Attorney-Approved Affidavit of Death Form for Texas

Misconceptions

Understanding the Texas Affidavit of Death form is crucial for those navigating the complexities of estate management and probate. However, several misconceptions can lead to confusion. Here’s a breakdown of nine common myths surrounding this important document.

-

The Affidavit of Death is only for estates with a will.

This is not true. The Affidavit of Death can be used in both testate (with a will) and intestate (without a will) situations. It serves as a declaration of the decedent's passing, regardless of whether a will exists.

-

Only a lawyer can complete the Affidavit of Death.

While legal assistance can be beneficial, individuals can fill out the form themselves. It is designed to be user-friendly, allowing personal representation in the process.

-

The Affidavit of Death is the same as a death certificate.

These are distinct documents. A death certificate is an official record issued by the state, while the Affidavit of Death is a sworn statement used primarily for legal purposes in probate proceedings.

-

The Affidavit of Death must be filed with the court immediately.

There is no strict timeline for filing the affidavit. However, it is advisable to submit it in a timely manner to facilitate the management of the deceased’s estate.

-

All heirs must sign the Affidavit of Death.

Only the person making the affidavit needs to sign it. However, it is beneficial to have the agreement of other heirs, as it can help avoid disputes later.

-

The Affidavit of Death is only necessary for large estates.

This is a misconception. Even small estates may require an Affidavit of Death to transfer assets or settle affairs properly.

-

Once filed, the Affidavit of Death cannot be changed.

While it is important to ensure accuracy before filing, corrections can be made if errors are discovered after submission, typically through a formal amendment process.

-

The Affidavit of Death is a public document.

It is not automatically a public record. Access to it may depend on local laws and the specific circumstances of the estate.

-

Using the Affidavit of Death guarantees a smooth probate process.

While it is a helpful tool, it does not ensure that all issues will be resolved without complications. Other legal requirements may still need to be addressed.

By debunking these misconceptions, individuals can approach the Texas Affidavit of Death with clarity and confidence, ensuring that they take the right steps in managing their loved ones' affairs.

What to Know About This Form

What is a Texas Affidavit of Death?

