Free Tax POA dr 835 PDF Form

Misconceptions

The Tax POA DR 835 form is often surrounded by misconceptions that can lead to confusion. Below are seven common misunderstandings about this form, along with clarifications.

-

Only accountants can file the Tax POA DR 835 form.

This is not true. While accountants often assist with tax matters, any individual can file the form on behalf of someone else, provided they have the appropriate authority.

-

The form is only for businesses.

The Tax POA DR 835 form can be used by both individuals and businesses. It is applicable in situations where someone needs to represent another person in tax matters.

-

Filing the form guarantees a favorable outcome with the IRS.

Submitting the form does not ensure that the IRS will grant any specific request. It simply allows the designated representative to act on behalf of the taxpayer.

-

The form needs to be filed every year.

This is a misconception. The Tax POA DR 835 form remains valid until revoked or until the specific matter it pertains to is resolved, unless a new form is filed.

-

Only one person can be appointed as a representative.

In fact, multiple representatives can be appointed. The form allows for more than one individual to be designated, as long as their roles are clearly defined.

-

Once submitted, the form cannot be changed.

This is incorrect. If changes are necessary, a new form can be submitted to replace the previous one, or the existing form can be revoked.

-

The Tax POA DR 835 form is only for federal tax issues.

This is misleading. The form can also be utilized for state tax matters, depending on the jurisdiction and specific requirements of the state involved.

