Free Sample Tax Return Transcript PDF Form

Misconceptions

Understanding the Sample Tax Return Transcript form can be tricky, and many misconceptions can lead to confusion. Here are some common misunderstandings and clarifications to help you navigate this important document:

- It is a complete tax return. Many believe that the transcript provides a full representation of their tax return. In reality, it summarizes key information but does not include all details.

- It reflects current account activity. Some think the transcript shows ongoing account activity. However, it only displays the amounts as they appeared on the original return and any adjustments made.

- It can be used to file taxes. A common misconception is that the transcript can serve as a substitute for filing a tax return. It cannot; it merely provides a snapshot of past filings.

- It includes all income sources. Some individuals expect to see every income source listed. The transcript only includes specific income types that were reported on the tax return.

- It is the same as a tax return copy. People often confuse the transcript with a copy of their actual tax return. They are different documents, with the transcript being a summary.

- It is only for individuals. Some assume that the transcript is exclusively for personal tax returns. In fact, businesses can also request transcripts for their tax filings.

- It is not legally binding. There is a belief that the information on the transcript holds no legal weight. In truth, it can be used as evidence in various legal matters.

- It shows refund status. Many think the transcript indicates the status of any tax refunds. While it provides financial data, it does not track the refund process.

- It is difficult to obtain. Some believe that acquiring a transcript is a complicated process. In reality, transcripts can be requested easily through the IRS website or by mail.

By clearing up these misconceptions, individuals can better understand their tax situation and utilize the Sample Tax Return Transcript form effectively.

What to Know About This Form

What is a Sample Tax Return Transcript?

