Free Stock Transfer Ledger PDF Form

Misconceptions

Misconceptions about the Stock Transfer Ledger form can lead to confusion. Here are five common misunderstandings:

- It is only for large corporations. Many believe that only large companies need a Stock Transfer Ledger. In reality, any corporation, regardless of size, must maintain this record for accurate tracking of stock ownership.

- It is optional. Some think that keeping a Stock Transfer Ledger is optional. However, it is a legal requirement for corporations to maintain this document to ensure proper record-keeping of stock transactions.

- It only tracks stock issuance. A common misconception is that the form is solely for tracking stock issuance. In fact, it also records stock transfers, providing a complete history of ownership changes.

- It can be filled out at any time. Many believe they can complete the form whenever they choose. However, it should be updated immediately following any stock issuance or transfer to maintain accurate records.

- Only the corporation's secretary needs to manage it. Some think that only the corporate secretary is responsible for the Stock Transfer Ledger. In truth, all corporate officers should be aware of its contents and updates, as it is crucial for corporate governance.

What to Know About This Form

What is the purpose of the Stock Transfer Ledger form?

The Stock Transfer Ledger form is used to record the issuance and transfer of stock within a corporation. It helps maintain an accurate record of stock ownership, ensuring that all transactions are documented properly for both the corporation and its shareholders.

What information do I need to fill out the form?

