Attorney-Approved Transfer-on-Death Deed Form for Pennsylvania

Misconceptions

The Pennsylvania Transfer-on-Death Deed (TOD) form is a legal document that allows individuals to transfer real estate to a beneficiary upon their death without going through probate. However, several misconceptions exist regarding this form. Below is a list of ten common misconceptions along with explanations.

- The TOD deed automatically transfers property upon signing. In reality, the transfer occurs only upon the death of the property owner, not at the time of signing the deed.

- All types of property can be transferred using a TOD deed. This is not true. The TOD deed can only be used for real estate, not personal property or other types of assets.

- A TOD deed eliminates the need for a will. While a TOD deed can transfer property outside of probate, it does not replace the need for a will to address other assets or matters.

- Beneficiaries cannot be changed after the deed is signed. This is incorrect. The property owner can revoke or change the beneficiary at any time before their death by executing a new TOD deed.

- The TOD deed is only for married couples. This misconception overlooks that anyone can use a TOD deed, regardless of marital status.

- There are no tax implications associated with a TOD deed. While the transfer may avoid probate, it does not exempt the property from estate taxes, which may still apply.

- A TOD deed is a guaranteed way to avoid disputes among heirs. Disputes can still arise, especially if the intentions of the property owner are unclear or if there are multiple claims to the property.

- The TOD deed must be filed with the county before the owner’s death. The deed must be recorded with the county office, but it can be done at any time before the owner’s death to be effective.

- Using a TOD deed is always the best option for transferring property. While it can be beneficial, it may not be suitable for every situation. Individuals should consider their specific circumstances and consult with a legal professional.

- Once a TOD deed is executed, the property owner loses control over the property. This is not accurate. The property owner retains full control and can sell or mortgage the property during their lifetime.

What to Know About This Form

What is a Transfer-on-Death Deed in Pennsylvania?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Pennsylvania to designate a beneficiary who will receive the property automatically upon the owner's death. This means the property can transfer outside of the probate process, simplifying the transfer for your loved ones.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Pennsylvania can use a Transfer-on-Death Deed. This includes single individuals, married couples, and even joint owners. However, it is important to ensure that the deed is properly executed and recorded to be effective.

How do I create a Transfer-on-Death Deed?

