Blank Promissory Note Form

Promissory NoteDocuments for Particular States

Promissory Note Form Categories

Misconceptions

Understanding the Promissory Note form is essential for anyone engaging in lending or borrowing money. However, several misconceptions often cloud this important financial instrument. Below are eight common misconceptions, along with clarifications to enhance understanding.

- All Promissory Notes are the Same: Many people believe that all promissory notes have identical terms and formats. In reality, these documents can vary significantly based on the agreement between the parties involved.

- A Promissory Note Must Be Notarized: Some assume that notarization is a requirement for a promissory note to be valid. While notarization can enhance the note's credibility, it is not legally necessary in all jurisdictions.

- Only Financial Institutions Use Promissory Notes: It is a common misconception that only banks or financial institutions utilize promissory notes. In fact, individuals and small businesses frequently use them for personal loans and business transactions.

- Promissory Notes Are Only for Large Loans: Many believe that promissory notes are only applicable for significant sums of money. However, they can be used for any amount, large or small, depending on the agreement between the parties.

- Once Signed, a Promissory Note Cannot Be Changed: Some think that a signed promissory note is immutable. In truth, parties can modify the terms through mutual consent, provided that the changes are documented properly.

- A Promissory Note Guarantees Payment: It is a misconception that a promissory note ensures that the borrower will repay the loan. While it serves as a legal promise to pay, it does not eliminate the risk of default.

- Interest Rates on Promissory Notes Are Fixed: Many assume that the interest rates on promissory notes are always fixed. In reality, the terms can be negotiated, and variable rates are also possible.

- Promissory Notes Are Only for Secured Loans: There is a belief that promissory notes are exclusively used for secured loans. However, they can also be utilized for unsecured loans, depending on the agreement between the parties.

By dispelling these misconceptions, individuals can better navigate the complexities of promissory notes and make informed decisions in their financial dealings.

What to Know About This Form

What is a Promissory Note?

A Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. It serves as a legal document that outlines the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payment. This document is essential for both the lender and the borrower as it provides clarity and protects their rights.

Who can use a Promissory Note?

Any individual or business can use a Promissory Note. It is commonly used in personal loans, business loans, and real estate transactions. Both lenders and borrowers should understand the terms before signing. It is important for both parties to ensure that the note reflects their agreement accurately.

What information should be included in a Promissory Note?

