Blank Real Estate Purchase Agreement Form

Real Estate Purchase AgreementDocuments for Particular States

Real Estate Purchase Agreement Form Categories

Misconceptions

Understanding the Real Estate Purchase Agreement (REPA) is crucial for anyone involved in a property transaction. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings regarding the REPA.

- The REPA is a standard document that requires no customization. Many believe that the REPA is a one-size-fits-all form. In reality, each transaction has unique elements that may necessitate modifications to the agreement.

- Signing the REPA means the sale is final. Some individuals think that once they sign the REPA, the deal is complete. However, the agreement is often contingent on various factors, such as inspections and financing.

- The REPA only protects the buyer. It is a common belief that the REPA is solely beneficial to the buyer. In truth, it also outlines the seller's rights and responsibilities, ensuring fairness for both parties.

- All terms in the REPA are non-negotiable. Many assume that the terms set forth in the REPA cannot be changed. However, both parties can negotiate terms before finalizing the agreement.

- The REPA is only necessary for residential properties. Some people think that the REPA is only applicable to residential transactions. In fact, it is also used for commercial and industrial real estate deals.

- Once the REPA is signed, it cannot be amended. There is a misconception that amendments are not possible after signing the REPA. In reality, changes can be made if both parties agree and document the modifications properly.

- Legal representation is not needed when using the REPA. Many believe they can handle the REPA without legal assistance. However, having legal guidance can help clarify terms and protect interests throughout the process.

Addressing these misconceptions can lead to a smoother transaction and a better understanding of the Real Estate Purchase Agreement.

