Blank Prenuptial Agreement Form

Prenuptial AgreementDocuments for Particular States

Misconceptions

Many people hold misconceptions about prenuptial agreements. Understanding these can help clarify their purpose and benefits. Here are seven common misconceptions:

- Prenuptial agreements are only for the wealthy. This is not true. Prenups can benefit anyone, regardless of financial status, by providing clarity on asset division and financial responsibilities.

- Prenups are only for divorce. While they do address divorce scenarios, they can also outline financial arrangements during marriage, helping couples manage their finances better.

- Prenups are unromantic. Many couples find that discussing and planning for the future can actually strengthen their relationship. Open communication is key.

- Prenups are not legally enforceable. When properly drafted and executed, prenuptial agreements are legally binding in most jurisdictions, provided they meet certain requirements.

- Prenups can cover anything. There are limits to what can be included. For example, they cannot dictate child custody or support arrangements.

- Prenups are only for the bride or groom's assets. They can address both parties’ assets and debts, ensuring fairness and clarity for both individuals.

- Prenups are complicated and expensive. While they can be complex, the process can be straightforward and affordable with the right guidance and planning.

Understanding these misconceptions can help couples make informed decisions about their financial futures together.

What to Know About This Form

What is a prenuptial agreement?

A prenuptial agreement, often referred to as a "prenup," is a legal document created by two individuals before they get married. This agreement outlines the division of assets and financial responsibilities in the event of a divorce or separation. It can also address issues such as spousal support and the management of debts. By establishing these terms in advance, couples can protect their individual interests and reduce potential conflicts in the future.

Who should consider a prenuptial agreement?

Anyone planning to get married may benefit from a prenuptial agreement. This is especially true for individuals with significant assets, debts, or children from previous relationships. A prenup can provide clarity and security, ensuring that both parties understand their rights and obligations. Even couples with modest assets may find it useful to outline financial responsibilities and expectations.

What can be included in a prenuptial agreement?

A prenuptial agreement can cover a wide range of topics. Common provisions include the division of property acquired before and during the marriage, management of debts, and spousal support. Couples may also address how to handle inheritance or gifts received during the marriage. However, certain topics, such as child custody and child support, are typically not enforceable in a prenup and are usually determined by the court based on the child's best interests.

How do I create a prenuptial agreement?

Creating a prenuptial agreement involves several steps. First, both parties should openly discuss their financial situations and expectations. It is advisable to consult with separate legal professionals to ensure that both individuals understand their rights and the implications of the agreement. After drafting the agreement, both parties must review it thoroughly before signing. It’s crucial that the prenup is signed well in advance of the wedding to avoid any claims of coercion or undue pressure.

Can a prenuptial agreement be changed or revoked?

Yes, a prenuptial agreement can be modified or revoked after it has been executed. Both parties must agree to any changes, and it is advisable to document these changes in writing. If either party wishes to revoke the agreement entirely, this should also be done in writing, and both parties should sign the revocation. Keeping the agreement updated is important, especially if significant life changes occur, such as the birth of children or major financial shifts.

Popular Templates:

How to Gift a Car in Louisiana - Each party may need to provide identification when signing the form.

To facilitate a clear and effective transaction, it is essential to utilize the California Vehicle Purchase Agreement, which you can access through Fast PDF Templates, ensuring all vital details are captured in a legally binding format, thereby safeguarding the interests of both the buyer and the seller.

Trespassing Warning Letter - It serves as a legal notice of trespassing restrictions for the recipient.