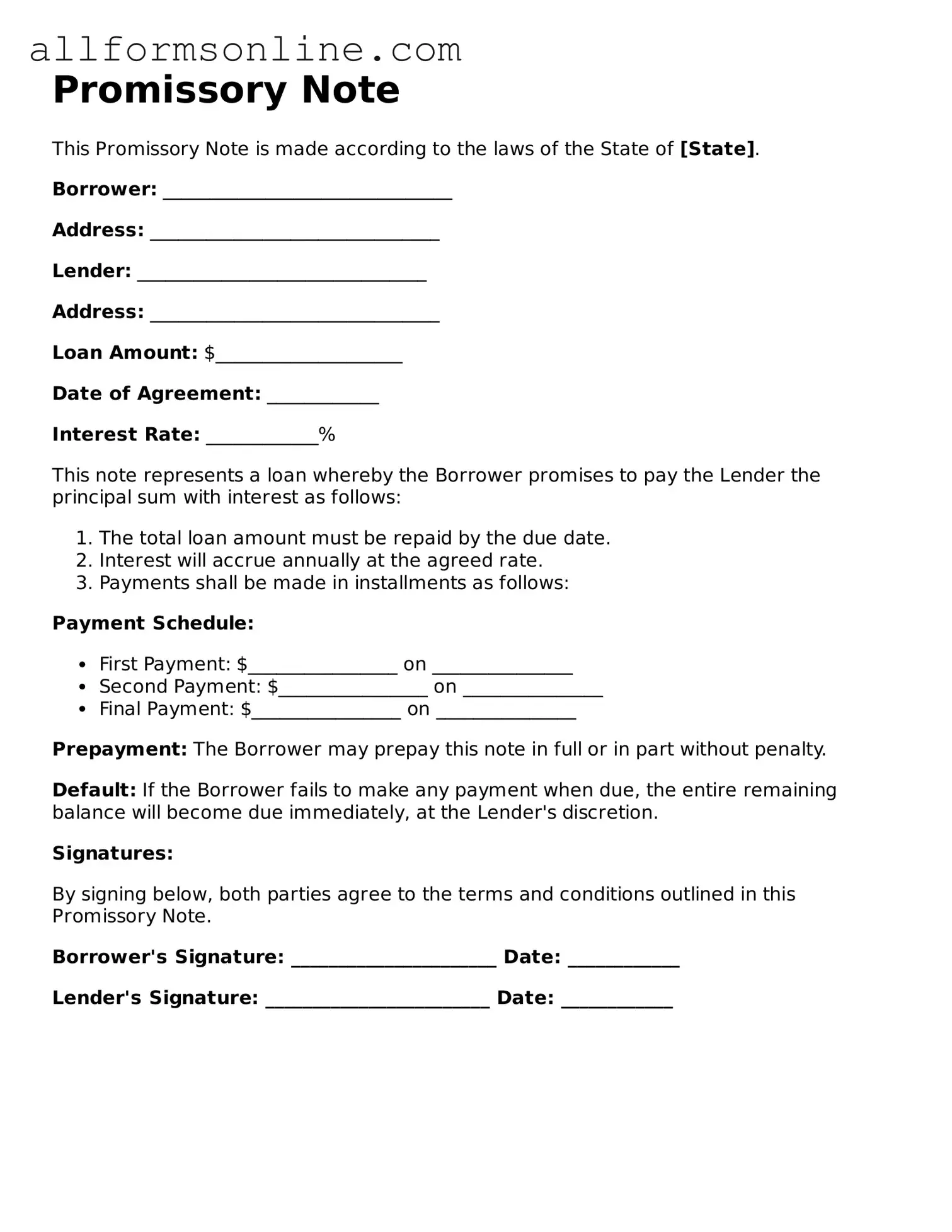

A Promissory Note should include the following key information: the names and addresses of the borrower and lender, the principal amount being borrowed, the interest rate, the repayment schedule, and any late fees or penalties. Additionally, it should state the date of the agreement and any terms regarding default. Including this information helps prevent misunderstandings in the future.

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding document, provided it meets certain criteria. It must include the essential elements such as the parties involved, the amount, and the terms of repayment. Once signed by both parties, it can be enforced in a court of law if necessary. This binding nature emphasizes the importance of understanding the terms before signing.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the updated agreement. This ensures that everyone is on the same page and helps avoid future disputes regarding the terms of the loan.

Popular Templates:

CBP Declaration Form 6059B - Travelers should be aware of their obligations when filling out the CBP 6059B form.

To further facilitate the vehicle purchasing process, you may consider using resources such as Fast PDF Templates, which provide templates designed to simplify the creation of essential documents like the California Vehicle Purchase Agreement, ensuring that all necessary details are accurately captured and both parties are protected throughout the transaction.

How to Balance a Cash Register - Enables quick identification of cash discrepancies.

How to Use Promissory Note

Once you have your Promissory Note form in hand, it's time to fill it out carefully. This document serves as a formal agreement between the lender and the borrower, outlining the terms of the loan. Make sure to have all the necessary information ready before you start. Here’s a step-by-step guide to help you complete the form accurately.

- Title the Document: At the top of the form, write “Promissory Note” to clearly indicate the purpose of the document.

- Enter the Date: Fill in the date on which the note is being created. This establishes when the agreement takes effect.

- Borrower Information: Write the full name and address of the borrower. Make sure the information is current and accurate.

- Lender Information: Provide the full name and address of the lender. This could be an individual or an institution.

- Loan Amount: Clearly state the amount of money being borrowed. Use numerals and spell it out in words for clarity.

- Interest Rate: Specify the interest rate applicable to the loan. Indicate whether it is fixed or variable.

- Payment Terms: Describe the repayment schedule, including the frequency of payments (monthly, quarterly, etc.) and the due date for each payment.

- Maturity Date: Indicate the date by which the loan must be fully repaid.

- Signatures: Both the borrower and lender should sign the document. Include the date of each signature to confirm when the agreement was finalized.

After completing the form, review it for any errors or missing information. It’s essential to ensure that everything is accurate before both parties sign. Once signed, keep a copy for your records and provide one to the other party. This document will serve as a reference throughout the life of the loan.