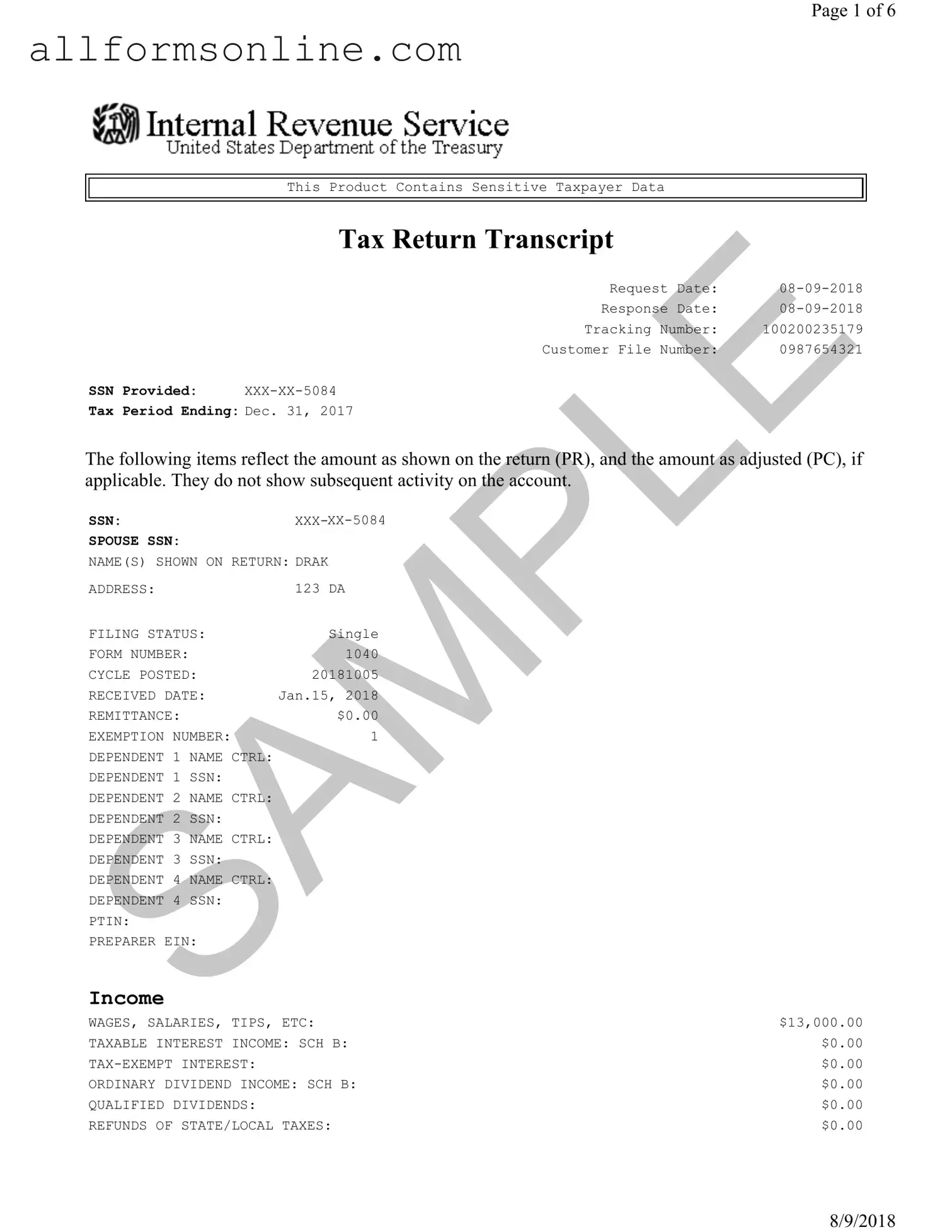

A Sample Tax Return Transcript is a document that summarizes key information from a taxpayer's tax return. It includes details such as income, deductions, credits, and tax liability. This document is often used for verification purposes, such as applying for loans or financial aid.

How can I obtain my Sample Tax Return Transcript?

You can request your Sample Tax Return Transcript through the IRS website, by phone, or by mail. To obtain it online, you will need to create an account on the IRS website and verify your identity. Alternatively, you can call the IRS at 1-800-908-9946 or complete Form 4506-T and send it to the IRS by mail.

What information is included in the Sample Tax Return Transcript?

The transcript includes your Social Security Number (SSN), filing status, income details, adjustments, tax credits, and any payments made. It provides a comprehensive overview of your tax situation for the specified tax year.

Is the Sample Tax Return Transcript the same as my full tax return?

No, the Sample Tax Return Transcript is not the same as your full tax return. The transcript summarizes key information but does not provide all the details found in your complete tax return. It is a condensed version meant for specific purposes.

How long does it take to receive my Sample Tax Return Transcript?

If you request your transcript online, you may receive it immediately. Requests made by phone or mail may take longer, typically around 5 to 10 business days, depending on the method used and the IRS's processing times.

Can I use the Sample Tax Return Transcript for loan applications?

Yes, many lenders accept the Sample Tax Return Transcript as proof of income. It provides a reliable summary of your financial information, which can help support your loan application. Always check with your lender to confirm their specific requirements.

What should I do if I notice an error on my Sample Tax Return Transcript?

If you find an error on your transcript, you should contact the IRS to resolve the issue. You may need to provide additional documentation or information to correct the error. It's important to address any discrepancies promptly to avoid potential issues with your tax records.

Are there any fees associated with obtaining my Sample Tax Return Transcript?

No, there are no fees for obtaining your Sample Tax Return Transcript from the IRS. The service is provided free of charge, whether you request it online, by phone, or by mail.

Different PDF Forms

Australian Passport Application Form - Your face should be square to the camera in your photos.

The Employment Verification Form is a document used to confirm a person's employment status, title, and duration of employment at a particular company. Employers often request this form during background checks or when applying for loans or rental agreements. To streamline the process of obtaining this necessary documentation, individuals can utilize resources such as Fast PDF Templates to ensure that the employment history presented by an applicant is legitimate and reliable.

Bbb File a Complaint - File a complaint about misleading advertising practices.

How to Use Sample Tax Return Transcript

Filling out the Sample Tax Return Transcript form requires careful attention to detail. This form contains sensitive taxpayer information, and accuracy is crucial. Follow these steps to ensure the form is completed correctly.

- Begin by entering the Request Date at the top of the form. This should reflect the date you are submitting the request.

- Next, fill in the Response Date. This is typically the date you expect to receive the transcript.

- Locate the Tracking Number field and write in the unique identifier for your request.

- In the Customer File Number section, provide the number associated with your account.

- Fill in the SSN Provided field with your Social Security Number, ensuring it is accurate.

- Indicate the Tax Period Ending date, which should match the year for which you are requesting the transcript.

- Under Name(s) Shown on Return, write your name as it appears on your tax return.

- Enter your Address, ensuring that it matches the address used in your tax filings.

- Specify your Filing Status (e.g., Single, Married Filing Jointly).

- List the Form Number you are using, typically this will be Form 1040.

- In the Cycle Posted section, enter the cycle number related to your tax filing.

- Provide the Received Date of your tax return submission.

- Fill in the Remittance amount, if applicable, indicating any payments made.

- Complete the Exemption Number section by entering the number of exemptions claimed on your return.

- List any dependents in the designated sections, including their names and Social Security Numbers.

- Finally, review all entries for accuracy before submitting the form.