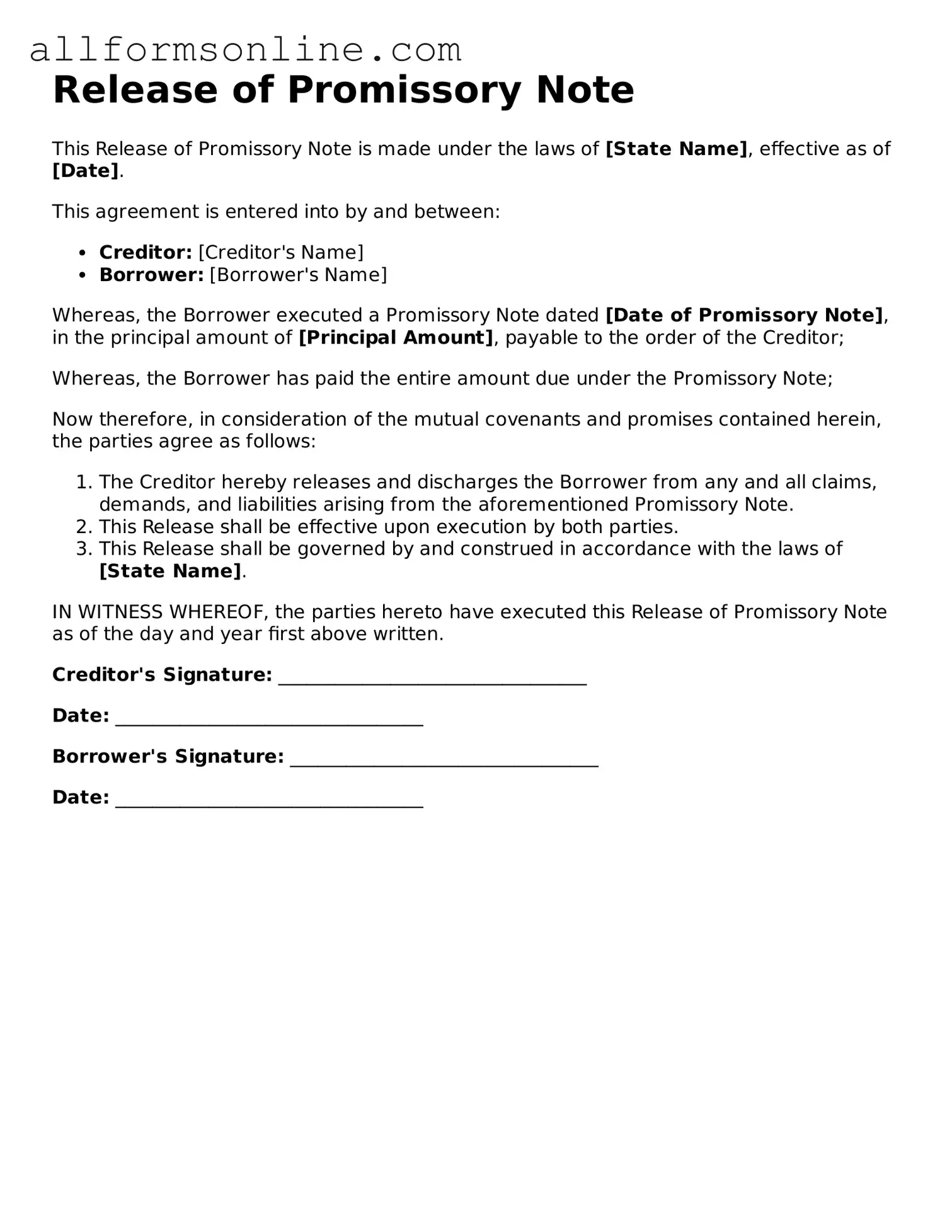

Blank Release of Promissory Note Form

Misconceptions

The Release of Promissory Note form is an important document in financial transactions, yet several misconceptions surround it. Understanding these misconceptions can help individuals navigate their financial obligations more effectively.

- Misconception 1: The form is only necessary for large loans.

- Misconception 2: Once the note is released, all obligations are erased.

- Misconception 3: The form can be completed without legal assistance.

- Misconception 4: The release must be notarized to be valid.

- Misconception 5: The release is only for the lender's benefit.

- Misconception 6: A verbal agreement can replace the need for the form.

- Misconception 7: The form is only needed in case of default.

