Blank Promissory Note for a Car Form

Misconceptions

Understanding the Promissory Note for a Car is essential for both buyers and sellers. However, several misconceptions can lead to confusion. Here are ten common misunderstandings:

- It is the same as a car title. Many believe that a promissory note serves as proof of ownership. In reality, a promissory note is a financial document that outlines the terms of a loan, while the car title indicates ownership.

- Only banks can issue promissory notes. This is not true. Individuals can create and sign promissory notes for personal loans, including those for car purchases.

- It is not legally binding. A properly executed promissory note is a legally enforceable contract. Both parties are obligated to adhere to its terms.

- Verbal agreements are sufficient. While verbal agreements can be made, they are difficult to enforce. A written promissory note provides clear evidence of the agreement.

- Interest rates are not necessary. Some assume that promissory notes must be interest-free. However, it is common to include interest rates, which should be clearly stated in the document.

- It cannot be transferred. Many think that once a promissory note is created, it cannot be sold or transferred. In fact, promissory notes can be sold to another party, subject to certain legal requirements.

- Only one signature is needed. A common misconception is that only the borrower needs to sign. Both the borrower and the lender should sign the note for it to be valid.

- It does not require a witness or notarization. While not always necessary, having a witness or notarizing the document can add an extra layer of protection and legitimacy.

- It is only for new car purchases. Some believe that promissory notes are only applicable to new cars. However, they can be used for both new and used vehicles.

- It is a complicated document. Many think that drafting a promissory note is overly complex. In reality, it can be straightforward, especially with templates available online.

Being aware of these misconceptions can help individuals navigate the process of financing a car more effectively. Understanding the role and function of a promissory note is key to making informed financial decisions.

What to Know About This Form

What is a Promissory Note for a Car?

