Blank Quitclaim Deed Form

Quitclaim DeedDocuments for Particular States

Misconceptions

Understanding the Quitclaim Deed can be challenging, and several misconceptions often arise. Here are eight common misunderstandings about this legal document:

- Quitclaim Deeds Transfer Ownership Completely: Many believe that a quitclaim deed transfers full ownership of a property. In reality, it only conveys whatever interest the grantor has, if any. If the grantor has no ownership, the recipient receives nothing.

- Quitclaim Deeds Are Only for Divorces: While quitclaim deeds are often used in divorce settlements to transfer property between spouses, they are not limited to this situation. They can be used in various circumstances, such as transferring property to family members or in estate planning.

- Quitclaim Deeds Eliminate Liens: Some people think that using a quitclaim deed removes any existing liens on the property. This is incorrect. Liens remain attached to the property regardless of the ownership change.

- Quitclaim Deeds Are Always Quick and Easy: While they can simplify the transfer process, quitclaim deeds still require proper documentation and may involve legal considerations. It's essential to ensure all parties understand the implications.

- Quitclaim Deeds Are Only for Real Estate: Many assume that quitclaim deeds apply solely to real estate transactions. However, they can also be used to transfer interests in other types of property, such as vehicles or business assets.

- Quitclaim Deeds Do Not Require Notarization: Some believe that quitclaim deeds can be signed without notarization. In most cases, notarization is necessary to validate the document and ensure it is legally binding.

- Quitclaim Deeds Offer Protection Against Future Claims: A common misconception is that a quitclaim deed protects the new owner from future claims. Unfortunately, it does not guarantee that the grantor has clear title, nor does it protect against any future disputes.

- Quitclaim Deeds Are the Same as Warranty Deeds: Many confuse quitclaim deeds with warranty deeds. Unlike a warranty deed, a quitclaim deed does not guarantee that the grantor has a valid title or any rights to the property being transferred.

By clarifying these misconceptions, individuals can make more informed decisions when considering the use of a quitclaim deed in their property transactions.

What to Know About This Form

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document that transfers ownership interest in a property from one party to another. Unlike a warranty deed, it does not guarantee that the property title is free of claims or liens. Essentially, the person transferring the property, known as the grantor, relinquishes any rights they may have in the property, but they do not guarantee those rights are valid. This type of deed is often used between family members or in situations where the parties know each other well.

When should I use a Quitclaim Deed?

You might consider using a Quitclaim Deed in several scenarios. Common situations include transferring property between family members, adding or removing a spouse from a title after marriage or divorce, or clearing up title issues. It is important to note that this deed is not suitable for transactions involving a sale or purchase where the buyer needs assurance about the property's title.