What to Know About This Form

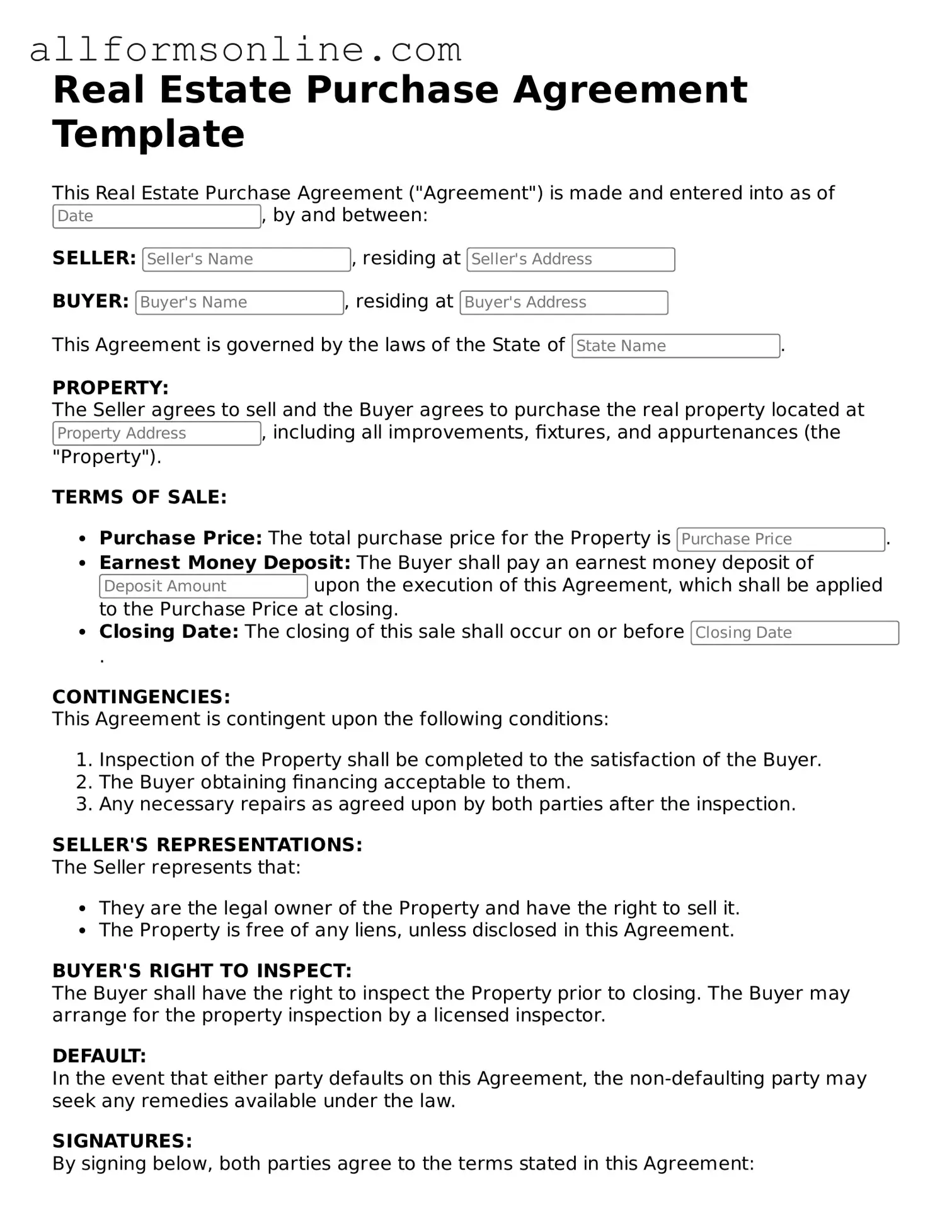

What is a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement typically includes details such as the purchase price, closing date, and any contingencies that must be met before the sale can be finalized. It serves as a binding contract once both parties have signed it, ensuring that everyone is clear on their obligations and expectations throughout the transaction process.

What key elements should be included in the agreement?

Several important elements should be included in a Real Estate Purchase Agreement. These typically encompass the names of the buyer and seller, a detailed description of the property, the purchase price, and any earnest money deposits. Additionally, it should outline any contingencies, such as financing or home inspections, and specify the closing date. Including these details helps protect both parties and ensures a smoother transaction.

What are contingencies, and why are they important?

Contingencies are specific conditions that must be met for the sale to proceed. Common contingencies include the buyer securing financing, the property passing a home inspection, or the sale of the buyer's current home. These provisions are crucial because they provide an opportunity for buyers to back out of the agreement without penalty if certain conditions are not met. This protects the buyer's interests and allows for a more secure transaction.

Can a Real Estate Purchase Agreement be modified?

Yes, a Real Estate Purchase Agreement can be modified, but both parties must agree to any changes. Modifications can occur for various reasons, such as adjusting the closing date or altering the terms of a contingency. It is essential to document any changes in writing and have both parties sign the amended agreement to ensure that the modifications are legally binding.

What happens if either party breaches the agreement?

If either party fails to fulfill their obligations as outlined in the Real Estate Purchase Agreement, it is considered a breach of contract. The consequences of a breach can vary depending on the circumstances. The non-breaching party may have the right to seek damages, enforce the agreement, or terminate the contract. Legal recourse can be complicated, so it is often advisable to consult with a legal professional to understand the best course of action.

Is it necessary to have a real estate agent when using a Purchase Agreement?

While it is not legally required to have a real estate agent when using a Real Estate Purchase Agreement, having one can be beneficial. Real estate agents possess expertise in the buying and selling process and can help navigate the complexities of the agreement. They can also provide valuable insights into market conditions, assist with negotiations, and ensure that all legal requirements are met, making the process smoother for both parties.

Popular Templates:

Affidavit Letter for Immigration Marriage - Utilizing a personal touch, such as recalling special moments, makes the letter stand out.

Obtaining an Emotional Support Animal Letter can significantly enhance the well-being of individuals needing animal companionship, providing them with the necessary documentation to receive accommodations in various settings. For those looking to simplify the process, resources like Fast PDF Templates can offer valuable templates and guidance to ensure compliance with legal requirements.

What Is a Hold Harmless - This document can be tailored to various situations, including rental agreements and construction contracts.

CBP Declaration Form 6059B - The CBP 6059B form includes questions regarding personal information and travel plans.

How to Use Real Estate Purchase Agreement

Once you have the Real Estate Purchase Agreement form ready, it’s time to fill it out accurately. This document is crucial in formalizing the agreement between the buyer and seller, ensuring that both parties understand the terms of the sale. Follow these steps carefully to complete the form.

- Start with the date: Write the date on which you are filling out the agreement at the top of the form.

- Identify the parties: Clearly state the names and addresses of both the buyer(s) and seller(s). Make sure to include full legal names.

- Property description: Provide a detailed description of the property being sold. This includes the address, lot number, and any relevant legal descriptions.

- Purchase price: Enter the total purchase price agreed upon by both parties. Specify how this amount will be paid (e.g., cash, financing).

- Earnest money: Indicate the amount of earnest money the buyer will deposit to show good faith. Mention the due date for this deposit.

- Closing date: Specify the proposed closing date when the sale will be finalized and ownership transferred.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as financing or home inspection conditions.

- Signatures: Ensure that both parties sign and date the agreement at the bottom. This signifies their acceptance of the terms outlined in the document.

After completing the form, review it carefully for any errors or omissions. Once confirmed, both parties should keep a signed copy for their records. This agreement serves as a binding contract, so it’s essential that all details are accurate and agreed upon.