Free Profit And Loss PDF Form

Misconceptions

Understanding the Profit and Loss (P&L) form is essential for anyone involved in managing a business’s finances. However, several misconceptions can lead to confusion. Here are nine common misconceptions about the P&L form, along with clarifications to help demystify this important financial document.

- It only shows revenue and expenses. Many believe that the P&L form merely lists income and costs. In reality, it also provides insights into profitability, allowing businesses to assess their financial health over a specific period.

- It is the same as a cash flow statement. While both documents are crucial for financial analysis, the P&L focuses on revenues and expenses, whereas the cash flow statement tracks the actual cash entering and leaving the business.

- All expenses are deducted from revenue. Some assume that every expense automatically reduces profit. However, only those expenses directly related to generating income are considered, while others may be categorized differently.

- It reflects the company's cash position. The P&L form does not provide a complete picture of cash flow. A business may show a profit but still face cash shortages due to timing differences in revenue recognition and cash collection.

- It is only relevant for large businesses. Small businesses also benefit from a P&L form. It helps them understand their financial performance and make informed decisions regardless of their size.

- Profit is the only important figure. While profit is a key focus, other metrics, such as gross margin and operating income, provide valuable insights into a company’s efficiency and operational performance.

- It is a one-time report. Some people think the P&L form is only created annually. In fact, businesses often prepare monthly or quarterly P&L statements to monitor performance and make timely adjustments.

- All businesses use the same format. P&L forms can vary widely between industries and companies. Each organization may customize its P&L to reflect its unique operations and reporting needs.

- It is not necessary for tax purposes. While the P&L form itself is not submitted to tax authorities, the information it contains is crucial for preparing tax returns and understanding taxable income.

By addressing these misconceptions, individuals and business owners can better utilize the Profit and Loss form as a tool for financial management and strategic planning.

What to Know About This Form

What is a Profit and Loss form?

A Profit and Loss form, often referred to as a P&L statement, is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period, usually a fiscal quarter or year. This form provides a clear picture of a business's financial performance, allowing stakeholders to assess profitability. By comparing revenues against expenses, it helps in understanding whether the business is making a profit or incurring a loss.

Why is the Profit and Loss form important for businesses?

The Profit and Loss form is crucial for several reasons. First, it enables business owners to track income and expenses, which is vital for making informed financial decisions. Second, it serves as a tool for investors and lenders to evaluate the financial health of a business. Lastly, it aids in tax preparation by providing necessary information about income and deductible expenses, ensuring compliance with tax regulations.

How often should a Profit and Loss form be prepared?

The frequency of preparing a Profit and Loss form can vary based on the size and nature of the business. Many small businesses choose to prepare this statement monthly or quarterly, which allows for timely insights into financial performance. Larger companies may prepare it quarterly or annually. Regardless of the frequency, regular updates can help in identifying trends and making necessary adjustments to improve profitability.