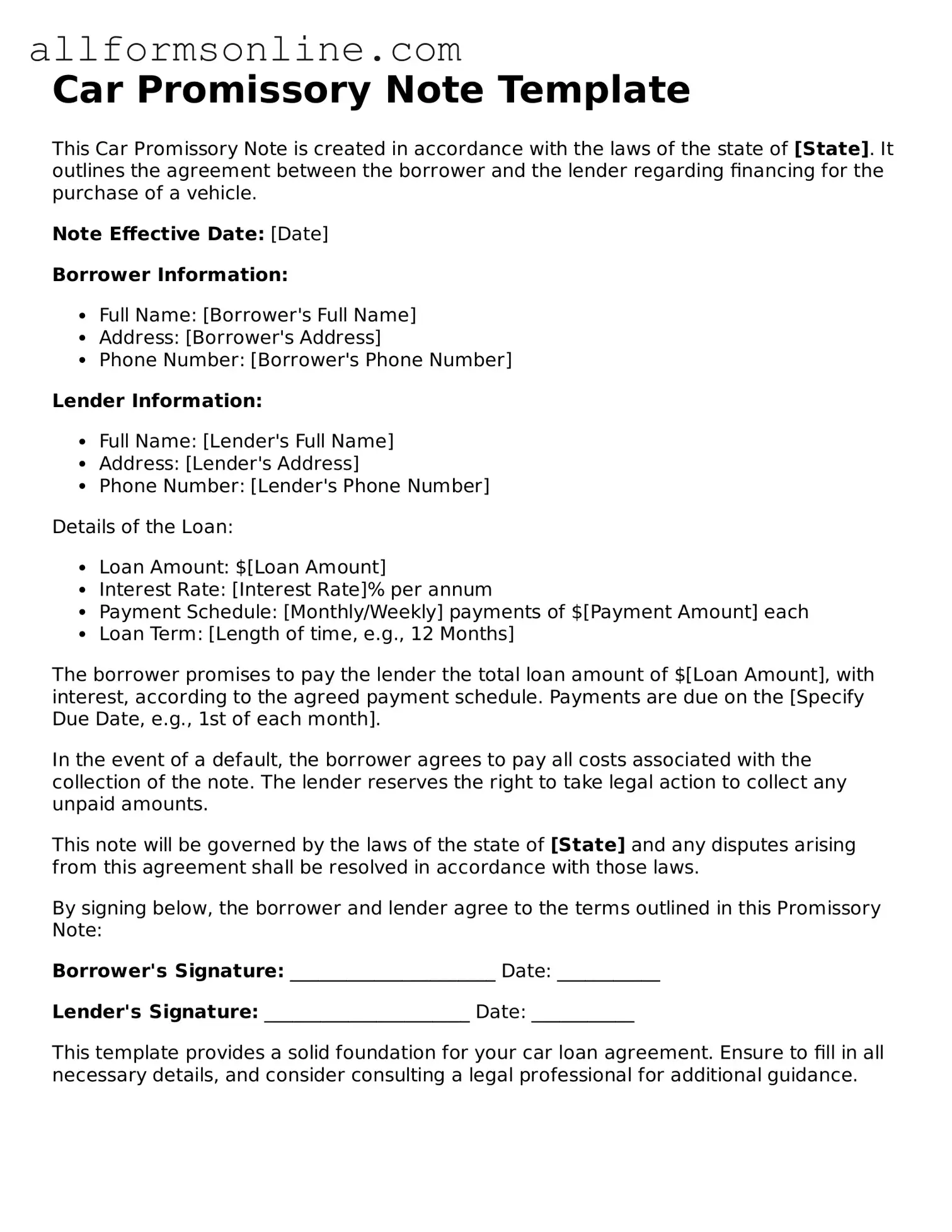

A Promissory Note for a Car is a legal document that outlines a borrower's promise to repay a loan used to purchase a vehicle. This note includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Essentially, it serves as a written agreement between the lender and borrower, ensuring both parties understand their obligations.

Why do I need a Promissory Note for a Car?

This document is important because it protects both the lender and the borrower. For the lender, it provides a legal recourse if the borrower fails to repay the loan. For the borrower, it clearly outlines the terms of the loan, preventing misunderstandings about payment amounts and due dates. Having a written agreement can also help build trust between the parties involved.

What information should be included in the Promissory Note?

Key information to include in the Promissory Note consists of the names and addresses of both the borrower and lender, the loan amount, interest rate, repayment terms, and the due date for payments. Additionally, it’s wise to specify what happens in case of default, such as repossession of the vehicle. Including these details can help avoid disputes later on.

How is the Promissory Note enforced?

If the borrower fails to make payments as agreed, the lender can enforce the Promissory Note through legal action. This might involve filing a lawsuit to recover the owed amount or, if applicable, repossessing the vehicle. The note serves as evidence of the debt, making it easier for the lender to prove their case in court.

Can I modify the terms of the Promissory Note?

Yes, modifications can be made, but both parties must agree to the changes. It's crucial to document any amendments in writing and have both parties sign the updated agreement. This ensures that everyone is on the same page and protects both the lender's and borrower's interests.

Is it necessary to have a lawyer review the Promissory Note?

While it’s not strictly necessary, having a lawyer review the Promissory Note can be beneficial. A legal expert can ensure that the document complies with state laws and adequately protects your rights. This extra step can provide peace of mind and help prevent potential issues down the road.

Popular Promissory Note for a Car Types:

What Happens to a Promissory Note When the Lender Dies - Serves as a reminder that obligations do indeed have an endpoint.

A New York Promissory Note is a written promise to pay a specified amount of money to a designated party at a predetermined time. This legal document serves as a critical tool in various financial transactions, providing clarity and security for both lenders and borrowers. For more information on how to create one, individuals can refer to the detailed resource available at https://nytemplates.com/blank-promissory-note-template/, which outlines the structure and requirements needed to navigate their financial obligations effectively.

How to Use Promissory Note for a Car

Completing the Promissory Note for a Car form is an important step in securing a loan for your vehicle purchase. After filling out this form, you will need to ensure all parties involved understand their obligations and rights under the agreement.

- Begin by entering the date at the top of the form.

- Write the name of the borrower. This is the individual who will be responsible for repaying the loan.

- Provide the address of the borrower. Include the street address, city, state, and ZIP code.

- Enter the name of the lender. This is the person or institution providing the loan.

- Fill in the lender's address, similar to how you entered the borrower's address.

- Specify the principal amount of the loan. This is the total amount borrowed for the car.

- Indicate the interest rate. This is the percentage that will be charged on the unpaid balance.

- State the repayment terms. Include the duration of the loan and the frequency of payments (e.g., monthly, bi-weekly).

- Provide details about any collateral, if applicable. This typically includes information about the vehicle being financed.

- Include any additional terms or conditions that apply to the loan agreement.

- Both the borrower and lender should sign and date the form to validate the agreement.