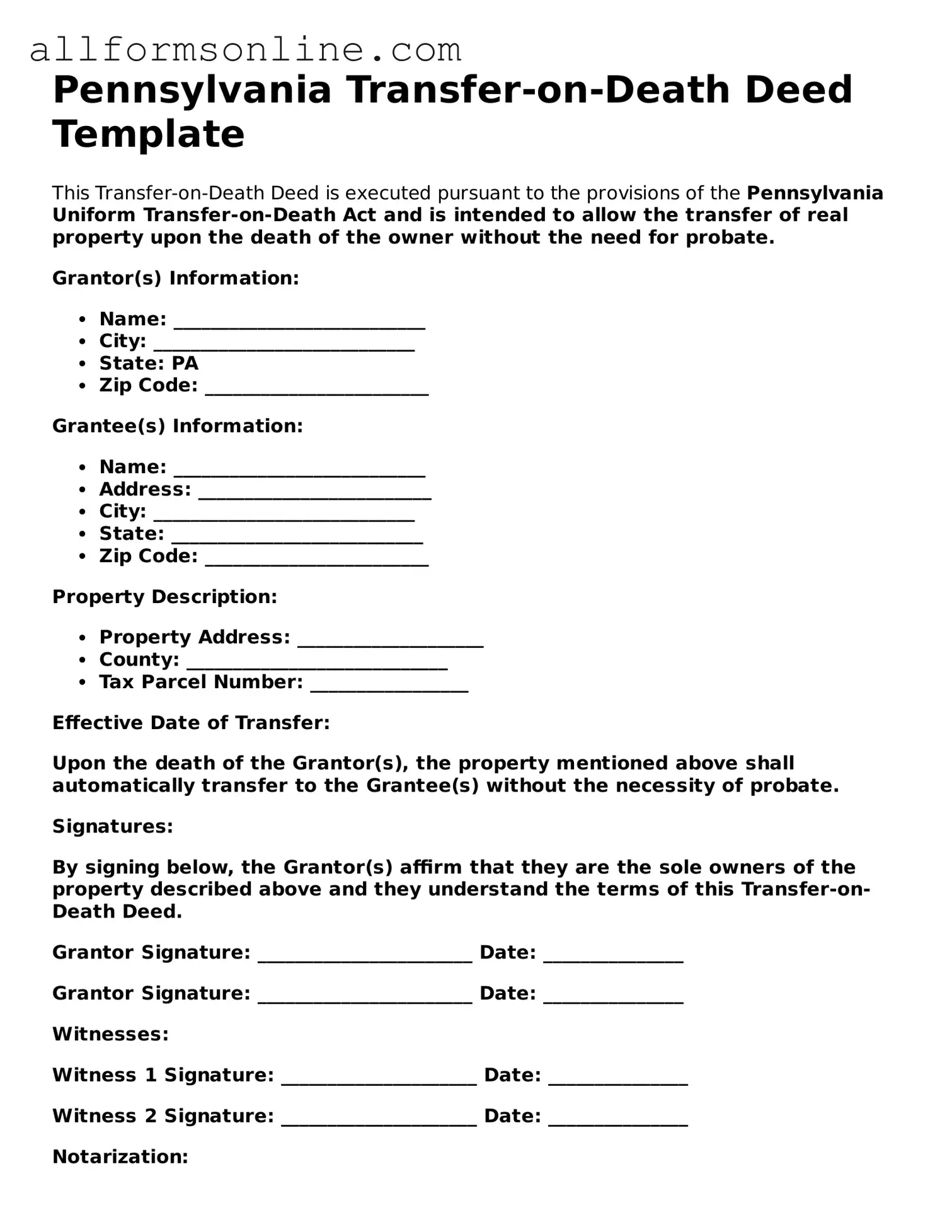

To create a Transfer-on-Death Deed, you must complete the form with specific information, including the property description and the name of the beneficiary. After filling out the deed, you need to sign it in the presence of a notary public. Finally, the deed must be recorded in the county where the property is located to be valid.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are still alive. To do this, you must create a new deed that either names a different beneficiary or explicitly states that the previous deed is revoked. Remember to record the new deed to ensure it takes effect.

What happens if I don’t name a beneficiary in the Transfer-on-Death Deed?

If you do not name a beneficiary, the property will not transfer upon your death. Instead, it will become part of your estate and will go through the probate process. This can lead to delays and additional costs for your heirs.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a Transfer-on-Death Deed. However, the beneficiary may be responsible for property taxes after the transfer occurs. It’s advisable to consult with a tax professional to understand any potential tax consequences.

Can a Transfer-on-Death Deed be contested?

Yes, like any other estate planning document, a Transfer-on-Death Deed can be contested. Heirs or other interested parties may challenge the deed based on claims such as lack of capacity, undue influence, or improper execution. It’s crucial to ensure that the deed is created and executed correctly to minimize the risk of disputes.

Is a Transfer-on-Death Deed the same as a will?

No, a Transfer-on-Death Deed is not the same as a will. A will outlines how your assets should be distributed after your death and goes through probate. In contrast, a Transfer-on-Death Deed allows for the direct transfer of property to a beneficiary without going through probate, making the process quicker and often less expensive.

Where can I find the Transfer-on-Death Deed form in Pennsylvania?

You can find the Transfer-on-Death Deed form on the official Pennsylvania government website or at your local county recorder’s office. It’s important to use the most current version of the form to ensure compliance with state laws.

Other Common State-specific Transfer-on-Death Deed Forms

Transfer on Death Deed Florida Form - Property owners can retain full control of their property during their lifetime, with the deed taking effect only after death.

Where Can I Get a Tod Form - Individuals can name multiple beneficiaries with clear instructions for the distribution of their property.

When engaging in the sale of a motorcycle, having the proper documentation is key, and that's where the California Motorcycle Bill of Sale form comes into play. This essential document not only streamlines the transfer of ownership but also provides a clear record for both the buyer and seller. To ensure a smooth transaction, you can utilize templates from Fast PDF Templates, which help mitigate any potential misunderstandings and safeguard the interests of both parties involved.

Avoiding Probate in California - An effective Transfer-on-Death Deed can eliminate potential challenges in court after death.

How to Use Pennsylvania Transfer-on-Death Deed

Once you have the Pennsylvania Transfer-on-Death Deed form in hand, you can begin the process of filling it out. This form allows you to designate a beneficiary who will receive your property upon your passing, without the need for probate. It's important to ensure that all information is accurate and complete to avoid any complications later on.

- Obtain the form: Download the Pennsylvania Transfer-on-Death Deed form from the official state website or acquire a physical copy from a local courthouse.

- Fill in your information: At the top of the form, enter your full name and address as the property owner. Make sure to include any relevant identification numbers, if required.

- Describe the property: Provide a detailed description of the property you wish to transfer. This includes the address, parcel number, and any other identifying details.

- Designate your beneficiary: Clearly write the full name and address of the person you want to inherit the property. If there are multiple beneficiaries, list them all and specify how the property should be divided among them.

- Sign the form: As the property owner, sign and date the form in the designated area. Your signature confirms your intention to transfer the property upon your death.

- Notarize the document: Have the form notarized to validate your signature. This step is crucial, as it adds legal weight to the document.

- Record the deed: Submit the completed and notarized form to the appropriate county recorder's office. There may be a small fee for recording the deed.

After submitting the form, keep a copy for your records. It's advisable to inform your designated beneficiary about the deed, so they are aware of their future inheritance. This proactive communication can help prevent confusion later on.