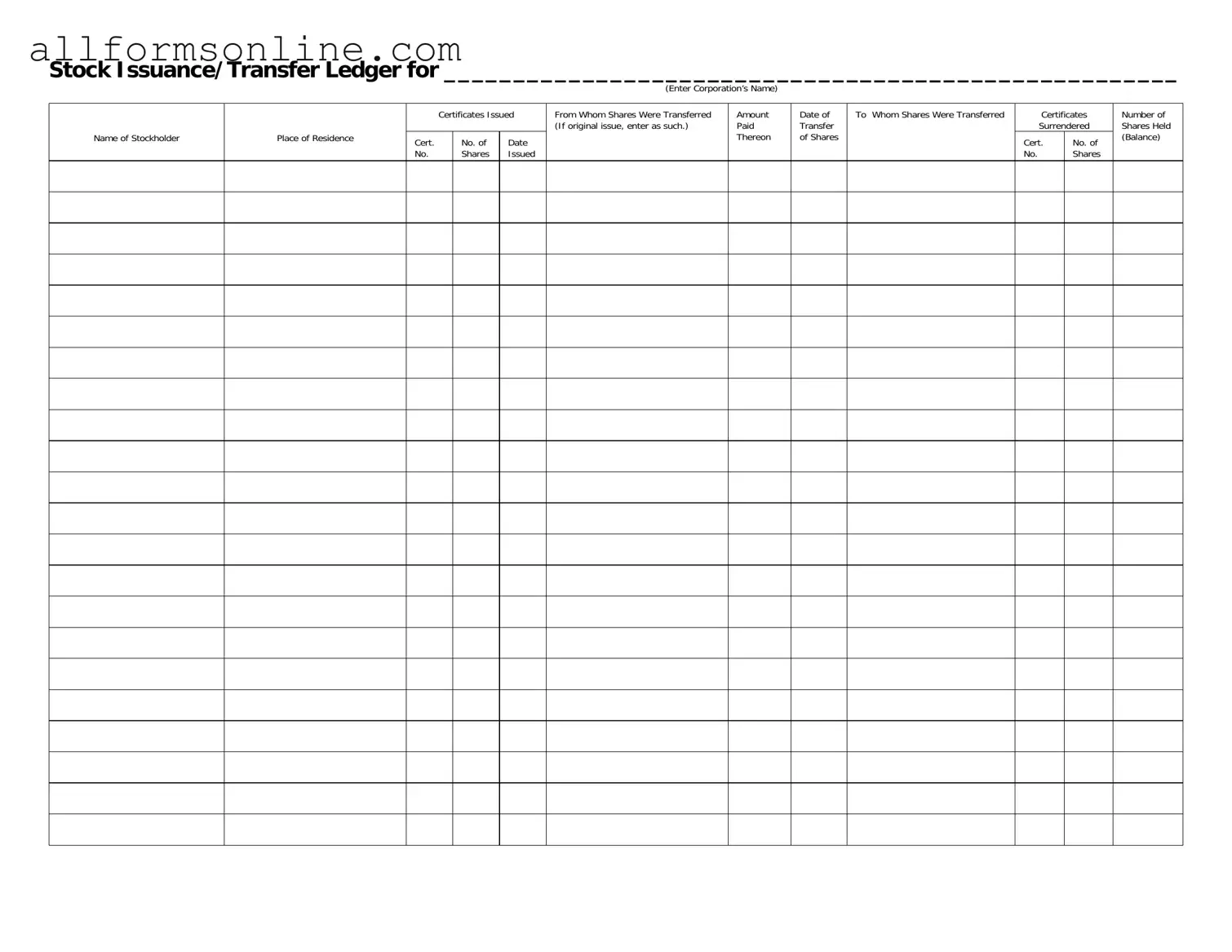

You will need the corporation’s name, the name of the stockholder, their place of residence, the certificate numbers, the number of shares issued, and the details of the transfer, including the amount paid and the date of transfer. This information ensures that all transactions are clear and traceable.

Who is responsible for maintaining the Stock Transfer Ledger?

The corporation's secretary or an appointed officer typically maintains the Stock Transfer Ledger. It is crucial for this individual to keep the ledger updated to reflect any changes in stock ownership accurately.

What should I do if I lose a stock certificate?

If a stock certificate is lost, the stockholder should notify the corporation immediately. A replacement certificate may need to be issued, and the Stock Transfer Ledger must be updated accordingly to reflect this change.

Can I transfer shares without using the Stock Transfer Ledger form?

While it is possible to transfer shares informally, it is highly recommended to use the Stock Transfer Ledger form. This ensures that all transfers are officially recorded, protecting both the seller and the buyer in the event of disputes.

What happens if there is an error on the form?

If an error is found on the Stock Transfer Ledger form, it should be corrected as soon as possible. Both the person making the correction and the person affected by the error should initial the changes to maintain transparency and accuracy.

Is there a fee associated with transferring shares?

Fees for transferring shares can vary depending on the corporation's policies. It is advisable to check with the corporation to understand any potential costs involved in the transfer process.

How does the Stock Transfer Ledger affect shareholder rights?

The Stock Transfer Ledger is crucial for determining shareholder rights. Only those listed in the ledger as stockholders have the right to vote and receive dividends. Therefore, accurate record-keeping is essential for protecting these rights.

What should I do if I have more questions about the Stock Transfer Ledger?

If you have additional questions, it is best to contact the corporation directly. They can provide specific guidance and address any concerns you may have regarding the Stock Transfer Ledger and the stock transfer process.

Different PDF Forms

Electrical Panel Schedule Template - Displays circuit breaker ratings and their corresponding loads.

When dealing with the transfer of ownership for a trailer, it's crucial to utilize the correct documentation, such as the California Trailer Bill of Sale form. This form not only outlines important transaction details but also helps clarify the responsibilities of both the buyer and seller. For those interested in creating or obtaining this document, Fast PDF Templates offers a valuable resource to ensure a smooth and legal transfer process.

Acord 130 - Various business types—corporations, LLCs, partnerships—can use this form for workers' coverage.

How to Use Stock Transfer Ledger

After completing the Stock Transfer Ledger form, the next steps involve submitting it to the appropriate corporate office for processing. Ensure all information is accurate and complete to avoid delays. This form plays a crucial role in maintaining accurate records of stock transfers.

- Begin by entering the corporation’s name in the designated space at the top of the form.

- Fill in the name of the stockholder in the appropriate section.

- Provide the stockholder's place of residence.

- Indicate the certificates issued by writing the certificate number in the specified field.

- Enter the date when the shares were issued.

- List the number of shares issued.

- Identify from whom the shares were transferred. If this is the original issue, write "original issue" in that section.

- Document the amount paid for the shares in the corresponding area.

- Write the date of transfer of shares.

- Specify to whom the shares were transferred.

- Record the certificate numbers of any certificates surrendered during the transfer.

- Indicate the number of shares that were surrendered.

- Finally, note the number of shares held after the transfer, which represents the balance.