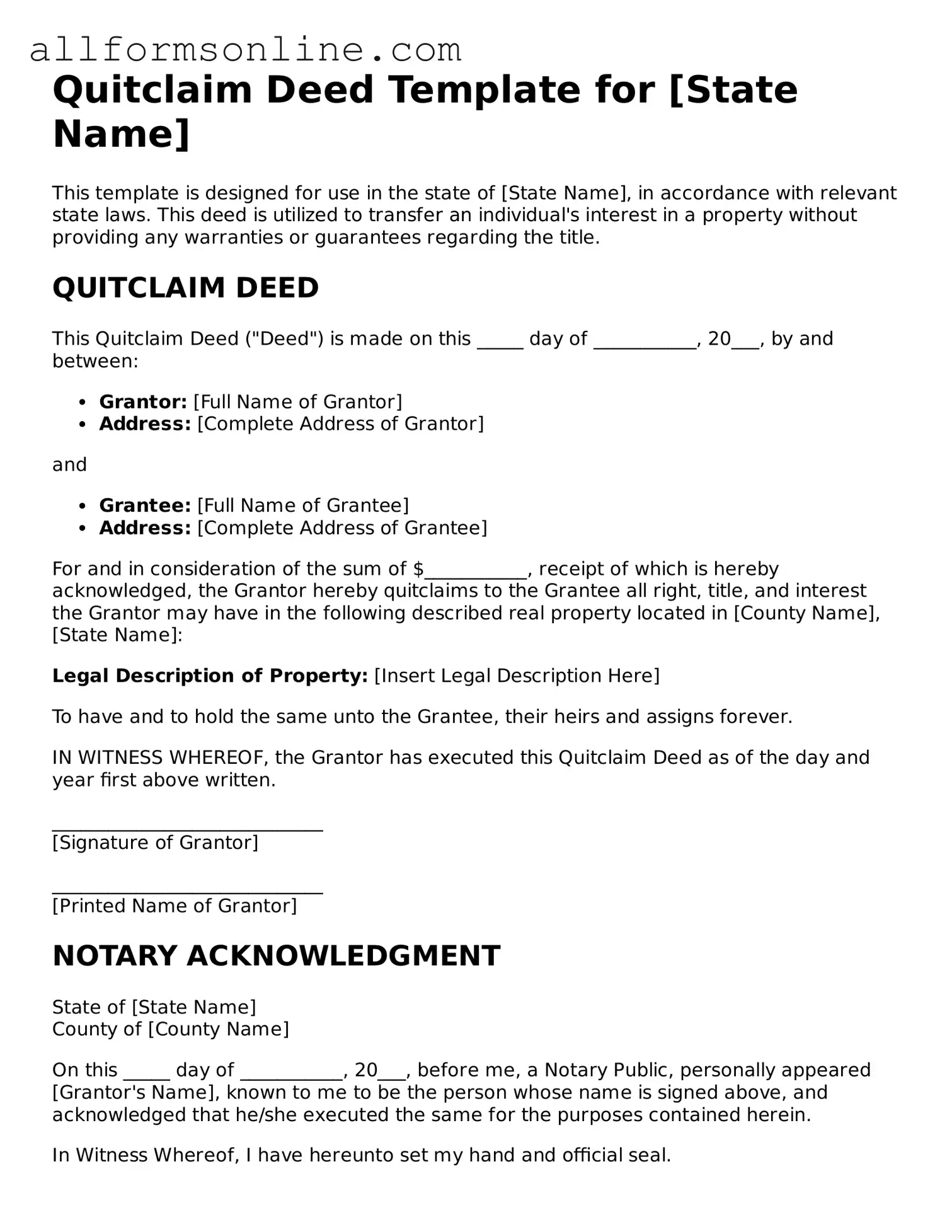

What information is required on a Quitclaim Deed?

A Quitclaim Deed typically requires several key pieces of information. You will need the names and addresses of the grantor and grantee, a legal description of the property, and the date of the transfer. Additionally, you may include the consideration, or the amount paid for the property, although this is not always necessary. Ensure that the document is signed by the grantor and notarized to make it legally binding.

Do I need to file the Quitclaim Deed with the county?

Yes, it is essential to file the Quitclaim Deed with the appropriate county office, usually the county recorder or clerk's office, where the property is located. Filing the deed creates a public record of the transfer, which protects the rights of the grantee and provides notice to third parties about the new ownership. Failing to file could lead to disputes over property ownership in the future.

Are there any tax implications when using a Quitclaim Deed?

There can be tax implications when using a Quitclaim Deed, especially if the transfer involves a significant value. Depending on your state laws, you may need to pay transfer taxes or document fees. Additionally, the transfer could affect property tax assessments. It is advisable to consult a tax professional to understand how the transfer may impact your tax situation.

Can I revoke a Quitclaim Deed once it is executed?

Once a Quitclaim Deed is executed and filed, it generally cannot be revoked unilaterally. The grantor has given up their rights to the property, and the grantee now holds the interest. However, in some cases, it may be possible to create a new deed to transfer the property back to the grantor, but this requires mutual agreement between both parties. Legal advice should be sought if there is a need to reverse the transfer.

Is it advisable to use a lawyer when preparing a Quitclaim Deed?

While it is possible to prepare a Quitclaim Deed without legal assistance, consulting a lawyer is highly advisable. A legal professional can ensure that the deed is properly drafted, meets all state requirements, and is executed correctly. This step can help prevent future disputes and ensure that all parties understand their rights and obligations. Investing in legal guidance can save time and resources in the long run.

Popular Quitclaim Deed Types:

What Is Deed in Lieu of Foreclosure - This action typically only occurs once other loss mitigation options have been exhausted or declined.

For those looking to understand the intricacies of vehicle transactions, our resource on the comprehensive Motor Vehicle Bill of Sale is indispensable. This document not only facilitates the transfer process but also serves as a vital record for both parties involved. You can access the form at this link.

Correction Deed California - It helps ensure that the property's title reflects accurate and complete information.

How to Use Quitclaim Deed

Once you have gathered all necessary information, you are ready to fill out the Quitclaim Deed form. This document will need to be completed carefully to ensure that all details are accurate. After filling out the form, you will typically need to have it notarized and then file it with the appropriate local government office to complete the transfer.

- Begin by entering the date at the top of the form. This is usually found in the upper right corner.

- Next, provide the name of the grantor (the person transferring the property). Make sure to include their full legal name.

- Then, list the name of the grantee (the person receiving the property). Again, use their full legal name.

- In the next section, describe the property being transferred. This includes the address and any legal description available. Be specific to avoid confusion.

- Indicate the consideration amount, which is the value exchanged for the property. This can be a nominal amount, like $1, or the actual sale price.

- Sign the form where indicated. The grantor must sign the document, and it may require witnesses depending on your state’s laws.

- Have the form notarized. A notary public will verify the identities of the signers and witness the signing.

- Finally, file the completed Quitclaim Deed with your local county recorder’s office. There may be a small fee associated with this process.