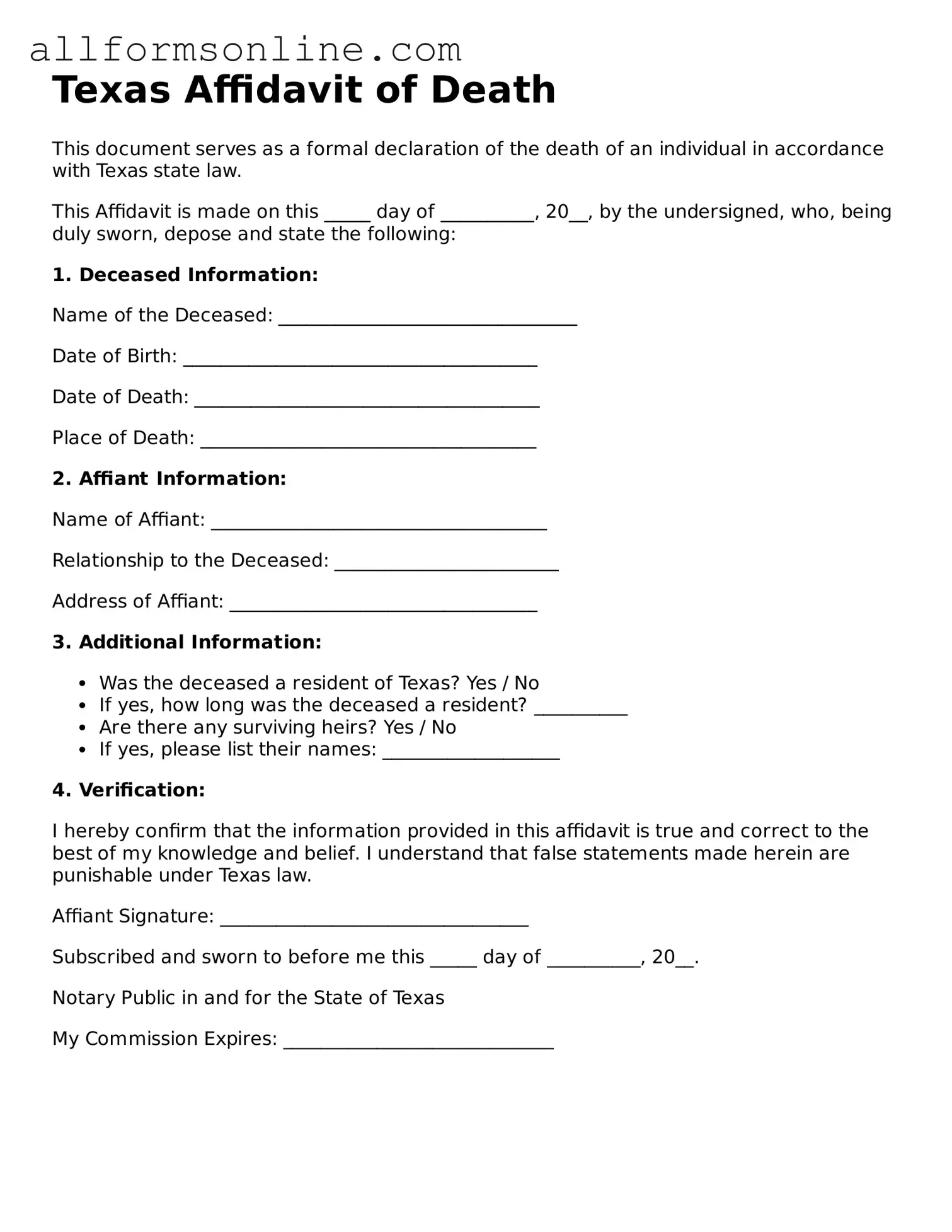

A Texas Affidavit of Death is a legal document used to declare the death of an individual. This form is often utilized to settle estates, transfer property, or update records. It serves as an official statement that verifies a person's death and may be required by banks, financial institutions, or government agencies to process claims or change account ownership.

Who can file a Texas Affidavit of Death?

Generally, any person who has personal knowledge of the deceased's death can file the affidavit. This often includes family members, friends, or legal representatives. It is important that the individual filing the affidavit is able to provide accurate information regarding the deceased and the circumstances of their death.

What information is required on the affidavit?

The affidavit typically requires specific details about the deceased, including their full name, date of birth, date of death, and last known address. Additionally, the affiant (the person making the affidavit) must provide their own name, relationship to the deceased, and any relevant contact information. Supporting documentation, such as a death certificate, may also be needed.

Where do I file the Texas Affidavit of Death?

The Texas Affidavit of Death is usually filed with the county clerk's office in the county where the deceased resided at the time of death. In some cases, it may also be necessary to file the affidavit with other entities, such as banks or courts, depending on the specific circumstances surrounding the estate or property involved.

Is there a fee associated with filing the affidavit?

Yes, there may be a filing fee associated with submitting the Texas Affidavit of Death. Fees can vary by county, so it is advisable to check with the local county clerk's office for the exact amount. In addition to the filing fee, there may be costs for obtaining certified copies of the affidavit or related documents.

Can the affidavit be contested?

While the Texas Affidavit of Death is generally a straightforward declaration, it is possible for it to be contested. If there are disputes regarding the validity of the affidavit or the circumstances of the death, interested parties may challenge it in court. It is important to ensure that all information provided in the affidavit is accurate and truthful to minimize the risk of disputes.

Other Common State-specific Affidavit of Death Forms

Affidavit of Death California Pdf - It can serve as an important tool for recognizing and affirming the end of legal obligations tied to the deceased.

The California Residential Lease Agreement is a legal document that outlines the terms and conditions under which a property is rented from a landlord to a tenant. This form is essential for clearly defining the rights and responsibilities of both parties in the rental relationship. To simplify the process further, landlords and tenants can refer to resources like Fast PDF Templates to access templates that can enhance their leasing experience and help avoid potential disputes.

How to Use Texas Affidavit of Death

After gathering the necessary information, you will be ready to complete the Texas Affidavit of Death form. This form is essential for legally documenting the death of an individual. Follow these steps to ensure that you fill it out correctly.

- Begin by writing the full name of the deceased in the designated space at the top of the form.

- Next, enter the date of death. Make sure to use the correct format, typically month, day, and year.

- Provide the place of death, including the city and county.

- In the following section, include the deceased’s date of birth.

- Fill in the deceased’s last known address, ensuring that it is complete and accurate.

- Identify yourself as the affiant. Write your full name and relationship to the deceased.

- Sign the form where indicated. Your signature should be in the presence of a notary public.

- Finally, have the notary public complete their section, including their signature and seal.

Once you have completed the form, make sure to keep a copy for your records. You may need to submit the original form to the appropriate authorities or organizations as required.