How to Use Prenuptial Agreement

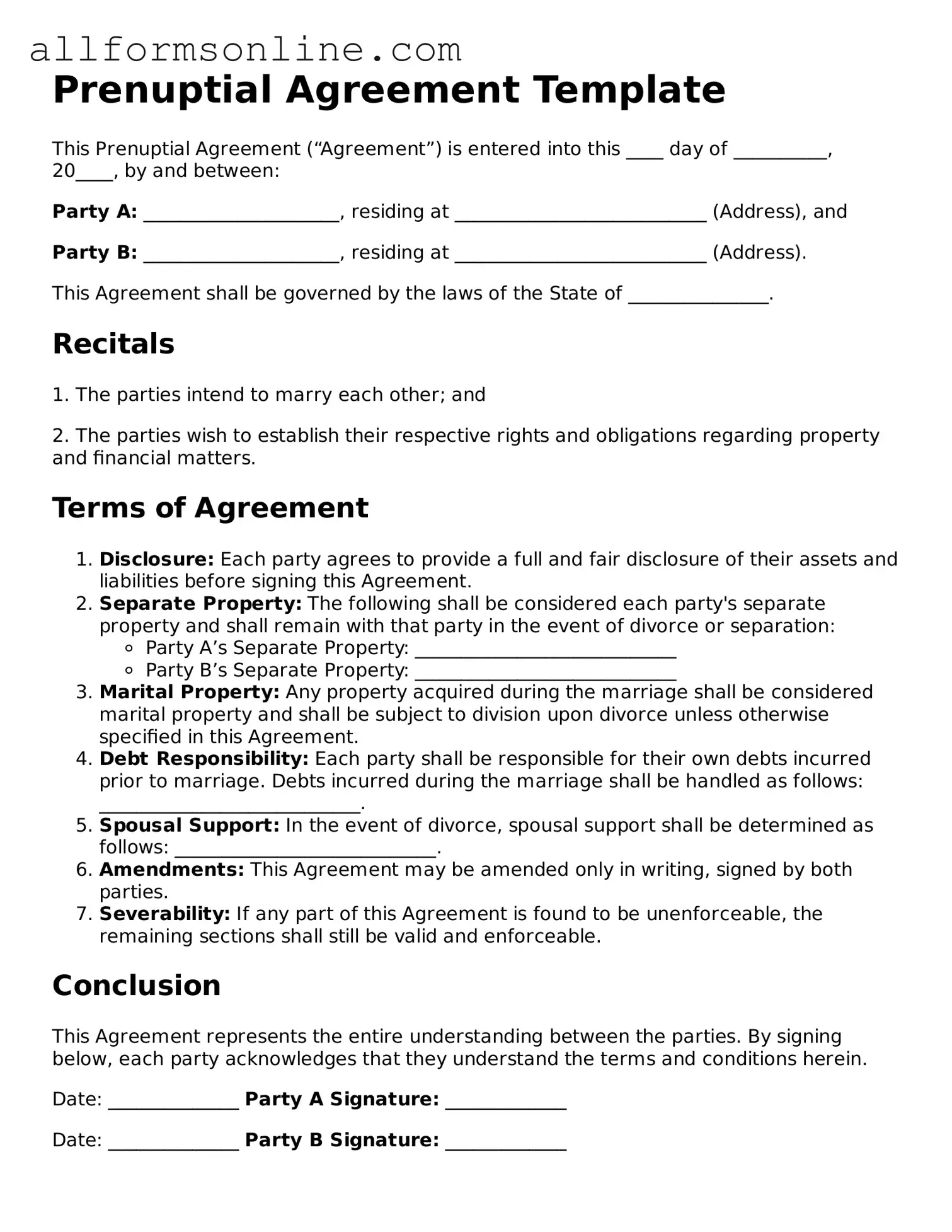

Filling out a Prenuptial Agreement form requires careful attention to detail and clear communication between both parties. This document is essential for outlining the financial rights and responsibilities of each partner in the event of a divorce or separation. The following steps will guide you through the process of completing the form accurately.

- Begin by gathering personal information for both parties. This includes full names, addresses, and contact information.

- Next, state the purpose of the agreement clearly at the top of the form.

- List the assets owned by each party. Include bank accounts, real estate, investments, and any other significant property.

- Identify any debts that each party may have. This includes credit card debt, loans, and mortgages.

- Discuss and outline how you both wish to handle future earnings and property acquired during the marriage.

- Include any provisions for spousal support or alimony, if applicable. Clearly state the terms agreed upon.

- Both parties should review the agreement thoroughly to ensure all information is accurate and agreed upon.

- Sign the document in the presence of a notary public to make it legally binding.

After completing these steps, the Prenuptial Agreement should be stored in a safe place. Both parties should keep a copy for their records. It is also wise to consult with a legal professional to ensure that the agreement meets all necessary legal requirements.