What to Know About This Form

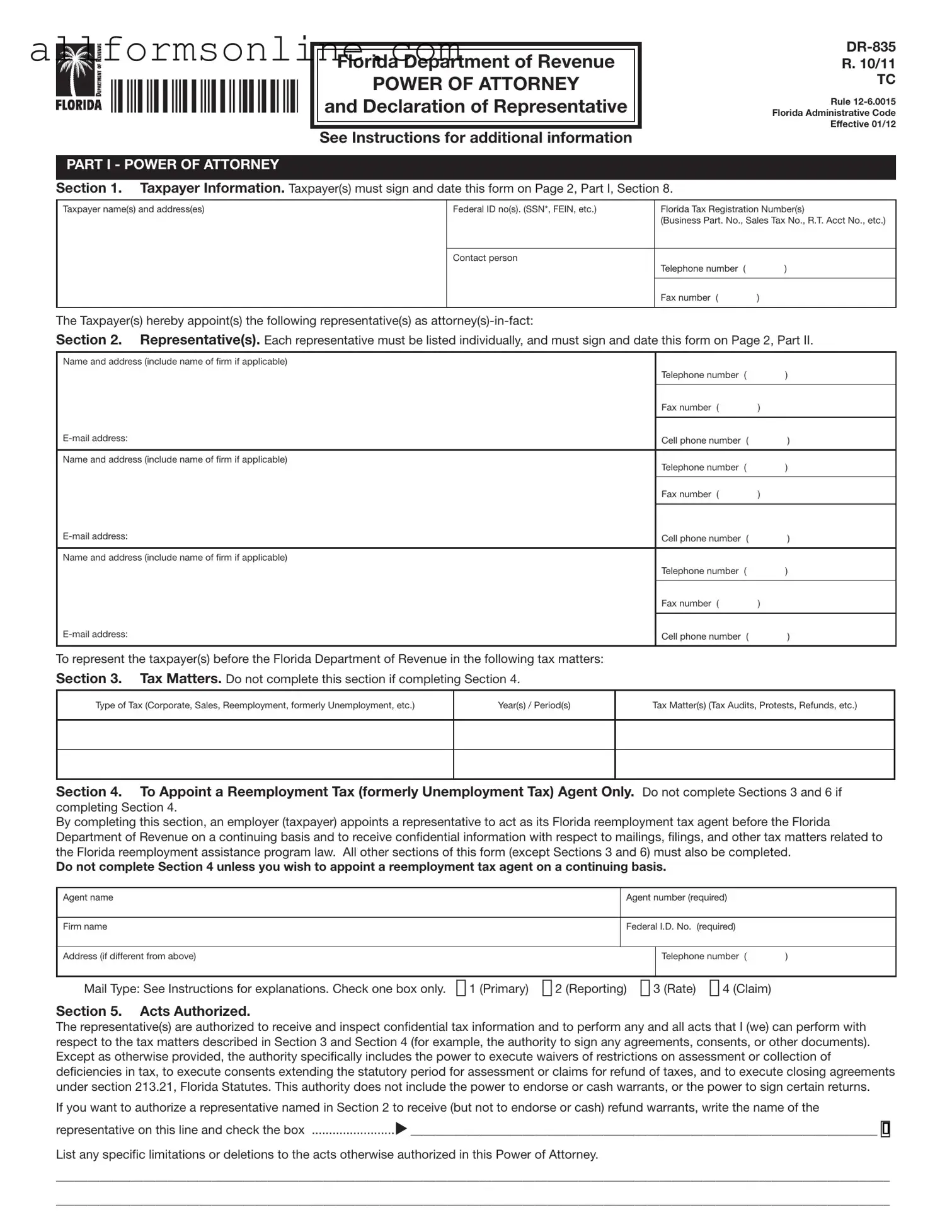

What is the Tax POA DR 835 form?

The Tax POA DR 835 form is a Power of Attorney document specifically used for tax matters in certain jurisdictions. It allows individuals to designate someone else, typically a tax professional or attorney, to represent them before tax authorities. This form grants the designated representative the authority to handle tax-related issues, including filing returns, responding to inquiries, and managing disputes. It simplifies communication between taxpayers and tax agencies, ensuring that important matters are addressed promptly and effectively.

Who should consider using the Tax POA DR 835 form?

Anyone who needs assistance with their taxes may benefit from using the Tax POA DR 835 form. This includes individuals who may not feel comfortable navigating tax laws on their own, those who are facing complex tax situations, or anyone who simply wants to delegate their tax responsibilities to a trusted professional. Business owners, in particular, often find it useful to appoint a tax advisor to manage their corporate tax matters efficiently.

How do I complete the Tax POA DR 835 form?

Completing the Tax POA DR 835 form involves a few straightforward steps. First, gather the necessary information about yourself and the person you wish to appoint as your representative. This includes names, addresses, and identification numbers. Next, fill out the form accurately, ensuring that all required fields are completed. Finally, sign and date the form to validate it. It’s important to keep a copy for your records and provide the completed form to your representative so they can act on your behalf.

Is there a fee associated with submitting the Tax POA DR 835 form?

How long does it take for the Tax POA DR 835 form to be processed?

Different PDF Forms

Fake Vehicle Inspection Form - Ensure that the vehicle's odometer is functioning correctly.

The California Motorcycle Bill of Sale form is a crucial document that facilitates the transfer of ownership for motorcycles. By providing essential information about the buyer, seller, and the motorcycle itself, it serves as a record of the transaction. For those looking to easily create this document, resources like Fast PDF Templates can be particularly helpful. This form not only ensures transparency but also protects both parties involved in the sale.

Chick Fil a Careers - Join a team focused on serving delicious meals with a smile.

How to Use Tax POA dr 835

Once you have gathered all necessary information, you can begin filling out the Tax POA dr 835 form. This form allows you to authorize someone to represent you before the tax authorities. It’s important to ensure that all details are accurate to avoid any issues later on.

- Start by entering your name in the designated field at the top of the form.

- Next, provide your Social Security Number (SSN) or Employer Identification Number (EIN) as required.

- Fill in your address, including street, city, state, and ZIP code.

- Indicate the type of tax for which you are granting power of attorney. This could be income tax, sales tax, or others as specified.

- In the next section, write the name of the individual or organization you are authorizing. Make sure this person is qualified to represent you.

- Provide the representative’s address, including street, city, state, and ZIP code.

- Include the representative’s phone number and email address for easy communication.

- Review the form for any errors or missing information. Double-check all entries to ensure accuracy.

- Sign and date the form at the bottom. Your signature is crucial as it validates the authorization.

- Finally, submit the completed form to the appropriate tax authority as instructed.