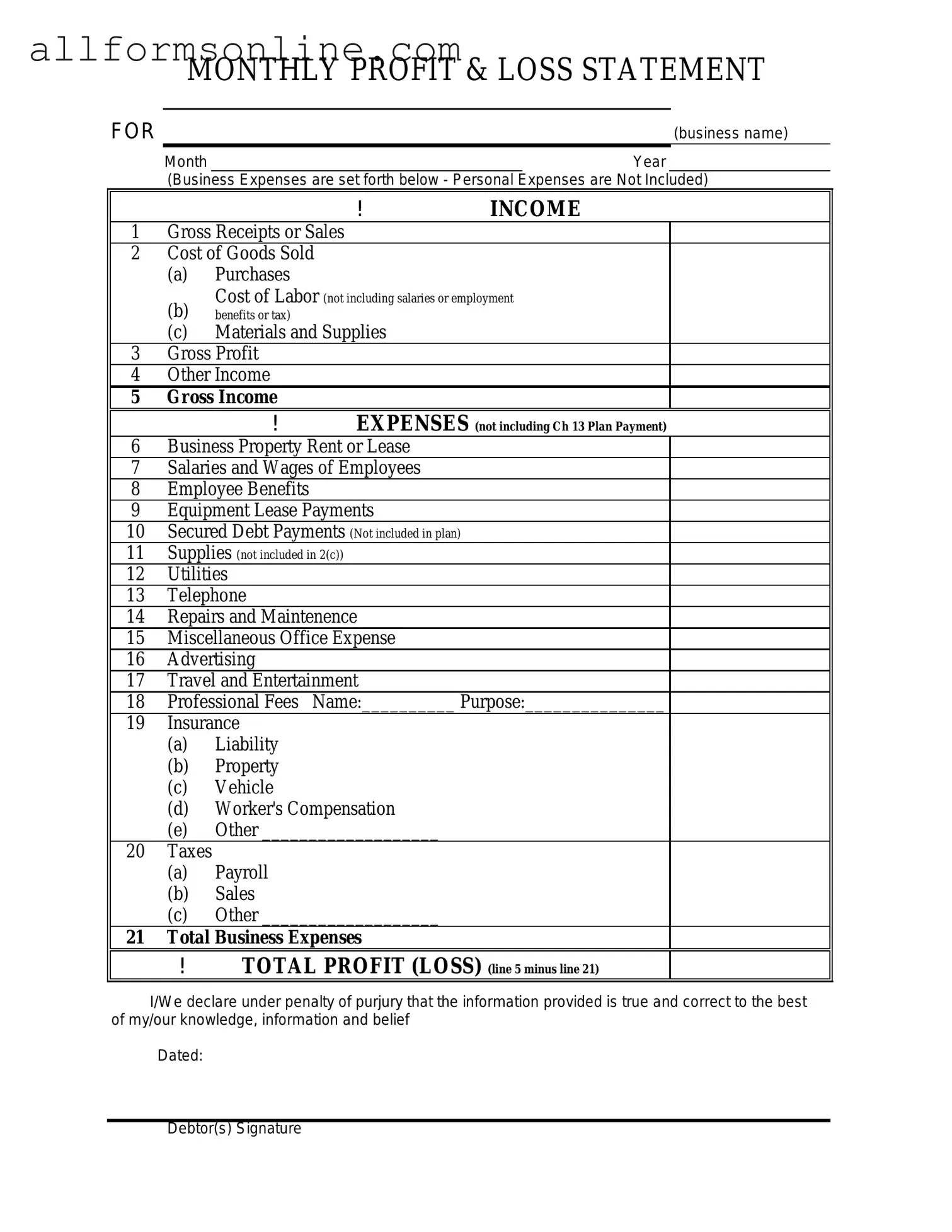

What key components should be included in a Profit and Loss form?

A comprehensive Profit and Loss form typically includes several key components. First, it should list total revenue or sales, followed by the cost of goods sold (COGS), which gives insight into direct costs associated with producing goods. Next, operating expenses, such as salaries, rent, and utilities, should be detailed. After calculating gross profit and subtracting operating expenses, the form should reflect net profit or loss. Additionally, other income and expenses, such as interest or taxes, may also be included for a complete financial overview.

Different PDF Forms

Written Estimate for Auto Repair - Gauge the cost of repairs to avoid surprises later on.

When considering legal arrangements for their children, many parents find it invaluable to understand the necessary Power of Attorney for a Child documentation. This knowledge can help ensure that their child's welfare is prioritized even in their absence.

Online Medication Administration Record - It serves as a reminder to maintain stringent medication safety protocols.

Gf Number on T-47 - The information in this form is considered legally binding.

How to Use Profit And Loss

Completing the Profit and Loss form is an essential step in tracking financial performance over a specific period. This form will require accurate input of various financial figures. Follow these steps to ensure proper completion.

- Gather all financial documents related to income and expenses for the period you are reporting.

- Begin by entering your business name and the reporting period at the top of the form.

- List all sources of income in the designated section. Include revenue from sales, services, and any other income streams.

- Calculate the total income by adding all sources of income together. Write this figure in the total income box.

- Move to the expenses section. Itemize all expenses incurred during the reporting period, such as rent, utilities, salaries, and other operational costs.

- Add up all expenses to find the total expenses for the period. Enter this amount in the total expenses box.

- To determine net profit or loss, subtract total expenses from total income. Record this figure in the net profit/loss box.

- Review all entries for accuracy. Ensure that figures are correctly calculated and that all relevant income and expenses are included.

- Sign and date the form to certify its accuracy before submission.