agreement legally binding?

Yes, once both parties sign the Pennsylvania Real Estate Purchase Agreement, it becomes a legally binding contract. This means that both the buyer and the seller are obligated to fulfill the terms outlined in the agreement. If either party fails to comply, the other party may have legal grounds to seek remedies, which could include enforcing the contract or seeking damages.

Can the agreement be modified after it is signed?

Modifications to the Pennsylvania Real Estate Purchase Agreement can be made, but they typically require the consent of both parties. Any changes should be documented in writing and signed by both the buyer and the seller to ensure that they are enforceable. It’s important to keep communication open and clear when discussing any potential changes to the agreement.

What happens if a buyer wants to back out of the agreement?

If a buyer wishes to back out of the agreement, the consequences depend on the terms laid out in the contract. If the buyer has included contingencies, such as a financing or inspection contingency, they may be able to withdraw without penalty. However, if the buyer simply changes their mind without a valid reason, they could potentially lose their earnest money deposit or face legal action from the seller.

Are there any contingencies that are commonly included?

Yes, several contingencies are often included in the Pennsylvania Real Estate Purchase Agreement. Common ones include financing contingencies, which allow the buyer to back out if they cannot secure a mortgage, and inspection contingencies, which permit the buyer to withdraw if significant issues are discovered during a home inspection. These contingencies protect the buyer's interests and provide an opportunity to negotiate repairs or price adjustments based on findings.

Where can I obtain a Pennsylvania Real Estate Purchase Agreement form?

Pennsylvania Real Estate Purchase Agreement forms can be obtained from various sources. Many real estate agents provide these forms as part of their services. Additionally, legal websites and local real estate associations often offer templates for purchase agreements. It’s advisable to use a form that is up-to-date and complies with current Pennsylvania laws to ensure its validity.

Other Common State-specific Real Estate Purchase Agreement Forms

Real Estate Sales Contract Form - This document serves as a legally binding contract between the buyer and seller.

Real Estate Purchase and Sale Agreement - Standardized forms may be available, although buyers and sellers can customize terms to meet unique needs.

To ensure proper understanding and compliance, individuals should refer to resources like Fast PDF Templates for guidance on drafting and utilizing the California Release of Liability form, which is essential for mitigating liability risks during various activities.

Texas Real Estate Contract - The Real Estate Purchase Agreement serves as a binding contract upon signature.

How to Use Pennsylvania Real Estate Purchase Agreement

Filling out the Pennsylvania Real Estate Purchase Agreement form is an important step in the home-buying process. This form will help you outline the terms of the sale, ensuring that both parties understand their rights and responsibilities. Once you have completed the form, you can move forward with the transaction, including negotiations and closing.

- Obtain the form: You can find the Pennsylvania Real Estate Purchase Agreement form online or through your real estate agent.

- Fill in the date: Write the date when you are completing the agreement at the top of the form.

- Identify the parties: Enter the names and contact information of the buyer(s) and seller(s).

- Property details: Clearly describe the property being sold, including the address and any relevant identifying information.

- Purchase price: Specify the agreed-upon purchase price for the property.

- Deposit amount: Indicate the amount of the earnest money deposit, which shows the buyer's good faith.

- Financing terms: Outline how the buyer plans to finance the purchase, whether through a mortgage, cash, or other means.

- Contingencies: List any conditions that must be met for the sale to proceed, such as inspections or financing approval.

- Closing date: Set a target date for when the sale will be finalized.

- Signatures: Ensure that both the buyer(s) and seller(s) sign and date the agreement to make it legally binding.