- Misconception 8: All lenders use the same release form.

This is false. The Release of Promissory Note form is relevant for any loan, regardless of size. Even small loans can benefit from formal documentation.

This is misleading. The release indicates that the debt has been satisfied, but it does not erase any prior agreements or conditions unless stated otherwise.

This is not always true. While notarization adds credibility, it is not a universal requirement for the release to be effective.

In reality, the release protects both parties. It provides the borrower with proof of repayment and releases them from further obligations.

This is incorrect. Verbal agreements can lead to misunderstandings and are often difficult to enforce. A written release provides clarity.

This is misleading. The form is necessary upon full repayment of the loan, regardless of whether there was a default or not.

This is not accurate. Different lenders may have their own specific forms, so it is important to use the correct one for each transaction.

What to Know About This Form

What is a Release of Promissory Note form?

The Release of Promissory Note form is a legal document that signifies the cancellation of a promissory note. This form is essential when a borrower has fulfilled their obligation to repay a loan, allowing both parties to formally acknowledge that the debt has been satisfied. By completing this form, the lender releases their claim to the borrowed amount, providing peace of mind to the borrower.

Why is it important to use a Release of Promissory Note form?

Using a Release of Promissory Note form is crucial for protecting both parties involved in a loan agreement. It serves as official documentation that the debt has been paid in full. This can prevent future disputes or misunderstandings about the status of the loan. Without this form, a borrower may face challenges in proving that they no longer owe the debt, which can lead to unnecessary stress and potential legal complications.

Who needs to sign the Release of Promissory Note form?

Typically, both the borrower and the lender must sign the Release of Promissory Note form. The borrower signs to confirm that they have repaid the loan, while the lender signs to acknowledge the release of the obligation. In some cases, a witness or notary may also be required to ensure the authenticity of the signatures and the validity of the document.

When should I complete a Release of Promissory Note form?

Complete the Release of Promissory Note form immediately after the borrower has paid off the loan. This ensures that both parties have a clear and formal record of the transaction. Delaying this process can lead to confusion or disputes in the future, especially if the lender inadvertently claims that the debt is still outstanding.

What information is needed to fill out the Release of Promissory Note form?

To complete the form, you will need basic information about the loan, including the names of the borrower and lender, the original amount of the loan, and the date the loan was issued. Additionally, you should include the date of repayment and any relevant details that clarify the loan's terms. Accurate information is vital to ensure the document's effectiveness.

Can I create my own Release of Promissory Note form?

While it is possible to draft your own Release of Promissory Note form, it is highly recommended to use a standard template or consult a legal professional. A well-structured form helps ensure that all necessary elements are included and that the document complies with local laws. This can save you from potential legal issues down the line.

What should I do after completing the Release of Promissory Note form?

Once the form is completed and signed by both parties, it is essential to distribute copies to everyone involved. The borrower should keep a copy for their records, while the lender should also retain a copy as proof of the release. Consider storing the original document in a safe place, as it may be needed for future reference or in case of disputes.

Popular Release of Promissory Note Types:

How to Write a Promissory Note for a Personal Loan - Gives details of payment methods accepted by the lender.

Utilizing a well-structured Promissory Note can help clarify loan terms and protect both party's interests during the lending process. This legally binding document outlines the necessary details surrounding the financial agreement, ensuring all aspects are properly addressed.

How to Use Release of Promissory Note

Once you have the Release of Promissory Note form ready, you can proceed to fill it out carefully. Ensure that you have all necessary information at hand to complete the form accurately. Following these steps will help you fill out the form correctly.

- Begin by entering the date at the top of the form. This should be the date you are completing the release.

- Provide your full name in the designated space. Make sure to use your legal name as it appears on the original promissory note.

- Next, fill in the name of the borrower or the party to whom the note was originally issued. This identifies the individual or entity that owes the debt.

- In the section for the promissory note details, include the original amount of the note. This is the principal amount that was borrowed.

- Indicate the date when the promissory note was executed. This is the date when the note was signed and became effective.

- Provide any additional details required about the note, such as the payment terms or interest rate, if applicable.

- Sign the form at the bottom. Your signature indicates your consent to release the borrower from the obligations of the promissory note.

- Finally, include your printed name below your signature to ensure clarity regarding who has signed the document.

After completing the form, review it for accuracy. Once verified, you may need to send it to the borrower or keep it for your records, depending on your specific situation.